You're all in luck! I have the one last thing you can read before you start your Labor Day weekend.

The IRS has issued a goofy notice that I had to triple-check before I believed that it actually means what it says...

ntu.org/foundation/det…

1/

The IRS has issued a goofy notice that I had to triple-check before I believed that it actually means what it says...

ntu.org/foundation/det…

1/

Here's the conclusion first, then I'll explain:

A small business that has a majority owner who works in the business (think, many family businesses) cannot take advantage of the COVID-relief Employee Retention Tax Credit (ERTC) if that person has any living relatives.

2/

A small business that has a majority owner who works in the business (think, many family businesses) cannot take advantage of the COVID-relief Employee Retention Tax Credit (ERTC) if that person has any living relatives.

2/

Not living relatives that work in the business. If they have any living relatives.

Explanation:

3/

Explanation:

3/

The Employee Retention Tax Credit (ERTC) was created by the CARES Act in 2020, the law that also created the Paycheck Protection Program (PPP) of forgivable loans. By the end of 2021, ~$36 billion will be claimed as ERTC, most by businesses with fewer than 100 employees.

4/

4/

IRS Notice 2021-49 may upend all that. Here’s the operative language from pages 28-29:

irs.gov/pub/irs-drop/n…

5/

irs.gov/pub/irs-drop/n…

5/

The IRS reasoning is laid out in a couple of steps.

First, the CARES Act did not create new eligibility rules for ERTC but instead uses the eligibility rules from the Work Opportunity Tax Credit (WOTC), a tax credit for hiring employees from specific disadvantaged groups.

6/

First, the CARES Act did not create new eligibility rules for ERTC but instead uses the eligibility rules from the Work Opportunity Tax Credit (WOTC), a tax credit for hiring employees from specific disadvantaged groups.

6/

Second, these recycled WOTC rules disallow counting any wages paid to close relatives (children, siblings, parents, nieces and nephews, and aunts and uncles).

7/

7/

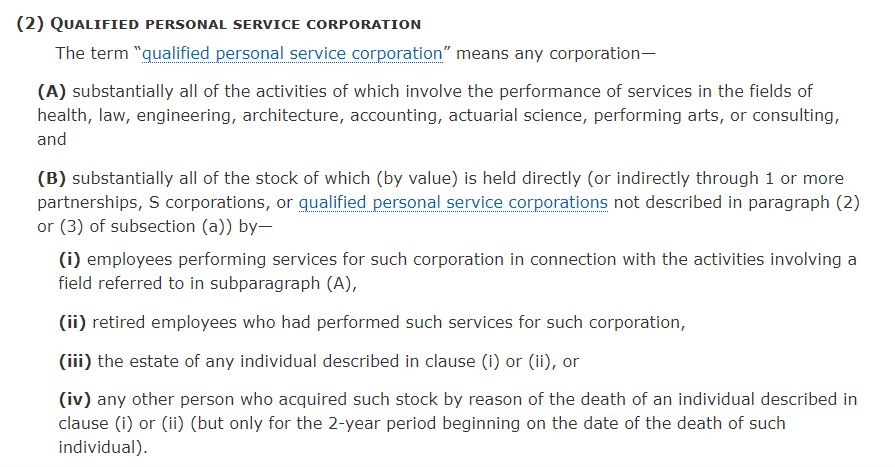

Third, those rules also disallow any wages paid to any individual that controls more than 50 percent of the business, including by Section 267 of the Internal Revenue Code.

What's Section 267?

8/

What's Section 267?

8/

Section 267 says a taxpayer can't shift shares to relatives to avoid being a majority shareholder, by assuming that any share of the company owned by a relative is actually a share owned by the taxpayer.

9/

9/

Bringing it all together, bc CARES says to use WOTC rules, and bc WOTC rules say use Section 267, and bc Section 267 says a taxpayer’s relatives are the same as the taxpayer, then any majority owner of a business isn’t really a majority owner if they have relatives.

10/

10/

That’s because, the IRS says, the relative is also a majority owner and the taxpayer a relative of them, and the wages of relatives are ineligible to be counted for the credit.

Therefore, the wages of a majority owner are ineligible for ERTC if they have immediate family.

11/

Therefore, the wages of a majority owner are ineligible for ERTC if they have immediate family.

11/

This ridiculous logic might be amusing if it were not about to cause significant and real harms.

First, the IRS is applying the notice retroactively to credits paid out for 2020 and so far in 2021.

12/

First, the IRS is applying the notice retroactively to credits paid out for 2020 and so far in 2021.

12/

National Conference of CPA Practitioners says this would cost up to $66,000 for a small business and "may make the difference between closing the doors or enabling those businesses to remain open and continue employing their staff for years to come."

images.magnetmail.net/images/clients…

13/

images.magnetmail.net/images/clients…

13/

Needless to say, the IRS and the Treasury Department didn’t need to do this. They could have:

-Only used direct WOTC rules

-Not applied it retroactively

-Flagged it as unintended and asked Congress to fix it

14/

-Only used direct WOTC rules

-Not applied it retroactively

-Flagged it as unintended and asked Congress to fix it

14/

Instead the IRS is proceeding directly to enforcement and any fix will have them as an adversary. Congress created the ERTC to keep small businesses open, and absent legislative intervention, IRS Notice 2021-49 will instead use that law to shut them down.

15/

15/

One last point: Notice 2021-49, like most IRS pronouncements, was issued without the benefit of the notice-and-comment procedures that every federal agency is required to follow when issuing regulations.

The IRS says they don't have to follow those rules.

16/

The IRS says they don't have to follow those rules.

16/

The IRS resists calls from NTUF and others to follow the Administrative Procedure Act (APA), losing 9-0 in the U.S. Supreme Court earlier this year in their attempt to shield their rules from being challenged on that basis.

ntu.org/foundation/det…

17/

ntu.org/foundation/det…

17/

The IRS’s resistance to following APA procedures before issuing binding regulations and interpretations may add legal vulnerability to Notice 2021-49.

NTUF is going to do everything we can to help fix this absurd outcome for taxpayers!

18/18

NTUF is going to do everything we can to help fix this absurd outcome for taxpayers!

18/18

• • •

Missing some Tweet in this thread? You can try to

force a refresh