Pidilite Industries Ltd conducted the concall today at 4:00 pm.

" Increase their distribution channel and maintaining its cost for future. "

Here are the Conference call highlights

@dmuthuk @connectgurmeet

☎️🧵

" Increase their distribution channel and maintaining its cost for future. "

Here are the Conference call highlights

@dmuthuk @connectgurmeet

☎️🧵

Outlook

- Fevicol Company has delivered strong growth during this period.

- Second wave of covid had surely disrupted the business community, and returning to normalcy has been a big relief.

- Fevicol Company has delivered strong growth during this period.

- Second wave of covid had surely disrupted the business community, and returning to normalcy has been a big relief.

- In business, their B2B and consumer and bazaar products has delivered strong growth during this period.

- This was possible due to industrial and other businesses growth.

- This was possible due to industrial and other businesses growth.

- Company is a large brand and has many niche products as well like steel grip, terminator and Motomax.

- Lots of success is seen in their B2C route and The company is working with many ecommerce players and other for its growth.

- Lots of success is seen in their B2C route and The company is working with many ecommerce players and other for its growth.

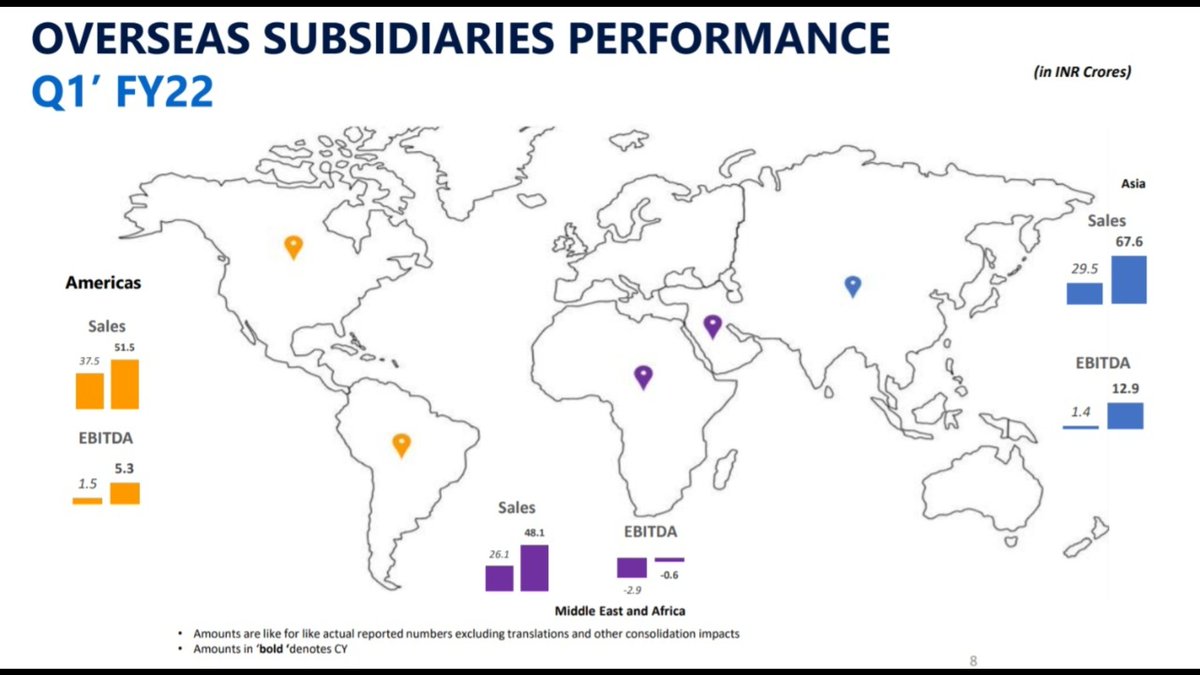

- On subsidiary front, company has 20 overseas subsidiaries and 1 JV.

- These subsidiaries delivered strong growth and have reported both currency revenue growth and strong earnings growth.

