I think a question many of us are asking right now, is how nervous should be we as investors in Chinese equities.

Here is a story that might provide an answer. About how Victor Sassoon moved to China and ultimately fled the country in the 1940s.

// Thread // 👇

Here is a story that might provide an answer. About how Victor Sassoon moved to China and ultimately fled the country in the 1940s.

// Thread // 👇

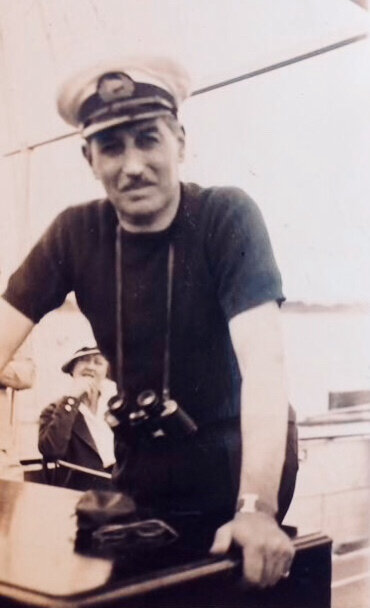

Victor Sassoon was a Jewish businessman from the wealthy Sassoon family, originally from Baghdad, Iraq.

The Sassoon family made its fortune in the opium trade, transporting India-made opium to China. But by the turn of the century, it was mostly a textile operation.

The Sassoon family made its fortune in the opium trade, transporting India-made opium to China. But by the turn of the century, it was mostly a textile operation.

Victor was born in 1881 raised in England, where he attended Harrow and Trinity College, Cambridge.

At six feet tall and with broad shoulders, he had been a college swimmer at Cambridge as well as a boxer.

At six feet tall and with broad shoulders, he had been a college swimmer at Cambridge as well as a boxer.

After college, Victor took up an offer from his uncle Elias Sassoon to join him in India and Shanghai.

He visited the Sassoon's family's Indian textile mills and learnt the ropes.

He later fell in love with the parties, hunting excursions and polo games in Shanghai.

He visited the Sassoon's family's Indian textile mills and learnt the ropes.

He later fell in love with the parties, hunting excursions and polo games in Shanghai.

Victor loved fast cars, aeroplanes, motion pictures and racing tracks.

But a plane crash in 1916 when serving in WW1 turned him into a cripple and needed crutches for the rest of his life.

Life for playbook Victor Sassoon would never become the same again.

But a plane crash in 1916 when serving in WW1 turned him into a cripple and needed crutches for the rest of his life.

Life for playbook Victor Sassoon would never become the same again.

After the war, Sassoon's Indian business started to suffer losses.

Gandhi began launching boycotts against British goods and called for self-rule.

Workers also started demanding higher wages.

With the business in tatters, Victor at age 40 moved to Bombay to right the ship.

Gandhi began launching boycotts against British goods and called for self-rule.

Workers also started demanding higher wages.

With the business in tatters, Victor at age 40 moved to Bombay to right the ship.

Victor did wonders for Sassoon's textile business. It was modernised, profitability improved and factory conditions were among the best in India. It was then the largest employer in India.

Yet political undercurrents moved against him and he became a symbol of colonial rule.

Yet political undercurrents moved against him and he became a symbol of colonial rule.

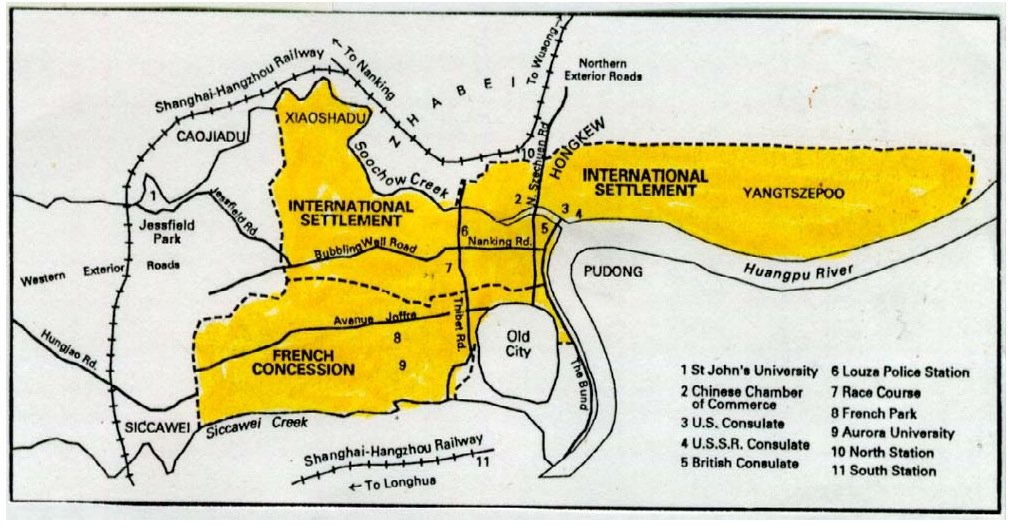

Sassoon, therefore, turned his eyes to Shanghai, which was stable and booming, taxes were low and British gunships protected the foreign concessions.

He decided to move his entire business to Shanghai. "Things never really get bad in China if we are firm with troops in the end"

He decided to move his entire business to Shanghai. "Things never really get bad in China if we are firm with troops in the end"

He liquidated his family's near-century worth of holdings in India and moved the entire fortune to Shanghai, roughly US$400m in today's dollars.

