What's in the House Dem budget bill draft that's circulating in DC? (NEAL_032.XML)

Page 525:

Section 138101 returns the corporate income tax to a graduated rate:

18% on income up to $400,000

21% on income between $400,000 and $5 million

26.5% on income above $5 million

Surtax on corporations with taxable income above $10 million: lesser of 3% or $287,000.

Section 138101 returns the corporate income tax to a graduated rate:

18% on income up to $400,000

21% on income between $400,000 and $5 million

26.5% on income above $5 million

Surtax on corporations with taxable income above $10 million: lesser of 3% or $287,000.

That surtax effectively phases out the benefit of the graduated rate for corporations making over $10 million.

Page 526:

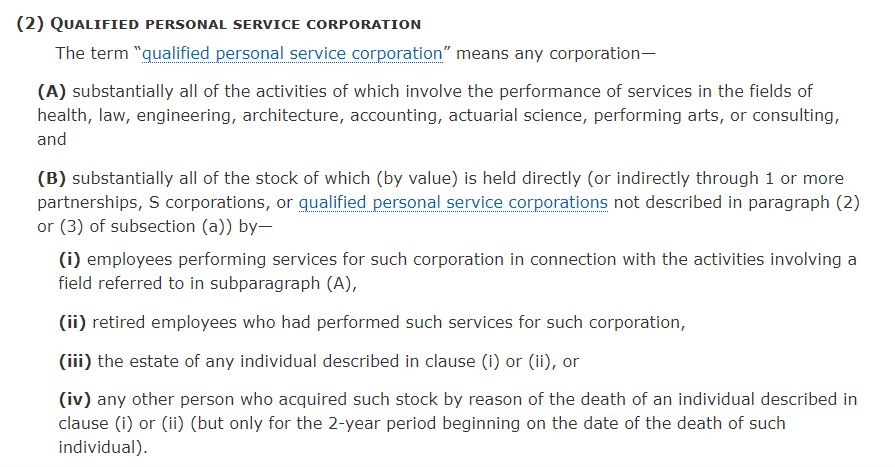

Personal services corporations - doctors, lawyers, engineers, architects, accountants, etc - are not eligible for graduated rates and pay 26.5% on all income.

Page 526:

Personal services corporations - doctors, lawyers, engineers, architects, accountants, etc - are not eligible for graduated rates and pay 26.5% on all income.

The corporate dividends received deduction is adjusted from 50% to 60% (TCJA reduced it from 70% to 50%), and for 20%-owned corporations, from 65% to 72.5% (TCJA reduced it from 80% to 65%).

Page 527: the limitation on earnings credit for a controlled group of corporations is modified to account for the graduated rates.

The section would take effect after December 31, 2021.

The section would take effect after December 31, 2021.

Page 532:

Section 138111 limits the interest deduction for domestic corporations the are members of an international financial reporting group. New 163(n) limits to 110% of net interest, for domestic corporations whose average interest amount over 3 years exceeds $12 million.

Section 138111 limits the interest deduction for domestic corporations the are members of an international financial reporting group. New 163(n) limits to 110% of net interest, for domestic corporations whose average interest amount over 3 years exceeds $12 million.

Page 541:

Section 163(j)(4) is amended to apply the interest deduction at the partner or shareholder level, rather than the entity level.

Section 163(j)(4) is amended to apply the interest deduction at the partner or shareholder level, rather than the entity level.

Page 542:

Allows carryforward of any interest not allowed to be deducted by the limitation. Can carry forward five years, FIFO. Applies after December 31, 2021.

Allows carryforward of any interest not allowed to be deducted by the limitation. Can carry forward five years, FIFO. Applies after December 31, 2021.

Page 544:

Section 138121 modifies FDII and GILTI. The Section 250 deductions are reduced for FDII to 21.875% and GILTI to 37.5%, resulting in (assuming a 26.5% corporate rate) a 16.5625% GILTI rate and a 20.7% FDII rate.

Section 138121 modifies FDII and GILTI. The Section 250 deductions are reduced for FDII to 21.875% and GILTI to 37.5%, resulting in (assuming a 26.5% corporate rate) a 16.5625% GILTI rate and a 20.7% FDII rate.

IRC Section 172(d)(9) is repealed, which would allow Section 250 deductions to be taken if they exceed taxable income.

Page 549:

IRC Section 898(c)(2) is repealed, which allows specified foreign corporations to elect a taxable year beginning 1 month before the U.S. shareholder year. Applies beginning after November 30, 2021.

IRC Section 898(c)(2) is repealed, which allows specified foreign corporations to elect a taxable year beginning 1 month before the U.S. shareholder year. Applies beginning after November 30, 2021.

Page 550:

Section 138123 limits what payments to a foreign government a dual capacity taxpayer may claim as a tax credit.

Section 138123 limits what payments to a foreign government a dual capacity taxpayer may claim as a tax credit.

Page 552:

Section 138124 requires foreign tax credit determinations to be made on a country-by-country basis for sections 904, 907, and 960.

Page 559:

Limits carryforward of excess foreign tax credit to 5 years (reduced from 10 years). Carryback repealed (reduced from 1 year).

Section 138124 requires foreign tax credit determinations to be made on a country-by-country basis for sections 904, 907, and 960.

Page 559:

Limits carryforward of excess foreign tax credit to 5 years (reduced from 10 years). Carryback repealed (reduced from 1 year).

Page 560:

Amendments to 904(b)

904(b)(4) repealed.

For GILTI foreign source income determination, count only deductions directly allocable to such income.

In covered asset dispositions, apply principles of 338(h)(16) (ignoring 338(g) election).

Amendments to 904(b)

904(b)(4) repealed.

For GILTI foreign source income determination, count only deductions directly allocable to such income.

In covered asset dispositions, apply principles of 338(h)(16) (ignoring 338(g) election).

Page 565:

Section 138125 adds oil shale and tar sands to the definition of foreign oil related income in Section 907, which limits crediting foreign taxes on oil related income against U.S. taxes.

Section 138125 adds oil shale and tar sands to the definition of foreign oil related income in Section 907, which limits crediting foreign taxes on oil related income against U.S. taxes.

Page 566:

Section 138126 adopts country-by-country for GILTI, including net CFC tested income, net deeded tangible income return and QBAI (reduced from 10% to 5%), and interest expense. Country-specific carryovers allowed. Includes foreign oil/gas income to tested income.

Section 138126 adopts country-by-country for GILTI, including net CFC tested income, net deeded tangible income return and QBAI (reduced from 10% to 5%), and interest expense. Country-specific carryovers allowed. Includes foreign oil/gas income to tested income.

Page 573:

Section 138127 changes the foreign tax credit "haircut" for GILTI calculation, reducing it from 20% to 5% (0% for taxes paid or accrued to U.S. territories). Effective 1/1/22.

Limits CFC status to companies with U.S. shareholders, retroactive to 1/1/18.

Section 138127 changes the foreign tax credit "haircut" for GILTI calculation, reducing it from 20% to 5% (0% for taxes paid or accrued to U.S. territories). Effective 1/1/22.

Limits CFC status to companies with U.S. shareholders, retroactive to 1/1/18.

Page 576:

Section 138128 limits the Section 245A 100% participation exemption for foreign source dividends to apply only to foreign dividends received from controlled foreign corporations. 1/1/18.

Section 138128 limits the Section 245A 100% participation exemption for foreign source dividends to apply only to foreign dividends received from controlled foreign corporations. 1/1/18.

Page 585:

Section 138129 limits foreign base company sales and services income to U.S. residents/entities. 1/1/22.

Limitations on CFC shareholder tax on their CFC income. Some of these retroactive to 1/1/18.

Section 138129 limits foreign base company sales and services income to U.S. residents/entities. 1/1/22.

Limitations on CFC shareholder tax on their CFC income. Some of these retroactive to 1/1/18.

Page 597:

Section 138131 - BEAT rate changed from 10% to 12.5% (2024 & 2025), and 15% (2026 and after). BEAT calculation takes into account tax credits.

BEAT calculation section is rewritten to include more in the modified taxable income determination.

Section 138131 - BEAT rate changed from 10% to 12.5% (2024 & 2025), and 15% (2026 and after). BEAT calculation takes into account tax credits.

BEAT calculation section is rewritten to include more in the modified taxable income determination.

Page 608: repeals exemption from BEAT for taxpayers with low base-erosion percentage, from 1/1/24.

Page 609:

Section 138141 - Section 45C (25% credit for clinical testing expenses for drugs for rare diseases) can only be used for first use/indication and must be done before approval.

Section 138141 - Section 45C (25% credit for clinical testing expenses for drugs for rare diseases) can only be used for first use/indication and must be done before approval.

Page 610:

Section 138142 - changes worthless securities loss determination date from end of calendar year to day of "event establishing worthlessness."

Applies to partnership interests.

Liquidation securities loss not allowed until all property disposed of to third parties.

Section 138142 - changes worthless securities loss determination date from end of calendar year to day of "event establishing worthlessness."

Applies to partnership interests.

Liquidation securities loss not allowed until all property disposed of to third parties.

Page 613:

Section 138143 - Adjusts basis in securities in divisive reorganization.

Page 616:

Section 138144 - REIT qualified income test excludes prison income.

Section 138145 - ineligible for portfolio interest exemption on a corp's stock if own 10%+ of that corp's stock.

Section 138143 - Adjusts basis in securities in divisive reorganization.

Page 616:

Section 138144 - REIT qualified income test excludes prison income.

Section 138145 - ineligible for portfolio interest exemption on a corp's stock if own 10%+ of that corp's stock.

Page 617:

Section 138146 - Section 871(m) to treat certain sale-repurchase payments as dividend equivalents.

Page 620:

Sections 138147 & 138148 - Changes rules on earnings and profits for CFCs, disallowing certain amounts.

Section 138146 - Section 871(m) to treat certain sale-repurchase payments as dividend equivalents.

Page 620:

Sections 138147 & 138148 - Changes rules on earnings and profits for CFCs, disallowing certain amounts.

Page 623:

Section 138149 - Partnership interests held in connection with performance of services - changes holding period for long-term capital gain treatment from 3 years to 5 years. Keeps 3 years for AGI less than $400,000.

Section 138149 - Partnership interests held in connection with performance of services - changes holding period for long-term capital gain treatment from 3 years to 5 years. Keeps 3 years for AGI less than $400,000.

Page 628:

Section 138150 - Limits 1202(a) exclusion of gain from qualified business stock for taxpayers with income over $400,000, and trusts and estates. Applies to sales and exchanges on or after 9/13/21, except binding contracts agreed as of 9/12/21.

Section 138150 - Limits 1202(a) exclusion of gain from qualified business stock for taxpayers with income over $400,000, and trusts and estates. Applies to sales and exchanges on or after 9/13/21, except binding contracts agreed as of 9/12/21.

Page 629:

Section 138151 - includes digital assets (crypto) in 1259(b)(1) constructive sales rules, regarding offsetting sales that limit or transfer taxable gain.

Section 138151 - includes digital assets (crypto) in 1259(b)(1) constructive sales rules, regarding offsetting sales that limit or transfer taxable gain.

Page 630:

Section 138152 - Specifies that Section 52(b) aggregation rules apply to any activity treated as a trade or business.

Section 138153 - Includes currency, commodities, and digital assets (crypto) in Section 1091 wash sale anti-abuse rule.

Section 138152 - Specifies that Section 52(b) aggregation rules apply to any activity treated as a trade or business.

Section 138153 - Includes currency, commodities, and digital assets (crypto) in Section 1091 wash sale anti-abuse rule.

INDIVIDUAL INCOME TAX SECTIONS:

Page 636:

Section 138201 - Restores top income tax rate of 39.6% on income over $400,000 single / $450,000 married. Effective 1/1/22.

Currently 37% on income over $500,000 single / $600,000 married.

Section 138201 - Restores top income tax rate of 39.6% on income over $400,000 single / $450,000 married. Effective 1/1/22.

Currently 37% on income over $500,000 single / $600,000 married.

Page 641:

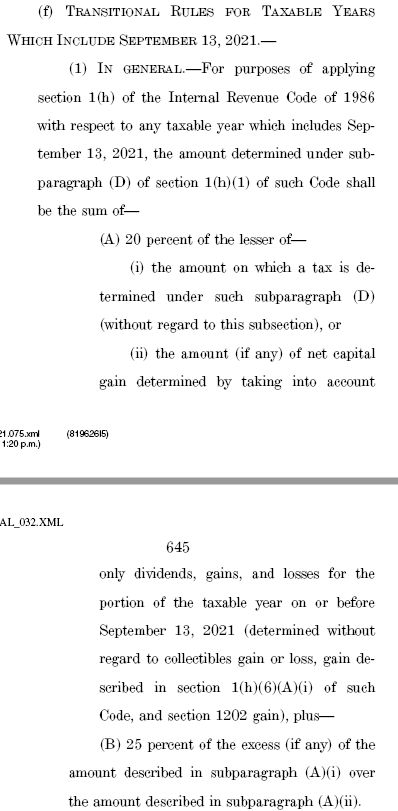

Section 138202- Raises capital gains tax rate for high-income individuals from 20% to 25%. Applies to taxable years ending after 9/13/21 (inc. binding contracts for later). For years including 9/13/21, shall be (roughly) 20% on gain prior to 9/13/21, 25% for gain after.

Section 138202- Raises capital gains tax rate for high-income individuals from 20% to 25%. Applies to taxable years ending after 9/13/21 (inc. binding contracts for later). For years including 9/13/21, shall be (roughly) 20% on gain prior to 9/13/21, 25% for gain after.

Page 646:

Section 138203 - applies Net Investment Income Tax (3.8% substitution for Medicare tax on income of high-income individuals) to net investment income from trade or business activity. Effective 1/1/22.

Section 138203 - applies Net Investment Income Tax (3.8% substitution for Medicare tax on income of high-income individuals) to net investment income from trade or business activity. Effective 1/1/22.

Page 650:

Section 138204 - Amends Section 199A (pass-through income deduction) to set maximum allowable deduction of $400,000 individual / $500,000 married. Effective 1/1/22.

Section 138204 - Amends Section 199A (pass-through income deduction) to set maximum allowable deduction of $400,000 individual / $500,000 married. Effective 1/1/22.

Page 651

Section 138205 - permanently disallows business losses in excess of business income for non-corporate taxpayers.

(TCJA limited losses up to $250,000 single/$500,000 married through 2025, but CARES suspended the suspension for 2018, 2019, 2020.)

Section 138205 - permanently disallows business losses in excess of business income for non-corporate taxpayers.

(TCJA limited losses up to $250,000 single/$500,000 married through 2025, but CARES suspended the suspension for 2018, 2019, 2020.)

Page 652:

Section 138206 - adds new Section 1A imposing a 3% tax on income in excess of $5 million (married or single; $2.5m for married filing separately). Effective 1/1/22.

Section 138206 - adds new Section 1A imposing a 3% tax on income in excess of $5 million (married or single; $2.5m for married filing separately). Effective 1/1/22.

Page 654:

Section 138207 - Repeal's TCJA's temporary (2018 through 2025) increase in the exclusion amount from the estate and gift tax, reverting it from $11.7 million to $5.85 million (per individual; double for couples). Effective 1/1/22.

Section 138207 - Repeal's TCJA's temporary (2018 through 2025) increase in the exclusion amount from the estate and gift tax, reverting it from $11.7 million to $5.85 million (per individual; double for couples). Effective 1/1/22.

Page 655:

Section 138208 - Increases exemption from estate tax for property used as a farm, allowing actual use valuation rather than fair market value, and increasing maximum allowable deduction from $750,000 to $11,700,000. Effective 1/1/22.

Section 138208 - Increases exemption from estate tax for property used as a farm, allowing actual use valuation rather than fair market value, and increasing maximum allowable deduction from $750,000 to $11,700,000. Effective 1/1/22.

Page 655:

Section 138209 - Adds new Section 2901 to include in taxable estate any trusts where the decedent is deemed owner of the trust.

Treats sales between grant trusts and deemed owner as sales between owner and third party.

Effective after date of enactment of the law.

Section 138209 - Adds new Section 2901 to include in taxable estate any trusts where the decedent is deemed owner of the trust.

Treats sales between grant trusts and deemed owner as sales between owner and third party.

Effective after date of enactment of the law.

Page 659:

Section 138210 - No transfer tax valuation discount for transfer of nonbusiness assets.

Section 138210 - No transfer tax valuation discount for transfer of nonbusiness assets.

Page 665:

Section 138301 - Disallows further Roth/IRA contributions if individual's total accounts exceed $10m. Applies to taxpayers with income over $400k single / $450k married.

Requires businesses to report all plan participants with $2.5m+ vested balance.

Effective 1/1/22.

Section 138301 - Disallows further Roth/IRA contributions if individual's total accounts exceed $10m. Applies to taxpayers with income over $400k single / $450k married.

Requires businesses to report all plan participants with $2.5m+ vested balance.

Effective 1/1/22.

Page 674:

Section 138302 - Requires distribution when combined IRA/Roth/DC balance exceeds $10 million, of 50% of excess. Effective 1/1/22.

Section 138302 - Requires distribution when combined IRA/Roth/DC balance exceeds $10 million, of 50% of excess. Effective 1/1/22.

Page 686:

Section 138311 - Disallows after-tax IRA contributions from being converted to Roth, for all taxpayers, effective 1/1/22.

Disallows Roth conversions entirely for taxpayers with income over $400k single / $450k married. Effective 1/1/32 (yes 2032).

Section 138311 - Disallows after-tax IRA contributions from being converted to Roth, for all taxpayers, effective 1/1/22.

Disallows Roth conversions entirely for taxpayers with income over $400k single / $450k married. Effective 1/1/32 (yes 2032).

Page 689:

Section 138312 - prohibits IRAs from holding securities that require the IRA owner to have minimum income or assets, or education or credential. Effective 1/1/22, with 2-year transition for IRAs holding such securities to comply.

Section 138312 - prohibits IRAs from holding securities that require the IRA owner to have minimum income or assets, or education or credential. Effective 1/1/22, with 2-year transition for IRAs holding such securities to comply.

Page 692:

Section 138313 - extends statute of limitations from 3 years to 6 years for valuation misreporting or prohibited transactions. Effective for taxes in which 3 year period ends after 12/31/21.

Section 138313 - extends statute of limitations from 3 years to 6 years for valuation misreporting or prohibited transactions. Effective for taxes in which 3 year period ends after 12/31/21.

Page 693:

Section 138314 - expands prohibition against IRA self-dealing by reducing definition of ownership interest from 50 percent to 10 percent. Effective 1/1/22, with 2-year transition for IRAs holding such investments to comply.

Section 138314 - expands prohibition against IRA self-dealing by reducing definition of ownership interest from 50 percent to 10 percent. Effective 1/1/22, with 2-year transition for IRAs holding such investments to comply.

Page 696

Section 138315 - IRA owner, including beneficiary who will inherit IRA after owner's death, is treated as disqualified person for prohibited IRA transactions. Effective 1/1/22.

Section 138315 - IRA owner, including beneficiary who will inherit IRA after owner's death, is treated as disqualified person for prohibited IRA transactions. Effective 1/1/22.

Page 698

Section 138401 - Provides extra $78.935 billion to the IRS for enforcement, audits, modernization.

Funds not "intended to increase taxes" on taxpayers below $400k.

Designates $410m for Inspector General and $157m for the Tax Court but otherwise does not specify use.

Section 138401 - Provides extra $78.935 billion to the IRS for enforcement, audits, modernization.

Funds not "intended to increase taxes" on taxpayers below $400k.

Designates $410m for Inspector General and $157m for the Tax Court but otherwise does not specify use.

Page 699

Section 138402 - Requires third party network transactions (Venmo, PayPal, etc) to deduct/withhold for payees paid $600+. Effective 1/1/22.

(ARPA reduced reporting threshold from $20,000 & 200+ transactions to $600, eff. 1/1/22. 200+transactions req't would be 2022 only

Section 138402 - Requires third party network transactions (Venmo, PayPal, etc) to deduct/withhold for payees paid $600+. Effective 1/1/22.

(ARPA reduced reporting threshold from $20,000 & 200+ transactions to $600, eff. 1/1/22. 200+transactions req't would be 2022 only

Page 700:

Section 138403 - Denies deduction for conservation easement donation where partnership contribution exceeds 2.5x the basis of the partnership.

Donors whom the IRS determines have defective deeds have 90 days to correct.

Effective for contributions after 12/23/16.

Section 138403 - Denies deduction for conservation easement donation where partnership contribution exceeds 2.5x the basis of the partnership.

Donors whom the IRS determines have defective deeds have 90 days to correct.

Effective for contributions after 12/23/16.

Page 709:

Section 138404 - Repeals requirement that IRS supervisors approve any assessment of penalties, for a penalty to be valid. Effective retroactive to 1/1/01.

Substitutes it with a quarterly letter by IRS supervisors certifying that their employees are following rules.

Section 138404 - Repeals requirement that IRS supervisors approve any assessment of penalties, for a penalty to be valid. Effective retroactive to 1/1/01.

Substitutes it with a quarterly letter by IRS supervisors certifying that their employees are following rules.

(Taking a break to eat a burrito and check in with colleagues, and then I will read the rest of this bill.)

Page 710:

Section 138501 - Moves up the 162(m) amendment from ARPA from 2027 to 1/1/22. Current law disallows deductions for compensation to CEO, CFO, and next 3 other highest compensated officers. ARPA changed it from next 3 to next 5.

Section 138501 - Moves up the 162(m) amendment from ARPA from 2027 to 1/1/22. Current law disallows deductions for compensation to CEO, CFO, and next 3 other highest compensated officers. ARPA changed it from next 3 to next 5.

Page 711:

Section 138502 - Extends expiration of the tax on coal to fund black lung disability payments from 12/31/21 to 12/31/25.

Section 138502 - Extends expiration of the tax on coal to fund black lung disability payments from 12/31/21 to 12/31/25.

Page 712:

Section 138503 - Includes as an IRA prohibited transaction holding an interest in a FSC or DISC owned by the IRA's beneficiary. Expands constructive ownership threshold from 25% to 10%. Effective 1/1/22.

Section 138503 - Includes as an IRA prohibited transaction holding an interest in a FSC or DISC owned by the IRA's beneficiary. Expands constructive ownership threshold from 25% to 10%. Effective 1/1/22.

Page 714:

Section 138504 - tobacco tax increases

Doubles federal cigarette tax from $1.0066/pack → $2.0132/pack.

Cigar: 3-5¢/cigar → 10¢/cigar.

Snuff: 11¢/can → $2.02/can.

Chewing tobacco: 3¢/oz → 67¢/oz.

Pipe: 18¢/oz → $3.10/oz

Roll your own: $1.55/oz → $3.10/oz

Section 138504 - tobacco tax increases

Doubles federal cigarette tax from $1.0066/pack → $2.0132/pack.

Cigar: 3-5¢/cigar → 10¢/cigar.

Snuff: 11¢/can → $2.02/can.

Chewing tobacco: 3¢/oz → 67¢/oz.

Pipe: 18¢/oz → $3.10/oz

Roll your own: $1.55/oz → $3.10/oz

Page 716:

Adds federal taxes on vaping and nicotine pouches at equalized rate with tobacco, at $100.66 per 1,810mg of nicotine.

A 5% pod = new $2.30 tax

Can of 20 2mg nicotine pouches = new $2.22 tax

Effective one quarter after law passed.

Taxes inflation-adjusted after 2022.

Adds federal taxes on vaping and nicotine pouches at equalized rate with tobacco, at $100.66 per 1,810mg of nicotine.

A 5% pod = new $2.30 tax

Can of 20 2mg nicotine pouches = new $2.22 tax

Effective one quarter after law passed.

Taxes inflation-adjusted after 2022.

Page 723:

Section 138505 - bans substitution drawback for tobacco products. This is when you get import duties refunded for a product you are exporting. Currently, you can swap similar products (import 100 bottles, export 100 different but similar bottles) and claim drawback.

Section 138505 - bans substitution drawback for tobacco products. This is when you get import duties refunded for a product you are exporting. Currently, you can swap similar products (import 100 bottles, export 100 different but similar bottles) and claim drawback.

That drawback change is retroactive to 12/18/08 and after.

Page 724:

Section 138506 - terminates tax credit employers can take for paying employees on family and medical leave, on 12/31/23 instead of 12/31/25.

Congress in February just extended it from 12/31/20 to 12/31/25.

Section 138506 - terminates tax credit employers can take for paying employees on family and medical leave, on 12/31/23 instead of 12/31/25.

Congress in February just extended it from 12/31/20 to 12/31/25.

Page 724:

Section 138507 - Gains from sale/exchange by a FSC or DISC to a foreign shareholder to be deemed to be had by that shareholder in the U.S. Effective 1/1/22.

Section 138507 - Gains from sale/exchange by a FSC or DISC to a foreign shareholder to be deemed to be had by that shareholder in the U.S. Effective 1/1/22.

Page 725:

Section 138508 - allows Treasury to internally share self-employment information about a taxpayer to determine eligibility for paid family and medical leave.

Section 138508 - allows Treasury to internally share self-employment information about a taxpayer to determine eligibility for paid family and medical leave.

Page 726:

Section 138509 - Allows S corporations to reorganize as a partnership without triggering tax. Effective 12/31/21 and must be done within 2 years.

Section 138509 - Allows S corporations to reorganize as a partnership without triggering tax. Effective 12/31/21 and must be done within 2 years.

Page 728:

Section 138510 - allows investors/producers of "qualified sound recording productions" to deduct costs when incurred rather than at release of production (added to Section 181). Capped at $150,000. Effective on enactment. Would expire 12/31/25 (with the rest of 181).

Section 138510 - allows investors/producers of "qualified sound recording productions" to deduct costs when incurred rather than at release of production (added to Section 181). Capped at $150,000. Effective on enactment. Would expire 12/31/25 (with the rest of 181).

Page 732:

Section 138511 - Adds refund mechanism for purchasers of diesel and kerosene fuel that is dyed (untaxed) but on which tax has already been paid. Effective 180 days after enactment.

Section 138511 - Adds refund mechanism for purchasers of diesel and kerosene fuel that is dyed (untaxed) but on which tax has already been paid. Effective 180 days after enactment.

Page 734:

Section 138512 - Allows beauty service (hair, nail, esthetics, body/spa) employers to take a credit for employer Social Security taxes they pay for their employees on tips received. Provision currently applies to restaurant/bar owners. Effective 1/1/22.

Section 138512 - Allows beauty service (hair, nail, esthetics, body/spa) employers to take a credit for employer Social Security taxes they pay for their employees on tips received. Provision currently applies to restaurant/bar owners. Effective 1/1/22.

Page 736:

Section 138513 - Increases Work Opportunity Tax Credit (for hiring veterans, ex-felons, ex-welfare recipients) from 40% on first $6,000 to 50% on first $10,000. Effective from date of enactment and expires 12/31/22.

Section 138513 - Increases Work Opportunity Tax Credit (for hiring veterans, ex-felons, ex-welfare recipients) from 40% on first $6,000 to 50% on first $10,000. Effective from date of enactment and expires 12/31/22.

Page 738:

Section 138514 - Adds a new above-the-line deduction for union dues payment by union members, up to $250. Effective 1/1/22.

Prior to 2017, union dues were deductible but only by itemizers and part of miscellaneous deductions (more than 2% of income).

Section 138514 - Adds a new above-the-line deduction for union dues payment by union members, up to $250. Effective 1/1/22.

Prior to 2017, union dues were deductible but only by itemizers and part of miscellaneous deductions (more than 2% of income).

Page 738:

Section 138515 - repeals expiration (currently 12/31/21) of the Puerto Rico/Virgin Islands rum "cover-over" (federal distilled spirits tax revenue from production in those territories is transferred to the respective territorial treasuries). Effective 1/1/22.

Section 138515 - repeals expiration (currently 12/31/21) of the Puerto Rico/Virgin Islands rum "cover-over" (federal distilled spirits tax revenue from production in those territories is transferred to the respective territorial treasuries). Effective 1/1/22.

Page 742:

Section 138516 - delays repeal of R&D expensing (changing to five year R&D amortization) from 12/31/21 to 12/31/25. Effective upon enactment.

Section 138516 - delays repeal of R&D expensing (changing to five year R&D amortization) from 12/31/21 to 12/31/25. Effective upon enactment.

Page 742:

Section 138517 - Adds new refundable tax credit for newspaper publishers for employment taxes paid on wages (up to $12,500/quarter) of local news journalists, at 50% of wages for first 4 quarters and 30% for each quarter after. Effective for 5 years after enactment.

Section 138517 - Adds new refundable tax credit for newspaper publishers for employment taxes paid on wages (up to $12,500/quarter) of local news journalists, at 50% of wages for first 4 quarters and 30% for each quarter after. Effective for 5 years after enactment.

Page 748:

Section 138518 - allows financial guaranty insurance company to include unearned premium reserves in its liability for determining if it is a passive foreign investment company. Effective retroactive to 1/1/18.

Section 138518 - allows financial guaranty insurance company to include unearned premium reserves in its liability for determining if it is a passive foreign investment company. Effective retroactive to 1/1/18.

Page 755:

Section 138519 - adds a new refundable tax credit of up to $2,000 in any 3-year period for qualified access technology used by a blind individual (if not covered by insurance). Indexed for inflation. Effective 1/1/22, expires 12/31/26.

Section 138519 - adds a new refundable tax credit of up to $2,000 in any 3-year period for qualified access technology used by a blind individual (if not covered by insurance). Indexed for inflation. Effective 1/1/22, expires 12/31/26.

Page 757:

Section 138520 - modifies constructive ownership rules for REITs. Effective upon enactment.

Section 138520 - modifies constructive ownership rules for REITs. Effective upon enactment.

And that's the bill! (The rest of it is non-tax drug pricing changes that others will have to parse.)

Or at least the part that was released today. There may be more tax proposals coming...

Or at least the part that was released today. There may be more tax proposals coming...

• • •

Missing some Tweet in this thread? You can try to

force a refresh