❓ Are you a recent graduate?

Then you'll lose more of your salary to taxes than working pensioners who earn twice as much, thanks to Boris Johnson's National Insurance levies.

Here's a #thread of what you need to know 👇 telegraph.co.uk/tax/income-tax…

Then you'll lose more of your salary to taxes than working pensioners who earn twice as much, thanks to Boris Johnson's National Insurance levies.

Here's a #thread of what you need to know 👇 telegraph.co.uk/tax/income-tax…

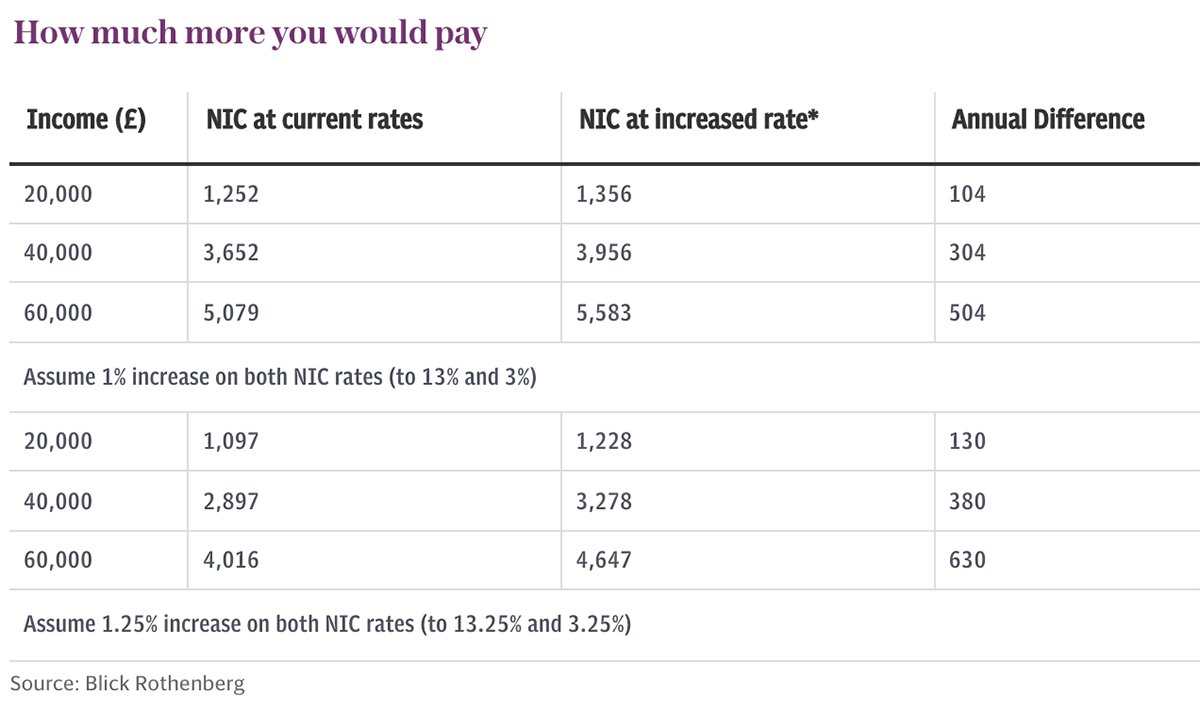

🏥 First, some background: Boris Johnson has announced a 1.25 percentage point National Insurance (NI) hike to fund landmark reforms of England's adult social care system and a backlog of NHS appointments telegraph.co.uk/tax/income-tax…

👩🎓 It means a graduate earning £30,000 a year will give up 21.5% of their earnings to income tax, NI and student loan repayments – an effective "indirect" levy once the 1.25 percentage point increase to NI rates comes into effect in April…

💷 But someone aged 66+ on a salary of £60,000 will part with just 20.1% under the new system 👇

📈 Critics argue the tax rise is contributing to a growing generational divide – especially between baby boomers (who have benefitted from rising property prices) and millennials, who face being the first generation to be worse off than their parents telegraph.co.uk/tax/income-tax…

💬 Neil Lovatt of @scotfriendly said the Government was "squeezing younger families to subsidise retired millionaires, older homeowners and asset-rich pensioners"…

❓ How will the National Insurance rise affect you?

Enter your salary into our National Insurance tax calculator to see your increase in NIC 👇 telegraph.co.uk/tax/income-tax…

Enter your salary into our National Insurance tax calculator to see your increase in NIC 👇 telegraph.co.uk/tax/income-tax…

❓ What else do you need to know?

Read more about how grads will lose more in tax than pensioners on double their income (it's currently free) 👉

telegraph.co.uk/tax/income-tax…

See the whole story on Snapchat 👉 story.snapchat.com/p/e6cd9c10-eb7…

Read more about how grads will lose more in tax than pensioners on double their income (it's currently free) 👉

telegraph.co.uk/tax/income-tax…

See the whole story on Snapchat 👉 story.snapchat.com/p/e6cd9c10-eb7…

• • •

Missing some Tweet in this thread? You can try to

force a refresh