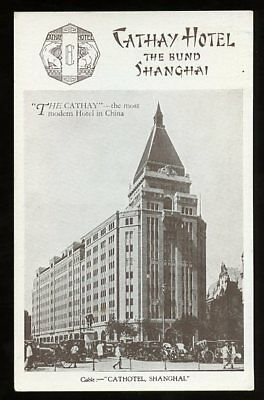

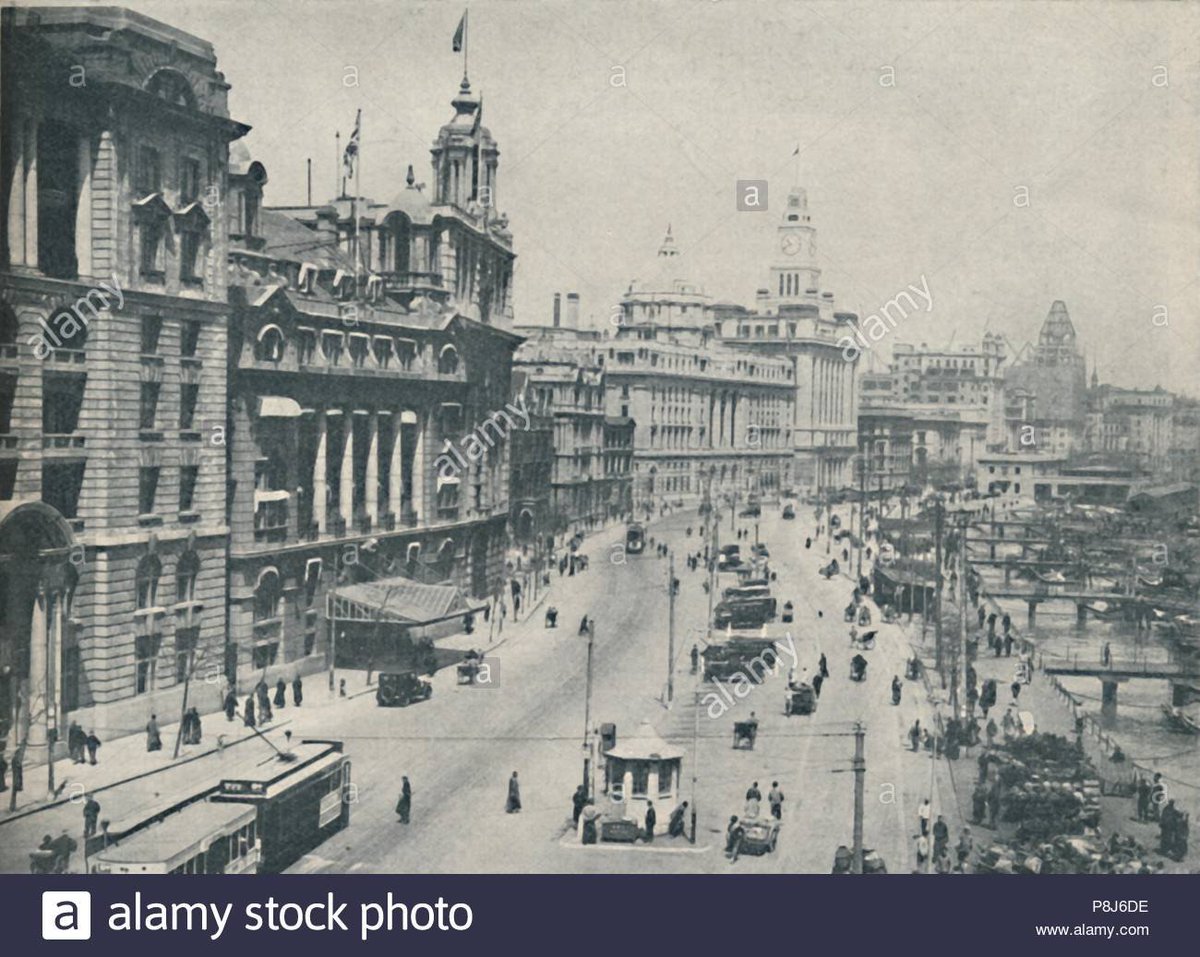

Victor bought the most prominent site on the Bund at the intersection of Nanjing Road, to be known as Sassoon House.

Victor bought the most prominent site on the Bund at the intersection of Nanjing Road, to be known as Sassoon House.

Within Sassoon House, he built a hotel called Cathay (later renamed Peace Hotel under communist rule).

Victor moved into a ninth-floor suite, with unobstructed views of the harbour.

The Cathay became the greatest hotel in Shanghai, with cocktail parties and cabarets weekly.

Victor moved into a ninth-floor suite, with unobstructed views of the harbour.

The Cathay became the greatest hotel in Shanghai, with cocktail parties and cabarets weekly.

Victor would keep nude photos he had taken of nude women in his Catha apartment, both European and Chinese.

Most famously, he dated an American writer named Emily Hahn who worked as a journalist and later fell under the spell of opium.

Most famously, he dated an American writer named Emily Hahn who worked as a journalist and later fell under the spell of opium.

How author Vicki Baum described Shanghai:

"Optimists, pessimists, Westerners, Easterners, men, women. Europeans, Americans, orients. Courage and cowardice. Idealism and greed. Enmity and love. People of every sort and colour and tendency. Voice, noise, laughter, tea, whisky."

"Optimists, pessimists, Westerners, Easterners, men, women. Europeans, Americans, orients. Courage and cowardice. Idealism and greed. Enmity and love. People of every sort and colour and tendency. Voice, noise, laughter, tea, whisky."

Victor built a second hotel, the Metropole and later Embankment House, Cathay Mansions, Hamilton House, Grosvenor House.

The building boom made property on the Bund more expensive than fashionable parts of London or New York.

The building boom made property on the Bund more expensive than fashionable parts of London or New York.

Victor now owned close to US$500 million worth of property on the bund, together with his Chinese textile mills, timber trading, shipyards, the Shanghai bus company, auto dealers, storage services and a brewery.

The Shanghai property boom caused prices to go up 7x.

But it was in many respects a chimera. State deficit financing and money printing found its way into real assets.

Shanghai boomed while farmers and the countryside fell into deep economic depression.

But it was in many respects a chimera. State deficit financing and money printing found its way into real assets.

Shanghai boomed while farmers and the countryside fell into deep economic depression.

Emily Hahn was introduced to Chinese intellectuals and leftist thinkers, including Zhou Enlai.

There was a sense that communism was the only way out, even among intellectuals.

While communists were banned from the rest of China, they thrived in the international settlement.

There was a sense that communism was the only way out, even among intellectuals.

While communists were banned from the rest of China, they thrived in the international settlement.

With Nationalists fighting Mao's Red Army, from the early 1930s the Nationalist government was starting to run out of money.

They nationalised Chinese banks and required all silver held by banks and individuals to be turned over to the government in exchange for paper money.

They nationalised Chinese banks and required all silver held by banks and individuals to be turned over to the government in exchange for paper money.

It cost Victor millions of dollars and froze his silver.

With the Nationalists controlling the banks, he could no longer send his profits out of the country.

His wealth was stuck in Shanghai.

Fighting against the Japanese made the Nationalists' money hole even deeper.

With the Nationalists controlling the banks, he could no longer send his profits out of the country.

His wealth was stuck in Shanghai.

Fighting against the Japanese made the Nationalists' money hole even deeper.

Shanghai after WWII was never the same again. Victor decided to abandon Shanghai and sell his properties. Buyers were few.

He sold several properties at a fraction of their appraised value. Victor began looking for ways to smuggle foreign currency out of the country.

He sold several properties at a fraction of their appraised value. Victor began looking for ways to smuggle foreign currency out of the country.

Soaring inflation after the war destroyed the value of paper money and the confidence of Chinese workers in the Nationalist government.

Victor's workers demanded to be paid in rice instead of paper currency.

Victor's workers demanded to be paid in rice instead of paper currency.

The communists launched their major offensive in early 1947. City trams stopped running.

Workers walked off the job at Shanghai's electricity company.

By 1948, thousands of Nationalist troops defected to the communists.

Workers walked off the job at Shanghai's electricity company.

By 1948, thousands of Nationalist troops defected to the communists.

Victor was pessimistic:

"They don't like foreigners and they never have... They'll do business with us but only to the extent that it suits their purpose."

"They don't like foreigners and they never have... They'll do business with us but only to the extent that it suits their purpose."

But he couldn't sell his assets.

"Who would buy them with the state China is in today?"

"If you can sell any of my assets there, I'll pay you a tremendous commission."

"Who would buy them with the state China is in today?"

"If you can sell any of my assets there, I'll pay you a tremendous commission."

The Communists took immediate control of companies crucial to the functioning of Shanghai.

Instead of seizing private property and expelling foreigners, the Communists decided to squeeze as much as they could out of foreign business.

Instead of seizing private property and expelling foreigners, the Communists decided to squeeze as much as they could out of foreign business.

They presented Victor with a never-ending series of tax bills, regulations and worker demands.

They refused to allow foreign executives to leave China until they met the demands.

Luckily, Victor was smart enough to have left early on.

They refused to allow foreign executives to leave China until they met the demands.

Luckily, Victor was smart enough to have left early on.

The buildings that Victor had built were assessed new tax bills of several million dollars in today's money, with interest of 1% per day.

Victor's employees said they couldn't pay. The Communists requested them to bring in foreign currency from overseas.

Victor's employees said they couldn't pay. The Communists requested them to bring in foreign currency from overseas.

Sassoon employed 1,400 people. None of them were allowed to leave the city.

The Cathay lost most of its guests. Tenants (mostly foreigners) left as well. So Sassoon had no rent coming in to pay its workers.

The Cathay lost most of its guests. Tenants (mostly foreigners) left as well. So Sassoon had no rent coming in to pay its workers.

Eventually, all of Sassoon's properties were taken over by the state, worth roughly US$0.5 billion in today's money.

The Communists turned the Cathay Hotel into the Peace Hotel, used by senior Party officials in the ensuing decades.

The Communists turned the Cathay Hotel into the Peace Hotel, used by senior Party officials in the ensuing decades.

Victor moved to the Bahamas where he lived the rest of his life. He turned from one of the richest men in the world to a has-been.

As for himself, he was done with China. He spoke about China with bitterness and loss.

As for himself, he was done with China. He spoke about China with bitterness and loss.

In his will, Victor Sassoon told his niece: "I want you to make me two promises"

1. Don't ever put all your egg in one basket.

2. Don't ever invest in get-rich-quick deals

Later, he added a third:

"3. Promise me you will never go to China."

1. Don't ever put all your egg in one basket.

2. Don't ever invest in get-rich-quick deals

Later, he added a third:

"3. Promise me you will never go to China."

Lessons from Victor Sassoon's experience in Shanghai? Don't trust communists. Diversify. Don't expect that you or your capital will be able to leave. You can and will be blackmailed. Be careful.

Source: The Last Kings of Shanghai by Jonathan Kaufman. An absolutely wonderful book.

amazon.com/Last-Kings-Sha…

amazon.com/Last-Kings-Sha…

• • •

Missing some Tweet in this thread? You can try to

force a refresh