A Primer on Data and Oracles✨

Over the past couple weeks, I've observed crypto oracles in detail, and it baffles me how the current system contains loopholes that can be highly detrimental to the ecosystem🤯

Pyth brings a unique perspective to “The Oracle Problem”. an ELI5 👇

Over the past couple weeks, I've observed crypto oracles in detail, and it baffles me how the current system contains loopholes that can be highly detrimental to the ecosystem🤯

Pyth brings a unique perspective to “The Oracle Problem”. an ELI5 👇

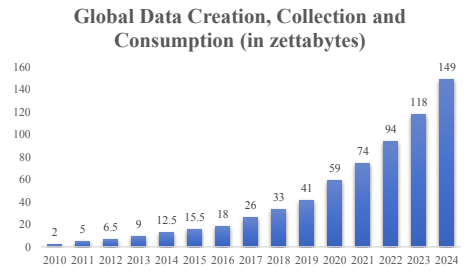

1/ Data is the life essence of how the world has developed, and it's certainly been the case for all segments of the financial markets, in various asset classes.

Global data need is urgent for a growing field like crypto, and everyone wants a slice of this global economic pie🚀

Global data need is urgent for a growing field like crypto, and everyone wants a slice of this global economic pie🚀

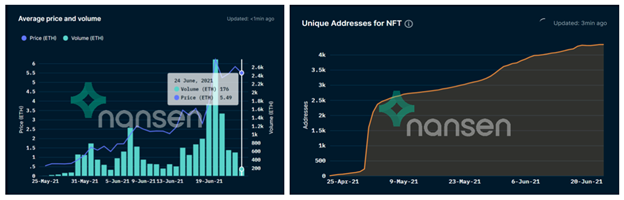

2/ From creative art and gaming projects such as NFTs and P2E games to computationally demanding derivative instrument projects, data is a critical infrastructure for developments.

As such, demand for quality data will keep growing exponentially as the crypto ecosystem matures

As such, demand for quality data will keep growing exponentially as the crypto ecosystem matures

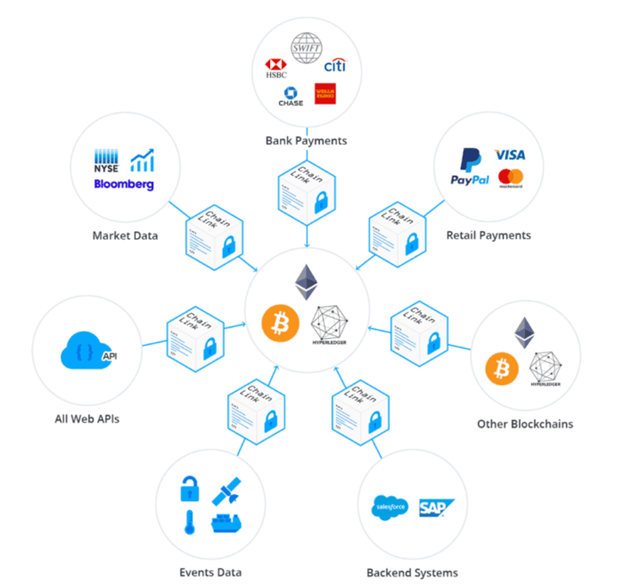

3/ At the same time, data oracles have become an inseparable part of the crypto economy. Market participants need oracles to navigate through this range of asset spectrum.

Oracles are the quintessential bridge of real-world data and are invaluable to the crypto ecosystem.

Oracles are the quintessential bridge of real-world data and are invaluable to the crypto ecosystem.

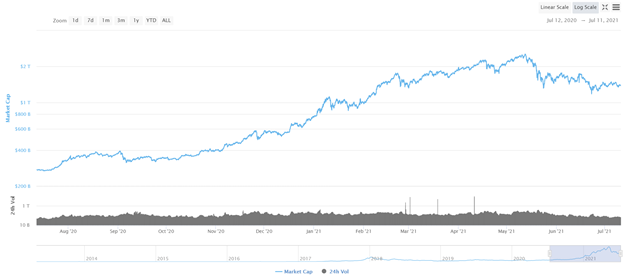

4/ With increasing usecases and exponential growth, the field of crypto oracles will be a highly lucrative business in the future.

As Chainlink is dominating the oracle space, it will be very interesting to see how new participants can grab market share from the incumbents.

As Chainlink is dominating the oracle space, it will be very interesting to see how new participants can grab market share from the incumbents.

5/ Different from the existing players, Pyth is bringing a unique approach to the oracle ecosystem.

This initiative brings forth the idea of primary data sources, and how it can be advantageous to have data directly from the providers, as opposed to third-party aggregators.

This initiative brings forth the idea of primary data sources, and how it can be advantageous to have data directly from the providers, as opposed to third-party aggregators.

6/ This is the matter that has gained traction in CT space because it can potentially be the game-changer for the oracles and how they will position themselves in the market.

Data sources will become the focal point for oracles as they scale further📊

Data sources will become the focal point for oracles as they scale further📊

https://twitter.com/PythNetwork/status/1423742094015881223?s=20

7/ For the oracles, having a primary data source vs. relying on third-party aggregators and verifying the data are two distinct points of views, and proponents of both sides have had long debates on the pros/cons of each approach.

8/ Despite all that, oracle end users would care less where the actual data comes from.

As long as the data is accurate and verifiable through the blockchain, people are content with the result and are willing to pay data oracles the appropriate amount.

As long as the data is accurate and verifiable through the blockchain, people are content with the result and are willing to pay data oracles the appropriate amount.

9/ We have seen this approach working well with Chainlink, and that many projects are relying on the oracle for pricing feed and other market data-related matters.

People “trust” Chainlink as the go-to oracle in the crypto land.

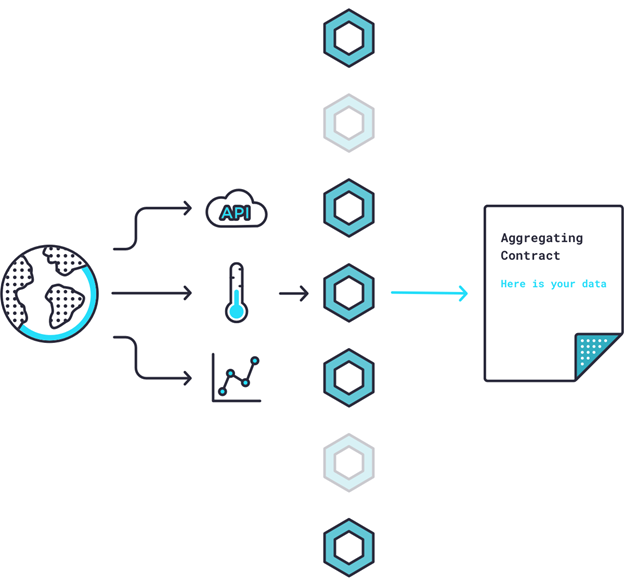

Still, “trust” is a highly subjective matter.

People “trust” Chainlink as the go-to oracle in the crypto land.

Still, “trust” is a highly subjective matter.

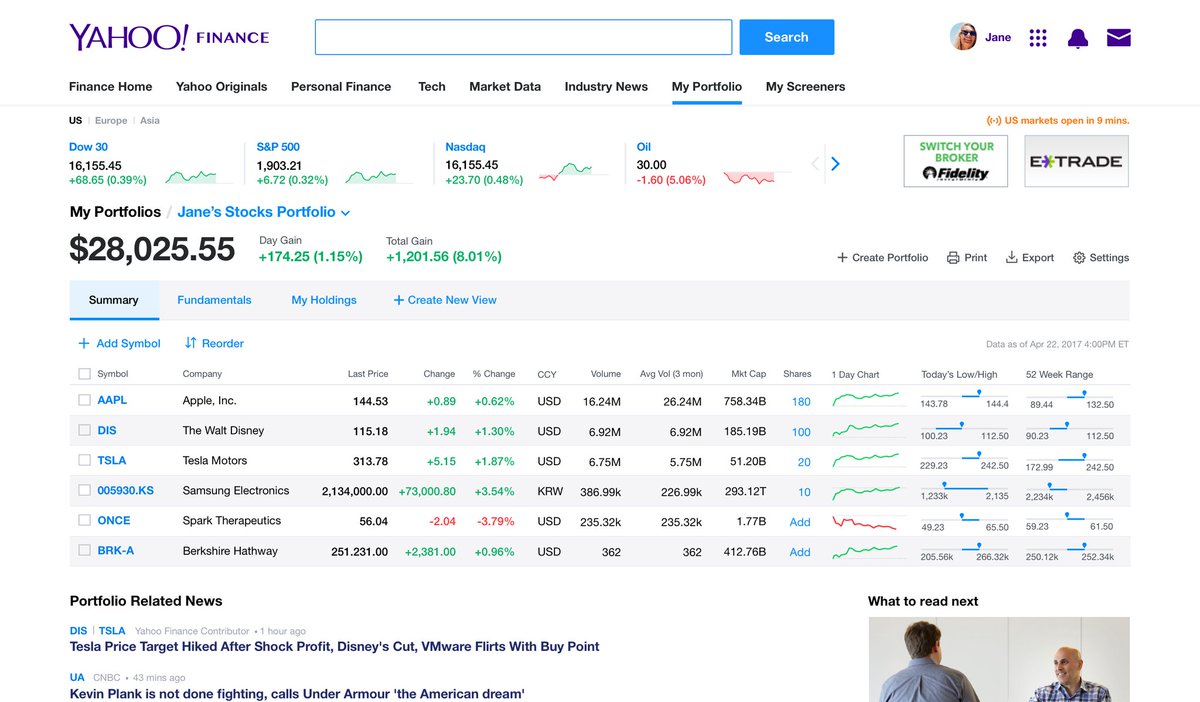

10/ In most instances, “Trusted” third-party data aggregators e.g. Yahoo Finance are good enough for most usecases.

In the case of oracles, the consensus mechanism for data verification becomes the vetting system for most people and has worked relatively well for the most part.

In the case of oracles, the consensus mechanism for data verification becomes the vetting system for most people and has worked relatively well for the most part.

11/ But let’s take a step back before we even dig deeper into the pros/cons of data sources.

What does “trust” even imply in the first place?

“Trust” is a word that’s often associated with heavy reliance upon something.

What does “trust” even imply in the first place?

“Trust” is a word that’s often associated with heavy reliance upon something.

12/ In the case of data collection, when you “trust” someone, means you rely on him/her having an edge (be it reputational or informational) on something that you can depend on.

This “trust” can go a long way, and in the world of finance, it is the lifeblood of your business🤝

This “trust” can go a long way, and in the world of finance, it is the lifeblood of your business🤝

13/ As an example, Bloomberg and Refinitiv are “trusted” due to many financial institutions relying on their data and has proven their relevancy over time.

Bloomberg has been around for close to 40 years, and Refinitiv (previously Thomson Financial) was established around 2008.

Bloomberg has been around for close to 40 years, and Refinitiv (previously Thomson Financial) was established around 2008.

14/ In crypto, you might think of Coinmarketcap or Coingecko as two of the go-to sources when it comes to crypto prices.

These sites have been around long enough (2013 and 2014 respectively) and for the most part, they are dependable sources used by many crypto natives to date.

These sites have been around long enough (2013 and 2014 respectively) and for the most part, they are dependable sources used by many crypto natives to date.

15/ So what are the similarities here? I think it’s safe to say that 2 factors drive “trust” for an entity.

They are: time relevancy and social consensus.

In TradFi and crypto, similar line of thinking can be applied in which these two factors drive “trust” sentiment the most

They are: time relevancy and social consensus.

In TradFi and crypto, similar line of thinking can be applied in which these two factors drive “trust” sentiment the most

16/ What do I mean by time relevancy and social consensus?

Well, time relevancy is quite straightforward in that over time, your credibility as a financial data provider will rise as long as you still exist and continue to provide quality services to your end customers🕘

Well, time relevancy is quite straightforward in that over time, your credibility as a financial data provider will rise as long as you still exist and continue to provide quality services to your end customers🕘

17/ Social consensus is quite unique in that the end users decide which providers give the most “value” for them.

Coming back to our previous example of Yahoo Finance, depending on the demography, one might think that it is one of the best sources for financial data.

Coming back to our previous example of Yahoo Finance, depending on the demography, one might think that it is one of the best sources for financial data.

18/ Why is it so?

With global coverages of all markets, support of diverse asset classes ranging from equities to commodities made easy to use, Yahoo Finance gets the job done for most financial data needs across demographic groups.

Also, being free is a huge plus ➕➕

With global coverages of all markets, support of diverse asset classes ranging from equities to commodities made easy to use, Yahoo Finance gets the job done for most financial data needs across demographic groups.

Also, being free is a huge plus ➕➕

19/ University students, academics to even finance professionals have used Yahoo Finance to some extent.

With so much brand awareness of the product, some people will choose Yahoo Finance over Bloomberg or Refinitiv due to the reasons mentioned above.

With so much brand awareness of the product, some people will choose Yahoo Finance over Bloomberg or Refinitiv due to the reasons mentioned above.

20/ However, what most people overlook is that Yahoo Finance often has issues with its data accuracy.

Even premium aggregators such as Bloomberg and Refinitiv can have problems with their data.

Precision is often an overlooked feature for aggregators.

cnbc.com/2017/07/03/nas…

Even premium aggregators such as Bloomberg and Refinitiv can have problems with their data.

Precision is often an overlooked feature for aggregators.

cnbc.com/2017/07/03/nas…

21/ The problem would be solved quite quickly if it only happened to only 1 site.

But since the glitch affected almost all notable data aggregators, this could have had severe ramifications if the pricing was used as a source of “truth” for many backend engines in TradFi.

But since the glitch affected almost all notable data aggregators, this could have had severe ramifications if the pricing was used as a source of “truth” for many backend engines in TradFi.

22/ In the actual event in 2017, thankfully nothing substantial happened.

All issues were resolved and the third-party providers supplying the data to the aggregators were notified immediately.

Everything was back to normal, or so it seemed to be like.

All issues were resolved and the third-party providers supplying the data to the aggregators were notified immediately.

Everything was back to normal, or so it seemed to be like.

23/ However, this wouldn’t be the case with the proliferation of data oracles relying on third-party data aggregators.

In 2017, Chainlink was just starting its roots, and barely anyone was trying to create data oracles in crypto back then.

In 2017, Chainlink was just starting its roots, and barely anyone was trying to create data oracles in crypto back then.

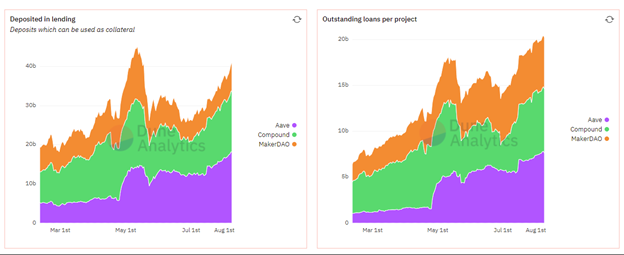

24/ With so many DeFi applications and NFT projects relying on the price feed coming from Chainlink, it is essentially the backbone engine of crypto.

Thus if it fails to deliver accurate pricing data, everything else in the system will fall apart, and this is not exaggerated.

Thus if it fails to deliver accurate pricing data, everything else in the system will fall apart, and this is not exaggerated.

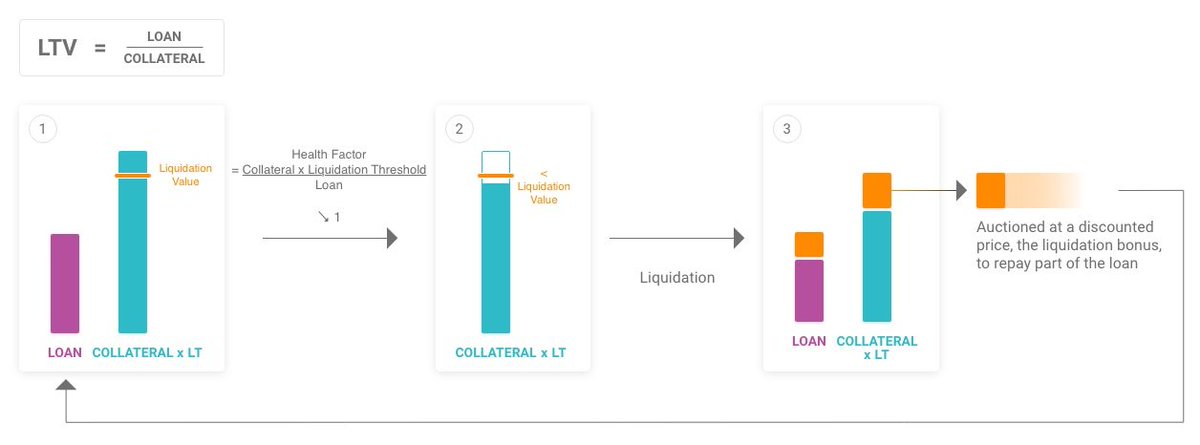

25/ Imagine a scenario whereby this pricing problem mentioned above affects the liquidation engine for some lending/borrowing platforms in DeFi.

Someone with a big position on e.g. Aave or Compound vault can get liquidated before he/she has time to "rescue" the position😱😱

Someone with a big position on e.g. Aave or Compound vault can get liquidated before he/she has time to "rescue" the position😱😱

26/ Mind you that this type of liquidation due to pricing glitch has happened previously, and numerous parties were left exploited without any compensation.

Take a look into this example that happened with Compound a few months back :

cointelegraph.com/news/compound-…

Take a look into this example that happened with Compound a few months back :

cointelegraph.com/news/compound-…

27/ Now, it’s hard to pinpoint who’s in the wrong for the $100 mn liquidation, but this serves as an issue that oracles have had a hard time dealing with.

This post lays out a wonderful explanation of the disadvantages of dependency on price oracles

hackernoon.com/the-strengths-…

This post lays out a wonderful explanation of the disadvantages of dependency on price oracles

hackernoon.com/the-strengths-…

28/ If all “trusted” price sources are mentioning the same price when it’s actually a glitch, the price will become the “truth” for that point in time.

This is the case with what happened in Compound, and certainly could have a significant effect on the overall system.

This is the case with what happened in Compound, and certainly could have a significant effect on the overall system.

29/ For this reason, data sources become the essential key to sustainability for many of these DeFi platforms.

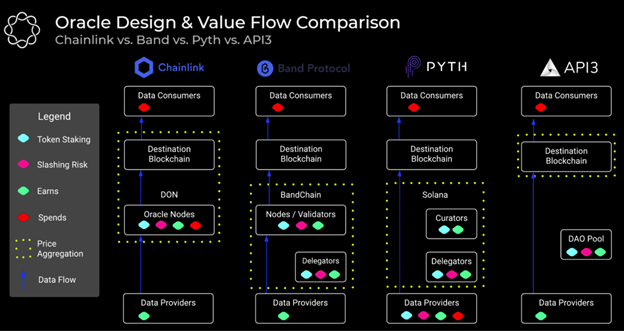

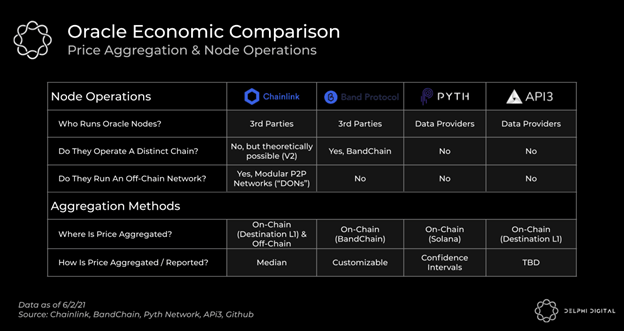

Delphi Digital posted a comprehensive report outlining the differences between each oracle, and how its current business model is run

delphidigital.io/reports/the-or…

Delphi Digital posted a comprehensive report outlining the differences between each oracle, and how its current business model is run

delphidigital.io/reports/the-or…

30/ While Chainlink depends on third-party data authenticity and the node operators’ help in the verification process

Pyth directly collaborates with the data providers to become the sources of “truth” for the oracle. What does this imply?

Pyth directly collaborates with the data providers to become the sources of “truth” for the oracle. What does this imply?

31/ It implies that contrary to Chainlink’s approach of third-party authentication, Pyth’s approach eliminates all middlemen i.e. third-party node operators and data sources, and instead gives full autonomy for data providers to provide the highest quality of data.

32/ This becomes a pivotal difference that can possibly alleviate pricing glitch issues. Suppose if Virtu or GTS is having a problem with their data for AAPL/USD pricing, Jump can still provide accurate data for Pyth oracle and assist Pyth in delivering precision to DeFi.

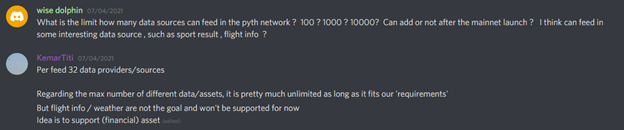

33/ In other words, if the source of data messes up its pricing data, Pyth can still use the data from other providers, as there are up to 32 individual and uncorrelated inputs that are used for its aggregation method.

34/ This is a stark comparison to the previous scenario whereby price glitches can affect price aggregators and bring catastrophic events to DeFi protocols through the oracles.

Unnecessary liquidations costing millions can happen periodically & users must factor in that risk.

Unnecessary liquidations costing millions can happen periodically & users must factor in that risk.

35/ With DeFi is still in its infancy, oracles will have to become the supporting pillars that bridge the dream of the Future of France to reality.

Having the recurring problem of pricing is NGMI behavior and this is where Pyth brings a fresh perspective of solving the issue.

Having the recurring problem of pricing is NGMI behavior and this is where Pyth brings a fresh perspective of solving the issue.

36/ Overall, the effectiveness of this approach remains to be seen.

Chainlink is still the go-to oracle for most DeFi ecosystem, but as the crypto market grows, there will be plenty of opportunities for other oracles to prove their worth in years to come.

Chainlink is still the go-to oracle for most DeFi ecosystem, but as the crypto market grows, there will be plenty of opportunities for other oracles to prove their worth in years to come.

37/ I can see a future possibility whereby as L1s continue to scale w/ tremendous transaction cost reduction, protocols can apply multiple oracles to support their price feed.

Chainlink, Pyth and others can complement one another in bringing the best data service for all crypto

Chainlink, Pyth and others can complement one another in bringing the best data service for all crypto

38/ If you enjoy this primer, give it a like and share!

It helps me as a writer to grow and enhance my skills down the road 🤝

I'll be sure to cover other projects as well in due time, don't you guys worry!

It helps me as a writer to grow and enhance my skills down the road 🤝

I'll be sure to cover other projects as well in due time, don't you guys worry!

• • •

Missing some Tweet in this thread? You can try to

force a refresh