this man's tweets have preceded a price drop 8 out of 8 times perfectly

that's better hit rate than Mia Khalifa, Meek Mill & Soulja Boy

that's better hit rate than Mia Khalifa, Meek Mill & Soulja Boy

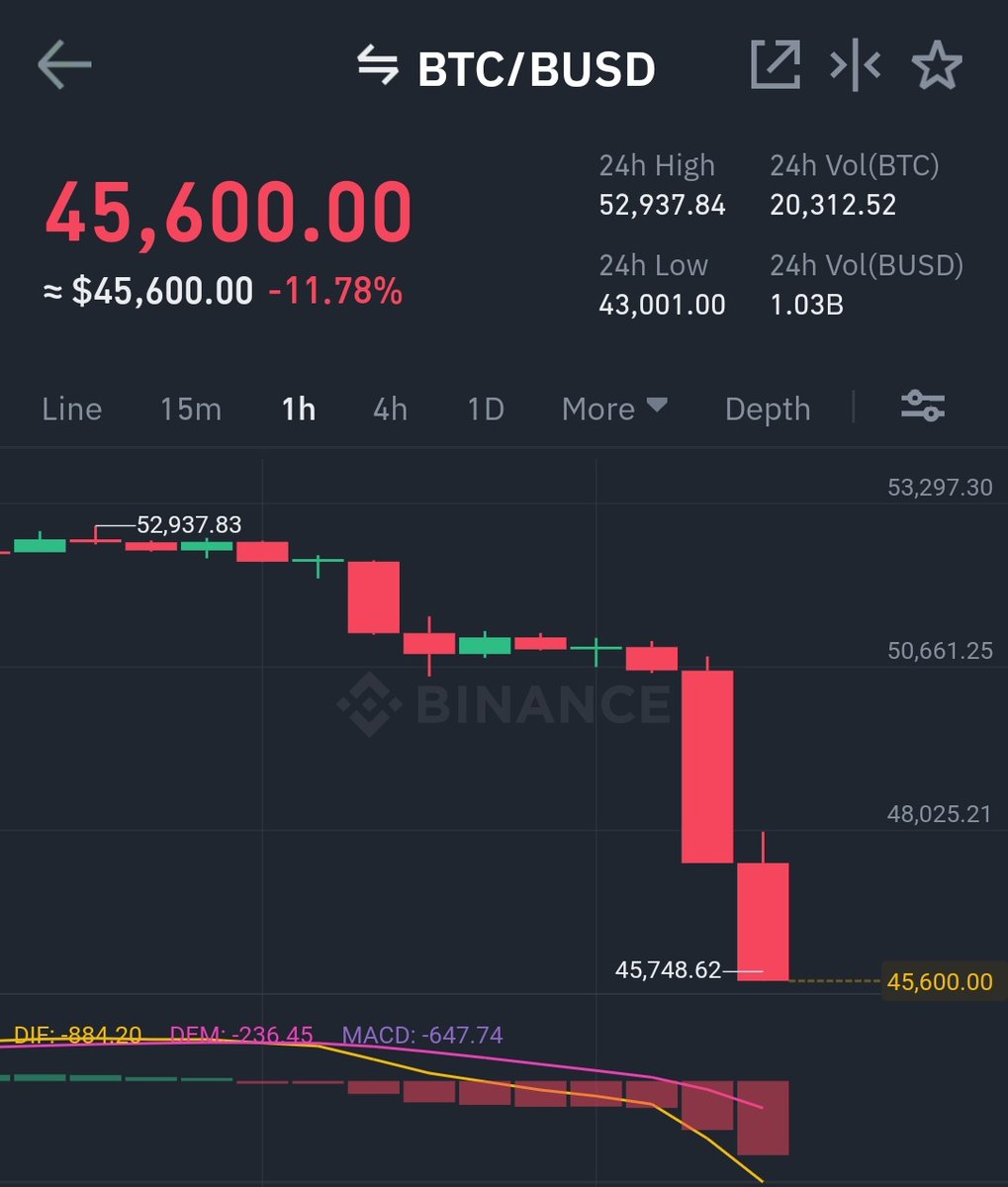

just look at this volatility...

now if you're holding a heavily leveraged position out here you're getting rinsed 💦💦💦

won't even hit a margin warning, straight clean out

won't even hit a margin warning, straight clean out

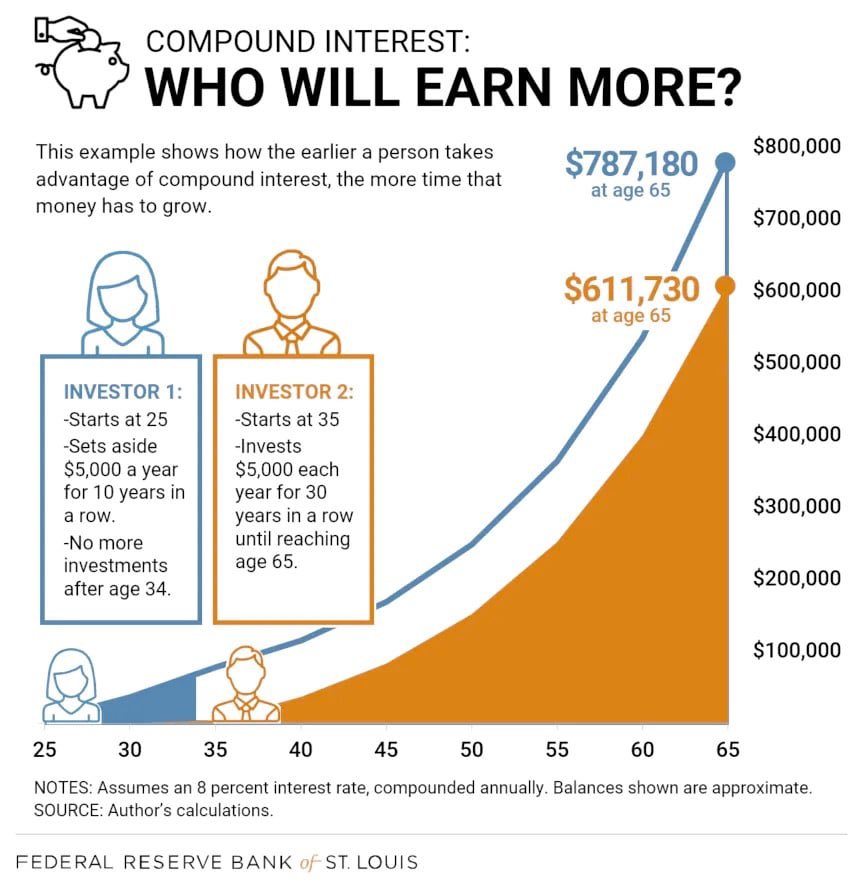

@djsbu can tell your intentions come from a good place. These streets desperately need more educational content on crypto ++ major help getting their hustles on lock

If you ever want to jump on a Space to tag team & talk crypto hmu. We have the same end goal 💪🏽💪🏽

If you ever want to jump on a Space to tag team & talk crypto hmu. We have the same end goal 💪🏽💪🏽

• • •

Missing some Tweet in this thread? You can try to

force a refresh