1 | $NVDA is breaking out in a major way this morning after strong earnings and forward guidance last week. . .

Let's take a closer look at the Q2 results

[THREAD]

Let's take a closer look at the Q2 results

[THREAD]

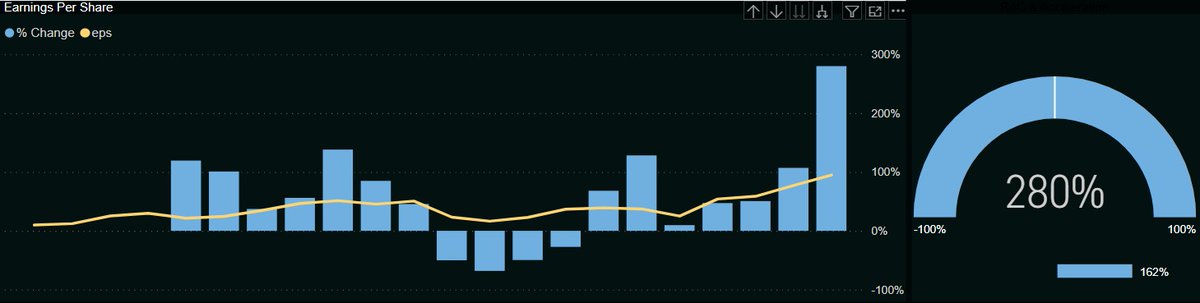

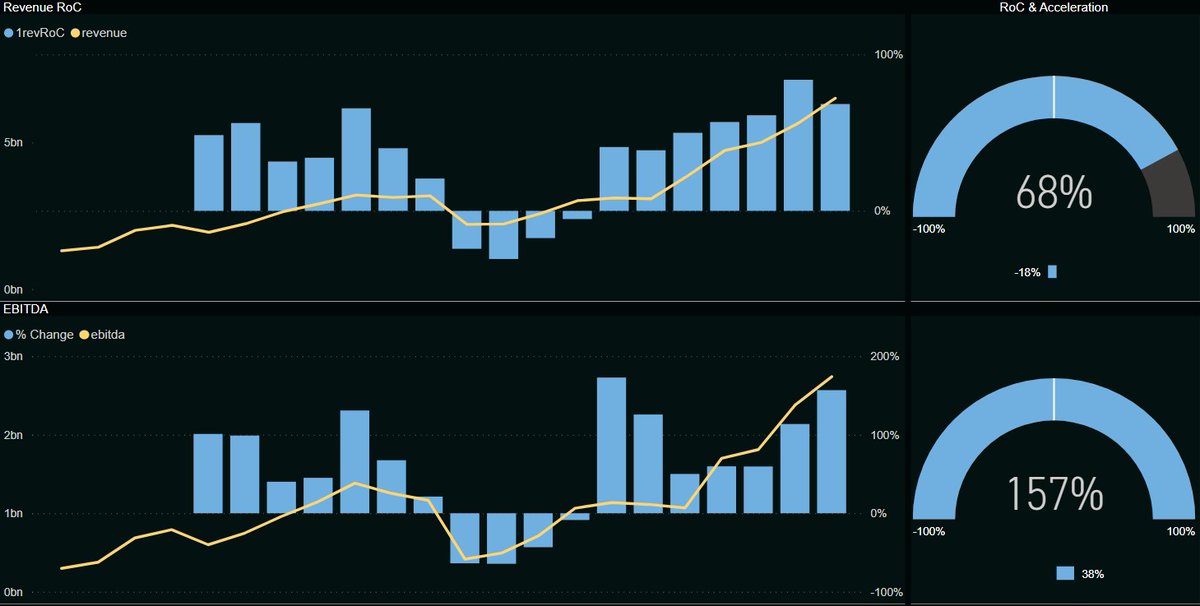

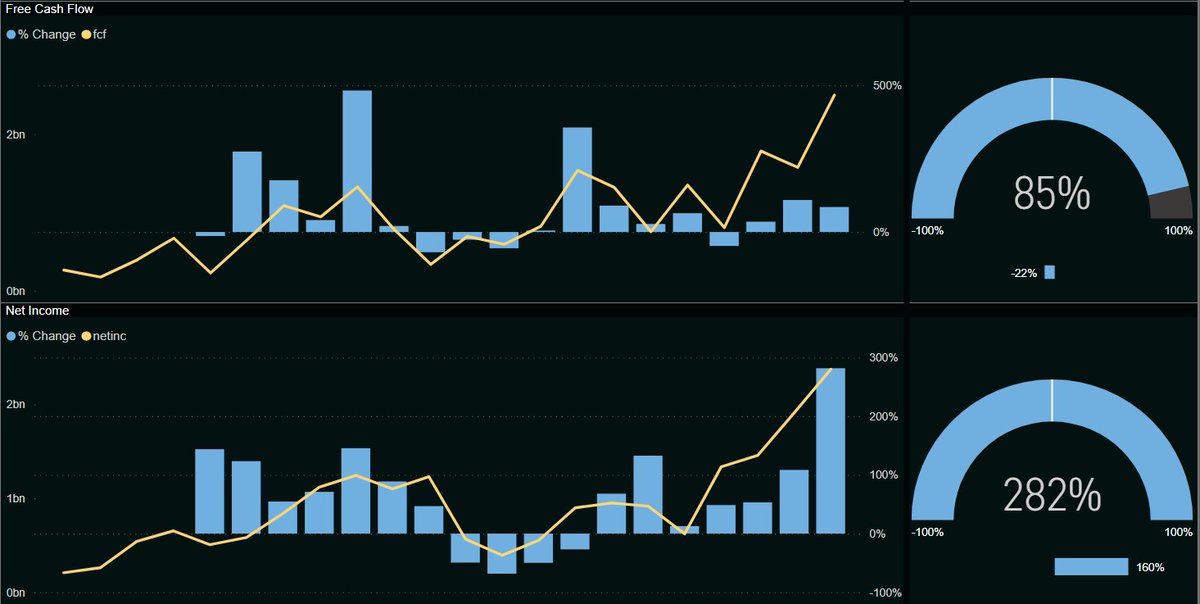

2| GROWTH -

$NVDA EPS blasted higher, up 280% Y/Y

Revenue, EBITDA, Net Income and Free Cash Flow (FCF) all continued higher as well - although the acceleration of the push higher in revenue began to slow (-18%) after lapping the easiest Y/Y comparisons to the 2020 COVID lows

$NVDA EPS blasted higher, up 280% Y/Y

Revenue, EBITDA, Net Income and Free Cash Flow (FCF) all continued higher as well - although the acceleration of the push higher in revenue began to slow (-18%) after lapping the easiest Y/Y comparisons to the 2020 COVID lows

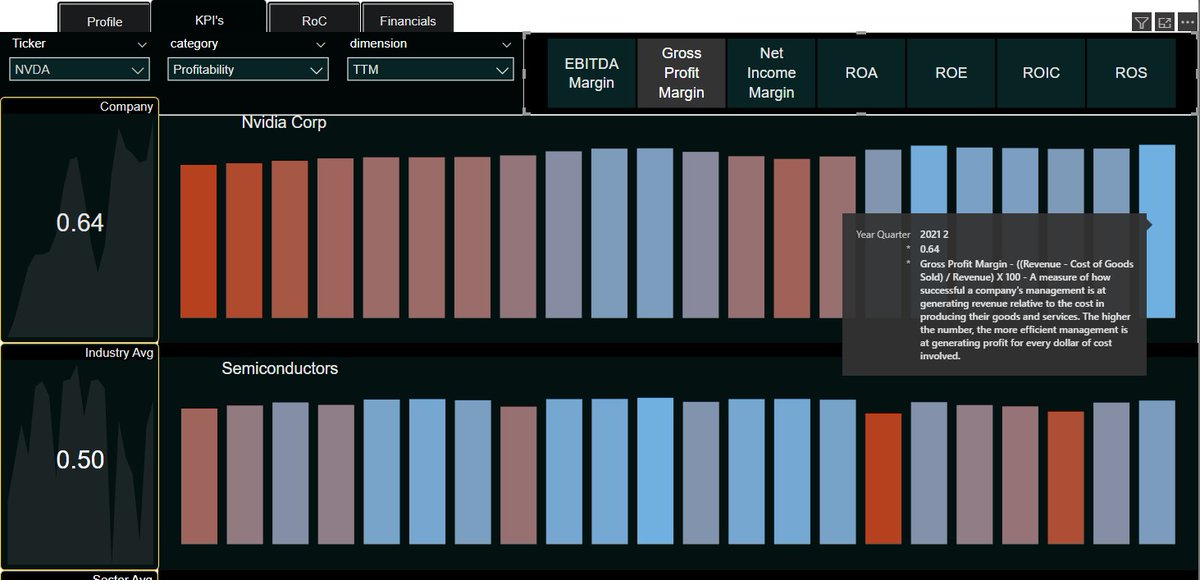

3 | PROFITABILITY - for $NVDA also improved and outperformed industry peers:

Gross Profit Margin: 0.64 vs industry 0.50

EBITDA Margin: 0.39 vs industry 0.20

Net Income Margin: 0.32 vs industry 0.08

Gross Profit Margin: 0.64 vs industry 0.50

EBITDA Margin: 0.39 vs industry 0.20

Net Income Margin: 0.32 vs industry 0.08

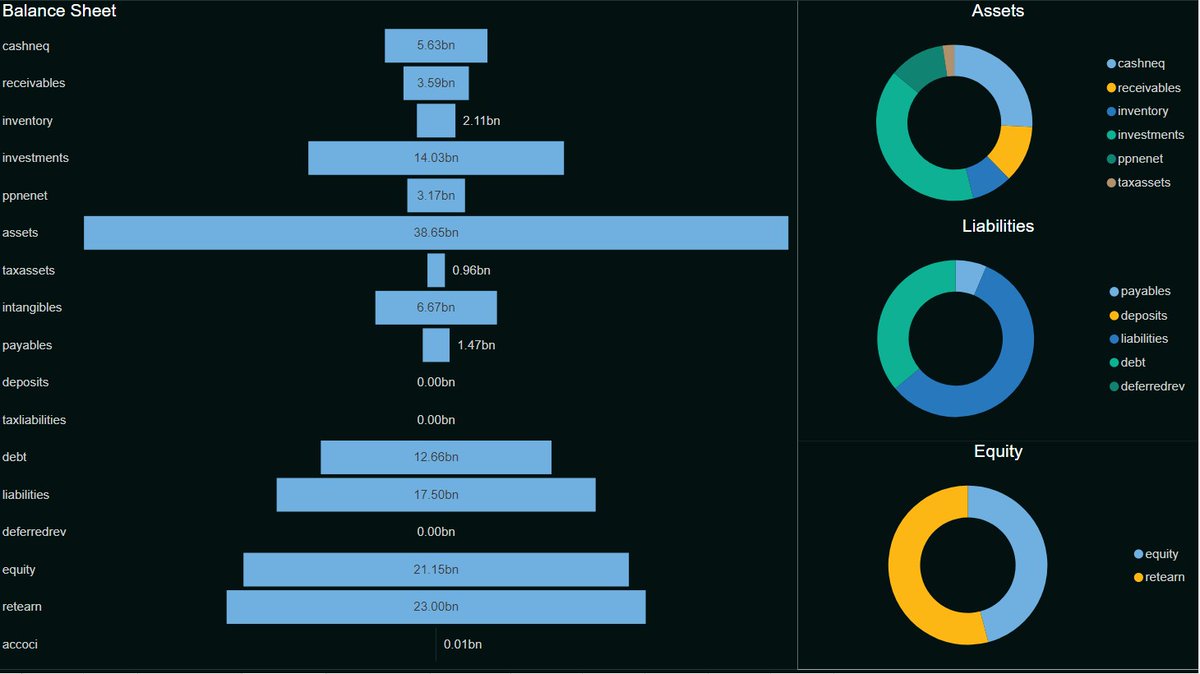

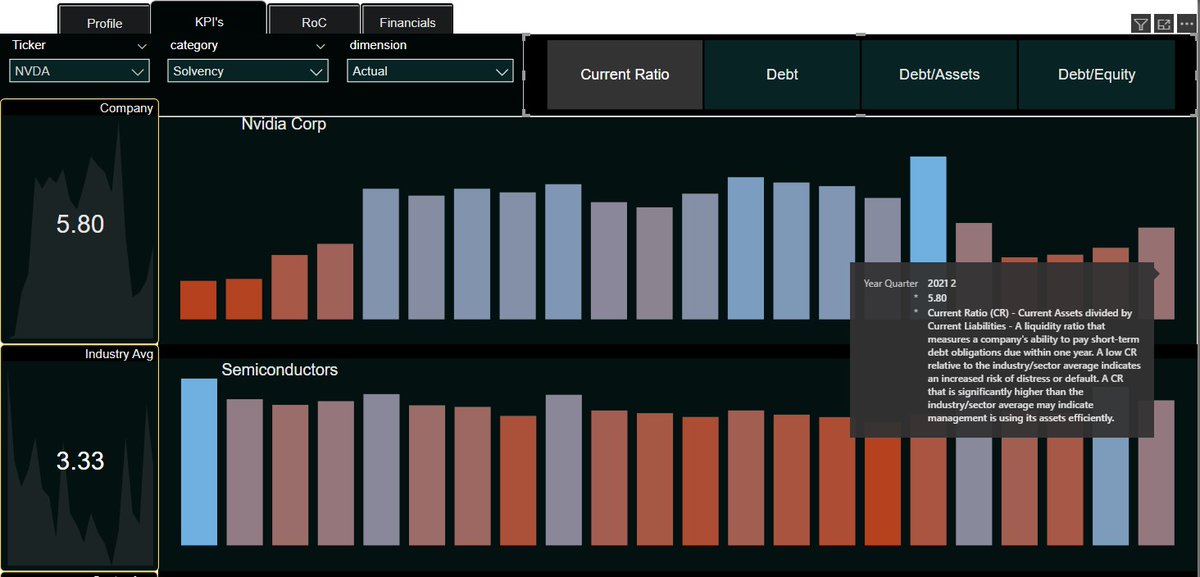

4 | SOLVENCY -

$NVDA has more debt ($12.6B) than cash ($5.63B) sitting on the balance sheet, but a healthy current ratio of 5.8 + superior earnings mean they will have no problem servicing their debt obligations.

$NVDA has more debt ($12.6B) than cash ($5.63B) sitting on the balance sheet, but a healthy current ratio of 5.8 + superior earnings mean they will have no problem servicing their debt obligations.

5 | VALUATION -

EV/EBITDA: 41.01 vs ind 11.50

P/E: 50.86 vs ind 17.10

P/B: 14.69 vs ind 2.90

P/S: 13.21 vs ind 3.20

$NVDA is far more expensive than industry peers, but with superior earnings & profitability it would seem they have earned their hefty valuation

EV/EBITDA: 41.01 vs ind 11.50

P/E: 50.86 vs ind 17.10

P/B: 14.69 vs ind 2.90

P/S: 13.21 vs ind 3.20

$NVDA is far more expensive than industry peers, but with superior earnings & profitability it would seem they have earned their hefty valuation

6 | #Semiconductors INDUSTRY TAILWINDS:

1. Global chip shortage boosting profitability

2. Secular semiconductor megatrend still intact as technology trends lift demand

3. Remote work trend another tailwind for demand

1. Global chip shortage boosting profitability

2. Secular semiconductor megatrend still intact as technology trends lift demand

3. Remote work trend another tailwind for demand

7 | It's easy to see what the market sees in $NVDA

- Accelerating growth

- Superior Profitability

- Healthy financial condition

- Industry tailwinds

- Accelerating growth

- Superior Profitability

- Healthy financial condition

- Industry tailwinds

8 | Sky high valuations are commonplace in a market as wild as this one. Don't let that stop you from seizing opportunities as they rise.

Solid underlying company performance + earnings beat + price break out = damn fine opportunity

*not investment advice*

Solid underlying company performance + earnings beat + price break out = damn fine opportunity

*not investment advice*

9 | For access to all the tools and training you need to perform this type of analysis:

marketbarometrix.com

marketbarometrix.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh