The thread explains my momentum scanner and how to build it in #TradePoint software.

@Definedge

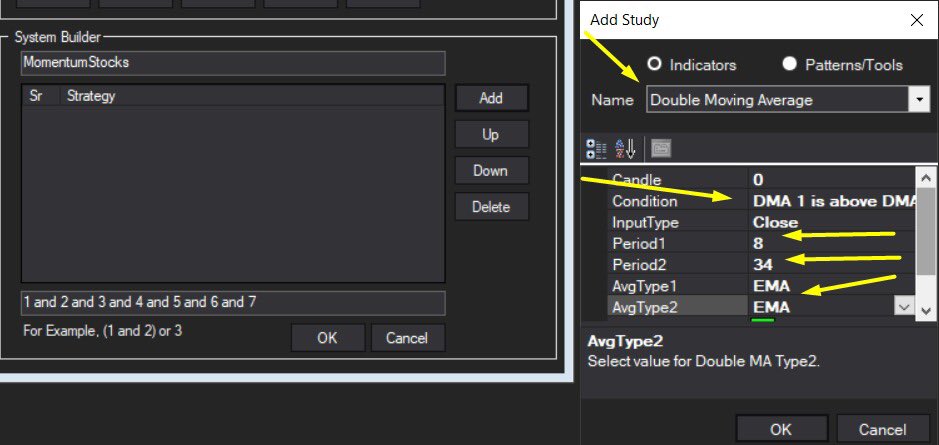

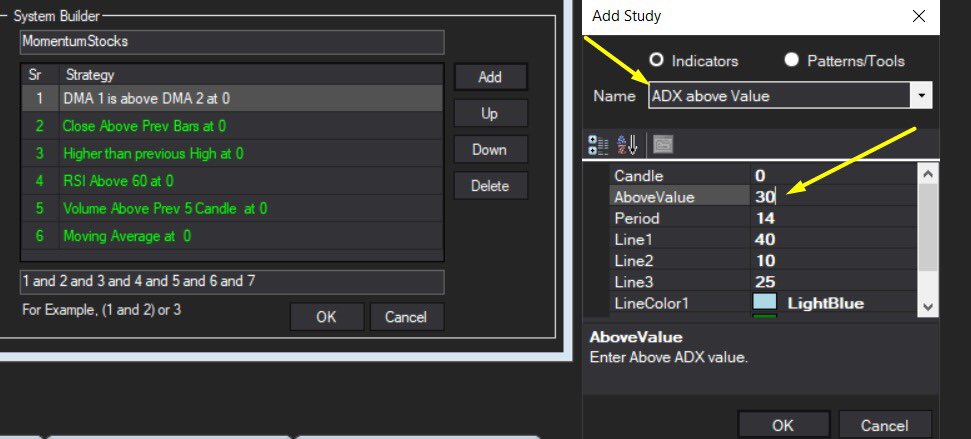

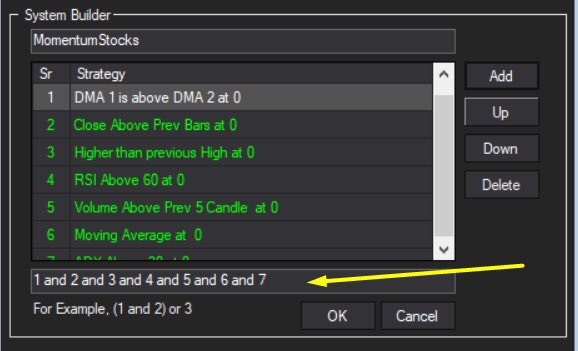

Conditions :

1)EMA 8 above EMA 34 and rising

2)Candle close above previous 5 candle high

3) RSI above 60

4) Volume above previous 5 candles

5) ADX above 30

1/n

@Definedge

Conditions :

1)EMA 8 above EMA 34 and rising

2)Candle close above previous 5 candle high

3) RSI above 60

4) Volume above previous 5 candles

5) ADX above 30

1/n

Let us run it on real-time scanner on 15 min time frame (since market is closed now it will show with reference to the last candle in 15min) we get the following stocks

12/n

12/n

This scanner will indicate momentum stocks and for entry exit etc I use P&F charts and trade intra day. While running the scanner we can specify the TF (like daily/weekly etc) in EOD scanner. Useful to run it on weekly or monthly for investment purposes.

14/14

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh