The Trump tax bill created a loophole for company executives that allows them to net millions by slashing their own salaries.

Here's how.

The latest from the Secret IRS Files 👇🧵

propublica.org/article/how-th…

Here's how.

The latest from the Secret IRS Files 👇🧵

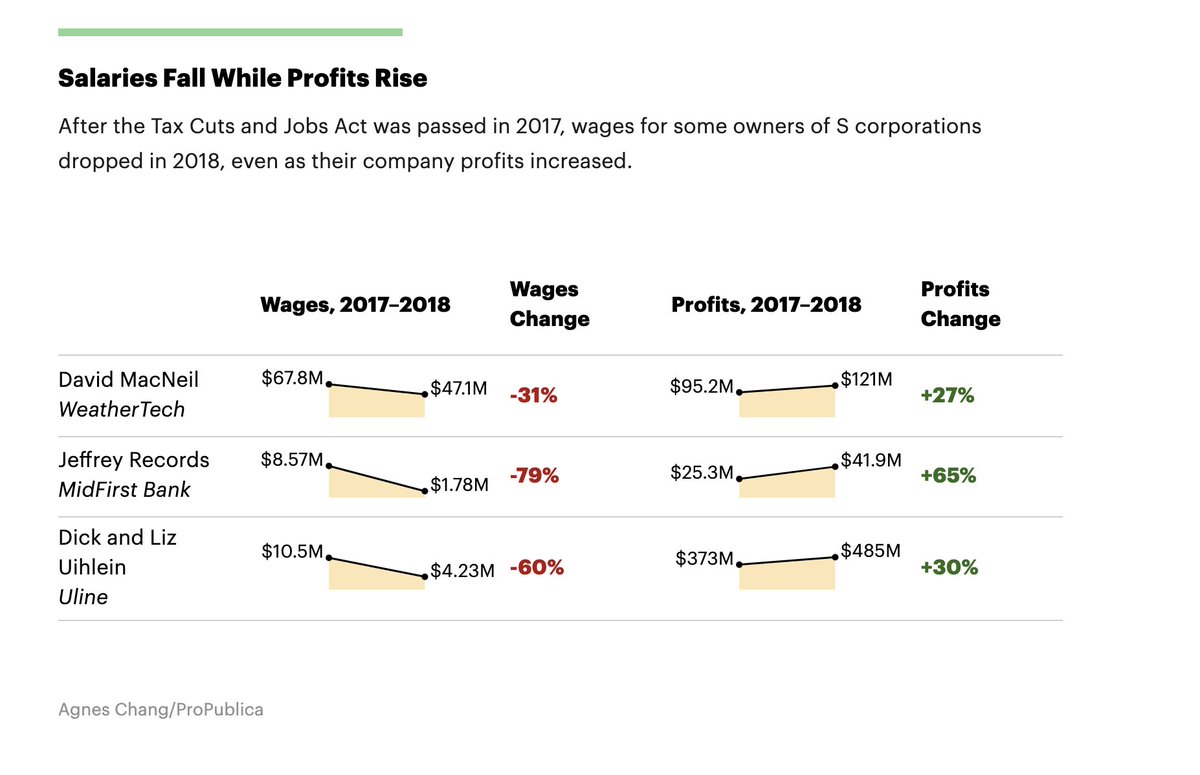

propublica.org/article/how-th…

2/ Under the Trump changes, taxes on profits from certain types of businesses were cut dramatically, while the tax rate on salaries those businesses paid was reduced only slightly.

3/ WAGES are now taxed at a top rate of 37%, plus an additional 3.8% for Medicare.

Meanwhile, PROFITS are taxed at a top rate of 29.6% (with no Medicare tax).

Meanwhile, PROFITS are taxed at a top rate of 29.6% (with no Medicare tax).

4/ This presented an alluring opportunity for people who are both owners AND employees of their companies:

Cut your own salary, which drives up your company's profits, then reap the benefit of those increased profits at a lower tax rate.

Cut your own salary, which drives up your company's profits, then reap the benefit of those increased profits at a lower tax rate.

5/ At a 2018 conference of financial advisers, one wealth planner said this “leaves a gaping hole in the tax code.”

As he put it, “The goal by the end of the presentation today is to make you guys the bus drivers...to drive right through that hole with your clients.”

As he put it, “The goal by the end of the presentation today is to make you guys the bus drivers...to drive right through that hole with your clients.”

6/ Confidential IRS data revealed multiple instances of top executives whose wages plummeted after the Trump tax bill, while their companies' profits rose.

7/ For example, the salary of David MacNeil, whose @WeatherTech floor mats are featured in a Super Bowl ad each year, fell from $68 million in 2017 to $47 million in 2018.

Meanwhile, WeatherTech's profits increased 27% that year. MacNeil avoided an estimated $8M in taxes.

Meanwhile, WeatherTech's profits increased 27% that year. MacNeil avoided an estimated $8M in taxes.

8/ MacNeil defended his wage drop and said he used the tax savings to create more jobs: “You want me investing in my country — my fellow Americans? Get out of my pocket.”

9/ In a message, MacNeil told a ProPublica reporter he didn’t understand the “real world” and added, “Maybe it’s time to grow up and get a real job with real responsibility.”

10/ “We’ve paid hundreds and hundreds of millions of dollars in taxes since 2012,” said MacNeil. “How much have you paid? Chump change for sure. Enjoy!”

11/ Jeffrey Records, CEO of Oklahoma City-based @MidFirst Bank, saw his wages sink from $8.6M in 2017 to $1.8M, but his bank's profits soared 65% during the same time period, while Records' share of the profits jumped more than $16 million.

12/ And the wages of Dick Uihlein, the Republican megadonor and chairman of shipping supplies behemoth @Uline, sank from $5.1 million to $2.1 million, lower than they'd been in over a decade, while Uline's profit's increased by about $216 million.

13/ These are all privately owned companies, which aren't required to publicly report profits, salaries for top execs or their rationales for compensation decisions.

14/ But experts who spoke to ProPublica said that, if audited, these execs would have to justify why the value of their labor plunged in a given year.

15/ Taking an unreasonably low salary in order to avoid taxes is illegal. But the IRS’ definition of “reasonable” is vague & the vast majority of owners will likely never have to justify the salary cuts. Only a tiny fraction of such companies have their wages examined by the IRS.

16/ "For a business owner, there’s every incentive to do this and every reason to believe you’ll get away with it," said Karen Burke, a tax law professor at the University of Florida.

17/ Representatives for Records declined to answer questions for this story, as did a spokesperson for the Uihleins.

18/ Get the full story on this "gaping hole in the tax" code and how it's costing the U.S. billions in uncollected tax revenue:

propublica.org/article/how-th…

propublica.org/article/how-th…

20/ The Secret IRS Files is an ongoing reporting project. Sign up here OR text “IRS” to 917-746-1447 to get each new dispatch as soon as it’s published:

propublica.org/newsletters/th…

propublica.org/newsletters/th…

• • •

Missing some Tweet in this thread? You can try to

force a refresh