Govt. of India has been resorting to increased borrowing. Does it have an impact on your personal finances and financial security? Does it have a bearing on the interest earned on your retirement savings? Read the thread and decide for yourself.

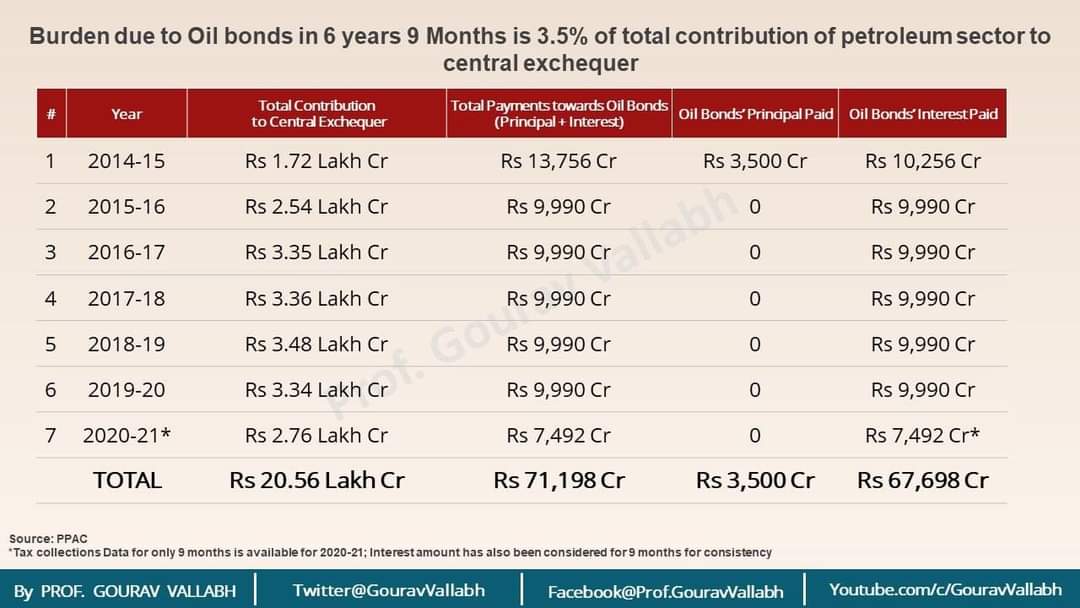

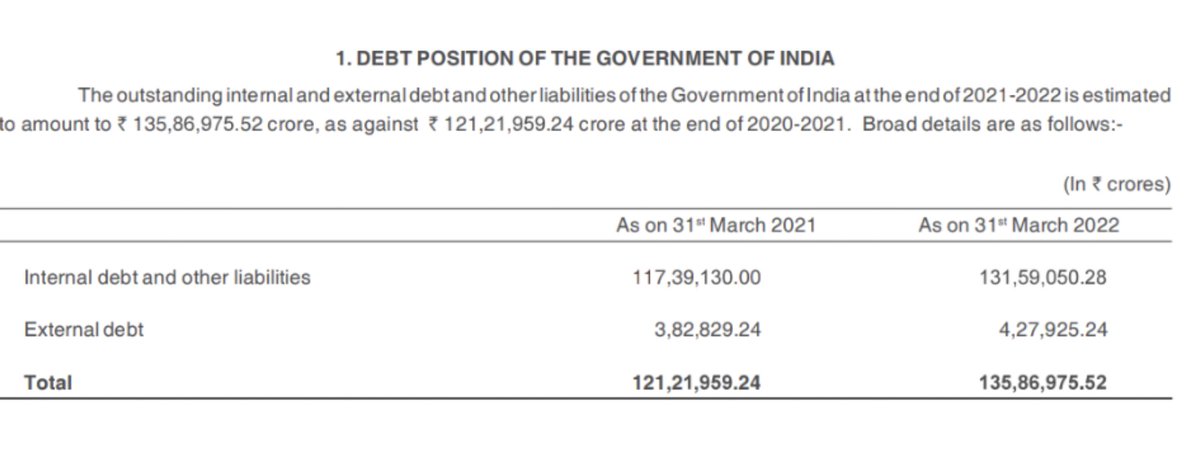

1. The total debt by Govt. of India which was 53 Lac crores in March 2014, would baloon to 136 Lac Crores by March 2022. GoI's debt-to-GDP ratio would go up to 62% in FY22, a 16-year-high. By the end of the year, each Indian will owe Rs.1 Lac, a loan they have never taken.

2. More than 40% of our annual budget is financed through borrowings. With high deficits funded through borrowings and limited space for increasing revenues or cutting expenditure, the shortcut that GOI may resort to is controlling interest on borrowings.

3. Lot of people justify our debt by mentioning debt to GDP ratios of Japan, which has a 257% ration and USA which has a 125% ratio. India's total National Debt (including debt by states) to GDP ratio will hit close to 100% in 2022.

4.The comparison stops here. World spends 5.75% of its revenues as interest on debt. Enabled by low interest rates, the interest cost as a ratio to revenues is 12% for Japan and 15% for USA. Interest on term deposits in Japan are close to ZERO and in USA, it is less than 1%.

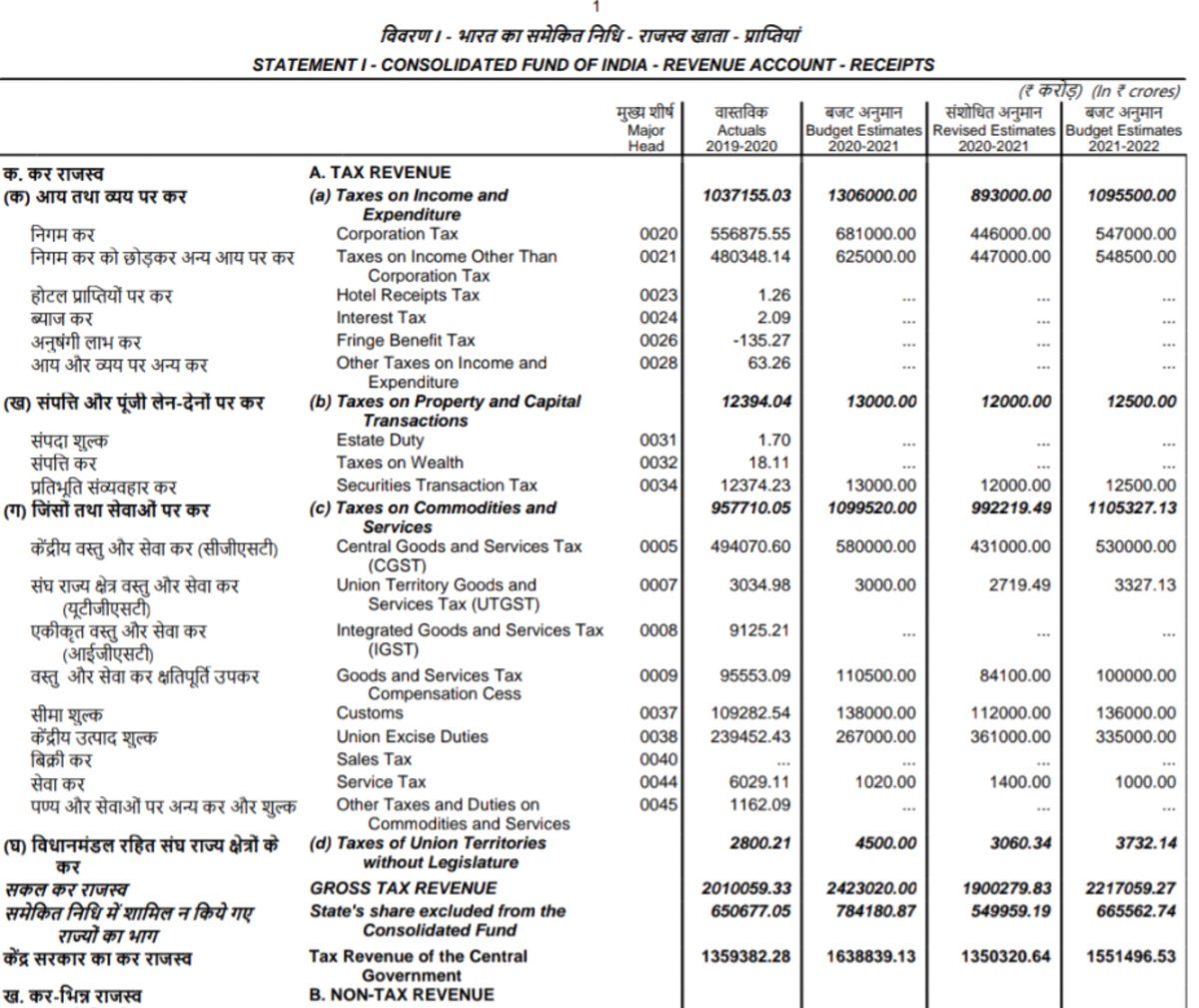

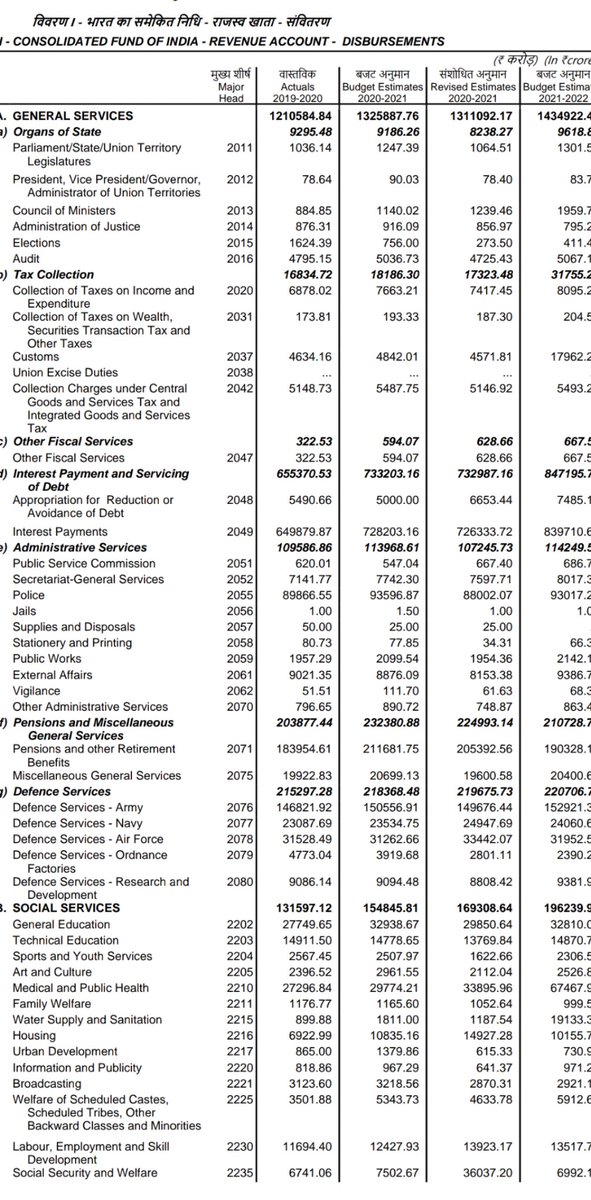

5. In FY 22, India's total Income and corporate taxes are projected at 10.95 Lac crore and GST at 11.05 lac crore. After paying the states' share of GST, the GOI tax revenues would be 15.51 lac crores. However, India's interest cost on debt is 8.47 lac crores.

6. Look at Major head 2048 in the attached sheet. Our interest cost is 55% of all tax revenues of GoI. With a burgeoning debt, this is a classic trap where we take loans even to repay interest. With such ratios, if we were a chit fund, this would be called a Ponzi scheme!

7. REPO rate is the interest rate at which the RBI lends money to commercial banks. It typically sets the interest rates on our FDs. The Repo rate in India was 8% in Jan 2014. It is today at 4%.

8. In 2014, the average interest rate on One Year FD of SBI was 9%. Today, it is 5%, a 45% fall. In 2014, with inflation at 4.9% and taxation at 30%, inflation adjusted return was 1.1%. In 2021, at SBI rate of 5%, inflation at 6 % and taxation at 30%, return is negative 2.35%

9. Today, Every citizen with a Million in deposit, would be losing 23,500 each year which in 2014 was an earning of 11000 (Post tax and inflation adjusted). Indian banks have 150 Trillion in deposits and we are losing 3.7 Trillion each year.

10. As people, we have falling interest incomes, rising inflation and rising unemployment. As GoI, we are resorting to debt, reducing interest rates to control deficits and pushed to rising debt servicing.

This is data. These are facts. Interpret it data your way. Maybe, experts @kaushikcbasu @ptrmadurai @arvindsubraman @PChidambaram_IN have a better take. But do take note and safeguard for a dramatic falling interest rate regime if we have NDA back in 2024!

• • •

Missing some Tweet in this thread? You can try to

force a refresh