Worried about the growth stock sell-off?

I’m not

I’ve invested & lived through MUCH WORSE volatility

Want to know how I learned to become comfortable with huge price swings?

Here’s my untold story of working at $PODD for 10 years:

I’m not

I’ve invested & lived through MUCH WORSE volatility

Want to know how I learned to become comfortable with huge price swings?

Here’s my untold story of working at $PODD for 10 years:

I was hired by Insulet ($PODD) in 2004

The company was 4 years old and funded entirely by venture capital

I was fresh out of college and started in marketing

(Fun fact: I helped name the company’s product OmniPod)

The company was 4 years old and funded entirely by venture capital

I was fresh out of college and started in marketing

(Fun fact: I helped name the company’s product OmniPod)

In 2004, we were still in the R&D phase

We were developing an innovative insulin pump for people with diabetes

We had:

❌No FDA approval

❌No revenue

❌No chance of reaching profitability for YEARS

But, our technology had A LOT of potential

We were developing an innovative insulin pump for people with diabetes

We had:

❌No FDA approval

❌No revenue

❌No chance of reaching profitability for YEARS

But, our technology had A LOT of potential

Within a year we won FDA approval (hooray!)

Up next: commercialization

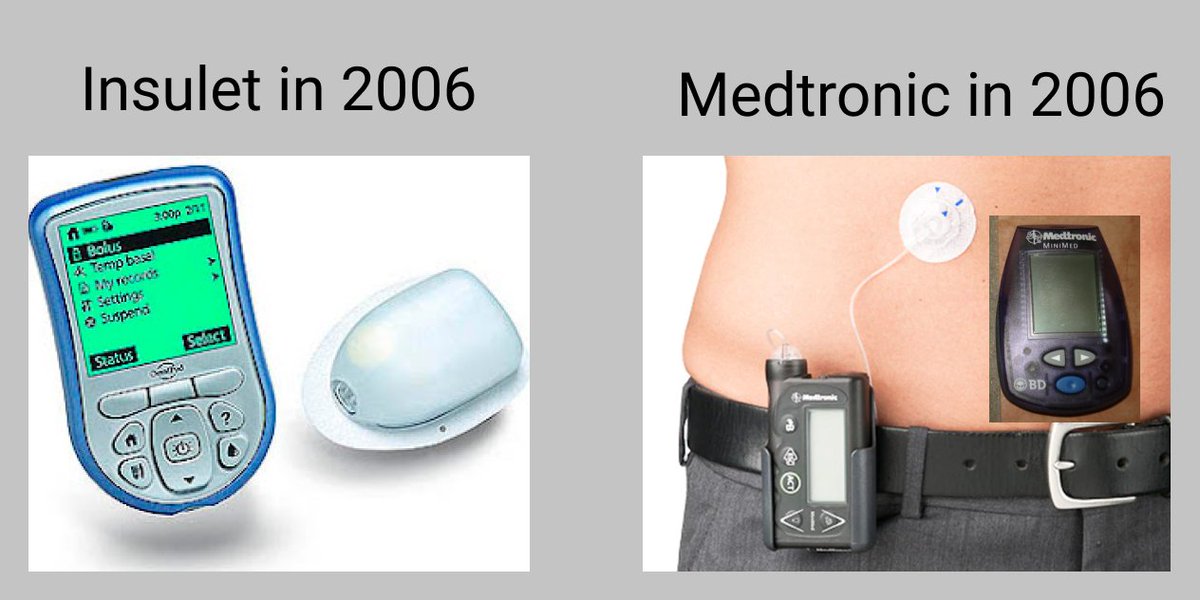

Everyone at the company believed that our product/technology was SUPERIOR to the competition

(mostly Medtronic, who had ~90% market share)

Up next: commercialization

Everyone at the company believed that our product/technology was SUPERIOR to the competition

(mostly Medtronic, who had ~90% market share)

OmniPod advantages:

✅No tubing

✅Automatic cannula insertion

✅Fewer parts

✅Built-in Glucometer

✅Smaller

✅Waterproof

I figured it was a “no brainer” choice and that commercialization would be easy (ha!)

