I've been thinking a lot about portfolio sizing. I've decided to eliminate arbitrary size limits in my portfolio, it doesn't make sense when you have new capital inflows every month and stock prices are moving around⬇️

Since i mostly invest in high moat companies with long duration cash flows, i think of my holdings as having broadly similar runways. This is especially true given my industry concentrations (over 50% of my capital invested in Aerospace and Defense, for example)

According to "concentration". I should identify 1 or 2 of the best Aerospace companies, put all my money in them, and keep adding to those positions as new capital flows in. But this never made sense to me because the prices of those stocks moves around daily.

If i buy a stock at a 10% FCF yield, and in a month it moves up 20%, it now trades at an 8.3% FCF yield. The future fundamentals likely did not change in that short timespan, only the entry price. This affects the forward return calculation.

I prefer to think of my portfolio as a "stable", and at any given time, a horse within my stable may be priced in such a way so as to give me better odds. Any incremental money i have should be applied to the horse that has the best payoff at that time.

Therefore, I don't want to "anchor" to an arbitrary weight for my investments. I like $TDG a lot, I doubled my position when the stock hit $330 during Covid, within a year the stock went to $680, it's mathematically a different bet at that level.

Meanwhile, $SAFRY stock has traded off significantly in the last month or two. Both these stocks have similar 30 year runways of protected aftermarket revenues at great margins

$TDG normalized FCF/share is probably ~$33-35/share, so at the current price of $610 its trading at 18.5x. I think SAFRY will earn about EUR9 in a few years, which means it trades at 11x. Shouldn't i allocate more money to SAFRY while this price disparity exists? I think so

It's something that i've seen with Buffett as well, He bought $KO at a very cheap multiple in 1987/88. He basically hasn't really added to that position materially over the next 35 years, despite it sometimes trading for cheaper than his entry multiple.

Since Buffett has new capital coming in constantly, he allocates to whatever will give the best forward returns at that time, he doesn't just plus up his $KO position because it was once weighted at 20% or whatever

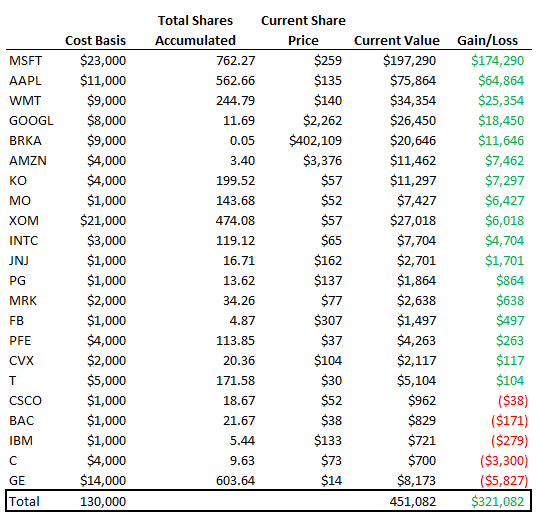

I think i will end up owning something like 50 stocks over a long period of time, that means i will have a big stable, and at any given time there will be stocks in that stable that are cheap that i can allocate to.

All my research energy is spent on trying to identify companies that pass strict business quality hurdles. Once a company is good enough, it can become part of the stable, and then it's weight at any given time is just a matter of whether the price is low enough to be attractive

I think this means that, as a portfolio, i will "underperform" for significant periods of time, because i'm likely to be allocating against momentum. But over time i expect each individual stock to outperform or at least match the index.

• • •

Missing some Tweet in this thread? You can try to

force a refresh