At first glance, there's some fundamental flaws in this “study” from the @USChamber today (featured in @Morning_Tax)

It takes many leaps of logic to think ending the carried interest #tax loophole will lose the US ~5 million(!) jobs. The Chamber needs to try again 🧵

It takes many leaps of logic to think ending the carried interest #tax loophole will lose the US ~5 million(!) jobs. The Chamber needs to try again 🧵

https://twitter.com/USChamberCCMC/status/1435313004225105925

What’s going on?

Biden proposes closing a loophole letting Private Equity and Venture Capital managers pay 20% cap gains rate instead of the regular 39.6%

The Chamber says this costs as many jobs as in the state of Georgia and billions of tax $.

The argument is quite shaky

Biden proposes closing a loophole letting Private Equity and Venture Capital managers pay 20% cap gains rate instead of the regular 39.6%

The Chamber says this costs as many jobs as in the state of Georgia and billions of tax $.

The argument is quite shaky

Flaw 1: The Chamber’s own appendix

The Chamber says:Upping PE&VC managers’ taxes hurts firms activity, but offers no evidence.

Q:what happened when their taxes rose⬆️33% (5pp) in 2012?

A:PE deals increased, the opposite of what this “study” claims!

Why's this time different?

The Chamber says:Upping PE&VC managers’ taxes hurts firms activity, but offers no evidence.

Q:what happened when their taxes rose⬆️33% (5pp) in 2012?

A:PE deals increased, the opposite of what this “study” claims!

Why's this time different?

Flaw 2: The literature on raising tax rates

The Chamber assumes that for every 1% increase in taxes, managers decrease their income by .57

They take that number from this Saez&Slemrod paper: eml.berkeley.edu/~saez/saez-sle…

But that particular finding is not applicable here

The Chamber assumes that for every 1% increase in taxes, managers decrease their income by .57

They take that number from this Saez&Slemrod paper: eml.berkeley.edu/~saez/saez-sle…

But that particular finding is not applicable here

Saez&Slemrod say that .57 elasticity refers to raising the top rate (now 37%). Its high because raising rates causes rich people to use avoidance and loopholes (like carried interest)

Elasticities are not constant like this, closing loopholes lowers elasticity at the top

Elasticities are not constant like this, closing loopholes lowers elasticity at the top

Flaw 3: Taxable Income =/=real income

The Chamber says if PE managers report less tax income-> then real economic activity is going down. Saez&Slemrod disagree

Again, they cited this study, but even if they hadn’t, this is pretty basic stuff that any economist would tell you

The Chamber says if PE managers report less tax income-> then real economic activity is going down. Saez&Slemrod disagree

Again, they cited this study, but even if they hadn’t, this is pretty basic stuff that any economist would tell you

Flaw 4: this chain of logic

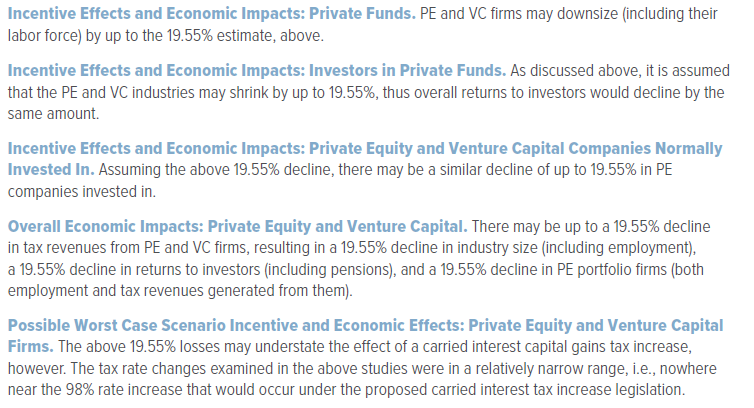

Increased tax on managers -> 20% decreased PE/VC investment-> AND -20% activity for all firms they invest in

PE and VC firms employ very few people, but if you count everyone they touch tangentially, that adds up! But, there’s no evidence for this

Increased tax on managers -> 20% decreased PE/VC investment-> AND -20% activity for all firms they invest in

PE and VC firms employ very few people, but if you count everyone they touch tangentially, that adds up! But, there’s no evidence for this

As @USChamber usually says, firms profit-maximize. Why would PE/VC activity disintegrate when their managers get a smaller post-tax profit? They’ll stop making profitable deals?

What about general equilibrium FX? Won’t other firms step in to fill the gap?

Nothing here on that

What about general equilibrium FX? Won’t other firms step in to fill the gap?

Nothing here on that

@USChamber Flaw 5: Their model

If instead we lower PE/VC taxes to 10%, the CoC model says jobs ⬆️to 27.5M

Then, if we re-raise taxes to 20%, jobs go to 27.5-(-19.5%)=22.1M: Less than we started with but same rate as before! Two different long-run steady-states at a 20% rate.

Neat.

If instead we lower PE/VC taxes to 10%, the CoC model says jobs ⬆️to 27.5M

Then, if we re-raise taxes to 20%, jobs go to 27.5-(-19.5%)=22.1M: Less than we started with but same rate as before! Two different long-run steady-states at a 20% rate.

Neat.

@USChamber In sum, the Biden Admin is doing what economists say to do: raising rates while closing loopholes and upping enforcement

This slapdash @USChamber “study” ignores simple econ concepts to pretend closing a millionaire loophole hurts real people. Their sloppiness shows you it wont

This slapdash @USChamber “study” ignores simple econ concepts to pretend closing a millionaire loophole hurts real people. Their sloppiness shows you it wont

Coda: See here for a technical dissection of the problem with how they use elasticities (including what the latest in the literature says) from @vicfleischer

https://twitter.com/vicfleischer/status/1435338729418153988

• • •

Missing some Tweet in this thread? You can try to

force a refresh