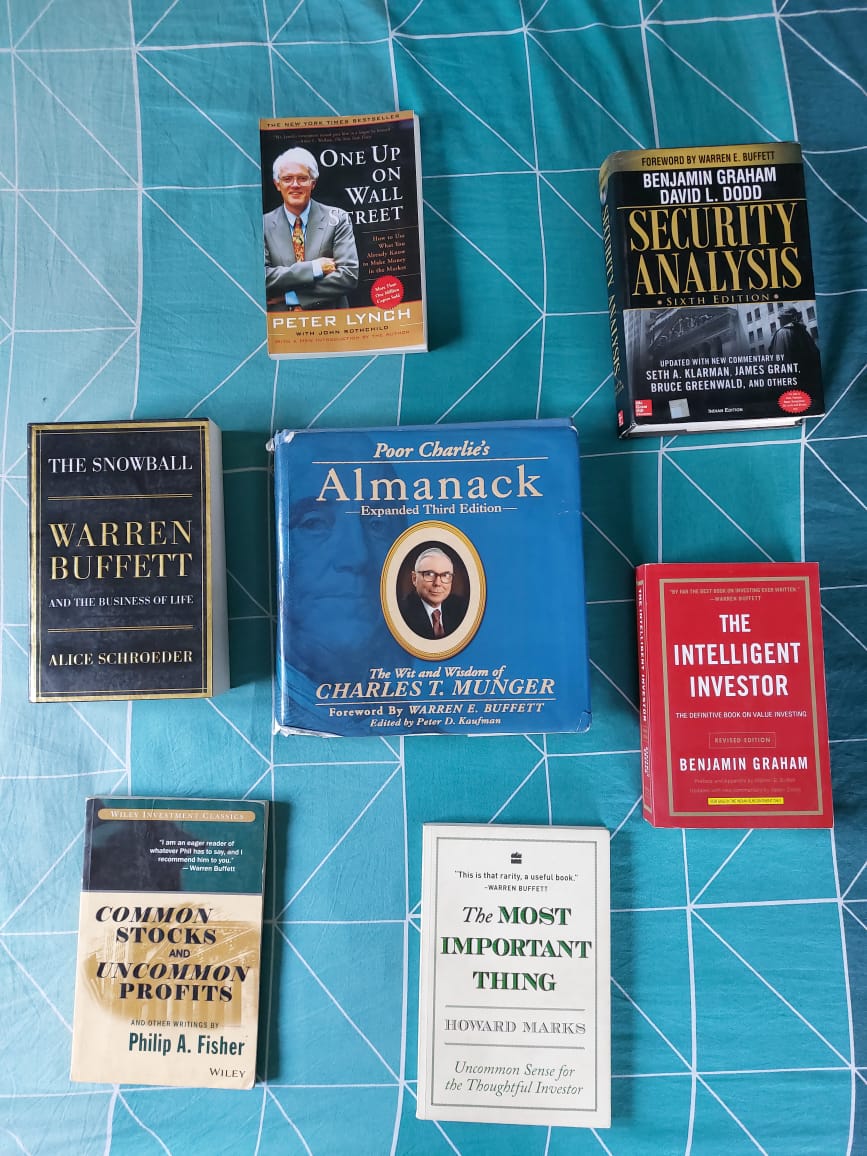

7 takeaways from 7 of the best books on stock market ever written.

~ One up on wallstreet.

~ Common stocks uncommon profits.

~ Poor charlie's almanack.

~ The intelligent investor.

~ Security analysis.

~ The most important thing.

~ The snowball.

~ One up on wallstreet.

~ Common stocks uncommon profits.

~ Poor charlie's almanack.

~ The intelligent investor.

~ Security analysis.

~ The most important thing.

~ The snowball.

One up on wall street by Peter Lynch.

1) Know what you own, and know why you own it.

2) Selling your winners and holding your losers is like cutting the flowers and watering the weeds.

3) Owning stocks is like having children - don't get involved with more than you handle.

1) Know what you own, and know why you own it.

2) Selling your winners and holding your losers is like cutting the flowers and watering the weeds.

3) Owning stocks is like having children - don't get involved with more than you handle.

4) In dieting and in stocks, it is the gut and not the head that determines the results.

5) Remember, things are never clear until it's too late.

6) Big companies have small moves, small companies have big moves.

7) When you sell in desperation, you always sell cheap.

5) Remember, things are never clear until it's too late.

6) Big companies have small moves, small companies have big moves.

7) When you sell in desperation, you always sell cheap.

Common stocks uncommon profits by Philip Fisher.

1) If the job has been correctly done when a common stock is purchased, the time to sell it is - almost never.

2) Usually a very long list of securities is not a sign of the brilliant investor, but of one who is unsure of himself

1) If the job has been correctly done when a common stock is purchased, the time to sell it is - almost never.

2) Usually a very long list of securities is not a sign of the brilliant investor, but of one who is unsure of himself

3) Take extreme care to own not the most, but the best.

4) Don’t be Influenced by What Doesn’t Matter.

5) In the field of common stocks, a little bit of a great many can never be more than a poor substitute for a few of the outstanding.

4) Don’t be Influenced by What Doesn’t Matter.

5) In the field of common stocks, a little bit of a great many can never be more than a poor substitute for a few of the outstanding.

6) More money has probably been lost by investors holding a stock they really did not want until they could 'at least come out even' than from any other single reason.

7) Nothing is worth doing unless it is worth doing right.

7) Nothing is worth doing unless it is worth doing right.

Poor charlie's almanack.

1) Take a simple idea and take it seriously.

2) I think track records are very important. If you start early trying to have a perfect one in some simple thing like honesty, you're well on your way to success in this world.

1) Take a simple idea and take it seriously.

2) I think track records are very important. If you start early trying to have a perfect one in some simple thing like honesty, you're well on your way to success in this world.

3) Spend each day trying to get a little wiser than u were when you woke up..Slug it out one inch at a time, day by day. At the end of the day - if you live long enough - most people get what they deserve

4) We just look for no-brainer decisions. We don't leap seven-foot fences.

4) We just look for no-brainer decisions. We don't leap seven-foot fences.

5) In essence, we are going into the business of creating and maintaining conditioned reflexes.

6) Every time you see the word Ebitda, you should substitute the words "bullshit earnings".

7) The secret of success in one word answer is "rational.

6) Every time you see the word Ebitda, you should substitute the words "bullshit earnings".

7) The secret of success in one word answer is "rational.

The intelligent investor by Benjamin Graham.

1) The longer the bull market lasts the more severely investors will be affected with amnesia; after five years or so, many people no longer believe that bear markets are possible.

1) The longer the bull market lasts the more severely investors will be affected with amnesia; after five years or so, many people no longer believe that bear markets are possible.

2) Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.

3) One must deliberately protect himself against serious losses.

4) You will be much more in control, if you realize how much you are not in control.

3) One must deliberately protect himself against serious losses.

4) You will be much more in control, if you realize how much you are not in control.

5) No matter how careful you are, the one risk no investor can ever eliminate is the risk of being wrong.

6) Successful investing is about managing risk, not avoiding it.

7) At heart, “uncertainty” and “investing” are synonyms.

6) Successful investing is about managing risk, not avoiding it.

7) At heart, “uncertainty” and “investing” are synonyms.

Security analysis by Benjamin Graham and David Dodd.

1) Abnormally good or abnormally bad conditions do not last forever.

2) While a trend shown in the past is a fact, a “future trend” is only an assumption.

3) A criterion based on adjectives is always ambiguous.

1) Abnormally good or abnormally bad conditions do not last forever.

2) While a trend shown in the past is a fact, a “future trend” is only an assumption.

3) A criterion based on adjectives is always ambiguous.

4) As a rule of thumb, investors should spend the bulk of their time on the disclosures of the security under study, and they should spend significant time on the reports of competitors.

5) We must recognize, however, that intrinsic value is an elusive concept.

5) We must recognize, however, that intrinsic value is an elusive concept.

6) Principle for the securities analyst: Nearly every issue might conceivably be cheap in one price range and dear in another.

7) Investors are constitutionally averse to buying into a troubled situation.

7) Investors are constitutionally averse to buying into a troubled situation.

The Most Important Thing by Howard Marks.

1) Experience is what you got when you didn’t get what you wanted.

2) Prices are too high” is far from synonymous with “the next move will be downward.” Things can be overpriced and stay that way for a long time...or become far more so.

1) Experience is what you got when you didn’t get what you wanted.

2) Prices are too high” is far from synonymous with “the next move will be downward.” Things can be overpriced and stay that way for a long time...or become far more so.

3) Being too far ahead of your time is indistinguishable from being wrong.

4) The perfect is the enemy of the good

5) People should like something less when its price rises, but in investing they often like it more.

4) The perfect is the enemy of the good

5) People should like something less when its price rises, but in investing they often like it more.

6) There’s a big difference between probability and outcome. Probable things fail to happen - and improbable things happen - all the time.

7) There's only one way to describe most investors: trend followers.

7) There's only one way to describe most investors: trend followers.

The Snowball by Alice Schroeder.

1) Time is the friend of the wonderful business, the enemy of the mediocre.

2) Intensity is the price of excellence

3) Be fearful when others are greedy, and greedy when others are fearful. This was the time to be greedy.

1) Time is the friend of the wonderful business, the enemy of the mediocre.

2) Intensity is the price of excellence

3) Be fearful when others are greedy, and greedy when others are fearful. This was the time to be greedy.

4) The big question about how people behave is whether they've got an Inner Scorecard or an Outer Scorecard. It helps if u can be satisfied with an Inner Scorecard

5) Lose money for the firm, & I will be understanding. Lose a shred of reputation for the firm, & I'll be ruthless.

5) Lose money for the firm, & I will be understanding. Lose a shred of reputation for the firm, & I'll be ruthless.

6) It pays to hang around with people better than you are, because you will float upward a little bit. And if you hang around with people that behave worse than you, pretty soon you’ll start sliding down the pole. It just works that way.

7) There are certain things that cannot be adequately explained to a virgin either by words or pictures.

~ Thread Ends ~

~ Thread Ends ~

• • •

Missing some Tweet in this thread? You can try to

force a refresh