✅No tubing

✅Automatic cannula insertion

✅Fewer parts

✅Built-in Glucometer

✅Smaller

✅Waterproof

I figured it was a “no brainer” choice and that commercialization would be easy (ha!)

I later was transitioned to sales

My job: convince providers to recommend Omnipod

In 2006, we faced some HUGE challenges:

❌Limited insurance coverage

❌Limited supply

❌Limited customer support

❌Limited resources

Medtronic also outnumbered us 30-to-1

My job: convince providers to recommend Omnipod

In 2006, we faced some HUGE challenges:

❌Limited insurance coverage

❌Limited supply

❌Limited customer support

❌Limited resources

Medtronic also outnumbered us 30-to-1

Despite these challenges, we grew rapidly

Demand ALWAYS outstripped supply

Gradually:

✅Insurance coverage improved

✅Customer support improved

✅Our sales/marketing team grew

✅Product supply improved

Demand ALWAYS outstripped supply

Gradually:

✅Insurance coverage improved

✅Customer support improved

✅Our sales/marketing team grew

✅Product supply improved

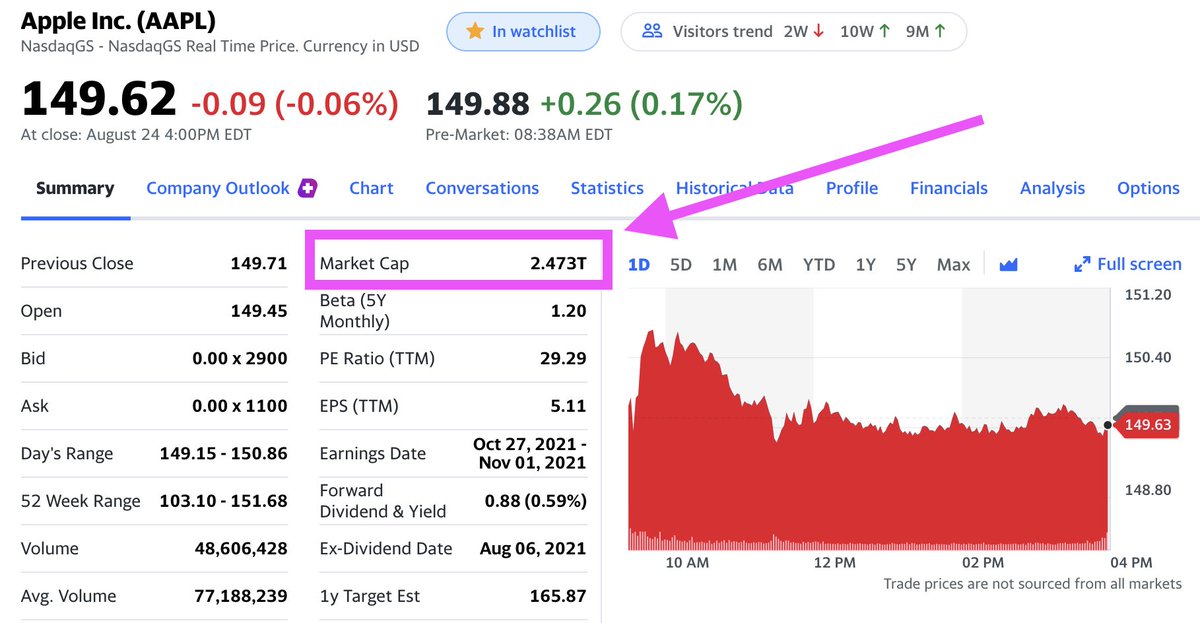

In May 2007, we needed capital

We went public on the NASDAQ (hooray!) pricing at $15/share

Our market cap was ~$400 million

Our TTM revenue was ~$10 million

So we priced at ~40x sales — expensive!

We went public on the NASDAQ (hooray!) pricing at $15/share

Our market cap was ~$400 million

Our TTM revenue was ~$10 million

So we priced at ~40x sales — expensive!

By Dec of 2007 — FOR NO REASON AT ALL — our stock was up a lot

We peaked at $27.85, a ~70% gain in 6 months

I remember thinking “I don’t understand why the stock is up this much”

But, my stock options were in the green, so we were all thrilled

We peaked at $27.85, a ~70% gain in 6 months

I remember thinking “I don’t understand why the stock is up this much”

But, my stock options were in the green, so we were all thrilled

Our 2007 year-end financials:

Revenue: $13 MM (+300%)

Cost of revenue: $26 million (yes, gross margin was NEGATIVE 95%)

Net loss: $54 MM

Cash: $94 MM

Debt: $16 MM

Price-to-sales ratio: 49

(Would you invest?)

Revenue: $13 MM (+300%)

Cost of revenue: $26 million (yes, gross margin was NEGATIVE 95%)

Net loss: $54 MM

Cash: $94 MM

Debt: $16 MM

Price-to-sales ratio: 49

(Would you invest?)

Up next: the 2008 financial crisis

Markets were in freewill

Suddenly NO ONE wanted to own a money-losing, high-growth, high-risk stock

Our stock started to drop

$25

$20

$15

$10

$5

By March of 2009, we bottomed at $2.57/share — a ~90% (!!!) peak-to-trough DROP

Markets were in freewill

Suddenly NO ONE wanted to own a money-losing, high-growth, high-risk stock

Our stock started to drop

$25

$20

$15

$10

$5

By March of 2009, we bottomed at $2.57/share — a ~90% (!!!) peak-to-trough DROP

You can imagine how this felt

Our previously valuable stock options were now HUGELY underwater

We were still burning capital ($93 MM in 2008)

Our management was forced to lay off employees

Some of my coworker friends were let go through no fault of their own…

It sucked

Our previously valuable stock options were now HUGELY underwater

We were still burning capital ($93 MM in 2008)

Our management was forced to lay off employees

Some of my coworker friends were let go through no fault of their own…

It sucked

Meanwhile, Insulet -- THE BUSINESS -- continued to improve

Every month, we grew

Insurance coverage, training, supply...all improve consistently

Revenue grew to $66 million by 2009

Gross margin was POSITIVE 30%

We were still losing money, but the business model was working

Every month, we grew

Insurance coverage, training, supply...all improve consistently

Revenue grew to $66 million by 2009

Gross margin was POSITIVE 30%

We were still losing money, but the business model was working

That taught me an important lesson:

The BUSINESS and the STOCK are NOT the same thing!

We were a MUCH STRONGER company in 2009 than in 2007,

but our stock was $27.85 in 2007 and $2.57 in 2009

Think about that!!!

18 months of PROGRESS resulted in a ~90% LOSS!

The BUSINESS and the STOCK are NOT the same thing!

We were a MUCH STRONGER company in 2009 than in 2007,

but our stock was $27.85 in 2007 and $2.57 in 2009

Think about that!!!

18 months of PROGRESS resulted in a ~90% LOSS!

By 2011, the markets and our stock were on the upswing

Revenue grew, margins improved

We hit $17/share, up 500+% from the 2009 lows

For risk-management purposes, I started to sell my $PODD stock and reinvest elsewhere

Revenue grew, margins improved

We hit $17/share, up 500+% from the 2009 lows

For risk-management purposes, I started to sell my $PODD stock and reinvest elsewhere

By 2014, Insulet was doing great

@DavidGFool even made it a Rule Breakers recommendation in May (I was thrilled)!

The rec price? $35.10

Yup — at an ALL-TIME HIGH (and 20x higher than the March 2009 lows!)

@DavidGFool even made it a Rule Breakers recommendation in May (I was thrilled)!

The rec price? $35.10

Yup — at an ALL-TIME HIGH (and 20x higher than the March 2009 lows!)

By 2015, the company was SO MUCH stronger, but my sales weren’t keeping up

I was burned out

I knew that I was put on earth to be an investor/financial educator, not sell insulin pumps

I was eventually shown the door (that's a story for another day)

I was burned out

I knew that I was put on earth to be an investor/financial educator, not sell insulin pumps

I was eventually shown the door (that's a story for another day)

Thankfully, @themotleyfool gave me a shot as a writer

Shout out to @anandchokkavelu, Michael Douglass, @KristineHarjes for taking a chance on me!

Shout out to @anandchokkavelu, Michael Douglass, @KristineHarjes for taking a chance on me!

Fast forward to today and Insulet has become HUGELY successful

TTM revenue: $995 MM

GM: 66%

Market cap: $20 billion

Stock price: $297

I sold it all between $17 - $50 (there’s a lesson!)

The stock is up 15x - 6x since

(@TMFRuleBreakers is up 700+% on their recommendation)

TTM revenue: $995 MM

GM: 66%

Market cap: $20 billion

Stock price: $297

I sold it all between $17 - $50 (there’s a lesson!)

The stock is up 15x - 6x since

(@TMFRuleBreakers is up 700+% on their recommendation)

Insulet wasn’t even the only diabetes company to have this EXACT experience

Dexcom $DXCM had even more dramatic volatility

2005 IPO price: $14

2006 high: $25.16

2009 low: $1.36 (down 95%!!!!)

Current price: $509

A 36-bagger from IPO and a 374-bagger from the 2009 low!

Dexcom $DXCM had even more dramatic volatility

2005 IPO price: $14

2006 high: $25.16

2009 low: $1.36 (down 95%!!!!)

Current price: $509

A 36-bagger from IPO and a 374-bagger from the 2009 low!

What’s funny is that if you only look at revenue, the journey for both $DXCM & $PODD is up and to the right!

If you only focused on the business, both companies continuously got bigger, better, & stronger!

If you only focused on the business, both companies continuously got bigger, better, & stronger!

$PODD & $DXCM have been home runs, but they aren’t the only big medical device winners

Since IPO:

$ALGN 3,780%

$ABMD +5,910%

$DXCM 4,220%

$EW 2,790%

$PODD 1,760%

$ISRG 17,040% (!!!)

(Can you tell why I LOVE searching for innovative medical device stocks?)

Since IPO:

$ALGN 3,780%

$ABMD +5,910%

$DXCM 4,220%

$EW 2,790%

$PODD 1,760%

$ISRG 17,040% (!!!)

(Can you tell why I LOVE searching for innovative medical device stocks?)

A few up-and-comers that I’m watching:

$DMTK (skin cancer)

$INSP (sleep apnea)

$LUNG (emphysema)

$NNOX (x-ray)

$NVCR (tumors)

$OM (dialysis)

$SILK (stroke prevention)

$SWAV (cardiovascular)

$TMDX (organ transplant)

$DMTK (skin cancer)

$INSP (sleep apnea)

$LUNG (emphysema)

$NNOX (x-ray)

$NVCR (tumors)

$OM (dialysis)

$SILK (stroke prevention)

$SWAV (cardiovascular)

$TMDX (organ transplant)

Will all of these medical device stocks work out?

OF COURSE NOT!!!

They are all HIGH RISK, so I’m sure that many of them will be duds

For every $PODD, there are DOZENS of companies that flammed out

But, if just one of them is the next $AMBD, you can do very well!

OF COURSE NOT!!!

They are all HIGH RISK, so I’m sure that many of them will be duds

For every $PODD, there are DOZENS of companies that flammed out

But, if just one of them is the next $AMBD, you can do very well!

Twitter caps threads at 25 and I've run out of Tweets

Please expand this thread to keep reading more about the story & lesson ⬇️

Please expand this thread to keep reading more about the story & lesson ⬇️

I get DMs all the time asking:

“why is X stock up/down today?”

“Do you still like X stock after the drop?”

People are looking for assurance that these stocks will recover…

This isn’t something that anyone (even the CEO of the company) can know!!!

“why is X stock up/down today?”

“Do you still like X stock after the drop?”

People are looking for assurance that these stocks will recover…

This isn’t something that anyone (even the CEO of the company) can know!!!

That’s why I focus on news/earnings and not the stock

I’m always asking myself: Is the thesis on track?

If it is, then the stock price will eventually take care of itself

(Here’s a recent video providing more details about my earnings review process)

I’m always asking myself: Is the thesis on track?

If it is, then the stock price will eventually take care of itself

(Here’s a recent video providing more details about my earnings review process)

I know this is very confusing, especially to new investors

Why do stock prices go DOWN if the company is doing well? It makes no sense!

Well, welcome to stock picking!

Why do stock prices go DOWN if the company is doing well? It makes no sense!

Well, welcome to stock picking!

No one can teach you what it feels like to watch wealth evaporate

That can ONLY be experience

Downturns always seem like “obvious” buying opportunities in hindsight

But, LIVING THROUGH THEM, with no knowledge of what’s going to happen, is an entirely different experience

That can ONLY be experience

Downturns always seem like “obvious” buying opportunities in hindsight

But, LIVING THROUGH THEM, with no knowledge of what’s going to happen, is an entirely different experience

Many people can’t handle the uncertainty

Seeing red in their portfolio drives them crazy!

(If that’s you, I suggest dollar-cost averaging into index funds!)

Seeing red in their portfolio drives them crazy!

(If that’s you, I suggest dollar-cost averaging into index funds!)

Say it with me:

The business is not the stock

The stock is not the business

I can’t predict short-term price movements (and I don’t even try!)

The business is not the stock

The stock is not the business

I can’t predict short-term price movements (and I don’t even try!)

Instead, I focus on:

▪️Business model

▪️Moat

▪️Growth rates

▪️Pricing Power

▪️Margins

▪️Management

▪️Optionality

▪️Risk!

I don’t focus on what the stock price is doing today

▪️Business model

▪️Moat

▪️Growth rates

▪️Pricing Power

▪️Margins

▪️Management

▪️Optionality

▪️Risk!

I don’t focus on what the stock price is doing today

Is my investing style “best”?

Perhaps not!

I’ll will always be the guy holding an “obvious” loser for too long.

I’m OK with that — because I’ve sold way too many winners early!

Perhaps not!

I’ll will always be the guy holding an “obvious” loser for too long.

I’m OK with that — because I’ve sold way too many winners early!

Over a period of days/week/quarters/years, I EXPECT to outperform sometimes and underperform other times

However, over multi-year periods — yes, MULTI-year period — I expect to outperform the market

But, THERE ARE NO GUARANTEES

However, over multi-year periods — yes, MULTI-year period — I expect to outperform the market

But, THERE ARE NO GUARANTEES

How do I cope with the volatility?

1) I study market history

2) I practice a barbell financial strategy

3) I follow / connect with like-minded investors

1) I study market history

2) I practice a barbell financial strategy

3) I follow / connect with like-minded investors

Thanks for reading

If you enjoy this thread, follow me @brianferoldi

I tweet regularly about investing, money, and self-improvement

If you enjoy this thread, follow me @brianferoldi

I tweet regularly about investing, money, and self-improvement

If you want to learn how I analyze a business in real-time, subscribe to my YouTube channel

Today, we are researching $APPS from scratch at 1 PM EST

youtube.com/brianferoldiyt…

Today, we are researching $APPS from scratch at 1 PM EST

youtube.com/brianferoldiyt…

Key takeaways:

▪️Volatility is normal

▪️Expect extreme volatility from high-growth, high-risk stocks

▪️Watch the business, not the stock

▪️Measure your performance in years, not days

▪️If you don’t want to pick stocks, dollar cost average into index funds

▪️Volatility is normal

▪️Expect extreme volatility from high-growth, high-risk stocks

▪️Watch the business, not the stock

▪️Measure your performance in years, not days

▪️If you don’t want to pick stocks, dollar cost average into index funds

• • •

Missing some Tweet in this thread? You can try to

force a refresh