#BANKNIFTY #37100PE Why did it happen and why it will be common?

Note :- it didn't happen due to margin rules.

normally what people are fond of selling the spot straddle and keep SL as total of the straddle and exit at end of day

1/n

Note :- it didn't happen due to margin rules.

normally what people are fond of selling the spot straddle and keep SL as total of the straddle and exit at end of day

1/n

Even some algos keep on enter-exit at market with same logic

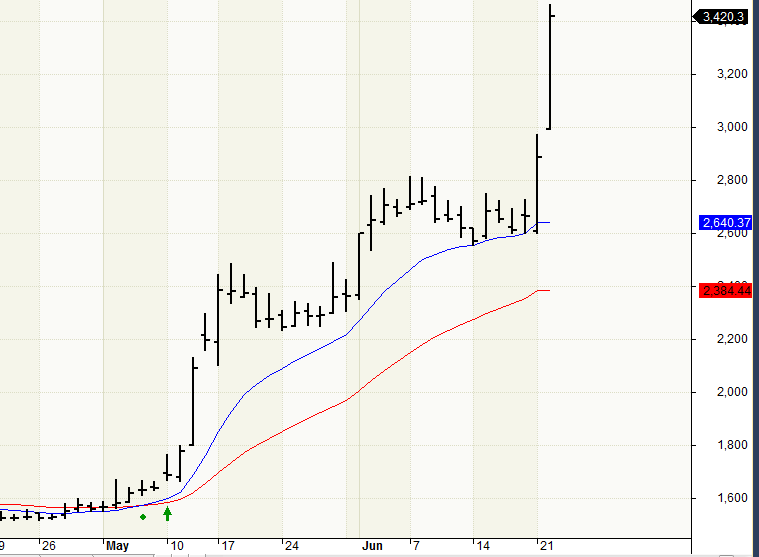

i think us bhai ne bhi yehi soch k trade lia tha what bad luck happen with him was that where his sl was placed their was no seller available and best seller after his stop was at 1921

2/n

i think us bhai ne bhi yehi soch k trade lia tha what bad luck happen with him was that where his sl was placed their was no seller available and best seller after his stop was at 1921

2/n

which was the high of that put, where the best order matched,these usually are arbitrage traders who place random bids to sell to just catch such price difference benifits.

yes, SL-L could have been better but now days everyone is fond of algos even algos have such glitches

3/n

yes, SL-L could have been better but now days everyone is fond of algos even algos have such glitches

3/n

u yourself put a timer say 5 secs

like if your order doesn't trades in 5 secs exit at market in the 6th sec after the sl had been crossed.

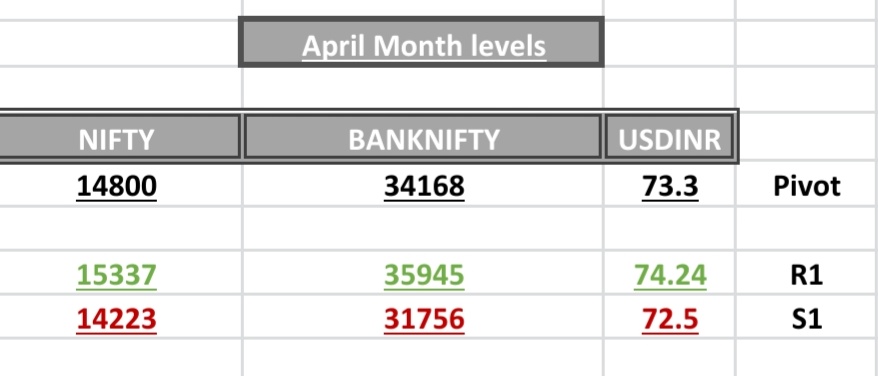

Multiple of 500(36500/37000/37500/38000) are most traded strikes so try to trade these strikes so that u don't encounter such accidents

n/n

like if your order doesn't trades in 5 secs exit at market in the 6th sec after the sl had been crossed.

Multiple of 500(36500/37000/37500/38000) are most traded strikes so try to trade these strikes so that u don't encounter such accidents

n/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh