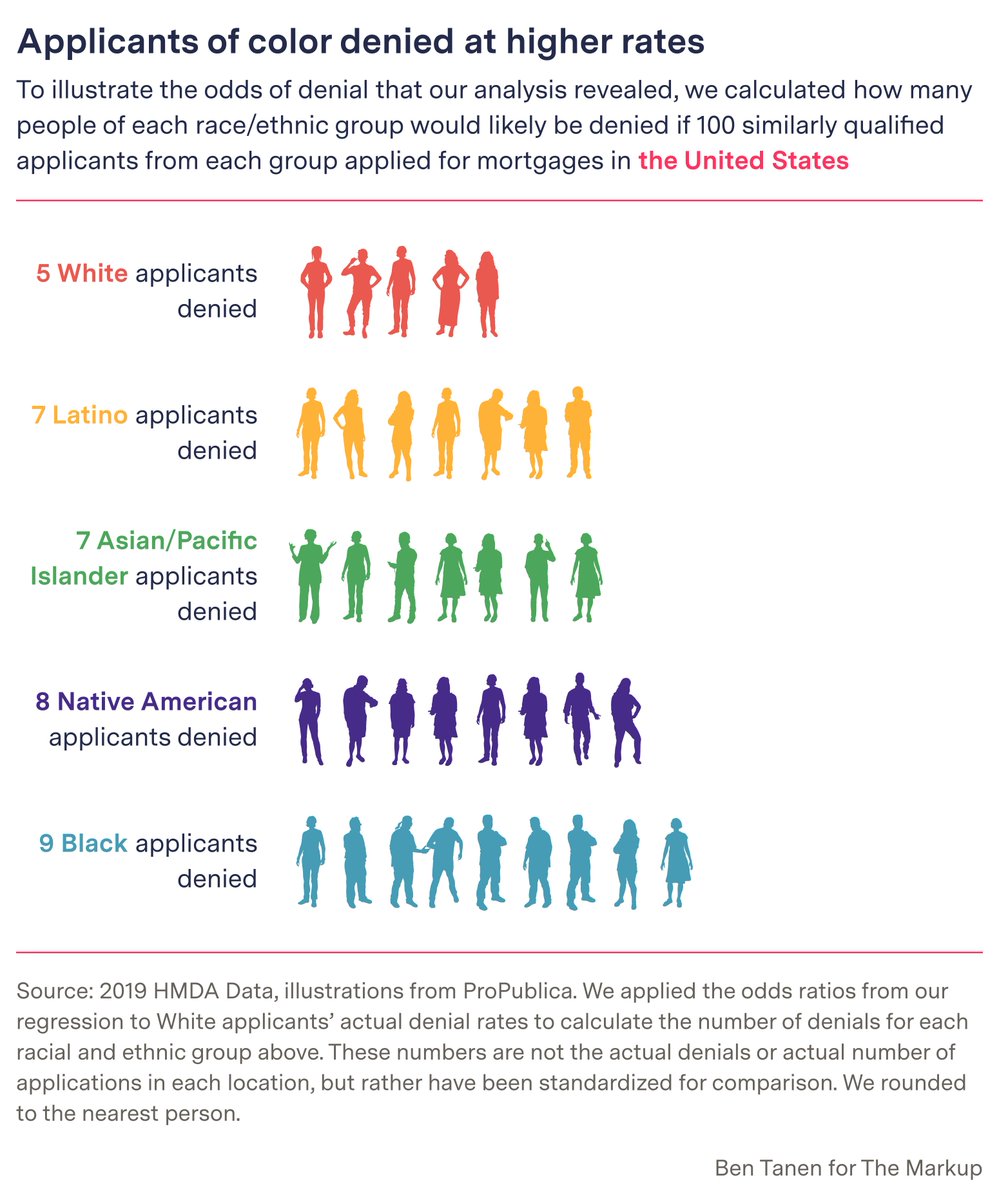

We found racial disparities in home loan denial rates throughout the mortgage industry.

But among large lenders, those owned by our nation’s largest home builders had some of the widest gaps, report @MalenaCarollo and @eh_mah_nwel. Thread. 🧵themarkup.org/denied/2021/08…

But among large lenders, those owned by our nation’s largest home builders had some of the widest gaps, report @MalenaCarollo and @eh_mah_nwel. Thread. 🧵themarkup.org/denied/2021/08…

Have you heard of D.R. Horton, Lennar Corporation, or PulteGroup Inc.? These are our nation’s largest home builders.

They have some things in common beyond new construction: owning mortgage companies that denied applicants of color at higher rates than their White counterparts.

They have some things in common beyond new construction: owning mortgage companies that denied applicants of color at higher rates than their White counterparts.

Let’s start with the widest disparity: DHI Mortgage, which finances homes built by parent company D.R. Horton, the nation’s largest home builder.

It was 160% more likely to deny Black applicants and 100% more likely to deny Latinos than similar White applicants.

It was 160% more likely to deny Black applicants and 100% more likely to deny Latinos than similar White applicants.

The second widest: Lennar Mortgage.

This lender was created in 1981 by Lennar Corporation, the nation’s second-largest home builder.

Lennar Mortgage was 130% more likely to deny Black applicants and 110% more likely to deny Latino applicants than their White counterparts.

This lender was created in 1981 by Lennar Corporation, the nation’s second-largest home builder.

Lennar Mortgage was 130% more likely to deny Black applicants and 110% more likely to deny Latino applicants than their White counterparts.

Coming in third: Pulte Mortgage.

This company is owned by PulteGroup Inc., the third-largest home builder in the country.

Pulte Mortgage was 120% more likely to deny Latino applicants than White applicants with similar financial characteristics.

This company is owned by PulteGroup Inc., the third-largest home builder in the country.

Pulte Mortgage was 120% more likely to deny Latino applicants than White applicants with similar financial characteristics.

DHI Mortgage and Lennar Mortgage said they are “deeply committed to providing equal opportunity” and “support initiatives to address macroeconomic and societal disparities,” respectively.

Neither disputed our analysis.

Pulte Mortgage declined to comment entirely.

Neither disputed our analysis.

Pulte Mortgage declined to comment entirely.

Read @lkirchner’s and @eh_mah_nwel’s full investigation into racial disparities in home lending here. themarkup.org/denied/2021/08…

• • •

Missing some Tweet in this thread? You can try to

force a refresh