1) £32m loss after tax - I forecast £39m in Jan20 ✅

2) Mr Demin has dug deep into his pockets - he has now £21m of Equity and £109m of debt invested in the club 👀

3) Playing squad cost now over £200m 💪

1/12...

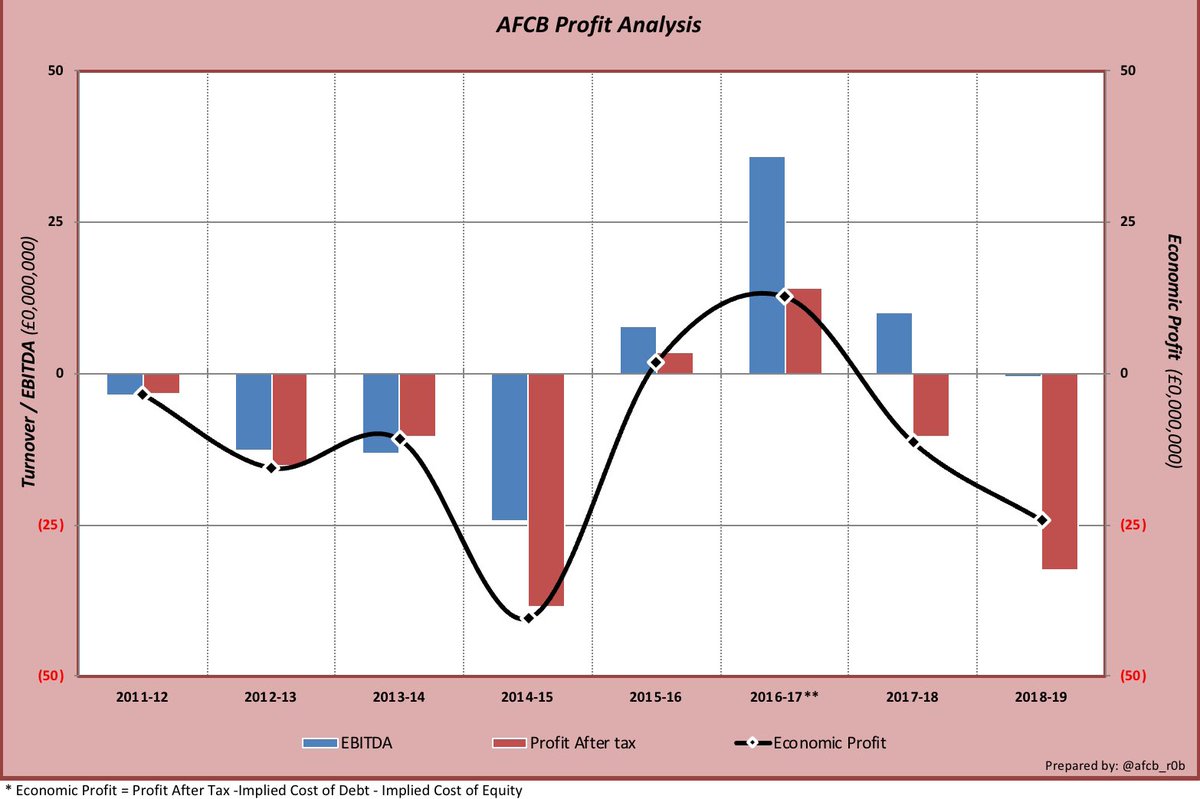

2018/19 #afcb profit

A) £32m bottom line loss not especially out of kilter with PL results so far

B) EBITDA (an approximation for cash generated from normal operations) broadly break even

C) Economic Profit (after cost of equity and debt) declining so who’d be an investor?

2018/9 #afcb turnover

A) Pretty flat but balance is changing

B) Operating turnover down £3.7m due to

- falling gate receipts (-5%),

- lower TV money (-3%)

- new sleeve sponsorship (+£0.3m)

C) Offset by rising player loan fees now at £8m - increasingly important

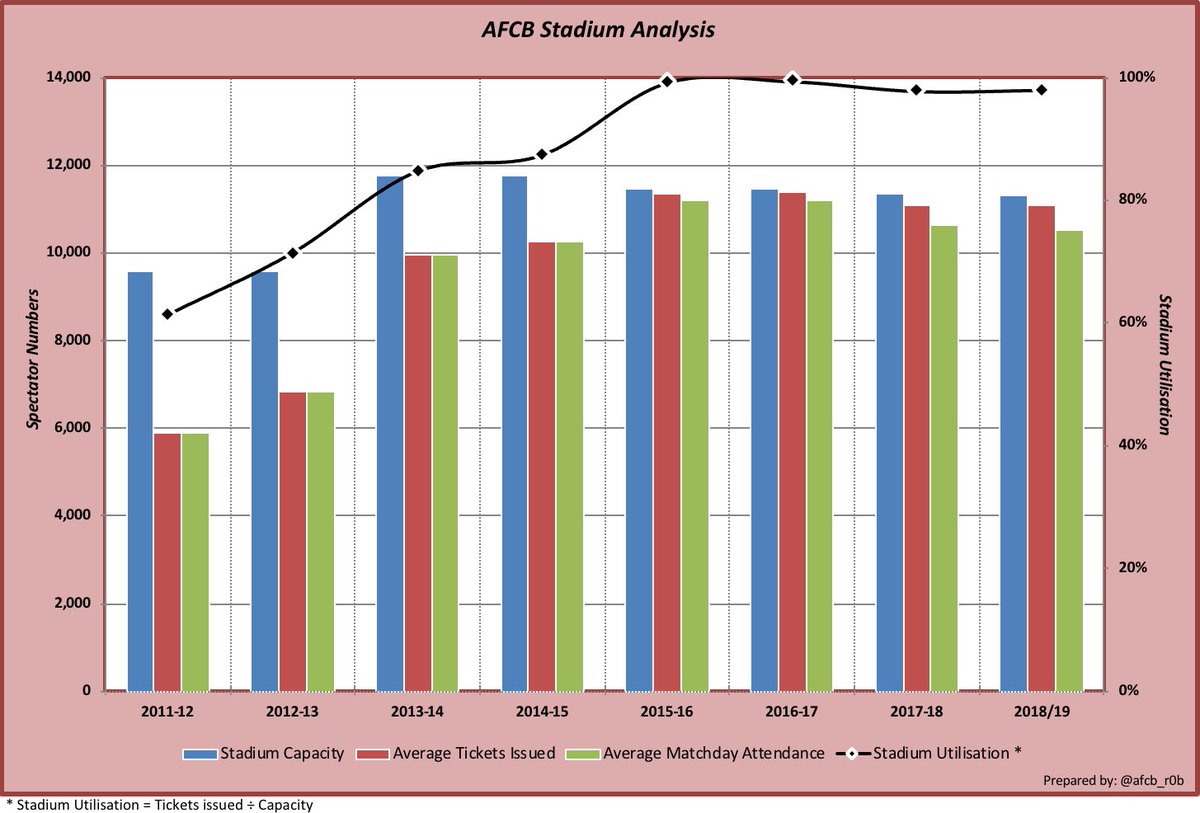

2018/19 #afcb gate receipts

A) Gate receipts down £0.3m

B) Utilisation holding up at around 98%

C) Small reduction in capacity (accessibility changes?)

D) Average gate receipt per ticket below £20 for first time in PL (low cost Cup tickets?)

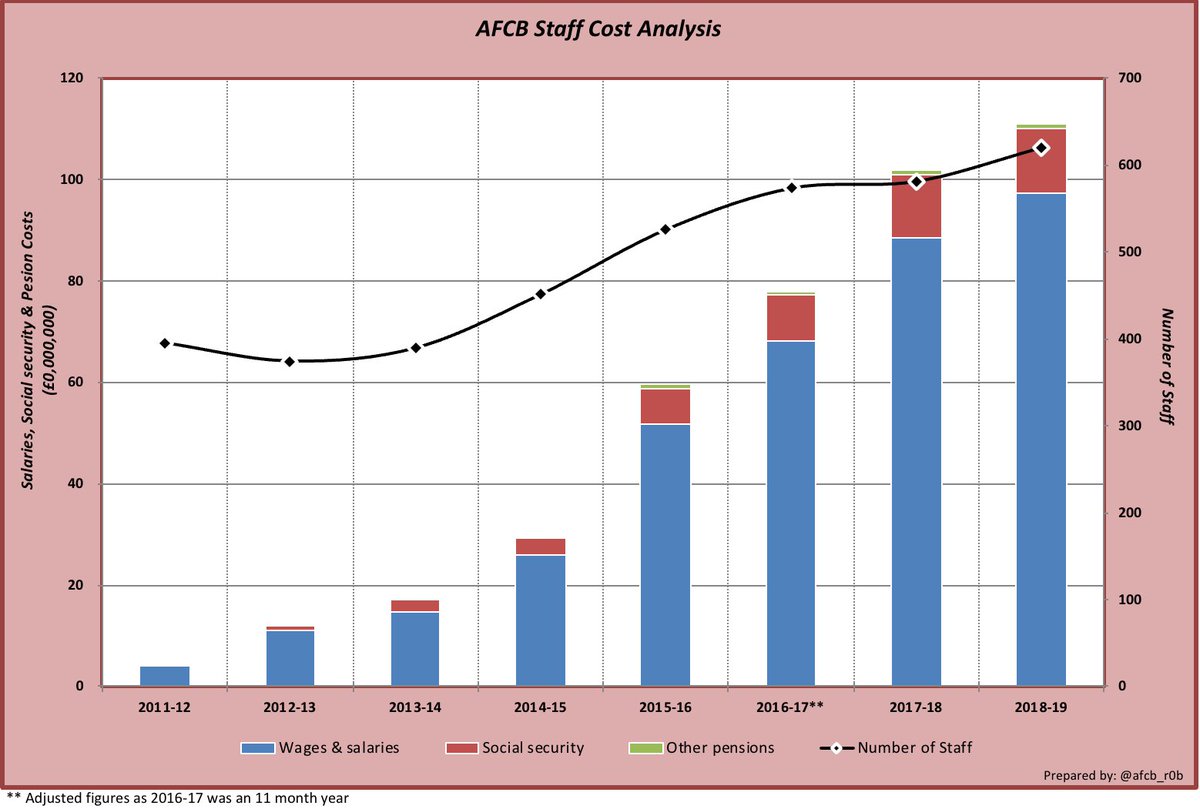

2018/19 #afcb staff costs

A) Costs up 10% to £110m

B) Staff numbers up 7% to 621 - inc 27 new matchday staff (increased security?)

C) Wages biggest riser by 10% probably driven by playing and admin staff increases

D) Costs now at 85% of Op Turnover (but 70% is sustainable)

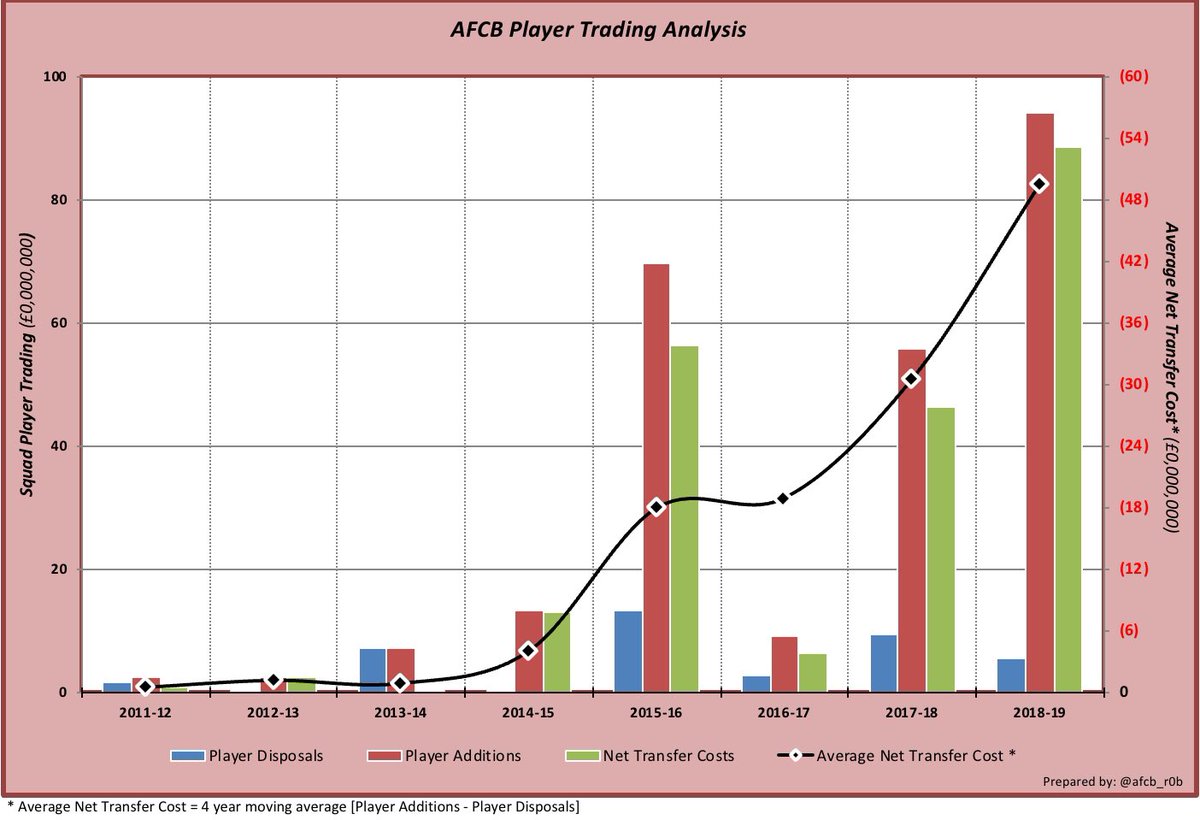

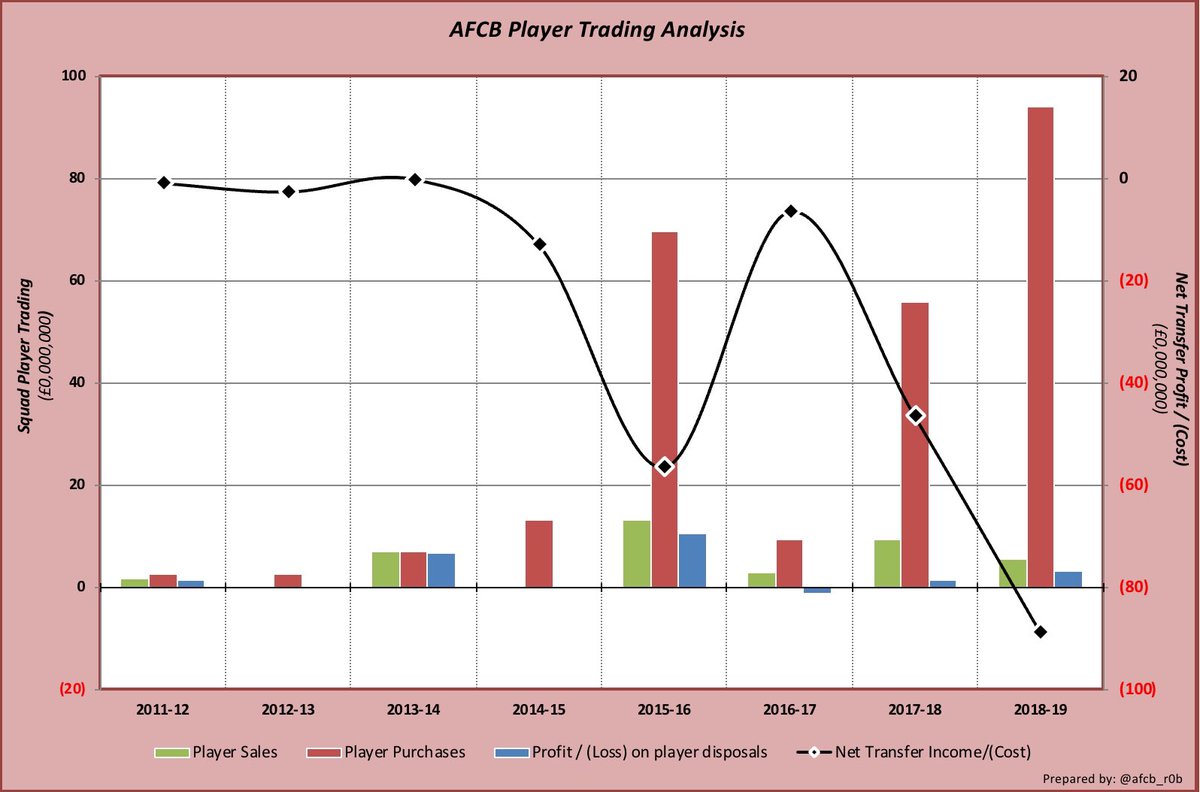

2018/19 #afcb player trading

A) £3m profit on player sales of £5.5m sales for the year

B) Player purchases at £94m

C) Giving Net Transfer costs of £88.5m

D) Post B/S £35m of purchases & £30m sales so break even ‘ish

E) Player loan fees now an important part of revenue stream

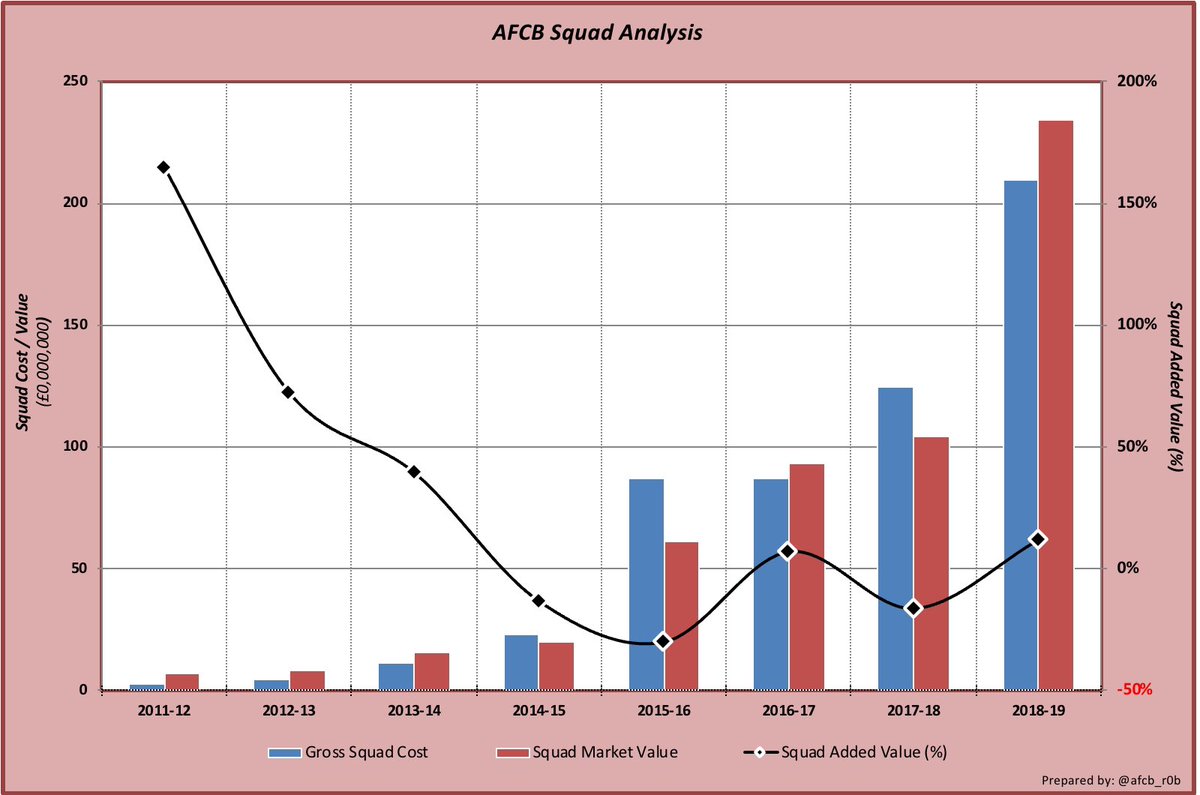

2018/19 #afcb squad

A) Gross squad cost 209m - up £85m from 2017/18

B) That represents about 3% of the Total PL Squad Costs

B) Squad Market Value £234m (from Transfermarkt.com)

C) So Ed adding value of 12% (with more to come)

D) About £100m of “profit” in the squad

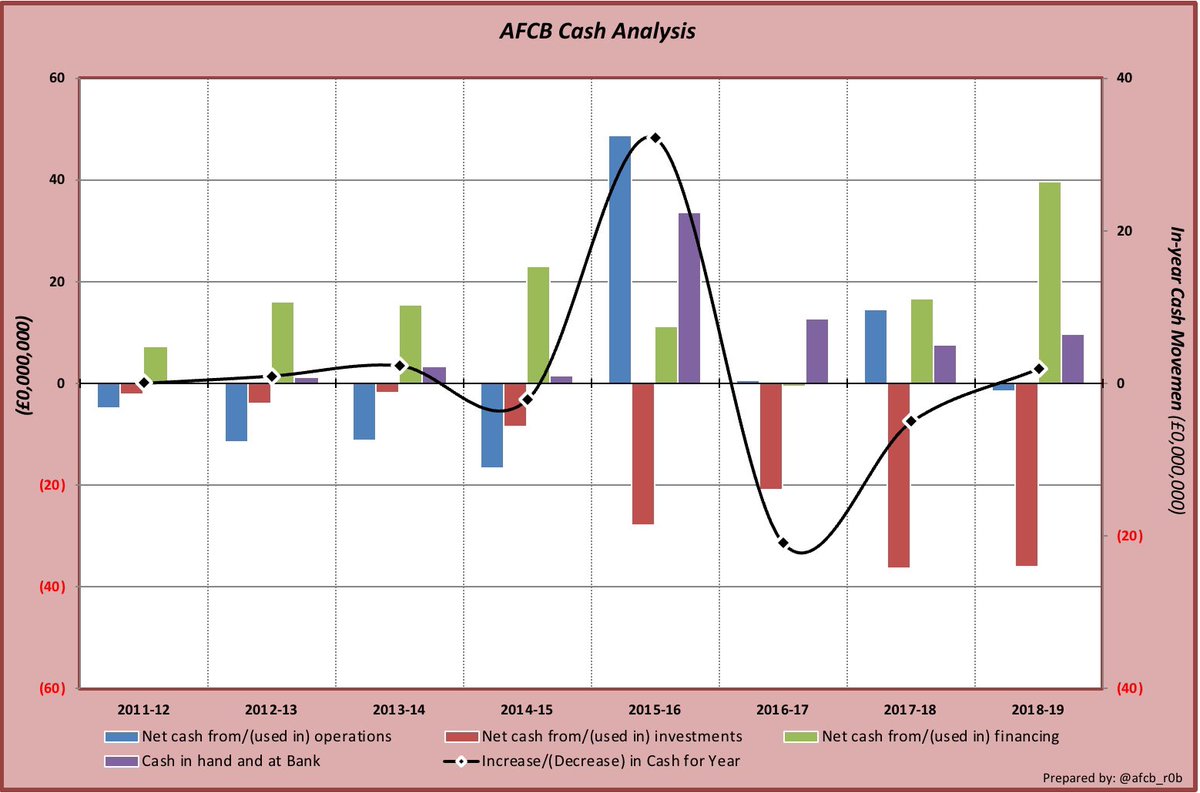

2018/19 #afcb cash

A) Underlying Operations “break even” in cash terms

B) Mr Demin injected a large sum of cash (£71m) to pay off Peak6 debt and fund transfers

C) Transfer cash spend £35m with a further £80m transfer fees due to be paid in installments

D) £9.7m in the Bank

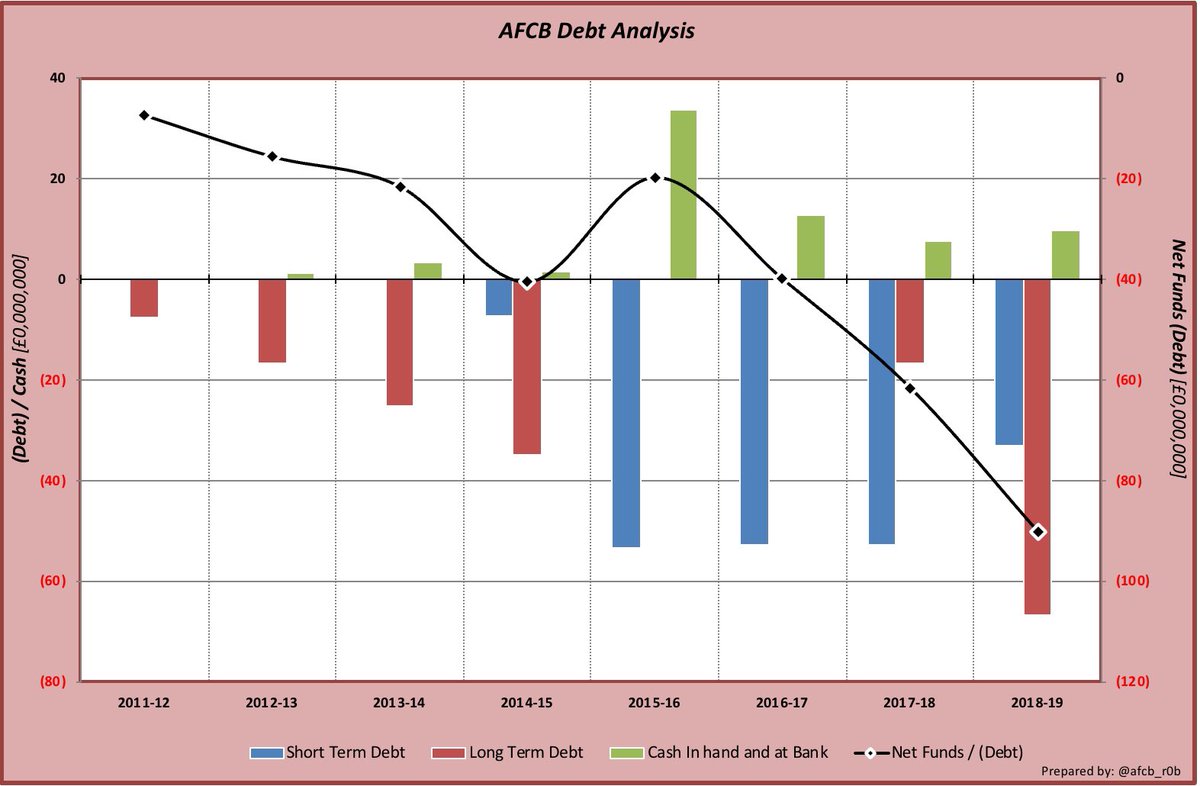

2018/19 #afcb debt

A) Club total losses now at £80m - need profit

B) Net Debt increased to £90m (0% interest)

C) Not exceptional for PL or Champ - with a couple of noteable exceptions eg Norwich and Burnley

D) Large chunk is long term so Mr Demin in for long run (or sale)

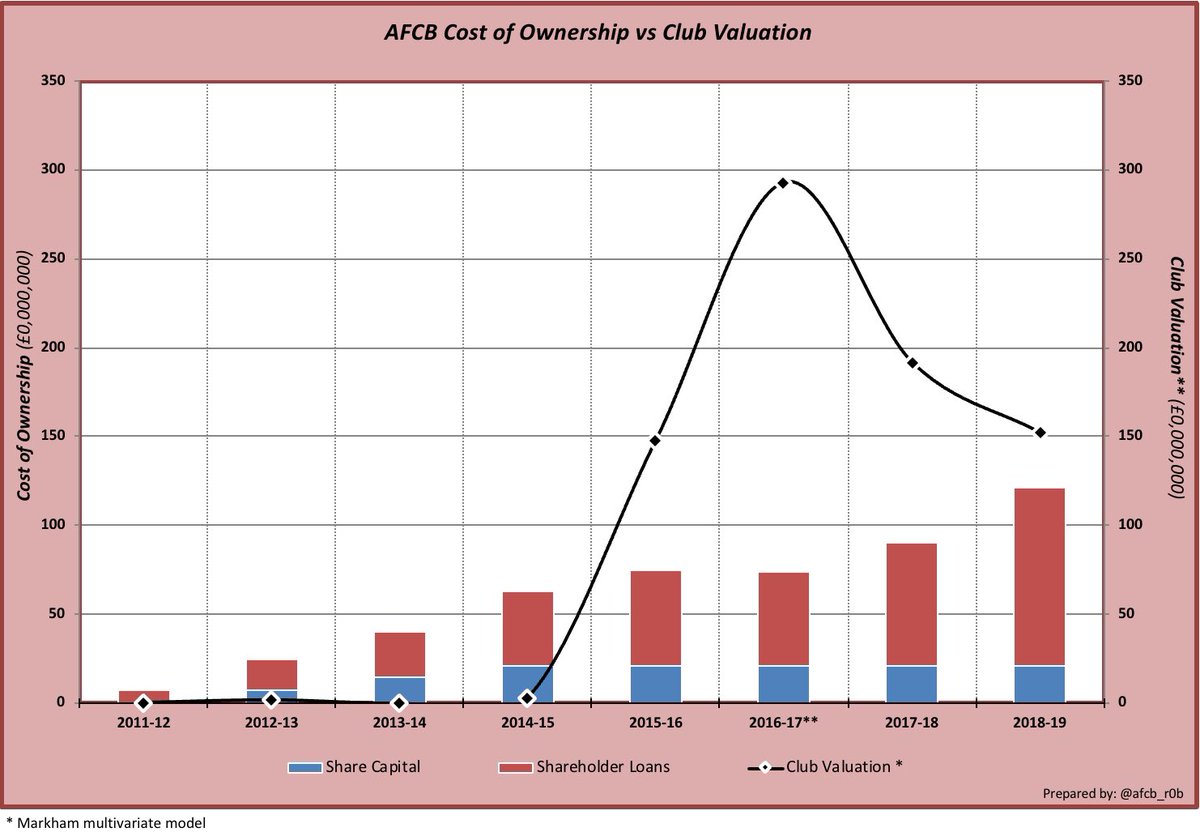

2018/19 #afcb cost of ownership

A) Who’d own a football club? Utterly BARMY!

B) Mr Demin “in” for total of £130m - £21m shares & £109m loans

C) Club valued at £150m (Markham method) provided it stays in PL

D) £100m of cash in the squad plus £80m parachute payments if needed

2018/19 #afcb after thoughts

So things are “ok” compared to our PL peers. No doubt increased profitability is needed. Shifting some high wage surplus players would help but improved performance on the pitch is the key. IMO Ed is the man for that so no need to re-run the Ad

Been asked about growth in #afcb’s transfer spend. Columns show usual in-year transfers in/out/net cost but data points & line show a rolling 4 year average of “Net Transfer Cost” (4 years is av. contract length)

Its £50m per year in 4 years up to 2018/19 (drops in 2019/20)