Brief thread on the Fed's attitude towards inflation.

The July minutes reiterated that the general FOMC view is that currently elevated inflation is likely transitory. No complaints from me here—I agree, and the data (for now, at least) support it. 1/X

The July minutes reiterated that the general FOMC view is that currently elevated inflation is likely transitory. No complaints from me here—I agree, and the data (for now, at least) support it. 1/X

However, "most" FOMC participants also believe that substantial further progress has been made towards the inflation goal.

I struggle with this. If higher inflation is transitory, then the progress made so far will be ephemeral and eventually prove to be no progress at all. 2/X

I struggle with this. If higher inflation is transitory, then the progress made so far will be ephemeral and eventually prove to be no progress at all. 2/X

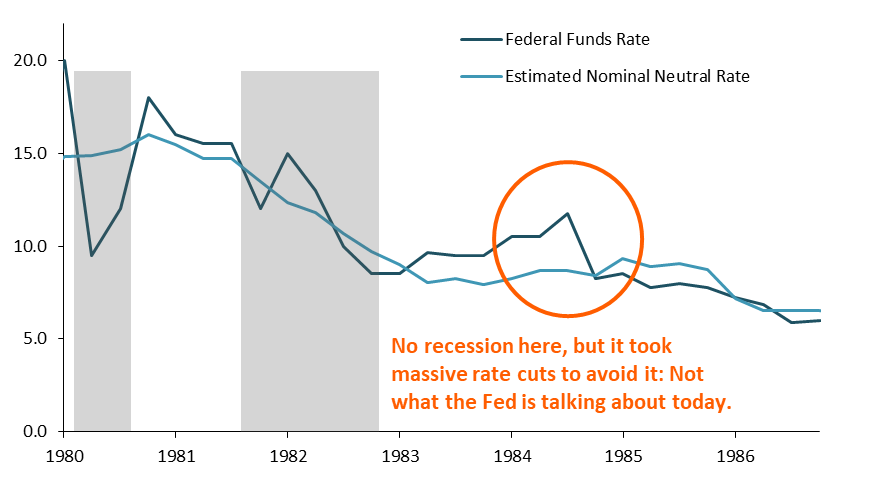

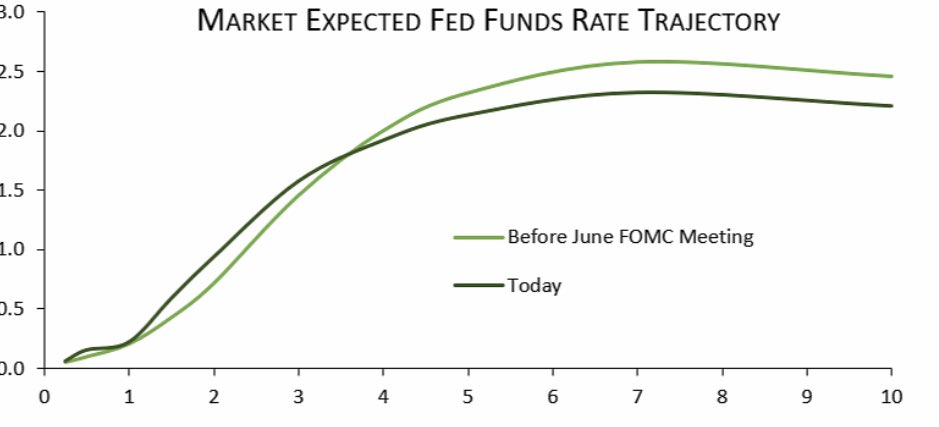

The market appears to be struggling with this as well. In fact, the market is now expecting a lower terminal Fed funds rate (well below the FOMC's median long-run dot of 2.5%) and more rate hikes in the near term. I.e., the market lost faith in the new FAIT framework. 3/X

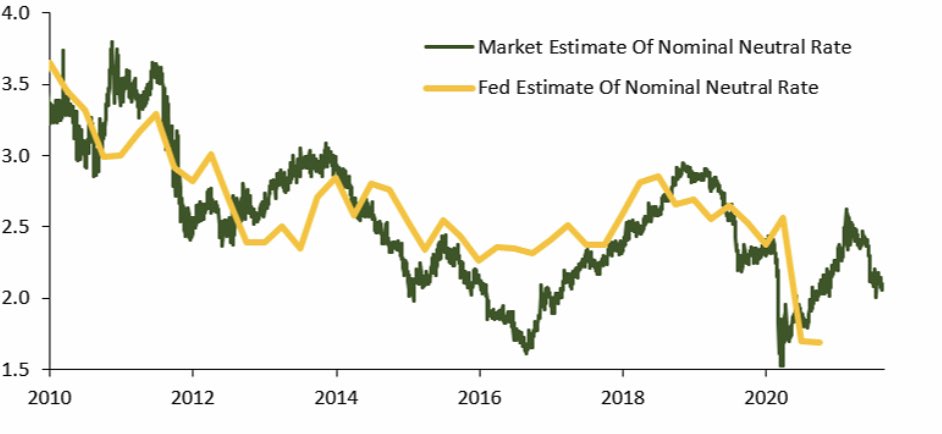

The drop in the expected terminal can be viewed as the mkt expectation for the nominal neutral rate. The drop since the June FOMC is huge. The mkt thinks the Fed was on the right track but is now overreacting to transitory inflation, nullifying the benefits of FAIT. I agree. 4/X

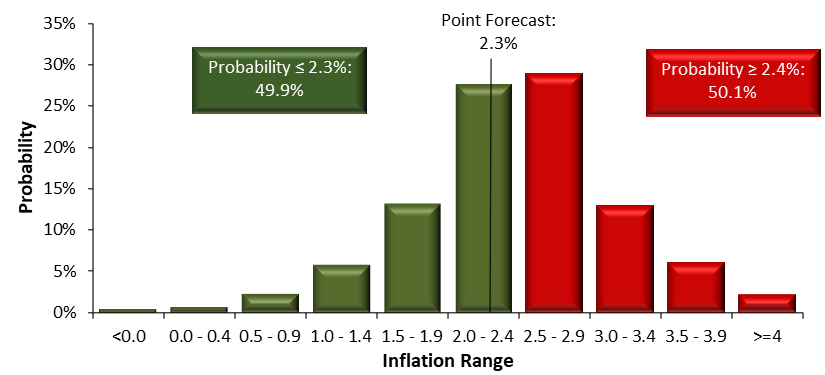

Interestingly, the Fed's own models (DKW) suggest that inflation expectations have declined and are below 2% and below pre-Covid levels. Not the picture the Fed would hope to see. Some more FOMC conviction in FAIT would probably do a lot of good to the longer term US outlook. 5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh