In 2008 Europe broke their growth trend - and never recovered.

The Italian and Greek economies have shrunk. The average Eurozone citizen earns $10k less than they would if the trend continued.

This is the story of the Great European Undershoot🧵

apricitas.substack.com/p/the-great-eu…

The Italian and Greek economies have shrunk. The average Eurozone citizen earns $10k less than they would if the trend continued.

This is the story of the Great European Undershoot🧵

apricitas.substack.com/p/the-great-eu…

First, lets take stock of the damage: GDP/capita in Greece and Italy were reset to mid-1990s levels. Growth in the Euro area has tanked. Even powerhouse economies like France weren't spared. The EU area's GDP/capita could be as high as Germany's if the trend had continued.

What happened? After the Great Recession, terrible monetary policy from the ECB almost destroyed the Euro. The ECB tightened too quickly and refused to act as a lender of last resort to member countries. Bond spreads - the risk differential between countries' debt - exploded.

Investors believed that all EU countries' debts were equally risky before 2008. They quickly realized the ECB wouldn't back debt 1:1. The sovereign debt crisis wasn't a traditional debt crisis - Greece could service its debt long-term, but it could not get Euros short-term.

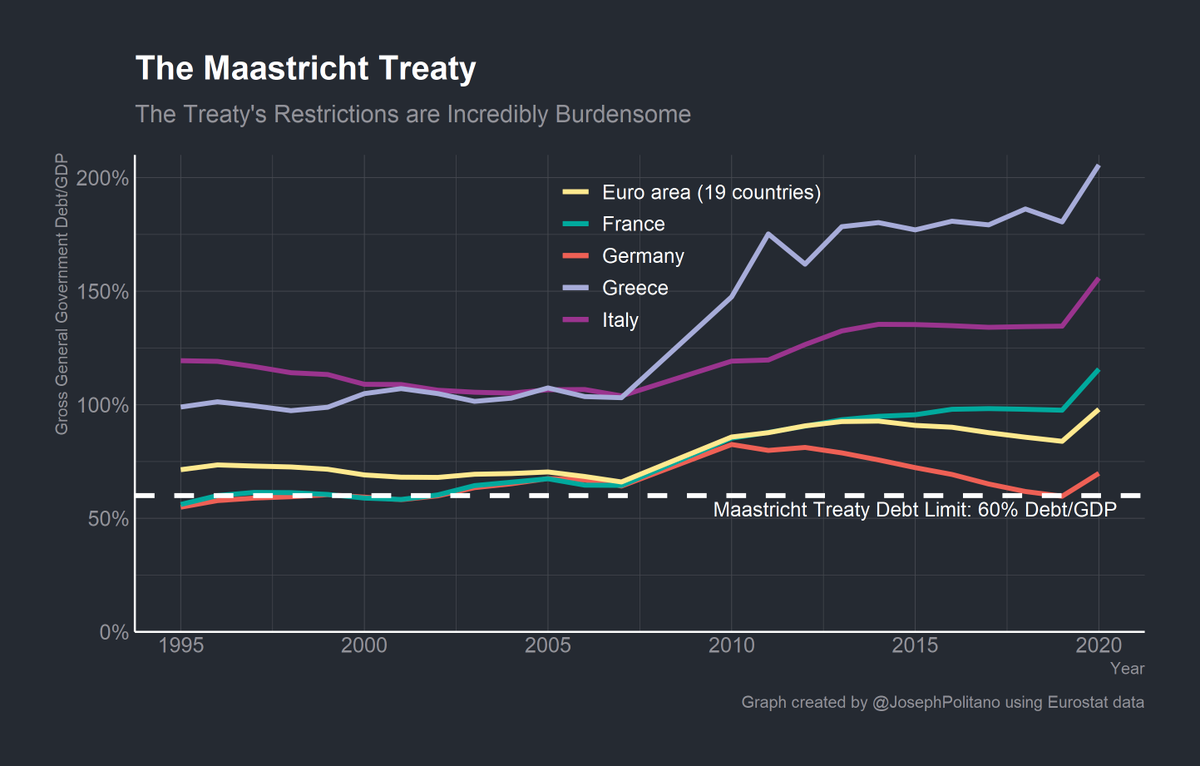

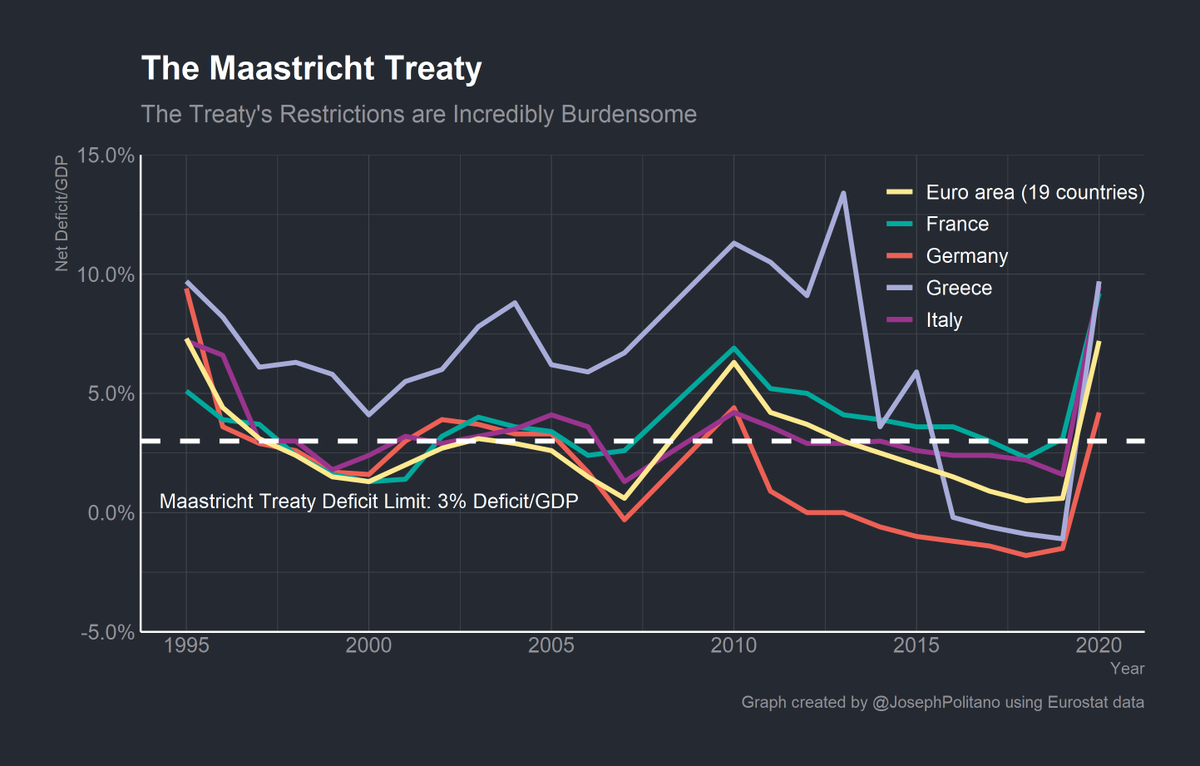

In addition to bad monetary policy, the Euro area had bad fiscal policy. In a time where countries needed to spend money to exploit the fiscal multiplier and close the output gap, the Maastricht treaty punished countries for having a debt/GDP ratio above 60%.

Gross debt is a terrible measure for national debt, especially in the context of an arbitrary numerical restriction. Gross debt measures overlook national assets, include debt held by the ECB that should be excluded, and do not account for interest rates.

The interaction of Maastricht, the Excessive Debt Program (EDP), and the ECB can have disastrous consequences. Even with below-full employment, Italy has run primary surpluses for decades. But because of bond spreads, high interest expenses push its deficit to the treaty's limit.

To move forward, the EU must embrace further integration. The ECB must guarantee all countries' national debts again, EU common bonds should redistribute funds across the bloc, and policymakers should work to circumvent Maastricht or remove its punishments.

If you like what I write, consider subscribing! It's free, and helps me out a ton.

Special thanks to @adb0wen for fact-checking and helping me workshop this post. Go follow them!

apricitas.substack.com

Special thanks to @adb0wen for fact-checking and helping me workshop this post. Go follow them!

apricitas.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh