I am a bitcoin maximalist | prev HF & @jpmorgan | tweeting about trading, markets & crypto | FTX Creditor

How to get URL link on X (Twitter) App

In the last days of the FTX saga there were people actively looking to buy&sell their FTX account balance. The objective?

In the last days of the FTX saga there were people actively looking to buy&sell their FTX account balance. The objective?

flexUSD has currently 200M outstanding and trading at 0.87$

flexUSD has currently 200M outstanding and trading at 0.87$

The Luna Foundation Guard (LFG) has raised $1 billion through an over-the-counter sale of LUNA, the native token of the Terra blockchain.

The Luna Foundation Guard (LFG) has raised $1 billion through an over-the-counter sale of LUNA, the native token of the Terra blockchain.

The trade is called “funding arbitrage”, take out your notebook and follow me in the rabbit hole 🐇

The trade is called “funding arbitrage”, take out your notebook and follow me in the rabbit hole 🐇

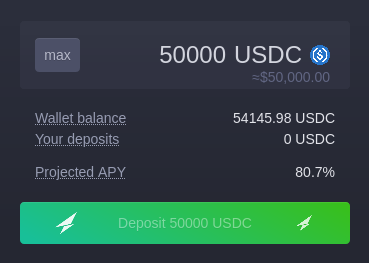

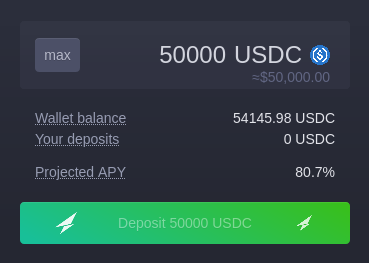

I deposited on the Cash Secured Put vault 50k USDC on the 4th of January and left it there for 4 epochs (1 month) for testing purposes.

I deposited on the Cash Secured Put vault 50k USDC on the 4th of January and left it there for 4 epochs (1 month) for testing purposes.

https://twitter.com/crypto_notte/status/1454955336067133443@ApricotFinance has a nice UI which allows for a full breakdown of interests, both paid and received.

https://twitter.com/solendprotocol/status/1455216784110411776The two accounts do not have any other tokens, strange! It must be that the two accounts were crated just for the purpose of investing and deploying capital in Solend.

Should we stop at TVL or can we dig deeper? Let’s dig deeper. Is it better to have 1B$ TVL on Solana or on Terra? All collateral is not equally good, some collateral is much better than others. For example on @FTX_Official , from a collateral POV, 1$ in BUSD > 1$ in BTC > 1$ BNB

Should we stop at TVL or can we dig deeper? Let’s dig deeper. Is it better to have 1B$ TVL on Solana or on Terra? All collateral is not equally good, some collateral is much better than others. For example on @FTX_Official , from a collateral POV, 1$ in BUSD > 1$ in BTC > 1$ BNB