If you're struggling to understand how you own a car/ house/ excavator even though you borrowed money from the bank to pay for it, here's a 2min explainer without any accounting jargon...

There's two sides to every purchase you make.

1. How you get the money (sources)

2. How you spend the money (uses)

Sources: salary, side hustle, bank loan, drug trafficking, OnlyFans

Uses: houses, cars, excavators, Birkins, garden chair for Midrand apartment

1. How you get the money (sources)

2. How you spend the money (uses)

Sources: salary, side hustle, bank loan, drug trafficking, OnlyFans

Uses: houses, cars, excavators, Birkins, garden chair for Midrand apartment

Once you source the money, the money is yours to use. Whatever you buy with the money, you own.

If you borrow 100k & buy Louis Vuitton, it's still your handbag.

If you use your own money to buy a house using cash, you own the money (source) and you own the house (use).

If you borrow 100k & buy Louis Vuitton, it's still your handbag.

If you use your own money to buy a house using cash, you own the money (source) and you own the house (use).

When you borrow money, the person/ institution lending it to you wants to make sure you can pay it back.

To make sure they check your income levels, credit history, run affordability tests & whether you support Arsenal.

They also have one last protection - called security

To make sure they check your income levels, credit history, run affordability tests & whether you support Arsenal.

They also have one last protection - called security

Security isn't ADT or Trellidor - it's what happens if you can't pay back the money!

If you lose your entire salary in Dogecoin & can't pay your home loan, the bank will intervene & try to sell your house to get their money back.

This is the where sources & uses intersect.

If you lose your entire salary in Dogecoin & can't pay your home loan, the bank will intervene & try to sell your house to get their money back.

This is the where sources & uses intersect.

When it comes to sources of money, each source only cares about being paid back. Whether it's a friend/ bank/ mashonisa

You could take a loan for a million bucks, then borrow a million from a friend & pay the bank off - the bank will never contact you again

(Unlike Netflorist)

You could take a loan for a million bucks, then borrow a million from a friend & pay the bank off - the bank will never contact you again

(Unlike Netflorist)

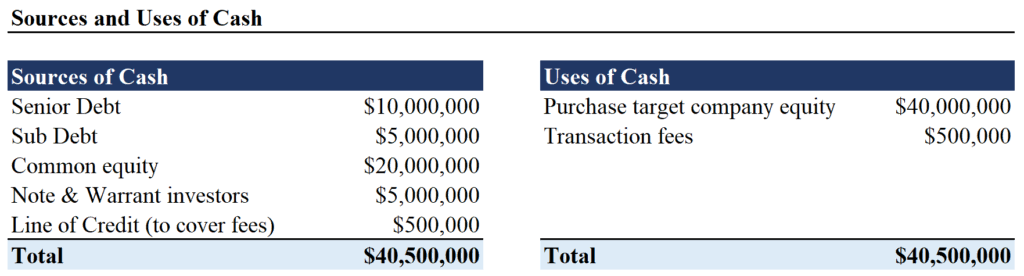

Sources & Uses is a tool used heavily in M&A ++ financing deals in investment banking.

It helps show what you need to pay back & the value of the stuff you're buying. It can get a bit complex on some deals but the concept stays the same.

It helps show what you need to pay back & the value of the stuff you're buying. It can get a bit complex on some deals but the concept stays the same.

This is useful whenever you're faced with a "do I own this?" question & don't want to call up your CA friend & hear about IFRS (also because they're annoying as fuck)

Most times you own the stuff you buy (use), you don't always own the money you used to buy stuff (source)

[END]

Most times you own the stuff you buy (use), you don't always own the money you used to buy stuff (source)

[END]

Here's an additional thread on debt

https://twitter.com/iamkoshiek/status/1365947899151085573?s=19

My goal is to make everything finance related accessible

If there's ANY finance topics/ concepts (basic or complex) you need me to break down using no jargon - feel free to post them & I will thread 🚀🚀

If there's ANY finance topics/ concepts (basic or complex) you need me to break down using no jargon - feel free to post them & I will thread 🚀🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh