Next up at #SmartCon is a keynote speech from @SergeyNazarov, co-founder of @chainlink

#Chainlink $LINK

#Chainlink $LINK

Cryptographic truth is strictly better than "just trust us"

Smart contracts are larger than many assume

The problem being solved is "what is the truth" and "how does the society work on the notion of trust"

It is a spectrum from paper promises to cryptographic truth

Smart contracts are larger than many assume

The problem being solved is "what is the truth" and "how does the society work on the notion of trust"

It is a spectrum from paper promises to cryptographic truth

People don't think they have an alterative, but they do, it appeared in 2009 with Bitcoin and has since evolved

Cryptographic truth to guarantee outcomes based on math

Bitcoin, Ethereum, DeFi is based on decentralized infrastructure

Right side of spectrum just appeared

Cryptographic truth to guarantee outcomes based on math

Bitcoin, Ethereum, DeFi is based on decentralized infrastructure

Right side of spectrum just appeared

Since the invention of bank notes, we've seen overprinting, defaults, and inflation

All have similar inflation issues, Sergey gives a history lesson in fiat history

Defaults happened in a few years, not decades

Such failures keep happening; e.g. great depression

All have similar inflation issues, Sergey gives a history lesson in fiat history

Defaults happened in a few years, not decades

Such failures keep happening; e.g. great depression

This is the longer term history of paper based promises, usually the same story

"great idea, let's see how fair it goes, accelerate, push the gas petal, massive amount of paper fiat, on no we over did it, inflation, default, promises no longer being honored, tough luck"

"great idea, let's see how fair it goes, accelerate, push the gas petal, massive amount of paper fiat, on no we over did it, inflation, default, promises no longer being honored, tough luck"

That doesn't need to be the way the world works

In modern times, we haven't learned from history

We keep pushing the gas petal, historically it's always lead to the same place

"just trust us" there's always a boom and bust cycle

We're in the boom cycle....

In modern times, we haven't learned from history

We keep pushing the gas petal, historically it's always lead to the same place

"just trust us" there's always a boom and bust cycle

We're in the boom cycle....

There will be a problem at some point, inflation has already increased

People has pushed the metal to the floor

Off the gold standard since 1971, we've accelerated by a lot

Leads to debt and insolvency

Every single indicator shows we've pushed the gas petal hard

People has pushed the metal to the floor

Off the gold standard since 1971, we've accelerated by a lot

Leads to debt and insolvency

Every single indicator shows we've pushed the gas petal hard

Over 20% of USD has been printed in the last year

Greek banks denying access to funds in 2015

"just trust us" guarantees don't work, but finally there is an alterative

That is what our industry is about

Modern example is @RobinhoodApp...

Greek banks denying access to funds in 2015

"just trust us" guarantees don't work, but finally there is an alterative

That is what our industry is about

Modern example is @RobinhoodApp...

"just trust us" era is coming to an end

Very different way for world to work

In DeFi, there are cryptographic guarantees to execute a certain way, can't get away from that

You're going to get the behavior you expect

Never before in history has this been possible

Very different way for world to work

In DeFi, there are cryptographic guarantees to execute a certain way, can't get away from that

You're going to get the behavior you expect

Never before in history has this been possible

Now with a private key and blockchain, you control your own funds

Why should we care?

It's not just about finance, gaming, or insurance

It's about the way the world works

This influences everyone, average consumer, institutions, everyone

Why should we care?

It's not just about finance, gaming, or insurance

It's about the way the world works

This influences everyone, average consumer, institutions, everyone

Cryptographic truth is the alterative, backed by math, encryption and physics

Best guarantee that can be provided from every single product

So different, that people who aren't used to it, can't even process the difference

It's a night and day difference

Best guarantee that can be provided from every single product

So different, that people who aren't used to it, can't even process the difference

It's a night and day difference

Every single case he's mentioned this to, institutions, startups, etc, he has yet to hear "I prefer the just trust us process, sounds fun"

Nobody prefers the weak paper promises where you can be screwed

Nobody prefers the weak paper promises where you can be screwed

Chainlink Labs and Chainlink Network aims to connect everything to truth

That's a world much better to live in for everyone

No small group of people who can take money from everyone

Worthwhile goal

That's a world much better to live in for everyone

No small group of people who can take money from everyone

Worthwhile goal

This is achieved, by creating more and more advanced hybrid smart contracts

the more advanced SCs become, the more use cases the technology our industry provides can go

The more SCs can do, the more gaming, insurance, etc is powered by SCs

Seeking to extend SCs

the more advanced SCs become, the more use cases the technology our industry provides can go

The more SCs can do, the more gaming, insurance, etc is powered by SCs

Seeking to extend SCs

This will expand and grow the pie, the source of cryptographic truth

Transition the world from paper guarantees trust us, to the cryptographic truth model

For every industry, works on multiple models

Transition the world from paper guarantees trust us, to the cryptographic truth model

For every industry, works on multiple models

Trust-minimized off-chain computation and all the world's existing infrascture

Off-chain portion of the world falls into

Off-chain Data

Off-chain Compute

Cross-chain compute

Off-chain portion of the world falls into

Off-chain Data

Off-chain Compute

Cross-chain compute

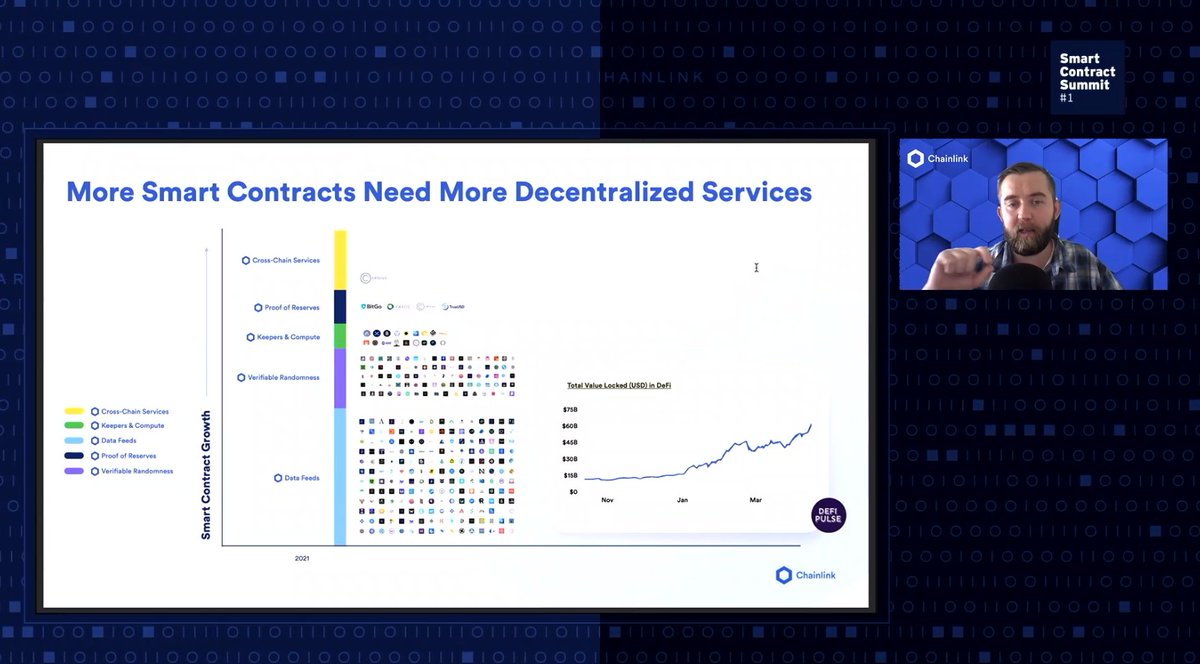

We are already see hybrid smart contracts with DeFi because they have these services

This has already resulted change in our industry, well past what DeFi started as

Many more entities have joined the advantages of smart contracts

Multiple off-chain services by SCs

This has already resulted change in our industry, well past what DeFi started as

Many more entities have joined the advantages of smart contracts

Multiple off-chain services by SCs

Building a global standard for cryptographic truth

HTTPS

Linux

Chainlink

Open-source standard, built on better security, innovative first mover, services most smart contracts

Improve society through infrastructure

Over 250+ working at Chainlink Labs and many users

HTTPS

Linux

Chainlink

Open-source standard, built on better security, innovative first mover, services most smart contracts

Improve society through infrastructure

Over 250+ working at Chainlink Labs and many users

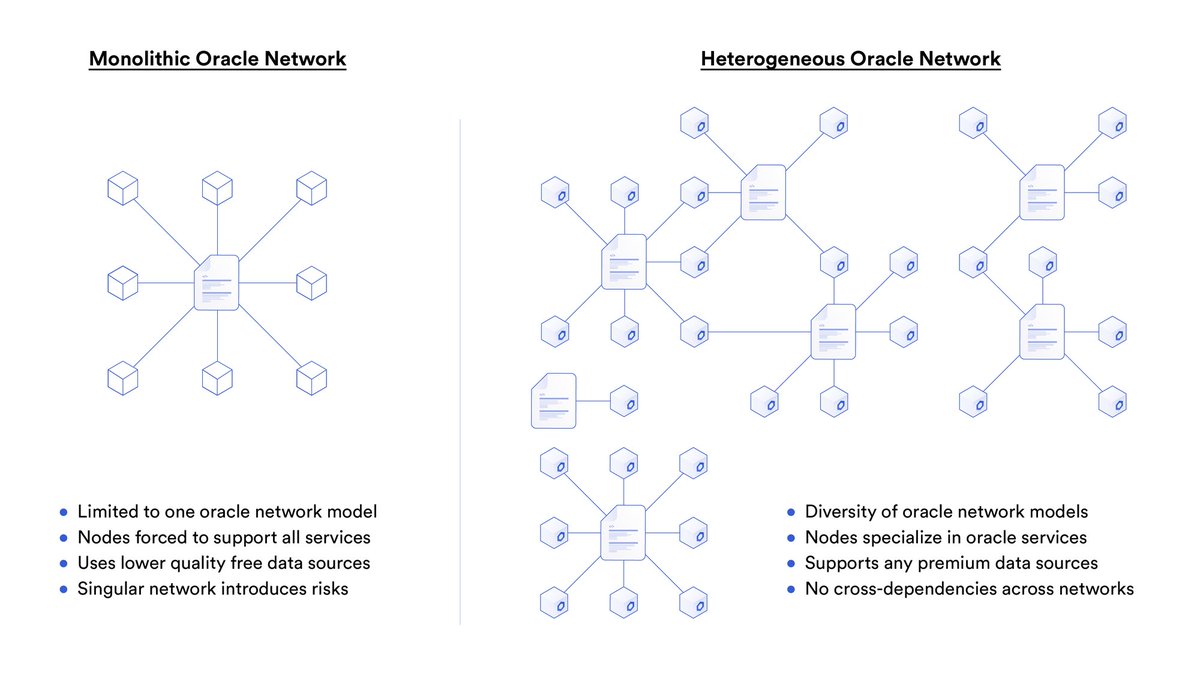

Initially, what we see is various decentralized services enabled distinct industries that could not exist without otherwise

Price Data is the first well-known use case of this

Chainlink powers the largest lending and DeFi protocols

Price Data is the first well-known use case of this

Chainlink powers the largest lending and DeFi protocols

Time-tested, battle-hardened, and continues to secure the ecosystem

Majority of DeFi uses Chainlink oracles

Reliable system of data

Majority of DeFi uses Chainlink oracles

Reliable system of data

$70B market size initially

All of the world's financial products, insurance processes, etc will eventually be in a smart contract

Absolutely no reason why they wouldn't

Many many industries will be powered by Chainlinked smart contracts

Composability for all world's markets

All of the world's financial products, insurance processes, etc will eventually be in a smart contract

Absolutely no reason why they wouldn't

Many many industries will be powered by Chainlinked smart contracts

Composability for all world's markets

Hyper-reliability for all markets, DeFi is just a signal, the early picture of what is to come

This is inevitable, only question is how quickly this will happen

Speed at which "just trust us" guarantees fail, is going to accelerate this

Talking with many banks, chains, etc

This is inevitable, only question is how quickly this will happen

Speed at which "just trust us" guarantees fail, is going to accelerate this

Talking with many banks, chains, etc

People want reliable guarantees that can be fulfilled

More and more services, means more smart contracts, more useful use cases, more adoption

More and more services, means more smart contracts, more useful use cases, more adoption

Proof of Reserve replaces the one year audit process

Enron, Wirecard, buddies with auditors that missed something, conflict of interest

1 year audit versus 1 second audit providing every single thing

On-chain Proof of Reserve is superior

Everyone wants faster better audits

Enron, Wirecard, buddies with auditors that missed something, conflict of interest

1 year audit versus 1 second audit providing every single thing

On-chain Proof of Reserve is superior

Everyone wants faster better audits

Starts with Fintechs, crypto firms, but the fundamental proof benefits, is 100x better than the existing 1 year audits

Everyone can audit stablecoins on a block by block basis, proven by a data source

Undercollateralized stablecoins will be discovered within 10 seconds

Everyone can audit stablecoins on a block by block basis, proven by a data source

Undercollateralized stablecoins will be discovered within 10 seconds

From there, it just expands

Cryptographically valid proofs, you can then build all kinds of systems

Initial step from Chainlink

Cryptographically valid proofs, you can then build all kinds of systems

Initial step from Chainlink

Favorite example from Sergey, weather insurance

Lack of rain, hurricanes, forest fires, etc

How do manage this risk if you don't have access to insurance, you pray to the rain gods

Important for emerging markets

Smart contract insurance can be accessed anywhere

Lack of rain, hurricanes, forest fires, etc

How do manage this risk if you don't have access to insurance, you pray to the rain gods

Important for emerging markets

Smart contract insurance can be accessed anywhere

Even if your local legal system doesn't work, or no insurance providers, predatory lending, now you can side-step that

Automatically get paid through on-chain smart contract Chainlinked insurance

$50 Android phone and internet, can now have better insurance than you

Automatically get paid through on-chain smart contract Chainlinked insurance

$50 Android phone and internet, can now have better insurance than you

That will change a farmer's life in emerging nations

Underpinning of society not seen by most

Underpinning of society not seen by most

Inclusion of data providers is key

@accuweather recently launched a Chainlink node to bring their weather data on-chain to power these smart contracts

smart contract state on blockchains + weather oracles = makes it reality

give smart contract developers what they need

@accuweather recently launched a Chainlink node to bring their weather data on-chain to power these smart contracts

smart contract state on blockchains + weather oracles = makes it reality

give smart contract developers what they need

This will change our industry and change the way the world works

Dynamic NFTs using Chainlink oracles to keep it updated, value of NFT can be tied to real world

Dynamic NFTs using Chainlink oracles to keep it updated, value of NFT can be tied to real world

Trust-minimized off-chain compute

Compute done in oracle network, that provides trust-minimized and decentralization

Compute done in oracle network, that provides trust-minimized and decentralization

Chainlink VRF generates 200k requests per month

Data is key, but so is trust-minimized computation for smart contracts

Data is key, but so is trust-minimized computation for smart contracts

Chainlink Keepers is now live on Mainnet

Launching for users by everyone, coming to more blockchains

Launching for users by everyone, coming to more blockchains

Give a computation to a Keeper network, can't do on-chain for capability reasons, cost-reasons, or privacy reasons

The other reason is just like centralization in data is an issue, so is centralization in compute, needs to be decentralized

Don't need to built infrastructure

The other reason is just like centralization in data is an issue, so is centralization in compute, needs to be decentralized

Don't need to built infrastructure

Off-load off-chain computation to a decentralized network, which can be verified on-chain

Smart contract dev can automate smart contract calls, like telling contracts the time

1,000+ interactions, need to do all of them, Chainlink Keepers provides reliability for this

Smart contract dev can automate smart contract calls, like telling contracts the time

1,000+ interactions, need to do all of them, Chainlink Keepers provides reliability for this

Why does this matter?

Secure decentralized systems need to be decentralized and secure end-to-end even during extreme 2,500 gwei gas congestion or server downtime

Centralized servers for a keeper is a central point of failure

Just like how you don't want centralized oracles

Secure decentralized systems need to be decentralized and secure end-to-end even during extreme 2,500 gwei gas congestion or server downtime

Centralized servers for a keeper is a central point of failure

Just like how you don't want centralized oracles

Prevent DDoS attacks, ensure reliability with Chainlink Keepers

Eliminate congestion issues, network issues, market issues, exploit issues, it's been proven

Reliable method to compute key functions

Eliminate congestion issues, network issues, market issues, exploit issues, it's been proven

Reliable method to compute key functions

Unburdens the SC team from doing this, focus on core business logic, provide end-to-end guarantee of decentralization

An example is @AaveAave liquidations to ensure the protocol is solvent, above water and useable

monitor and liquidate undercollateralized loans

An example is @AaveAave liquidations to ensure the protocol is solvent, above water and useable

monitor and liquidate undercollateralized loans

For @synthetix_io, it's about fee distribution of staking rewards

Another example is @PoolTogether_ to starting and ending no-loss lottery games

Keepers committed to ensuring reliability for these applications, a large improvement

Protocols become more decentralized and provide more cryptographic truth

Keepers committed to ensuring reliability for these applications, a large improvement

Protocols become more decentralized and provide more cryptographic truth

Keepers can off-load computations in the Keeper Network for contracts, this can be done today

A contract deployed on-chain can be split into two equal parts on-chain and off-chain execution

The Keeper Network at almost zero cost, execute a portion of the code on-chain

A contract deployed on-chain can be split into two equal parts on-chain and off-chain execution

The Keeper Network at almost zero cost, execute a portion of the code on-chain

Fully verifiable, a distinct service for that smart contract

A Keeper Network for each smart contract

Scalability and privacy, can have code broadcast on-chain

Very extensible capability already being done

More robust hybrid smart contracts

A Keeper Network for each smart contract

Scalability and privacy, can have code broadcast on-chain

Very extensible capability already being done

More robust hybrid smart contracts

Keepers monitoring and then execute results to be delivered on-chain and verified

Check out Keepers

keeper.chain.link

Add more nodes, expand computation, and prove this to your users

Check out Keepers

keeper.chain.link

Add more nodes, expand computation, and prove this to your users

Cross-chain compute is the next aspect

The way to make the most advanced smart contracts of the future, cross-chain dApps

String together multiple smart contracts on multiple chains together

The way to make the most advanced smart contracts of the future, cross-chain dApps

String together multiple smart contracts on multiple chains together

Announcing the Cross-Chain Interoperability Protocol (CCIP)

Similar to TCP/IP in that it provides connectivity under one standard

Global open-source standard, blockchains to interoperate with each other

Similar to TCP/IP in that it provides connectivity under one standard

Global open-source standard, blockchains to interoperate with each other

Truly cross-chain smart contracts

Giving devs access to perform different actions on different blockchain networks within a decentralized application

An entire world of innovation, new use cases that were not available before

Hybrid smart contracts reinvent how the world work

Giving devs access to perform different actions on different blockchain networks within a decentralized application

An entire world of innovation, new use cases that were not available before

Hybrid smart contracts reinvent how the world work

Expanded definition of smart contract

Scope of a smart contract has continued to expand through decentralized services

Now with CCIP, you can have different core contracts on different networks all inter-connected

Goal is grow the usefulness of the industry

Scope of a smart contract has continued to expand through decentralized services

Now with CCIP, you can have different core contracts on different networks all inter-connected

Goal is grow the usefulness of the industry

Larger societal collective consensus of cryptographic truth

$1.5T crypto marketcap to hundreds of trillions

@CelsiusNetwork with $16B in TVL will be using CCIP to capture yield across chains

Merge of CeFi and DeFi

$1.5T crypto marketcap to hundreds of trillions

@CelsiusNetwork with $16B in TVL will be using CCIP to capture yield across chains

Merge of CeFi and DeFi

Celsius can use Aave on different environments to capture yield and pump liquidity into DeFi

Banks and Fintechs, and more can interoperate with all of the useful smart contracts across all of the different chains

CCIP standard makes this simple, minimized complexity

Banks and Fintechs, and more can interoperate with all of the useful smart contracts across all of the different chains

CCIP standard makes this simple, minimized complexity

With CCIP you can send command and tokens to a CCIP programmable token bridge

Send tokens and instructions on what to do with the tokens to the bridge, the bridge will move the token into the protocols according to the instructions

Bridge accelerates cross-chain tokens

Send tokens and instructions on what to do with the tokens to the bridge, the bridge will move the token into the protocols according to the instructions

Bridge accelerates cross-chain tokens

Devs don't need to deeply integrate with chains, but can interact with chains by sending commands to token bridge

Like with Celsius, their users can access all yield from all chain

Provides massive amount of value to protocols on those blockchains

Like with Celsius, their users can access all yield from all chain

Provides massive amount of value to protocols on those blockchains

1M+ users on Celsius, Aave has a great lending protocol, with CCIP this can be combined as funds can be deposited to Aave markets on any chain

CCIP and programmable bridges to get to the next stage of creating advanced smart contract applications

data, cross-chain, and bridges

CCIP and programmable bridges to get to the next stage of creating advanced smart contract applications

data, cross-chain, and bridges

Prove to users with cryptographic truth

CCIP is in a layered stack

OCR 2.0 is the consensus and transparent level

Compute environment is the Chainlink Network

CCIP is in a layered stack

OCR 2.0 is the consensus and transparent level

Compute environment is the Chainlink Network

OCR 2.0 expands the topics that nodes can achieve off-chain computation off-chain

OCR 1.0 lowered costs by 90%

OCR 2.0 has a large amount of efficient and generalizes off-chain computation, signature aggregation

OCR is the consensus of this cross-chain solution

OCR 1.0 lowered costs by 90%

OCR 2.0 has a large amount of efficient and generalizes off-chain computation, signature aggregation

OCR is the consensus of this cross-chain solution

OCR 2.0 is it's efficiency gains, allows for more nodes to be added

Enterprises like Swisscom and T-Systems and more running nodes in these network

Highest quality nodes and largest amount of nodes in networks

Enterprises like Swisscom and T-Systems and more running nodes in these network

Highest quality nodes and largest amount of nodes in networks

Other bridges had poor cryptographic technology and single digit nodes (anonymous or unexperienced nodes)

With Chainlink, as the fees are aggregated, it increases the security budget to add hundreds of nodes into a Chainlink network

With Chainlink, as the fees are aggregated, it increases the security budget to add hundreds of nodes into a Chainlink network

CCIP is an open-source standard with various stake-holders that need a reliable messaging protocol

It's not just about building a bridge but moving commands across chains, which can be used to build a bridge and more

OCR 2.0 -> CCIP -> Programmable Token Bridge

It's not just about building a bridge but moving commands across chains, which can be used to build a bridge and more

OCR 2.0 -> CCIP -> Programmable Token Bridge

Cross-chain smart contracts can now send commands to each other, sets a global standard, enables various existing bridges and interfaces to build a better bridge

The messaging layer needs to be secure period, consensus about signatures and high quality nodes

The messaging layer needs to be secure period, consensus about signatures and high quality nodes

CCIP is a messaging protocol for public and private chains

Sending commands across chains in a hyper-reliable manner

e.g. Mint a token on this chain, or lock it on that chain

Multiple blockchains and many dApps, making the entire ecosystem more secure

Sending commands across chains in a hyper-reliable manner

e.g. Mint a token on this chain, or lock it on that chain

Multiple blockchains and many dApps, making the entire ecosystem more secure

The Programmable Bridge Reference Implementation shows how you can build a very advanced bridge

Not just movement of tokens, but also add commands like to deposit into a DeFi application, monitor yield, and return funds if it's too low

Bridge abstracts away complexities

Not just movement of tokens, but also add commands like to deposit into a DeFi application, monitor yield, and return funds if it's too low

Bridge abstracts away complexities

The DeFi applications get more usage

Chains benefit as they get more transactions

Whole ecosystem benefits as people can build more beneficial things

More value to everyone

Chains benefit as they get more transactions

Whole ecosystem benefits as people can build more beneficial things

More value to everyone

The Chainlink Programmable Token Bridge is one implementation

Others can build their own bridges on top of the CCIP

Large amount of messages for different bridges, they don't have to build their own messaging protocol, use CCIP and build a bridge

Others can build their own bridges on top of the CCIP

Large amount of messages for different bridges, they don't have to build their own messaging protocol, use CCIP and build a bridge

Bootstrap your validator set with Chainlink OCR 2.0 networks

Use CCIP to build even more advanced bridges and cross-chain dApps with their own bridge and messaging conditions

Use CCIP to build even more advanced bridges and cross-chain dApps with their own bridge and messaging conditions

The Anti-Fraud Network generates an oracle network that monitors various forms of risk

Like a decentralized anti-fraud department

Monitors all the activity at all levels in regards to cross-chain, movement of tokens, etc

Anti-Fraud Network is a paralleled network

Like a decentralized anti-fraud department

Monitors all the activity at all levels in regards to cross-chain, movement of tokens, etc

Anti-Fraud Network is a paralleled network

At the most detailed level possible, monitors the mint/burn, lock/unlock, aggregated signatures, deviations, do they need to be sped up

Reducing risk through a risk mode

Acceptable level of risk is set by users and monitored by the Anti-Fraud Network

Prevents fraud in a decentralized oracle network, that is transparent, becomes more advanced with AI

Acceptable level of risk is set by users and monitored by the Anti-Fraud Network

Prevents fraud in a decentralized oracle network, that is transparent, becomes more advanced with AI

Useful for all users of the CCIP, even beyond cross-chain

Modeled after proof-of-reserve model

Initial Chainlink Whitepaper 1.0 cross-chain listed the goal

Modeled after proof-of-reserve model

Initial Chainlink Whitepaper 1.0 cross-chain listed the goal

Anyone can be an interface for CCIP and benefit from the advantages it provides

Benefits the whole industry, fundamental goal is provide a more advanced version of what our industry provides

That will make the crypto industry about 100s of trillions

Benefits the whole industry, fundamental goal is provide a more advanced version of what our industry provides

That will make the crypto industry about 100s of trillions

The direction this goes is the entire world's value flowing through a Chainlink abstraction layer

Fintechs, banks, etc they just want to use blockchain

CCIP enables people to send commands to blockchains from a single interface

Good for entire industry

Fintechs, banks, etc they just want to use blockchain

CCIP enables people to send commands to blockchains from a single interface

Good for entire industry

Before you were stuck in integrations, but with a single interface web2.0, fintech, and enterprise can use Chainlink to connect with 100s of chains and use all the applications on all of the chains

Talking with enterprises, this is exactly what they need

Talking with enterprises, this is exactly what they need

Chainlink is the abstraction layer that allows them to reliably and provably interact with any blockchain and the applications on those chains

This extends beyond enterprises to CBDCs, allow CBDCs to interoperate with any chains

If

This extends beyond enterprises to CBDCs, allow CBDCs to interoperate with any chains

If

CCIP will open the floodgates and allow 100s of trillions of dollars into public and private blockchains

If CBDCs are issued on blockchains, then they will need a cross-chain solution to bridge the CBDCs across chains

TRILLIONS OF DOLLARS INTO BITCOIN, DEFI, GAMING, AND BEYOND

If CBDCs are issued on blockchains, then they will need a cross-chain solution to bridge the CBDCs across chains

TRILLIONS OF DOLLARS INTO BITCOIN, DEFI, GAMING, AND BEYOND

If the world moves to a blockchain based model for the global industries, what matters is that the entire world moves to the Cryptographically truth based model

Every single time an enterprise integration a blockchain, more value will flow into those environments

Every single time an enterprise integration a blockchain, more value will flow into those environments

Chainlink continues to expand its array of services

Accelerate developers with what they can do with blockchains

Decentralized services for all of these use case that people want to see

Feeds

Proof of Reserve

VRF

Keepers

FSS

CCIP

Much more

Accelerate developers with what they can do with blockchains

Decentralized services for all of these use case that people want to see

Feeds

Proof of Reserve

VRF

Keepers

FSS

CCIP

Much more

As each service goes live, more useful stuff gets built, the market speeds up

More and more and more and more decentralized services

Hybrid smart contracts reinvent how smart contracts work

More and more and more and more decentralized services

Hybrid smart contracts reinvent how smart contracts work

Percentage in DeFi has grown, but still small

$70B is impressive? Just another 5% of crypto and that doubles

10x growth, 50% of crypto will be in DeFi

$70B is impressive? Just another 5% of crypto and that doubles

10x growth, 50% of crypto will be in DeFi

The game hasn't even started, pre-game music

Before the beginning, people haven't taken their seats yet

Amount of value that will flow into DeFi and hybrid smart contracts

A rounding error for now

Before the beginning, people haven't taken their seats yet

Amount of value that will flow into DeFi and hybrid smart contracts

A rounding error for now

The entire global economy will be powered by smart contracts

Trade finance, gaming, insurance, ad network aren't even on this diagram

All of those will be powered by cryptographic truth

that's where this is going

Trade finance, gaming, insurance, ad network aren't even on this diagram

All of those will be powered by cryptographic truth

that's where this is going

"just truth us" paper promises mess -> cryptographically guaranteed math based truth

That fundamental difference will result in this transition

Largest transitions of history, that's why he's working on this

Point in history, before cryptographic truth and after

That fundamental difference will result in this transition

Largest transitions of history, that's why he's working on this

Point in history, before cryptographic truth and after

New age of productivity, reliability, and interact with each other in a reliable predictable way

The reason is fundamentally there, see it everyday with users

Nobody wants to go back after they get cryptographic truth

The reason is fundamentally there, see it everyday with users

Nobody wants to go back after they get cryptographic truth

Virtuous cycle by providing all the capabilities that will take the world into a state of cryptographic truth

Increase in the amount of services used, Chainlink Network will run more services

This is a small list

Virtuous cycle, chicken or egg problem solved

Increase in the amount of services used, Chainlink Network will run more services

This is a small list

Virtuous cycle, chicken or egg problem solved

Keep generating these services with the community, users, partners, etc

Help build a world powered by truth

Deeply grateful to be working on it and working with others with the same vision

Solve the problem of "just trust us"

chainlinklabs.com/careers

Help build a world powered by truth

Deeply grateful to be working on it and working with others with the same vision

Solve the problem of "just trust us"

chainlinklabs.com/careers

If you see the world moving toward cryptographic truth, come work with Chainlink Labs

Work with everyone in the world

Over 250+ at Chainlink Labs around the world

Growing rapidly and working with many other teams

Work with everyone in the world

Over 250+ at Chainlink Labs around the world

Growing rapidly and working with many other teams

Deeply grateful with everyone working on various Chainlink Networks and Services, and CCIP

All the people that inform people about Chainlink and the larger crypto communities

Sergey is deeply grateful for the support given by everyone

Thank you @SergeyNazarov

All the people that inform people about Chainlink and the larger crypto communities

Sergey is deeply grateful for the support given by everyone

Thank you @SergeyNazarov

• • •

Missing some Tweet in this thread? You can try to

force a refresh