In the fast paced crypto market where hundreds of tokens are launched every day, it can be hard to single out which ones present the best investment opportunities..

For this reason, I’ve compiled a list of the top 20 blue chips I believe are best suited for success in the future

For this reason, I’ve compiled a list of the top 20 blue chips I believe are best suited for success in the future

1. Bitcoin

#Bitcoin has proven itself as one of the best investments for risk averse investors looking to get started in crypto.

Its outperformed every asset class in existence, has developed powerful network effects, & is growing even faster than the internet’s adoption rate

#Bitcoin has proven itself as one of the best investments for risk averse investors looking to get started in crypto.

Its outperformed every asset class in existence, has developed powerful network effects, & is growing even faster than the internet’s adoption rate

2. Ethereum

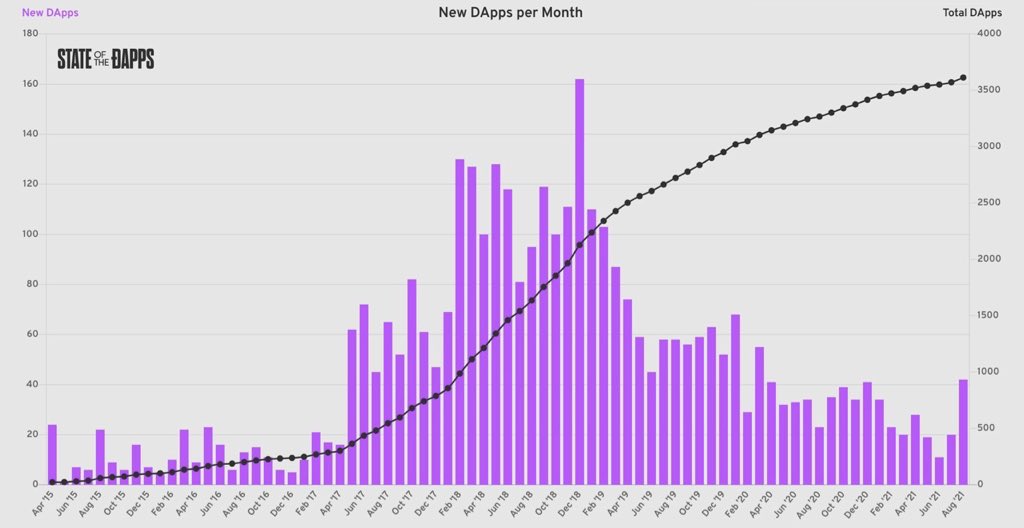

#Ethereum is one of the best growth assets to invest in, & it has the numbers to prove it.

By far, #Ethereum leads in protocol devs, # of active dApps, protocol revenue, & is expected to undergo a major upgrade known as “ETH 2.0” within the next couple years

#Ethereum is one of the best growth assets to invest in, & it has the numbers to prove it.

By far, #Ethereum leads in protocol devs, # of active dApps, protocol revenue, & is expected to undergo a major upgrade known as “ETH 2.0” within the next couple years

3. Monero

$XMR is a privacy focused currency designed to enhance address privacy weaknesses in #Bitcoin.

When you send funds to someone using Monero, you are not able to view the recipients holdings. Instead, they are routed to a random address used only for that tx.

$XMR is a privacy focused currency designed to enhance address privacy weaknesses in #Bitcoin.

When you send funds to someone using Monero, you are not able to view the recipients holdings. Instead, they are routed to a random address used only for that tx.

4. FTT

Don’t bet against SBF.

$FTT is the native token of the crypto exchange FTX, which has quickly risen to one of the top exchanges within a few years.

$FTT offers discounts for fees on the exchange, & receives monthly buybacks & burns based on based on platform revenue

Don’t bet against SBF.

$FTT is the native token of the crypto exchange FTX, which has quickly risen to one of the top exchanges within a few years.

$FTT offers discounts for fees on the exchange, & receives monthly buybacks & burns based on based on platform revenue

5. Maker

$MKR has established itself as the largest decentralized lending protocols on $ETH.

It allows users to stake $ETH, & take out a loan in the platforms stablecoin, $DAI, without the need of other intermediaries.

The global lending market today is worth $6932.29 Billion

$MKR has established itself as the largest decentralized lending protocols on $ETH.

It allows users to stake $ETH, & take out a loan in the platforms stablecoin, $DAI, without the need of other intermediaries.

The global lending market today is worth $6932.29 Billion

6. Sushi

What first started up as a DEX in DeFi summer, is now a massive liquidity engine powering a multi chain AMM, isolated lending markets, a token launchpad, & even an NFT marketplace.

The protocol has amassed billions in TVL, & distributes millions in revenue to its users

What first started up as a DEX in DeFi summer, is now a massive liquidity engine powering a multi chain AMM, isolated lending markets, a token launchpad, & even an NFT marketplace.

The protocol has amassed billions in TVL, & distributes millions in revenue to its users

7. Aave

$Aave can be looked at as the decentralized bank for #Ethereum.

Through a slick & easy to use UI, $Aave allows anyone to lend or borrow their crypto assets in the same way a bank does without the need of a centralized third party.

$Aave can be looked at as the decentralized bank for #Ethereum.

Through a slick & easy to use UI, $Aave allows anyone to lend or borrow their crypto assets in the same way a bank does without the need of a centralized third party.

8. Chiliz

$CHZ is the official currency used in the Socios platform, which aims to give millions of esports fan direct voting power in their favorite soccer clubs.

The platform is partnered with many notable pro soccer teams & have even announced a partnership with the UFC.

$CHZ is the official currency used in the Socios platform, which aims to give millions of esports fan direct voting power in their favorite soccer clubs.

The platform is partnered with many notable pro soccer teams & have even announced a partnership with the UFC.

9. REN

REN allows for anyone to transfer cryptocurrencies across different blockchains.

Users can lock $BTC, $BCH, $ZEC, $DOGE, & more in REN software & mint the erc20 equivalent tokens $RenBTC, $RenBCH, etc 1:1 which can then be put to use in a variety of DeFi products

REN allows for anyone to transfer cryptocurrencies across different blockchains.

Users can lock $BTC, $BCH, $ZEC, $DOGE, & more in REN software & mint the erc20 equivalent tokens $RenBTC, $RenBCH, etc 1:1 which can then be put to use in a variety of DeFi products

10. Ocean Protocol

$OCEAN is a decentralized data exchange protocol that aims to unlock data from its silos.

Rather than having it only available to corporations like Google or Facebook, Ocean makes data available for the common individual.

$OCEAN is a decentralized data exchange protocol that aims to unlock data from its silos.

Rather than having it only available to corporations like Google or Facebook, Ocean makes data available for the common individual.

11. Axie Infinity

One of the first movers in the gaming sector on #Ethereum, $AXS has received massive attention for its unique play to earn model.

Players can earn $AXS tokens for battling, breeding, & raising Axie’s within the Pokémon inspired Axie universe.

One of the first movers in the gaming sector on #Ethereum, $AXS has received massive attention for its unique play to earn model.

Players can earn $AXS tokens for battling, breeding, & raising Axie’s within the Pokémon inspired Axie universe.

12. ZKsync

ZKsync is a trustless scaling & privacy solution for $ETH developed by Matter Labs.

Utilizing ZK-Rollup technology, ZKsync is designed to bring low cost, visa level throughput to #Ethereum while maintaining privacy & security of users funds.

ZKsync is a trustless scaling & privacy solution for $ETH developed by Matter Labs.

Utilizing ZK-Rollup technology, ZKsync is designed to bring low cost, visa level throughput to #Ethereum while maintaining privacy & security of users funds.

13. Convex Finance

Convex is a platform designed to boost $CRV rewards for both stakers & LP’s without the need of locking $CRV tokens.

Liquidity providers can deposit their $CRV LP tokens into convex to earn $CRV trading fees, boosted $CRV & $CVX tokens

Convex is a platform designed to boost $CRV rewards for both stakers & LP’s without the need of locking $CRV tokens.

Liquidity providers can deposit their $CRV LP tokens into convex to earn $CRV trading fees, boosted $CRV & $CVX tokens

14. Keep3r

KP3R is a solution for automating contracts on $ETH.

The majority of functions in smart contracts require manual triggering, multiple times a day, which is infeasible & extremely costly.

KP3R creates an incentivized marketplace for these jobs to be executed

KP3R is a solution for automating contracts on $ETH.

The majority of functions in smart contracts require manual triggering, multiple times a day, which is infeasible & extremely costly.

KP3R creates an incentivized marketplace for these jobs to be executed

15. Chainlink

$LINK is an oracle network that will play a critical role in the implementation of blockchain in the real world.

Using $LINK, any smart contract can obtain access to real world data, whether it be weather or prices of other currencies in a reliable manner.

$LINK is an oracle network that will play a critical role in the implementation of blockchain in the real world.

Using $LINK, any smart contract can obtain access to real world data, whether it be weather or prices of other currencies in a reliable manner.

16. Truebit

Truebit is a layer 2 scaling solution for #Ethereum created by $ETH devs.

Initially spawned out of the #Dogethereum initiative, Truebit allows anyone to off load computation that exceeds the gas limit on $ETH for computation on Truebit.

Truebit is a layer 2 scaling solution for #Ethereum created by $ETH devs.

Initially spawned out of the #Dogethereum initiative, Truebit allows anyone to off load computation that exceeds the gas limit on $ETH for computation on Truebit.

17. Synthetix

$SNX is an $ETH based solution for the issuance of synthetic assets.

Using their software, users are able to trade “Synths”, which range from different cryptocurrencies, indexes, inverse tokens, & real world assets in the form of ERC20 tokens.

$SNX is an $ETH based solution for the issuance of synthetic assets.

Using their software, users are able to trade “Synths”, which range from different cryptocurrencies, indexes, inverse tokens, & real world assets in the form of ERC20 tokens.

18. Tornado Cash

Tornado Cash is an #Ethereum privacy solution based on zkSNARKs.

The protocol acts as a complete token mixer, which accepts $ETH as deposits and then withdraws it to different addresses & breaks the on chain link between them in the process.

Tornado Cash is an #Ethereum privacy solution based on zkSNARKs.

The protocol acts as a complete token mixer, which accepts $ETH as deposits and then withdraws it to different addresses & breaks the on chain link between them in the process.

19. Kleros

$PNK is a dispute resolution platform that leverages the blockchain & crowdsourcing for solving disputes in areas such as e-commerce, collaborative economy & more

Disputes are sent to a panel of randomly selected jurors, where decentralized arbitration can take place

$PNK is a dispute resolution platform that leverages the blockchain & crowdsourcing for solving disputes in areas such as e-commerce, collaborative economy & more

Disputes are sent to a panel of randomly selected jurors, where decentralized arbitration can take place

20. Immutable X

Immutable X is the worlds first layer 2 solution for NFT’s.

Immutable is built in collaboration with StarkWare, and utilizes ZK-Rollups to provide instant trade confirmation, zero gas fees for P2P trading, & an incredible 9,000 TPS on the platform

Immutable X is the worlds first layer 2 solution for NFT’s.

Immutable is built in collaboration with StarkWare, and utilizes ZK-Rollups to provide instant trade confirmation, zero gas fees for P2P trading, & an incredible 9,000 TPS on the platform

• • •

Missing some Tweet in this thread? You can try to

force a refresh