- These subsidiaries delivered strong growth and have reported both currency revenue growth and strong earnings growth.

- The Asian markets has been a major target area for their sales. It has grown by huge percentage on QOQ levels.

- The Asian markets are been followed by American markets and then Market East and African markets.

- At present, international markets are outperforming domestics.

- The Asian markets are been followed by American markets and then Market East and African markets.

- At present, international markets are outperforming domestics.

- The company has made big changes in its global strategy 2-3 years back and it had given good results.

- They had faced issues as well in many countries but over long term this situations are expected to get cleared.

- They had faced issues as well in many countries but over long term this situations are expected to get cleared.

- On domestic front, company has 15 domestic subsidiaries, 2 associate's and 1 partnership firm.

- They were hampered most with lockdown and have started to report growth from June onwards.

- They were hampered most with lockdown and have started to report growth from June onwards.

- Company has a target to increase their distribution areas.

- They have realised in last 15 months many of local and rural are yet to get covered.

- They have even entered into partnership with HUL for making gain for india.

- They have realised in last 15 months many of local and rural are yet to get covered.

- They have even entered into partnership with HUL for making gain for india.

- Company has already been in competition for new areas like water proofing, they just have a focus of maintaining their leadership positions.

- As new players enter, market tends to widen and hence new opportunities come up.

- As new players enter, market tends to widen and hence new opportunities come up.

- It's difficult to mention industrial growth rate, but for PAPL Ltd, it's a growth brand for them and will do wonders in futures.

- They expect to be 65 to 70% leader in its key markets.

- They expect to be 65 to 70% leader in its key markets.

Financials.

- As compared to last quarter net sales have grew by 120% approx.

- There has been a % rise in their material cost as well.

- On standalone basis company has delivered strong PAT growth by 408% excluding dividends from subsidiary.

- As compared to last quarter net sales have grew by 120% approx.

- There has been a % rise in their material cost as well.

- On standalone basis company has delivered strong PAT growth by 408% excluding dividends from subsidiary.

-Their key raw materials cost has risen to a higher level and company is been taking all the necessary steps to curb it.

-On PAPL, it's a premium customer part business but no growth is seen in margins due to high cost.

-Some subsidiaries are in real estate and margins are less

-On PAPL, it's a premium customer part business but no growth is seen in margins due to high cost.

-Some subsidiaries are in real estate and margins are less

- On real estate front, There has been good clearence of inventory, and as new projects are expected to launch, till that time company waits for opportunities to come up.

- On global level, chemical prices are highly volatile and linking to it a consolidation might be seen.

- On global level, chemical prices are highly volatile and linking to it a consolidation might be seen.

- They expect the prices to be back to a comfortable zone, to cover from the input cost inflation.

- Company is studying it's products closely, they want to have good price elasticity.

- Company is studying it's products closely, they want to have good price elasticity.

- Company sets a target to maintains its brand Premium by 10 to 20%.

- On Capex front, they spend 4 to 6% of their turnover. And from covid they understood, the need to keep evolving its business from all prespective. To be ready for future growth.

- On Capex front, they spend 4 to 6% of their turnover. And from covid they understood, the need to keep evolving its business from all prespective. To be ready for future growth.

- Company has very clear agenda , organically and inorganically. They have got ability to get best deals in market.

- Art and craft fall had a huge impact on company.

- As schools got closed major market was on hold.

- Art and craft fall had a huge impact on company.

- As schools got closed major market was on hold.

- At end , the company is ready to take upon any opportunities and any key areas for further growth.

- Company is expecting to launch 6 factories in which 2 are ready.

- For company, They try and launch new products in international markets and then launch it in india.

- Company is expecting to launch 6 factories in which 2 are ready.

- For company, They try and launch new products in international markets and then launch it in india.

For more discussion on Equity research and OI analysis

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

Subscribe to our YouTube channel 😃

Link 🖇: youtube.com/c/TheTycoonMin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh