What lies ahead for the secular rotation between growth and value, large and small? Hard to say. We are at the point in the super-cycle where, on a 10-year rate of change basis, the incumbent style leaders tend to peak. (THREAD)

But that’s on a 10-year rate of change basis. So, the large growers could keep running while the second derivative moderates, in line with the historical analog. The same thing happened from the October 1998 low (LTCM) to the dot.com peak in 2000. /2

I guess it all comes down to cash flows and who produces it, as well as how much of it is returned to shareholders via dividends and buybacks. /3

The chart below shows that the percentage of sales that has been returned to shareholders has been quite stable during this New Nifty 50 era. /4

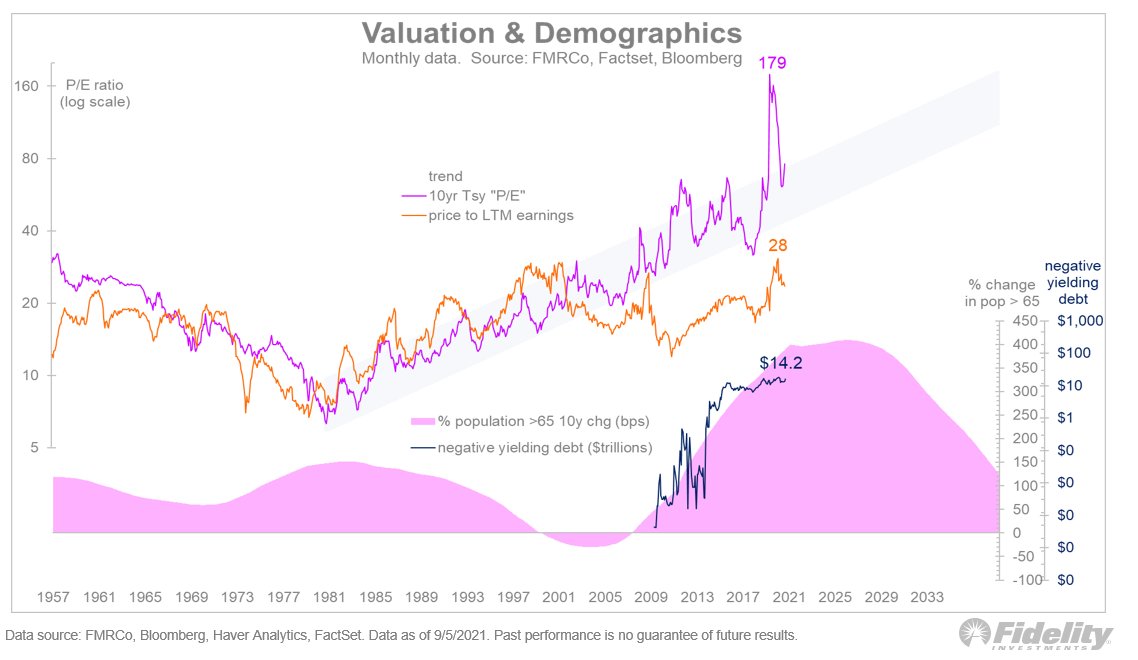

My thesis is that the combination of (a) aging boomers searching for yield, (b) ultra-low nominal yields & negative real yields, and (c) the ability of the big growers to generate excess cash flows (and return it to shareholders), has created the current regime. /5

The chart below illustrates the point. Judging by current demographic trends, monetary policy, and the share buyback machine of the big growers, it doesn’t look like this is going to end any time soon. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh