After Rattanindia (Revolt), let's explore another promising listed Electric 2W player, Greaves Cotton. (Read till the end for a comparison of #Ampere scooters with #Ola #Ather Okinawa). @itsTarH @sahil_vi @Investor_Mohit @ishmohit1 @MarathaIn @dmuthuk

1. Business Verticals & Products

1.1 Greaves is a 160+ years old company and has 4 key businesses:

A) Auto: Diesel, Petrol, CNG Engines

B) Non Auto: Farm equipment, Smart Gensets

1.1 Greaves is a 160+ years old company and has 4 key businesses:

A) Auto: Diesel, Petrol, CNG Engines

B) Non Auto: Farm equipment, Smart Gensets

C) New Mobility: EV 2W (Brand: Ampere), EV 3W (Brand: ele)

D) Aftermarket: Greaves Care Service Center which caters primarily to 3W (incl. Electric 3W) - spare parts, lubricants, batteries etc.

Finance is a non-core business

D) Aftermarket: Greaves Care Service Center which caters primarily to 3W (incl. Electric 3W) - spare parts, lubricants, batteries etc.

Finance is a non-core business

2. Transformative Strategy & Ampere acquisition:

2.1 Greaves planned a transformation journey in 2018 to shift from a traditional 3W engines focus (Greaves has 60% share of 3W diesel engines) to a broader Clean Mobility & Solutions Play

2.1 Greaves planned a transformation journey in 2018 to shift from a traditional 3W engines focus (Greaves has 60% share of 3W diesel engines) to a broader Clean Mobility & Solutions Play

2.2 The execution of this vision is playing out well with the acquisition of Ampere, launch of innovative & cleaner CREST CNG engine, launch of smart gensets (Greaves Genius) & launch of Greaves Retail network

2.3 Greaves first acquired ~67% stake in Ampere in 2018 for 77 Cr followed by ~14% in July 2019 for 38.5 Cr and ~19% for ~ 60 Cr in Nov 2019 valuing it at 320 Cr. FY19 sales of Ampere was ~54 Cr so Greaves paid a P/S of ~6. Mr. Ratan Tata was one of the early investors of Ampere

2.4 In simple terms, the strategy is to utilize the cash flows (Cash flow from ops ~150+ Cr) from traditional businesses (Auto & Aftermarket) to invest and grow new age business (EV & New engine applications). Very similar to RtnIndia's play.

3. Revenue Split Evolution:

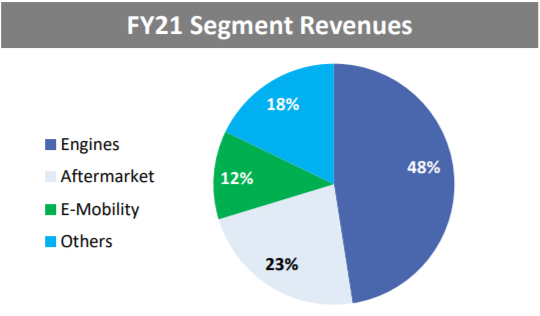

Revenue contribution from EV segment grew from 7% in FY20 to 12% in FY21

Revenue contribution from EV segment grew from 7% in FY20 to 12% in FY21

4. Deep dive into Ampere:

4.1 Although Greaves is a well diversified auto play, we should understand this very clearly: "Anyone investing in Greaves is primarily betting on its EV play"

4.1 Although Greaves is a well diversified auto play, we should understand this very clearly: "Anyone investing in Greaves is primarily betting on its EV play"

4.2 Intro: Ampere is one of the earliest players in EV 2W in India with 12 years of experience

4.3 Market share: It currently holds ~20% of share in EV 2W segment and is third behind Hero Electric & Okinawa. This might change significantly in the coming quarters with the launch of Ola scooters.

4.4 Dealers: Ampere has one of the largest dealership networks of any EV brand with 350+ dealers

4.5 Capacity: Greaves plans to invest ~700 Cr in phased manner in 10 years for a facility in Ranipet (TN) to build a capacity of 10 lakh EVs per year. Ampere currently has a facility in Coimbatore with a capacity of 60k scooters per year.

We can expect Ranipet facility to start functioning by end of this year with ~ 50 Cr capex (couldn't find exact figure - let me know if anyone has it). This will also open up opportunities to export to the huge SEA market through Chennai port.

4.6 Localization:

Ranipet will also house supporting infra. like testing facilities and R&D as part of the bigger plan “for a one-stop shop”.

Ranipet will also house supporting infra. like testing facilities and R&D as part of the bigger plan “for a one-stop shop”.

Ampere already controls 60-70% of the cost/ supply chain by manufacturing their own chargers, AC DC converters, motors & controllers. Batteries are a commodity hence they don't manufacture it.

4.5 Volumes: Average monthly volume run rate for FY21 (covid affected) was about 1800 -2000 scooters (800-1000 high speed scooters) and the overall industry's EV 2W high speed sales in FY21 was ~30k units

4.6 3W play:

In July 2020, Ampere acquired 74% stake in E-rick player Bestway (Ele) for ~INR 7Cr

In July 2020, Ampere acquired 74% stake in E-rick player Bestway (Ele) for ~INR 7Cr

4.7 The B2B Opportunity:

Another big opportunity for Ampere is the B2B segment where EV 2W & 3W could significantly reduce operations cost for logistics & ecommerce players. Ampere has an edge here vs. competition because of its lower pricing. Ampere already has ~50+ B2B buyers.

Another big opportunity for Ampere is the B2B segment where EV 2W & 3W could significantly reduce operations cost for logistics & ecommerce players. Ampere has an edge here vs. competition because of its lower pricing. Ampere already has ~50+ B2B buyers.

4.8 How Ampere products stacks up against other biggies ?

I believe Ampere has a well differentiated value for money product positioning in 2W segment targeting the aspiring urban middle class.

I believe Ampere has a well differentiated value for money product positioning in 2W segment targeting the aspiring urban middle class.

5 Ola Electric - a blessing in disguise

5.1 In my opinion, the launch of a VC funded player like Ola with huge a war chest is actually a blessing in disguise for the whole Indian EV industry

5.2 Currently, the pie is very small with 30k high speed scooters selling in FY21

5.1 In my opinion, the launch of a VC funded player like Ola with huge a war chest is actually a blessing in disguise for the whole Indian EV industry

5.2 Currently, the pie is very small with 30k high speed scooters selling in FY21

This is estimated to go upto 80k in FY22 but with the response that Ola has got in pre booking actual numbers can be much higher (at least 50k scooters just for Ola even if only 20% of pre bookings convert to sales)

5.3 The marketing money spent by Ola will hugely increase EV awareness in the country and push more buyers to evaluate EV vs. ICE scooters. Hence, this will positively impact all players including Greaves.

6 Let's talk valuation:

Let's do a quick sum of parts valuation

6.1 Ampere: Q4 FY21 revenue was 68 Cr.

Let's do a quick sum of parts valuation

6.1 Ampere: Q4 FY21 revenue was 68 Cr.

If this momentum continues FY22 revenue could be ~250 Cr which is ~50% higher than FY21 revenue of 177 Cr but is still on the conservative side as industry is growing at 60-70%. Assuming a similar growth rate for FY23, revenue could be ~380 Cr.

Taking a P/S of 6 (similar to what Greaves paid to Ampere), value is ~2300 Cr

6.2 Rest of the business:

Avg. P/S before acquisition of Ampere was ~2 (~3300 Cr market cap at sales of ~1650 Cr).

Assuming sales from rest of business will grow at lower double digit ~10%, FY23 sales = 1800 Cr hence value = ~3600 Cr at P/S of 2

Avg. P/S before acquisition of Ampere was ~2 (~3300 Cr market cap at sales of ~1650 Cr).

Assuming sales from rest of business will grow at lower double digit ~10%, FY23 sales = 1800 Cr hence value = ~3600 Cr at P/S of 2

6.3 Thus, total value = ~5900 Cr . This translates to a share price of ~250.

7. Interesting titbits: Company board had approved a 227 Cr buyback in Oct 2019 at 175 Rs per share and the stock is still trading below that.

Disclaimer: Please do your own research before investing. I am invested and hence biased.

Disclaimer: Please do your own research before investing. I am invested and hence biased.

Please like and retweet to benefit more fellow investors.

• • •

Missing some Tweet in this thread? You can try to

force a refresh