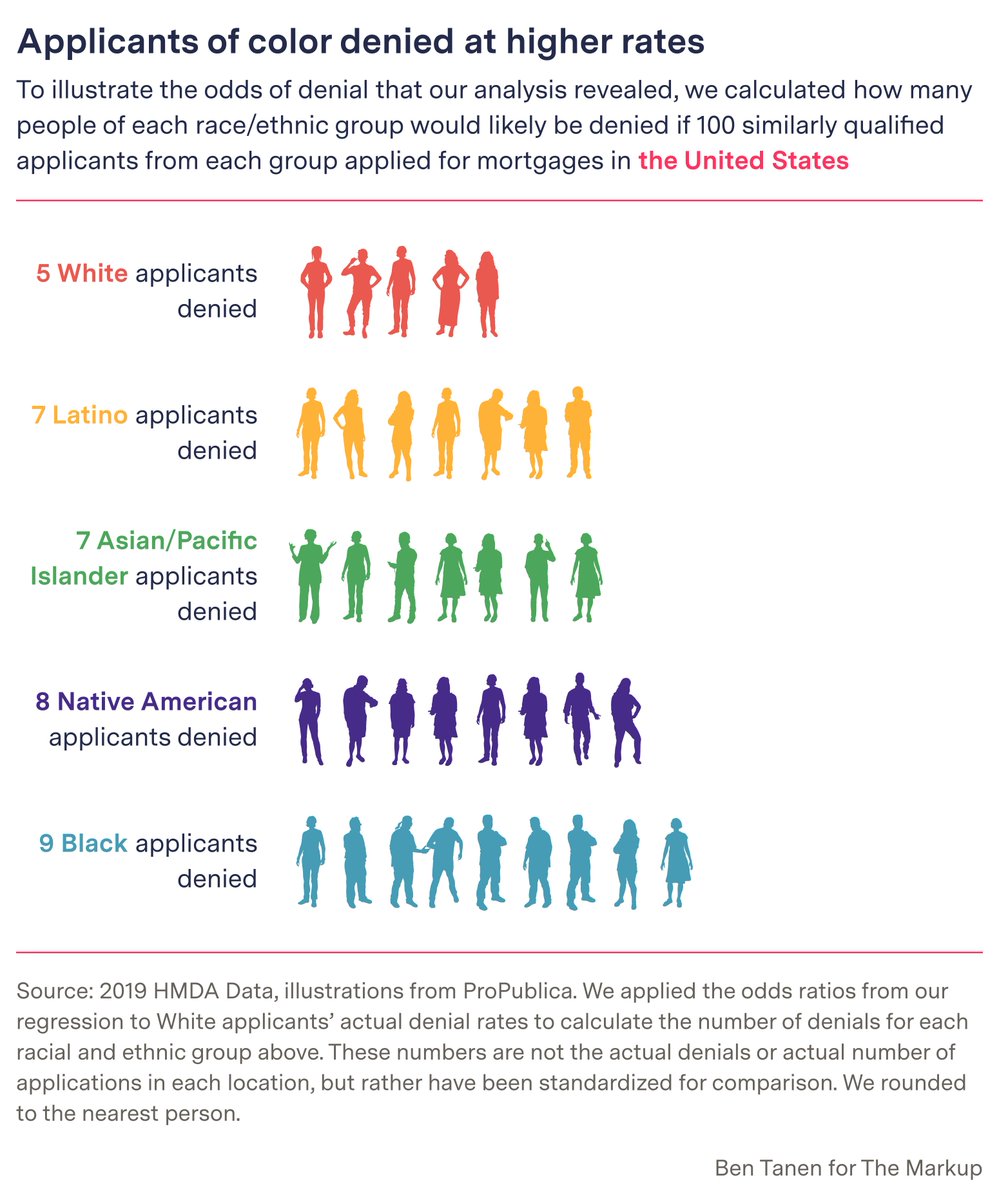

#NEW: Lenders are more likely to deny home loans to people of color than White people with similar financial backgrounds.

Black people were 80% more likely to be denied, @eh_mah_nwel and @lkirchner reveal in their latest investigation.

themarkup.org/denied/2021/08…

Black people were 80% more likely to be denied, @eh_mah_nwel and @lkirchner reveal in their latest investigation.

themarkup.org/denied/2021/08…

Nationally, our analysis found, the mortgage industry was 40% to 80% more likely in 2019 to deny home loans to people of color than to White people with similar financial characteristics.

We also found significant disparities in 89 metropolitan areas, spanning every region of the country, from Boston, Mass., to Riverside, Calif.

One Texas-based lender, whose top markets include Dallas, Houston, and Austin, was 160% more likely to deny Black applicants than comparable White applicants. themarkup.org/denied/2021/08…

When @eh_mah_nwel previously uncovered racial disparities in home loans with @reveal, @MBAMortgage criticized the analysis because the data didn’t include debt ratios, loan ratios, or credit scores—key factors it said would explain the disparities. revealnews.org/article/for-pe…

Two of those factors—debt-to-income and combined loan-to-value ratios—are now public and included in today’s investigation.

The federal government still strips the third factor, credit scores, from the public data.

The federal government still strips the third factor, credit scores, from the public data.

We found that even accounting for debt and loan ratios, disparities remain: People of color are denied loans at higher rates than similar White applicants.

Read our methodology here. themarkup.org/show-your-work…

Read our methodology here. themarkup.org/show-your-work…

Representatives of the mortgage industry and individual lenders say our work is still incomplete. Their main critique? The lack of credit scores.

But @CFPB regulators have access to credit scores and analyzed 2019 data accounting for them. Racial disparities weren’t eliminated.

But @CFPB regulators have access to credit scores and analyzed 2019 data accounting for them. Racial disparities weren’t eliminated.

Mortgage decisions are largely driven by a series of algorithms.

Quasi-government agencies @FreddieMac and @FannieMae, who buy about half of all home loans, require lenders to use an outdated credit-scoring model called Classic FICO.

Quasi-government agencies @FreddieMac and @FannieMae, who buy about half of all home loans, require lenders to use an outdated credit-scoring model called Classic FICO.

This credit-scoring model doesn’t consider things like on-time rent and cellphone payments. Instead, it rewards more traditional forms of credit, which White Americans have more access to.

Despite requests from fair housing advocates, the mortgage and housing industries, and Congress, @FreddieMac and @FannieMae haven’t switched to newer models that would potentially be fairer to people of color.

Their regulator, @FHFA, has allowed the agencies to stick with the old model for years.

Even @FICO, the company that created the Classic FICO model, has advocated for a newer version that could expand credit to more people.

Even @FICO, the company that created the Classic FICO model, has advocated for a newer version that could expand credit to more people.

@FannieMae and @FreddieMac also developed automated software to evaluate potential homebuyers. Even their regulator doesn’t know exactly how the programs weigh factors, and their decisions are stripped from public mortgage data.

Fair lending advocates are beginning to question the mortgage lending industry’s value system that some say focuses too much on risk, shutting out people of color.

Read the full investigation on racial disparities in mortgage lending—and how those disparities could potentially be addressed. themarkup.org/denied/2021/08…

• • •

Missing some Tweet in this thread? You can try to

force a refresh