Shalby conducted the concall today at 4:00 PM for Q1 FY22.

"Shalby is moving with exciting times with adapting various business lines, which will lead the growth in future"

Here are the Conference call highlights ☎️🧵

"Shalby is moving with exciting times with adapting various business lines, which will lead the growth in future"

Here are the Conference call highlights ☎️🧵

Business Updates:

• Majority of beds in month of May & April were converted to Covid beds.

• Average occupancy level increase to 60% this quarter.

• Shalby treated over 5,350 Covid-19 patients as compared to 776 in Q4 FY21.

• Majority of beds in month of May & April were converted to Covid beds.

• Average occupancy level increase to 60% this quarter.

• Shalby treated over 5,350 Covid-19 patients as compared to 776 in Q4 FY21.

Implant Business:

• Co. has recently acquired implant assets from Consensus Orthopedics in USA at USD 11.45 million to turnaround implant business by end of the next fiscal year.

• Plan to be breakeven in implant business by end of 2023

• In process of recruiting team members

• Co. has recently acquired implant assets from Consensus Orthopedics in USA at USD 11.45 million to turnaround implant business by end of the next fiscal year.

• Plan to be breakeven in implant business by end of 2023

• In process of recruiting team members

Franchise Model:

• Added 2 franchise partnership expected to commence

- Udaipur (FOFO mode)- Q2FY22

- Rajkot (FOCO model)- Q4 FY22

• This would be focus on orthopedic patient.

• Current focus in on Tier1 and Tier 2 cities and next expansion will be in metro cities.

• Added 2 franchise partnership expected to commence

- Udaipur (FOFO mode)- Q2FY22

- Rajkot (FOCO model)- Q4 FY22

• This would be focus on orthopedic patient.

• Current focus in on Tier1 and Tier 2 cities and next expansion will be in metro cities.

Udaipur is working with FOFO model: Franchise Own Franchise Operated Model. Here revenue would be noted in Shalby and share would be given to Franchise:

FOCO Model: Reverse reporting of revenue from FOFO model.

Revenue would be booked on the base of Franchise model.

FOCO Model: Reverse reporting of revenue from FOFO model.

Revenue would be booked on the base of Franchise model.

Healthcare Services:

• Added 500 patient this quarter, reaching to 4,300 patient.

• Launched SICS at Indore and Jaipur units.

• Improved utilization of Radiation oncology units at Naroda.

• Added 500 patient this quarter, reaching to 4,300 patient.

• Launched SICS at Indore and Jaipur units.

• Improved utilization of Radiation oncology units at Naroda.

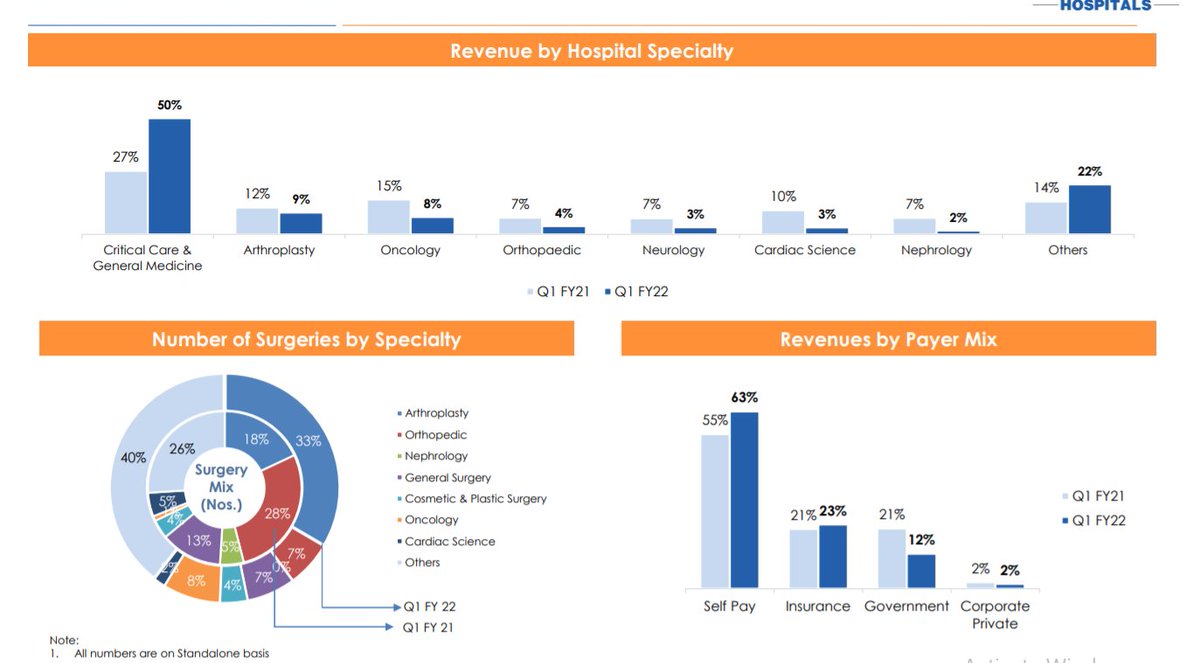

Revenue Share:

(Revenue shared mentioned in image)

• Critical Healthcare segment see major growth due to Covid 19: contributed 55% of revenue which was 17% in last quarter.

• Surgeries count in Q1FY22

• Operational Bed increased from 1200 to 1224 with 59% occupancy level

(Revenue shared mentioned in image)

• Critical Healthcare segment see major growth due to Covid 19: contributed 55% of revenue which was 17% in last quarter.

• Surgeries count in Q1FY22

• Operational Bed increased from 1200 to 1224 with 59% occupancy level

CAPEX:

• 20cr of investment in NAshik

• 150cr of investment in Mumbai.

• Shalby Advance Tech. doesn't require any major CAPEX as of now.

But most of CAPEX would be start happening in next financial year.

Maintenance CAPEX is expected to be around ~10cr.

• 20cr of investment in NAshik

• 150cr of investment in Mumbai.

• Shalby Advance Tech. doesn't require any major CAPEX as of now.

But most of CAPEX would be start happening in next financial year.

Maintenance CAPEX is expected to be around ~10cr.

ARPU:

• Decline in ARPU from was due to decline in Joing replacement surgery.

• ARPU number will be dependent on specialty mix.

• However higher ARPU would not necessarily mean higher EBIDTA.

• Decline in ARPU from was due to decline in Joing replacement surgery.

• ARPU number will be dependent on specialty mix.

• However higher ARPU would not necessarily mean higher EBIDTA.

Margin:

• Implant Business will be operational and by the end of next year, company expected to be profitable next year.

• Franchise model will be asset light model. Mgmt would watch 1-2 quarter to get margin expectation, but atleast 15-20% is what mgmt targeting as of now.

• Implant Business will be operational and by the end of next year, company expected to be profitable next year.

• Franchise model will be asset light model. Mgmt would watch 1-2 quarter to get margin expectation, but atleast 15-20% is what mgmt targeting as of now.

Other Key Data

• Co. is currently working at the highest occupancy level in non-covid segment.

• Hospital in Nashik is delayed due to external agencies and is expected to start in First half of next year.

• Around 100cr of revenue came from Covid.

• Co. is currently working at the highest occupancy level in non-covid segment.

• Hospital in Nashik is delayed due to external agencies and is expected to start in First half of next year.

• Around 100cr of revenue came from Covid.

For more discussion on Equity research and OI analysis

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh