How to get URL link on X (Twitter) App

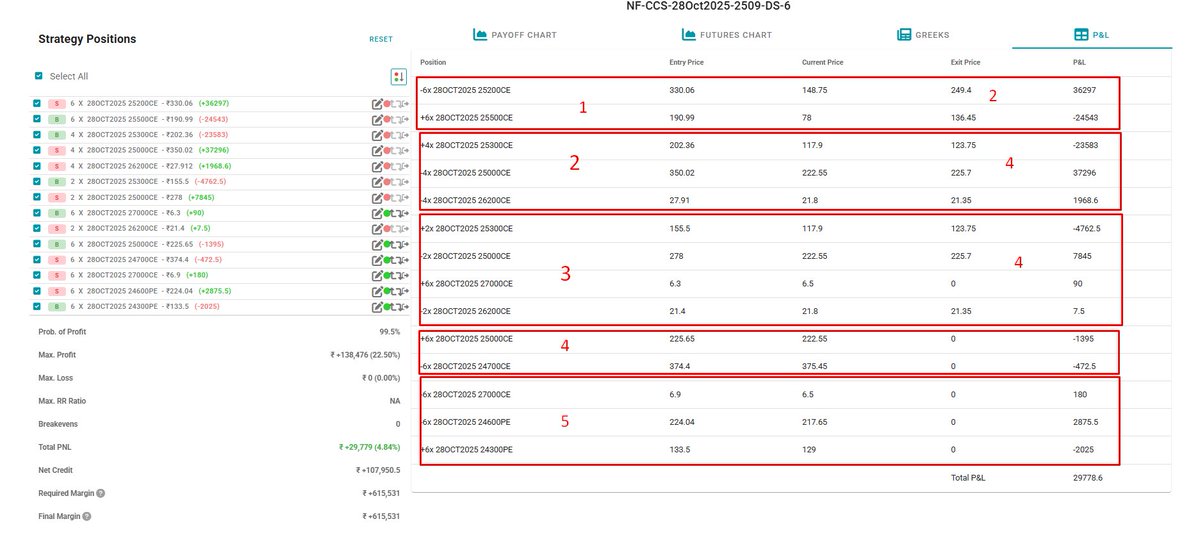

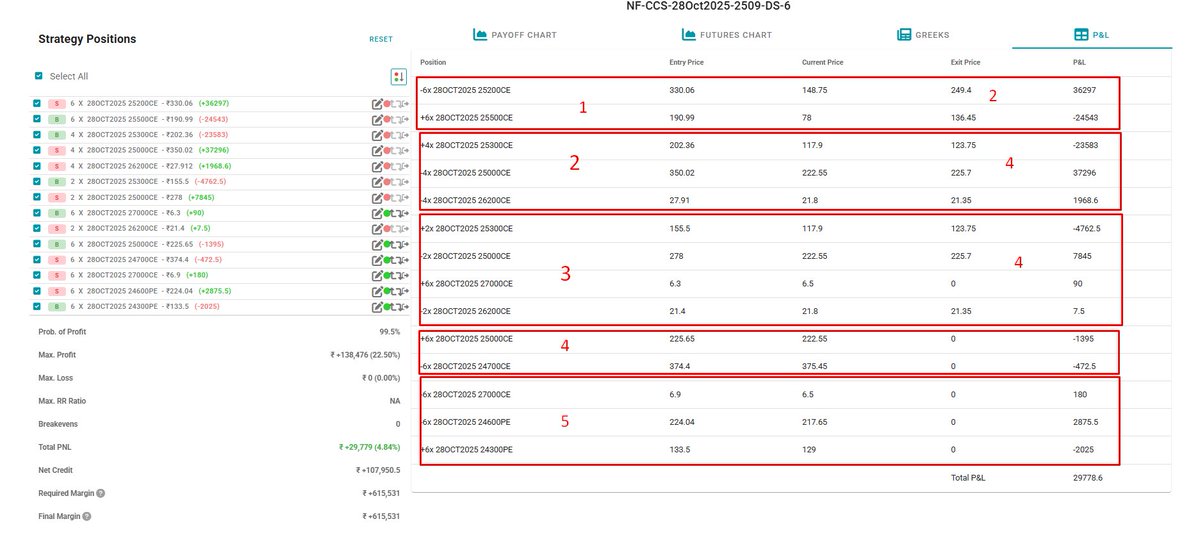

2) When the underlying moved favorably by more than 200 points, shifted the spread to

2) When the underlying moved favorably by more than 200 points, shifted the spread to

2) Shift 20100CE to 20200CE (50 delta to 40 delta). The payoff will be like this.

2) Shift 20100CE to 20200CE (50 delta to 40 delta). The payoff will be like this.

https://twitter.com/dtbhat/status/1631260367279226880+2/n

4) Convert to put butterfly at 18000 strike

4) Convert to put butterfly at 18000 strike

2/n

2/n