Some thoughts on DeFi from our desk on how to assess TVL and risks.

Time for a thread

👇👇👇

- 75% of all funds are still held inside ETH (110B$)

- 12% is held in Binance Smart Chain

- Polygon and Terra are fightning for the 3rd place

- Solana is 4th withonly 2B TVL

Time for a thread

👇👇👇

- 75% of all funds are still held inside ETH (110B$)

- 12% is held in Binance Smart Chain

- Polygon and Terra are fightning for the 3rd place

- Solana is 4th withonly 2B TVL

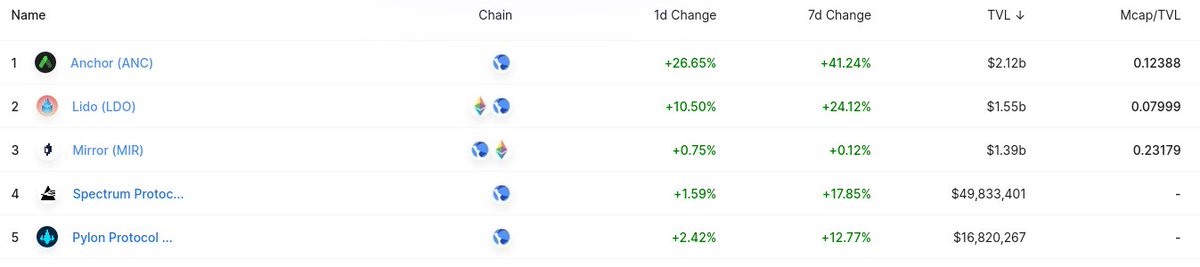

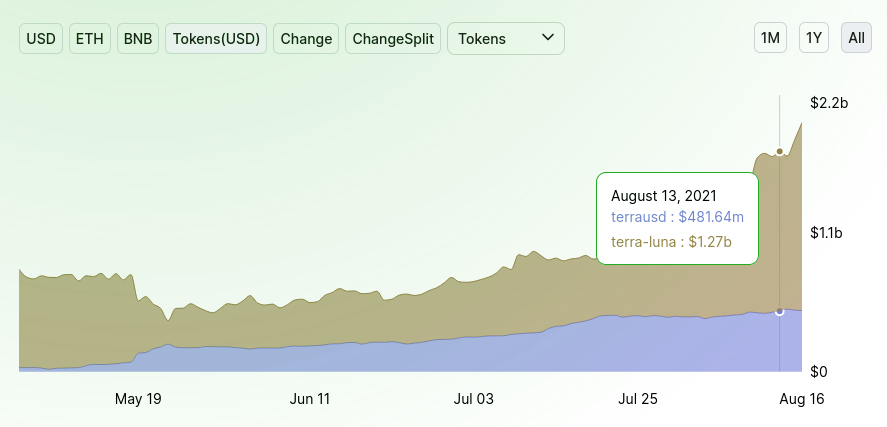

Should we stop at TVL or can we dig deeper? Let’s dig deeper. Is it better to have 1B$ TVL on Solana or on Terra? All collateral is not equally good, some collateral is much better than others. For example on @FTX_Official , from a collateral POV, 1$ in BUSD > 1$ in BTC > 1$ BNB

This makes sense as intuitively, when market is crashing, you can expect more volatility and less bids, on assets with less collateral weights (help.ftx.com/hc/en-us/artic…)

When looking at TVL in DeFi we should apply the same reasoning and discount assets being more volatile and less liquid at higher rate compared to asset with less volatility and more volume.📈📈

Let’s look at ETH TVL, we got 50B$ evenly split between AAVE, Compund, InstaDapp, Curve and MakerDao. Most of them hold a well diversified blend of assets (wBTC, USDT, blue chips and altcoins)

Looking at raw numbers, around 70/80% of ETH TVL comes from BTC, ETH and stablecoins (USDC and USDT). This means the “adjusted” TVL taking into account the quality of the underlying assets, is not too different from the initial TVL value of 110B$

Here, we have most of the assets being in TerraUST and LUNA, and clearly it entails much more risk and volatility compared to collateral held in stables, BTC and ETH.🔥🔥

Would you rather trust a 🏦financial institutions holding 🇺🇸US Treasuries or 🇬🇷Greek Bonds?

Perhaps the first, perhaps the second

Surely you would take into account RISK-ADJUSTED returns and discount your cash flows in different ways.

Perhaps the first, perhaps the second

Surely you would take into account RISK-ADJUSTED returns and discount your cash flows in different ways.

🛎️In the same way you should discount TVL by the quality of the underling assets🛎️

PS Not attacking TerraUST but over there we clearly have a lower quality collateral compared to all other DeFi protocols.

Thoughts?

🔚

PS Not attacking TerraUST but over there we clearly have a lower quality collateral compared to all other DeFi protocols.

Thoughts?

🔚

• • •

Missing some Tweet in this thread? You can try to

force a refresh