A detailed guide on #TX3 by @EdelweissFin

Software worth 50,000/- for F R E E 🏆

Scroll down 👇 for detailed analysis

(Using for 2+years)

User guide PDF 📙 edelweiss.in/ewwebimages/We…

#chartians #momentum #StockMarketindia #trading #tx3 #edelweiss

Software worth 50,000/- for F R E E 🏆

Scroll down 👇 for detailed analysis

(Using for 2+years)

User guide PDF 📙 edelweiss.in/ewwebimages/We…

#chartians #momentum #StockMarketindia #trading #tx3 #edelweiss

@CAPratik_INDIAN @_GauravVashisth @stockifi_Invest @TSG_Capital @VRtrendfollower @krishnblue @jitendrajain @SANAMBHATIA99 @ca_mehtaravi @chartmojo @jigspatel1988 @Rishikesh_ADX

Share for wider reach, so that people don't spend on costly softwares like Falcon/Spider 🙏

Share for wider reach, so that people don't spend on costly softwares like Falcon/Spider 🙏

1️⃣ TERMINAL LOOK

This is how the terminal looks like when you open it. You might be confused but we're here to help you out.

This is how the terminal looks like when you open it. You might be confused but we're here to help you out.

2️⃣ DEVICE WATCHLISTS

The terminal has 3 underlying watchlists.

(FnO/Nifty50)

Rest you can add as per your wish

The terminal has 3 underlying watchlists.

(FnO/Nifty50)

Rest you can add as per your wish

3️⃣ PREDEFINED WATCHLISTS

Here we can find each and every sector watchlists. When you click on them you'll get the stocks that are in that particular sector.

Can be helpful for sectoral Analysis.

Here we can find each and every sector watchlists. When you click on them you'll get the stocks that are in that particular sector.

Can be helpful for sectoral Analysis.

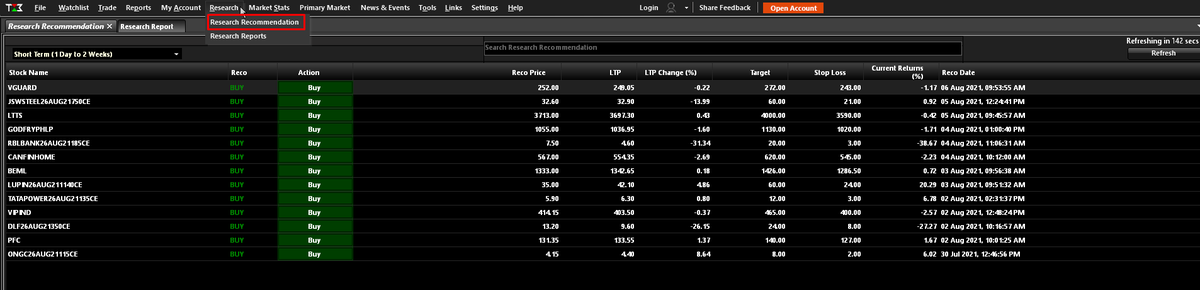

4️⃣ RESEARCH RECCOMENDADTION

Here @EdelweissFin provides stocks and good scripts for trading and investment.

Reccomendadtions vary from

- Options

- Cash stocks

- Future stocks

Here @EdelweissFin provides stocks and good scripts for trading and investment.

Reccomendadtions vary from

- Options

- Cash stocks

- Future stocks

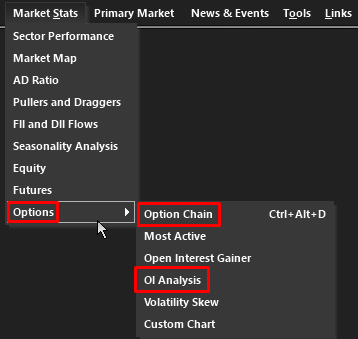

5️⃣ MARKET STATUS TOOLS

- Equity

- FnO

- Options

Get a detailed analysis on it right from

- Volume buzzers

- Options chain

- OI Analysis

- Volatility Skew

- Equity

- FnO

- Options

Get a detailed analysis on it right from

- Volume buzzers

- Options chain

- OI Analysis

- Volatility Skew

6️⃣ MARKET BREADTH

- Pullers and Draggers

- FII/DII Flow

- Sectoral Analysis

These tools can help you gauge the sentiment of the Market.

- Pullers and Draggers

- FII/DII Flow

- Sectoral Analysis

These tools can help you gauge the sentiment of the Market.

• • •

Missing some Tweet in this thread? You can try to

force a refresh