Agree on this... His views seem superficial

https://twitter.com/justbrosef/status/1432299977200611334

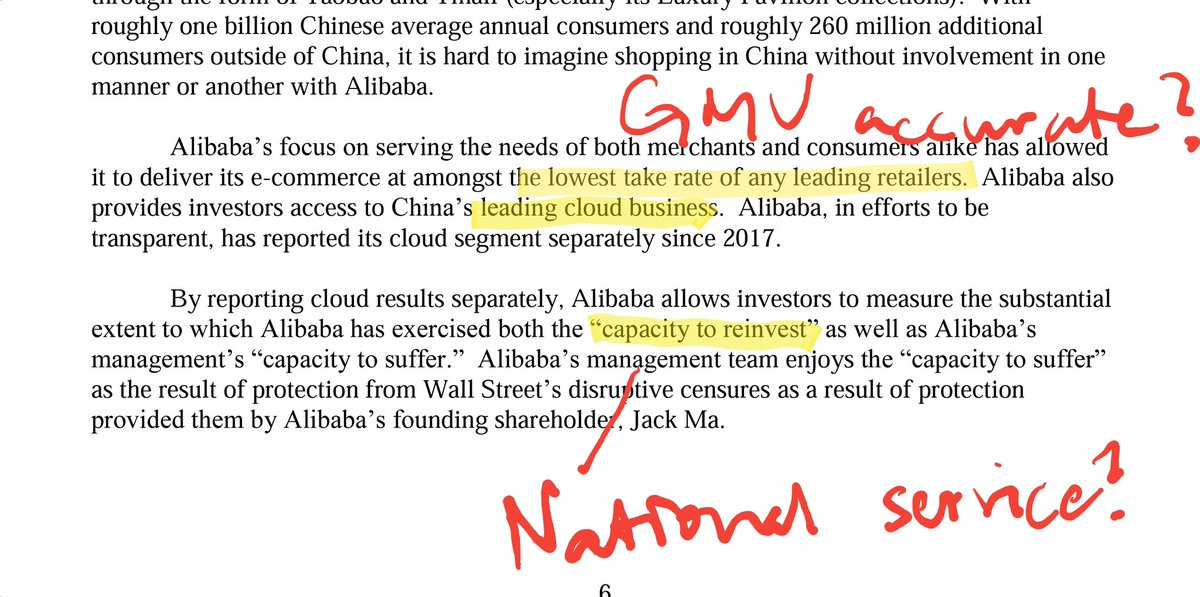

The take rate is not high... But to have confidence in the take rate you'd have to believe in the AUM number.

Are we sure cloud is not loss-making due to "national service", similar to Tencent's support of China's police IT infrastructure?

Are we sure cloud is not loss-making due to "national service", similar to Tencent's support of China's police IT infrastructure?

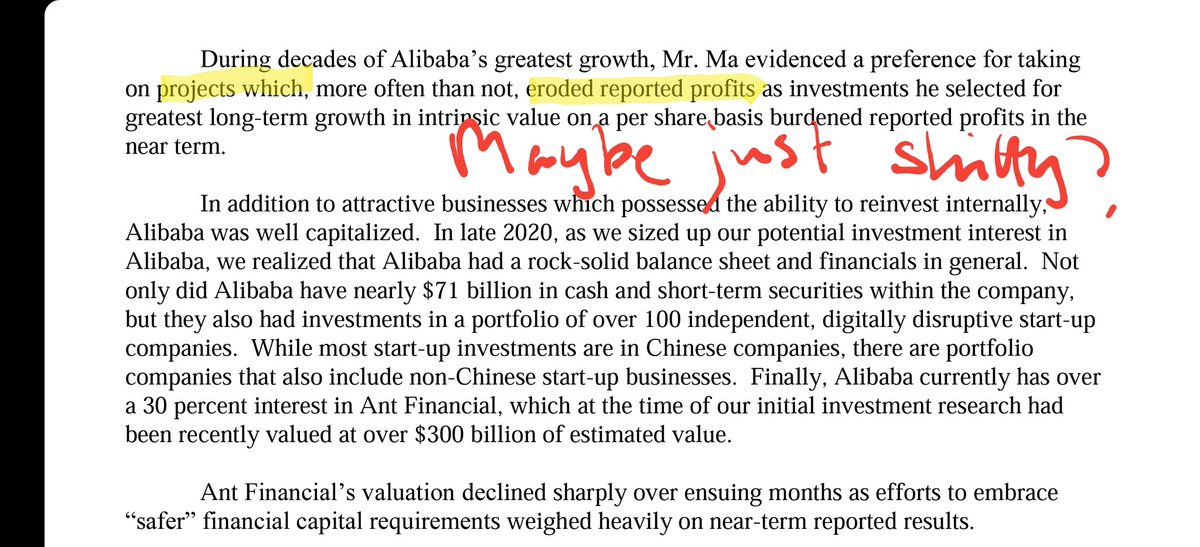

Would rather look at loss-making investments on a case by case basis. The unit economics may or may not work.

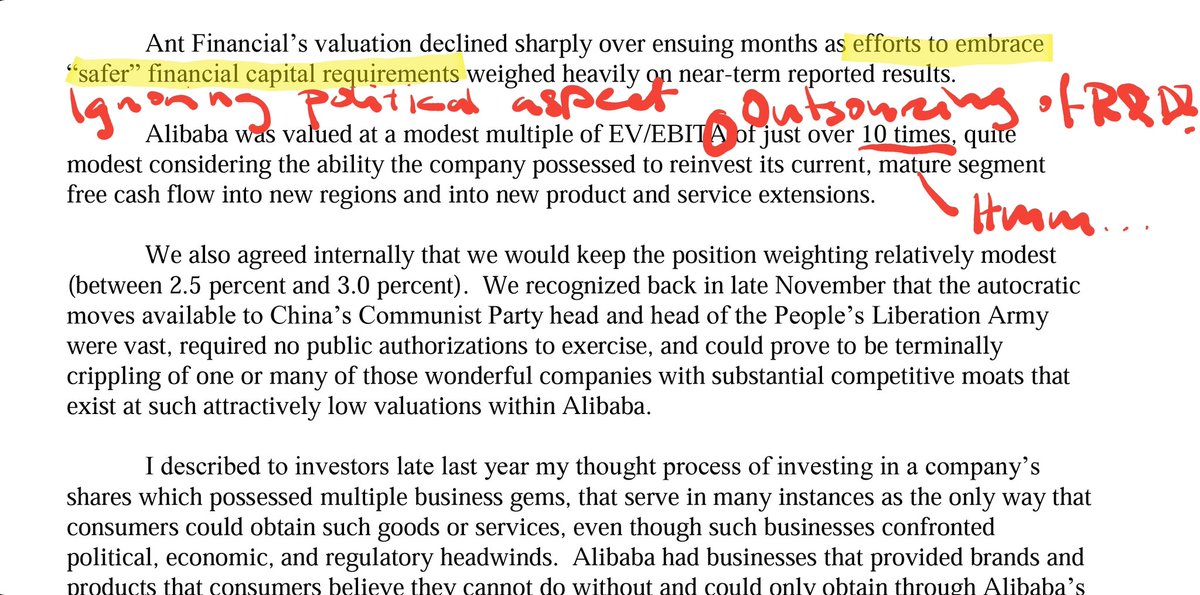

Simply cannot ignore the political aspects. Xi and Ma are not on good terms..

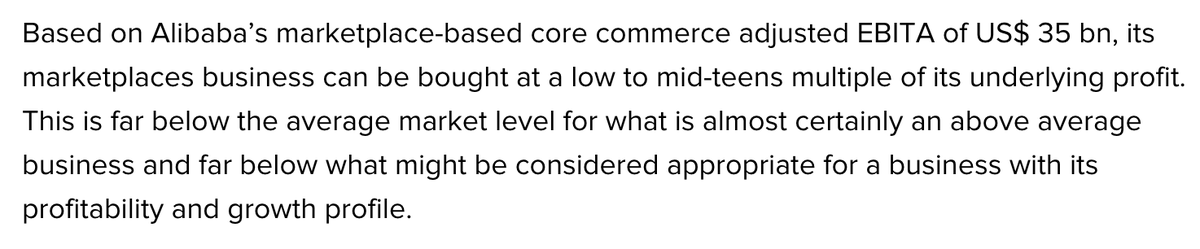

Why subtract Amortization? And even if you do, how does he get to 10x EBITA at the time or investment? I'm puzzled.

Why subtract Amortization? And even if you do, how does he get to 10x EBITA at the time or investment? I'm puzzled.

Why ignore the fact that Jack Ma is seemingly no longer running Alibaba?

Is it obvious that Alibaba will run more smoothly once the government's "redistribution" is over?

Is it obvious that Alibaba will run more smoothly once the government's "redistribution" is over?

Didi's app was banned right after the capital raise. Clearly, loss of data cannot have been the only consideration. Doing so 1 month earlier would have stopped the IPO.

Jack Ma's case is not unique. Many Chinese tech CEOs have "quit" recently: Pinduoduo's, Bytedance's, etc.

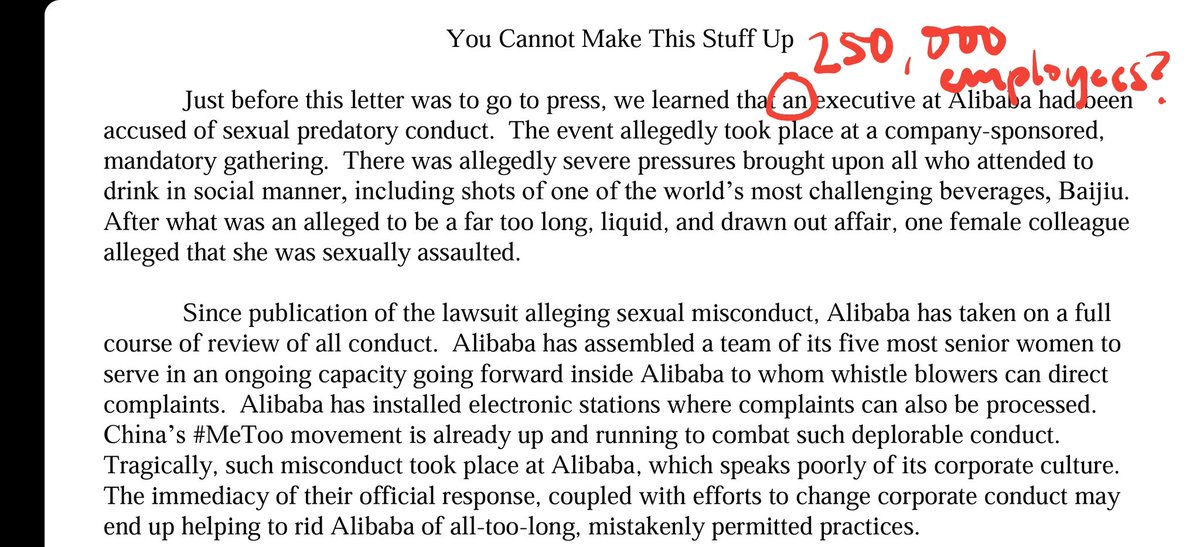

Also not sure what the point is mentioning the sexual misconduct case, with a sample size of 1 over total employees of 250,000

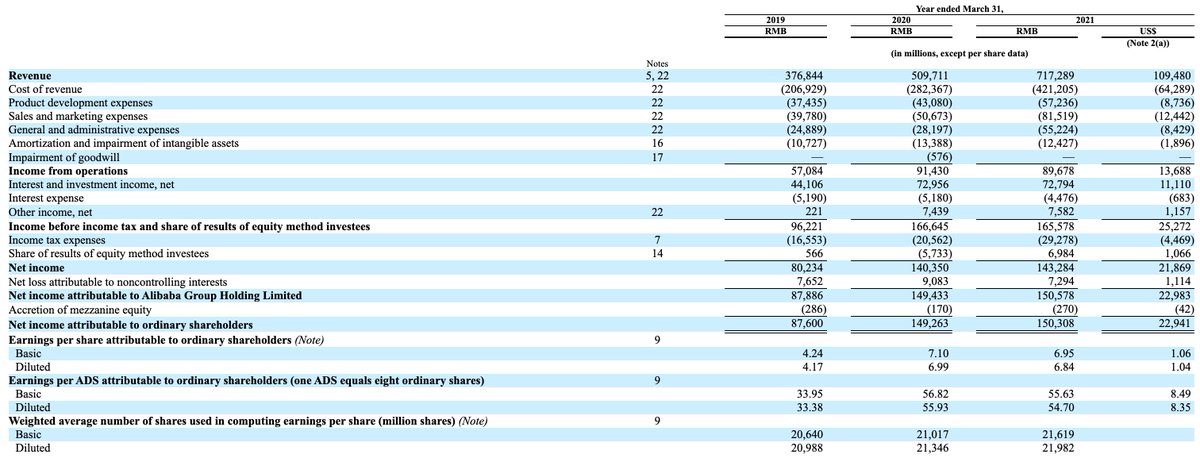

In early 2Q21, Alibaba's EV was US$590bn.

EBIT of US$14bn + A of US$10bn = US$24 bn.

EV/EBITA = 590/24 = 24.6x? Doesn't compute.

EBIT of US$14bn + A of US$10bn = US$24 bn.

EV/EBITA = 590/24 = 24.6x? Doesn't compute.

I can't say that I know Alibaba as well as some of these tech experts. These are just random thoughts I had from reading the document. I genuinely don't understand.

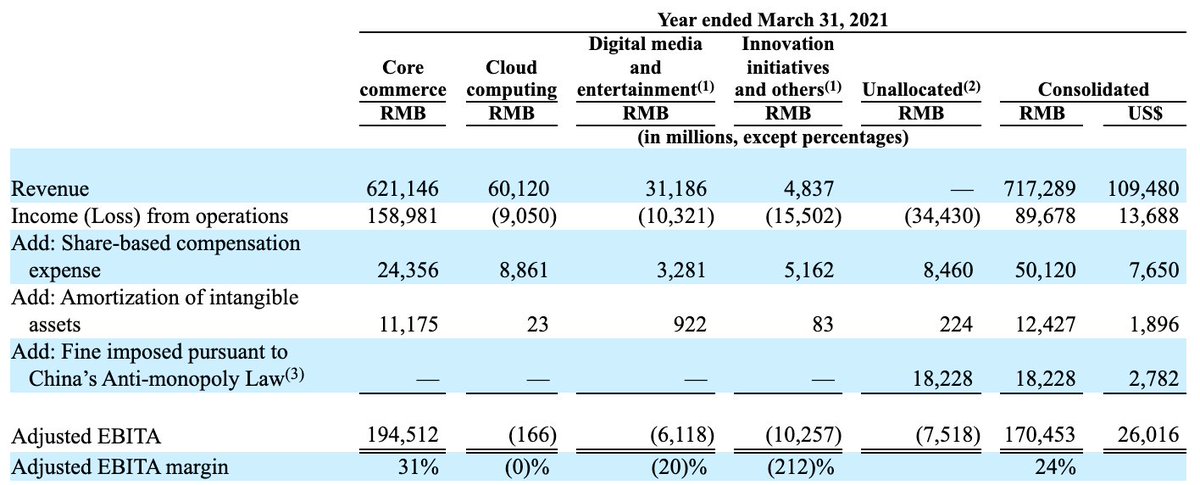

God knows how Russo got to 10x EBITA. If he excludes all loss-making segments and adds back share-based compensation and amortisation then you get to US$30bn in EBITA and EV/EBITA of 20x.

He most likely subtracts value from cloud / media / new projects / investments in EV.

He most likely subtracts value from cloud / media / new projects / investments in EV.

RV Capital values Alibaba on Core Commerce EBITA of US$35 billion.

So most bulls seem to use a SOTP to value the company, based on Alibaba's own allocation of revenues and expenses to its various segments.

So most bulls seem to use a SOTP to value the company, based on Alibaba's own allocation of revenues and expenses to its various segments.

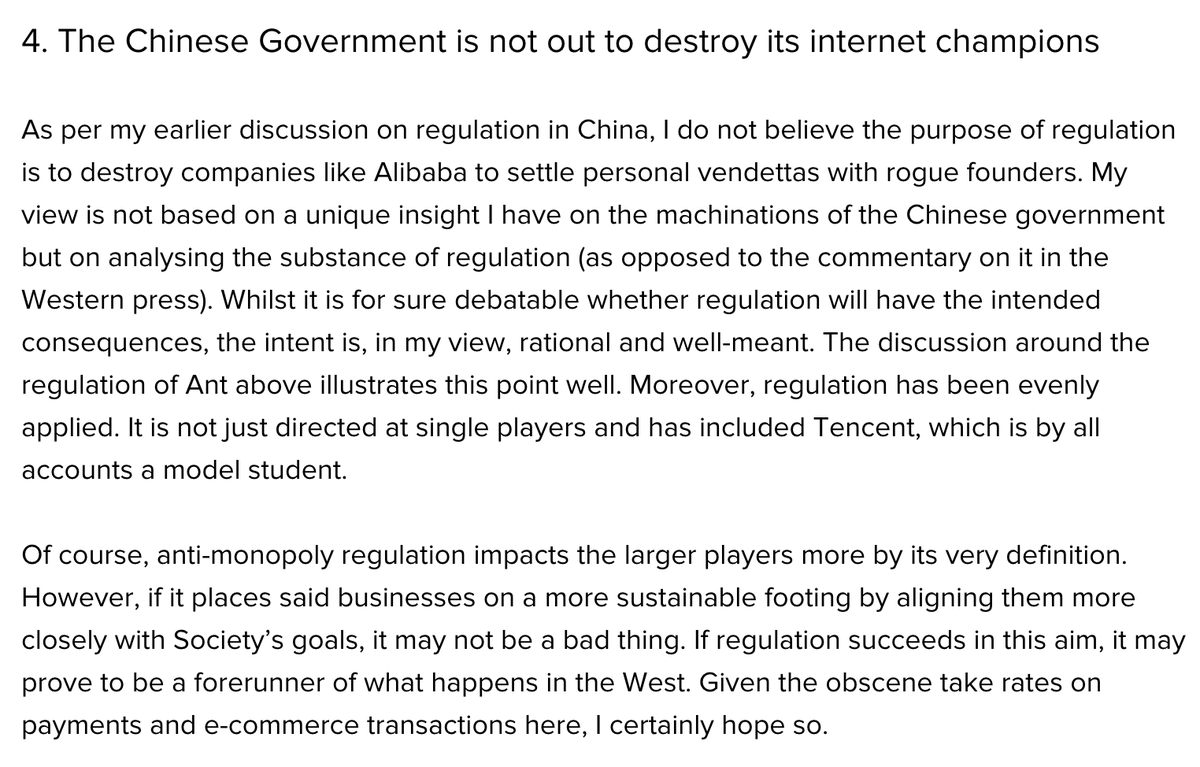

RV Capital ignores the fact that many of recent policies come directly from the Communist Party's general office. They do not represent typical industry regulations.

But we'll see what the leadership's true intentions are...

But we'll see what the leadership's true intentions are...

I have to say that the RV Capital letter is more coherent and does try to address key bear arguments.

rvcapital.ch/post/first-hal…

rvcapital.ch/post/first-hal…

And here is a link to Tom Russo's letter as well where he discusses Alibaba:

moiglobal.com/wp-content/upl…

moiglobal.com/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh