Here’s a financial take on #afcb’s summer window. No commentary on signings’ merit etc, just the money. There’s been lots of talk about spending, but before the window I said “Kids, Loans (& Frees)”. Boring but fairly predictable from a financial perspective. Here's why...

1/9

1/9

2/9

Its not an exact science & so I’ve made some #afcb assumptions:

1. Purchase and sale prices, contract lengths, etc from Transfermarkt or @markmcadamtv

2. Sell-on/Add-on/Agents fees from club’s historical averages

3. Future instalments based on club’s historical averages

Its not an exact science & so I’ve made some #afcb assumptions:

1. Purchase and sale prices, contract lengths, etc from Transfermarkt or @markmcadamtv

2. Sell-on/Add-on/Agents fees from club’s historical averages

3. Future instalments based on club’s historical averages

3/9

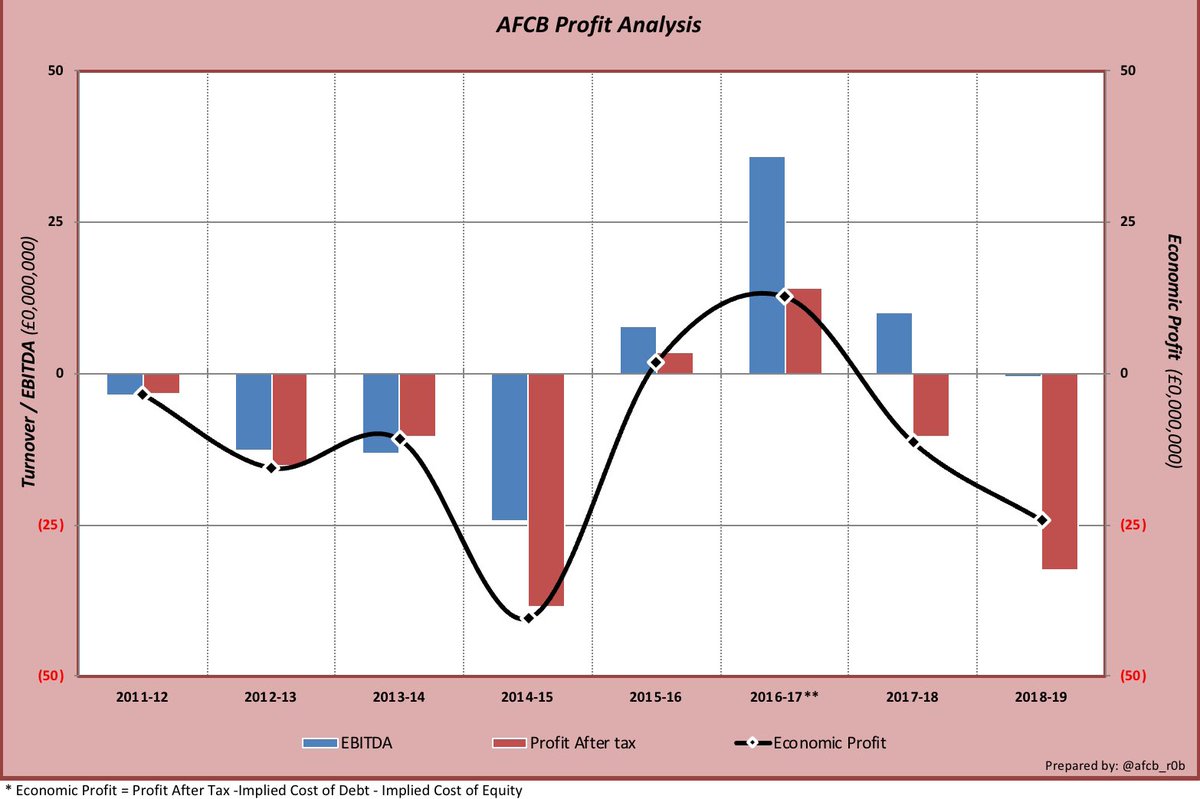

At £20m (3 year rolling average), #afcb’s net transfer position is in the black for the 1st time.

P&L player trading profit fell back to £6m from summer 2020’s £50m+ record.

Loan income has continued to fall from its 2018/19 peak when it was more than gate receipts.

At £20m (3 year rolling average), #afcb’s net transfer position is in the black for the 1st time.

P&L player trading profit fell back to £6m from summer 2020’s £50m+ record.

Loan income has continued to fall from its 2018/19 peak when it was more than gate receipts.

4/9

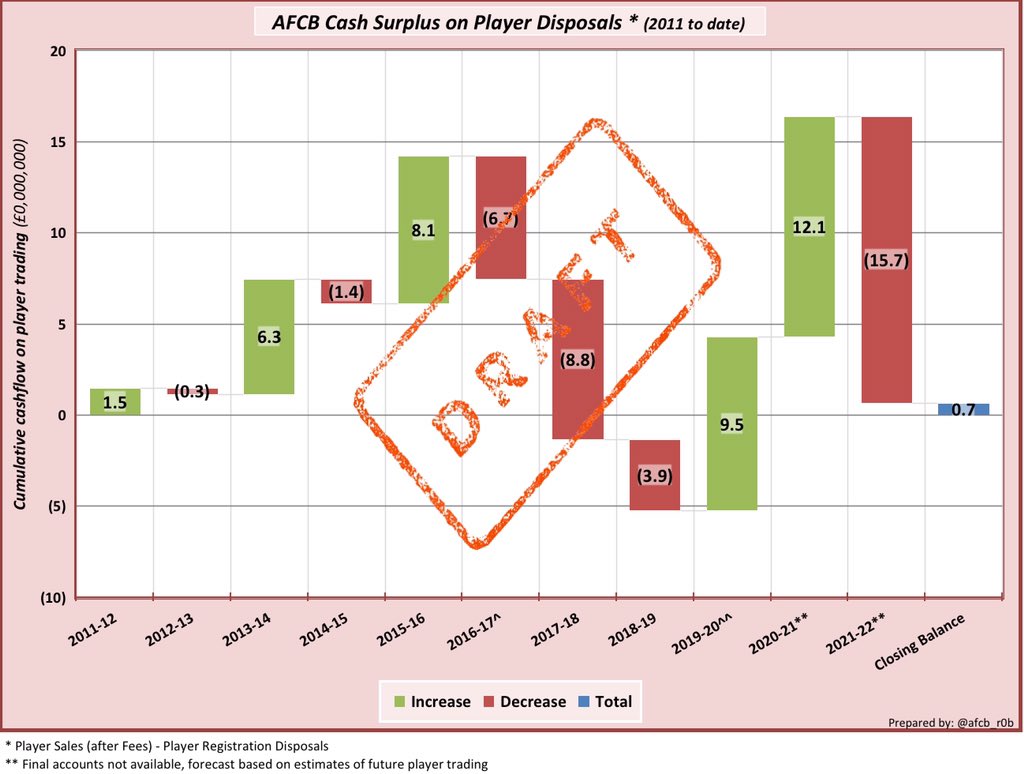

#afcb’s cash position on disposals “breaks even” over Max’s tenure (inc those gone for “free” & those seen as “fails").

I estimate that there’s around £20m instalments (net) owed to the club (BIG bucket of salt). This eases the overall cash position for the year.

#afcb’s cash position on disposals “breaks even” over Max’s tenure (inc those gone for “free” & those seen as “fails").

I estimate that there’s around £20m instalments (net) owed to the club (BIG bucket of salt). This eases the overall cash position for the year.

5/9

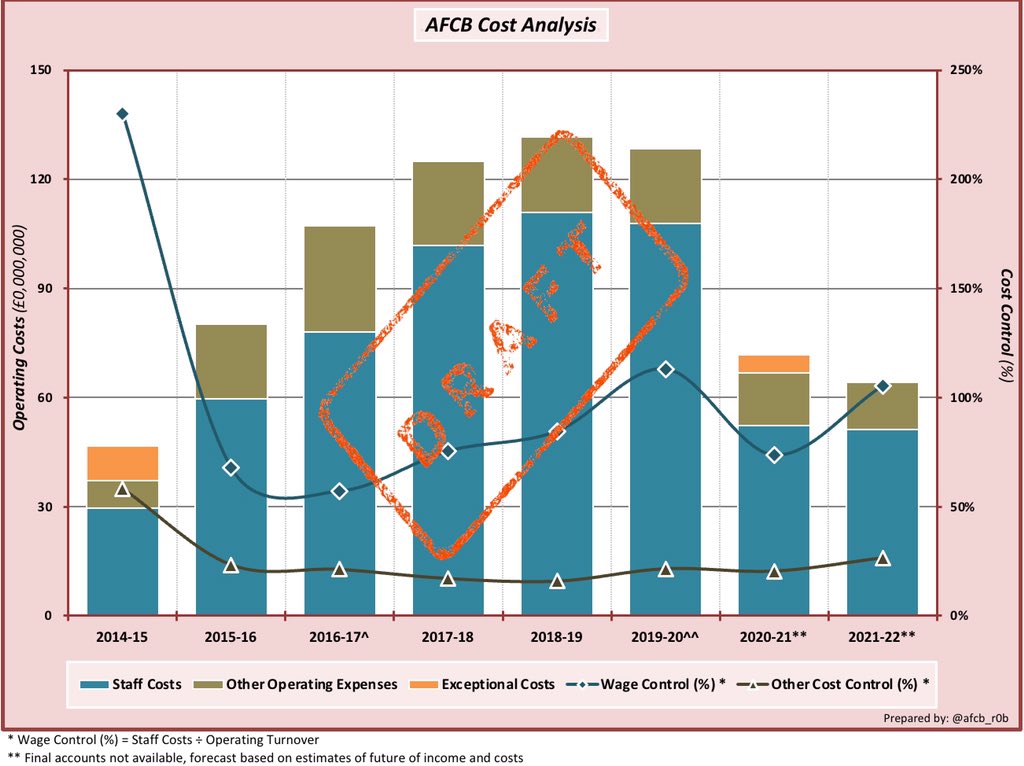

I suspect #afcb’s salary savings aren’t as much as some might think (HUGE bucket of salt). My guess is balancing outgoings with incomings, players in for a full year, plus kids saves about £1-4m this year. That’s good for PSR but wages are still high at over 100% of income.

I suspect #afcb’s salary savings aren’t as much as some might think (HUGE bucket of salt). My guess is balancing outgoings with incomings, players in for a full year, plus kids saves about £1-4m this year. That’s good for PSR but wages are still high at over 100% of income.

6/9

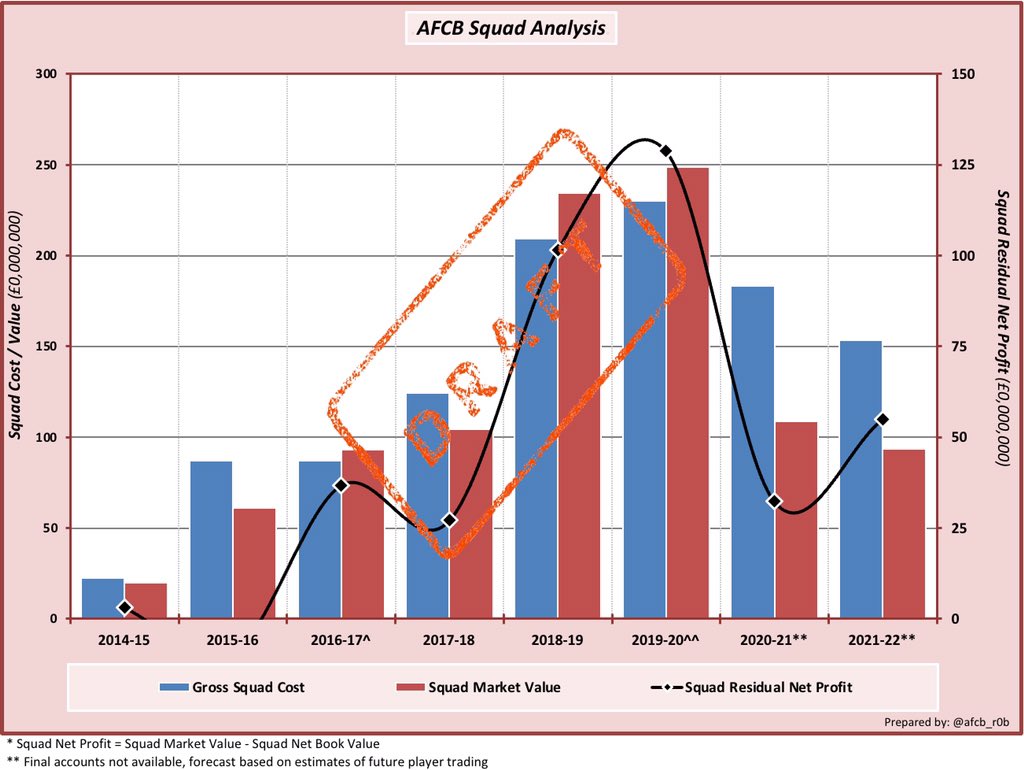

#afcb squad cost ca £150m with around £55m residual net profit still possible. So cash still locked in liquid assets.

Another upside is that the P&L impact of player amortisation is tumbling as the more costly acquisitions exit early helping to create more PSR headroom.

#afcb squad cost ca £150m with around £55m residual net profit still possible. So cash still locked in liquid assets.

Another upside is that the P&L impact of player amortisation is tumbling as the more costly acquisitions exit early helping to create more PSR headroom.

7/9

#afcb’s squad is very young (blue columns) - 25.0yrs on 1/8/21.

But the rising “contract ageing ratio” shows an underlying problem. 7 of the squad are in the last year of their contracts (inc 2x U21s), another 9 have 2 years left. So the renegotiation clock is ticking.

#afcb’s squad is very young (blue columns) - 25.0yrs on 1/8/21.

But the rising “contract ageing ratio” shows an underlying problem. 7 of the squad are in the last year of their contracts (inc 2x U21s), another 9 have 2 years left. So the renegotiation clock is ticking.

8/9

#afcb’s recruitment activity has been sound elsewhere too.

U21s & U18s have benefitted from internal promotions and talent from outside.

Mr Cuss has brought experienced players into the women's squad to back up the young home-grown talent.

So the talent pipeline continues

#afcb’s recruitment activity has been sound elsewhere too.

U21s & U18s have benefitted from internal promotions and talent from outside.

Mr Cuss has brought experienced players into the women's squad to back up the young home-grown talent.

So the talent pipeline continues

9/9

So has #afcb’s window delivered?

Net INCOME not net COST Mr Humphrey!

Transfer cashflow looks ok

Locked in value is decent

Wages still high and will need sorting

Squad age is no concern

Contract situation IS a concern

Now 2 points per game Mr Parker and life is good…

So has #afcb’s window delivered?

Net INCOME not net COST Mr Humphrey!

Transfer cashflow looks ok

Locked in value is decent

Wages still high and will need sorting

Squad age is no concern

Contract situation IS a concern

Now 2 points per game Mr Parker and life is good…

3a/9

I’ve ben asked “Why use an average Net Spend figure?”

Net Spend depends heavily on the period over which you measure it. Single year figures vary wildly and mean little. I use a 3 year average as its reasonable given contract length (4-5 years) and length of stay at a club.

I’ve ben asked “Why use an average Net Spend figure?”

Net Spend depends heavily on the period over which you measure it. Single year figures vary wildly and mean little. I use a 3 year average as its reasonable given contract length (4-5 years) and length of stay at a club.

5a/9

PSR = Profit & Sustainability Rules

This is the EFL’s “son-of-FFP”. The main measure uses an “adjusted profit” figure to assess compliance against a maximum annual loss limit agreed by the clubs (currently £13m). Compliance is judged using figures over three years.

PSR = Profit & Sustainability Rules

This is the EFL’s “son-of-FFP”. The main measure uses an “adjusted profit” figure to assess compliance against a maximum annual loss limit agreed by the clubs (currently £13m). Compliance is judged using figures over three years.

4a/9

I’ve been asked why I use 2011 as the starting point for my player trading cashflow. The simple arbitrary reason is that this was when Max took a financial interest in #afcb. Nothing more scientific I’m afraid.

I’ve been asked why I use 2011 as the starting point for my player trading cashflow. The simple arbitrary reason is that this was when Max took a financial interest in #afcb. Nothing more scientific I’m afraid.

7a/9

My list of #afcb players’ contractual situations:

2022: 2x Cook, Cahill, Nyland, Zemura, I-R (U21), Saydee (u21) [+2 loanees]

2023: Lerma, Solanke, Brooks, Mepham, Stacey, Travers, Dennis (u21), Smith, Stanislas,

My list of #afcb players’ contractual situations:

2022: 2x Cook, Cahill, Nyland, Zemura, I-R (U21), Saydee (u21) [+2 loanees]

2023: Lerma, Solanke, Brooks, Mepham, Stacey, Travers, Dennis (u21), Smith, Stanislas,

5b/9

Been asked about #afcb salary savings calc. I base my estimate on a season-to-season P&L comparison rather than an “in window” transaction analysis. It includes things like a full season impact of last Jan ins and outs, loanees, etc.

That gives the full impact on finances.

Been asked about #afcb salary savings calc. I base my estimate on a season-to-season P&L comparison rather than an “in window” transaction analysis. It includes things like a full season impact of last Jan ins and outs, loanees, etc.

That gives the full impact on finances.

1a/9

My original financial forecast for 2020/21 and its impact on #afcb’s plans in 2021/22…

My original financial forecast for 2020/21 and its impact on #afcb’s plans in 2021/22…

https://twitter.com/afcb_r0b/status/1410493634806484992

• • •

Missing some Tweet in this thread? You can try to

force a refresh