One of the questions I often get in response to my modelling threads (such as last Thursday’s below) is: what does this imply for levels of hospital occupancy with covid? Unfortunately I don’t have a good model of hospital stay dynamics, but helpfully...

https://twitter.com/JamesWard73/status/1436043734181896202?s=20

…I know a man who does, and @nicfreeman1209 very generously offered to convert my various scenarios for weekly admissions into a corresponding occupancy forecast. So what follows is very much a collaboration on the analysis, but the policy commentary is all mine.

Essentially, Nic’s model uses the known data for hospital admissions and occupancy to estimate a distribution of how long people stay in hospital with covid – here’s some discussion on an earlier version:

https://twitter.com/nicfreeman1209/status/1406506033414033408?s=20

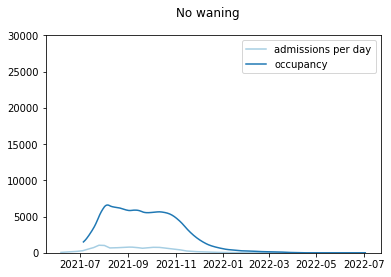

And if we take that distribution and apply it to my admissions curve with no waning, we get something like this. Note the occupancy stays around its current level (a bit over 6k covid patients in England) and then falls away during November. That would be a good outcome.

As we know, putting some immunity waning into the model makes things worse. Let’s start with a relatively slow waning assumption – this still sees a fall away in late autumn, but with a resurgence to around double the current covid occupancy in early 2022.

With a moderate (i.e. slightly faster) level of waning, we get less of a fall, and more of a peak – reaching around 20k covid patients at worst. That’s higher than the level in April 2020, although still some way short of the peak we saw (c. 34k) in January 2021.

With even faster waning, we don’t get a higher peak, but more of a double-peak – with local maxima in late autumn, and then again in early 2022. So this might increase the risk of operational burnout, even if capacity is not stretched any further than in the other scenarios.

But that’s the bad news. What about the good news i.e. booster vaccinations? And yes, those do help. As we saw in my thread, boosters for the most vulnerable groups (JCVI 1-4) do reduce the total admissions, but perhaps with a slightly higher peak in admissions and occupancy:

And by continuing to boost other adults (JCVI 5-9, and 18-50s) at a slower pace, we can reduce the total admissions further, and bring the peak occupancy back down to under 15k patients. (as noted elsewhere, I'm not addressing the ethical questions on the merits of doing this)

So I guess the positive story here, such as it is, is that even in my more pessimistic scenarios, hospital occupancy of covid patients doesn’t approach the levels we saw back in January – although it could get close to or maybe even exceed the April 2020 peak.

And we need to remember that covid is not the only factor: in this coming winter we may face added pressures from flu and other respiratory diseases which were mostly absent in the winter of 2020/21, and we also have a much bigger backlog of less-urgent care to handle.

So I’m not presenting these figures with a feeling of “don’t worry it’ll all be fine”. But more a sense of “depending on what happens with waning and boosters, this could still be very challenging, even if the raw numbers don’t look as bad as they did in January”.

And, as I’ve noted before, that’s not an argument for an autumn lockdown or anything like it. But more a request for continued caution, awareness, and sensible contingency planning. It will be interesting to hear what Boris has to say on that front this week. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh