1/ What is "return stacking" and how is it different than stretching for returns?

(From our paper investresolve.com/return-stackin…)

A quick 🧵... (I know, I know...)

(From our paper investresolve.com/return-stackin…)

A quick 🧵... (I know, I know...)

2/ The expectation of low real returns going forward puts a significant burden on long-term investors striving to meet future needs.

e.g. Endowments who are making annual withdrawals, pensions that have future liabilities, and individuals who are saving for retirement.

e.g. Endowments who are making annual withdrawals, pensions that have future liabilities, and individuals who are saving for retirement.

3/ A phenomenon that we've witnessed over the last decade is investors moving up the risk curve by either (1) increasing equity exposure, (2) increasing credit risk (lower quality bonds), or (3) increasing liquidity risk (e.g. real estate, private equity or private credit).

4/ This is probably one of my favorite graphics related to the secular trend.

A portfolio with an expected nominal return of 7.5% was achievable with a 100% fixed income exposure in 1995.

In 2015, it had to be 90% risk assets, many of which are far less liquid.

A portfolio with an expected nominal return of 7.5% was achievable with a 100% fixed income exposure in 1995.

In 2015, it had to be 90% risk assets, many of which are far less liquid.

5/ Many investors have sought to incorporate diversifying alternatives, but their tracking error to traditional markets – particularly when traditionally allocated portfolios have realized such high Sharpe ratios – can make them difficult to stick with.

6/ The core idea behind "return stacking" is to use leverage to free up capital, without sacrificing traditional beta exposure, which can then be allocated to alternatives.

In doing so, we hope to achieve a more robust portfolio.

In doing so, we hope to achieve a more robust portfolio.

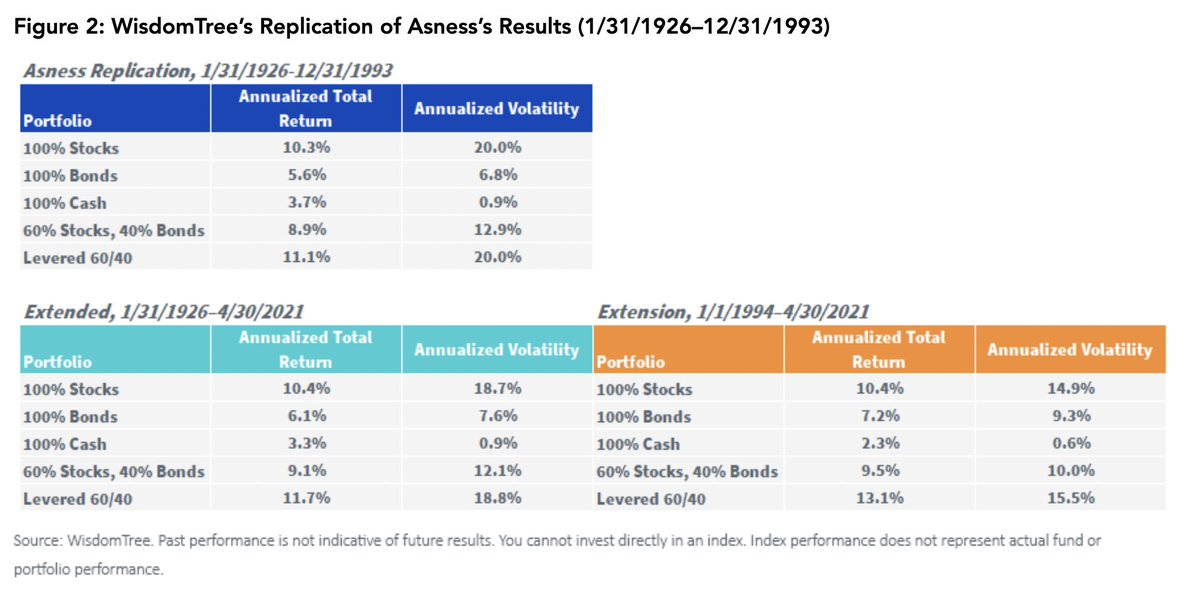

7/ In 1996, @CliffordAsness wrote "Why Not 100% Equities," (aqr.com/Insights/Resea…) pointing out that a 60/40, when levered to match the volatility of equities, had a superior return.

WisdomTree replicated and extended these results out-of-sample (wisdomtree.com/blog/2021-05-2…)

WisdomTree replicated and extended these results out-of-sample (wisdomtree.com/blog/2021-05-2…)

8/ Now this is the fun part (at least in my opinion).

If we were a 100% equity investor, we could just allocate 100% of our portfolio to the WisdomTree U.S. Efficient Core ETF ($NTSX), which provides 1.5x exposure to a 60/40 portfolio.

or...

If we were a 100% equity investor, we could just allocate 100% of our portfolio to the WisdomTree U.S. Efficient Core ETF ($NTSX), which provides 1.5x exposure to a 60/40 portfolio.

or...

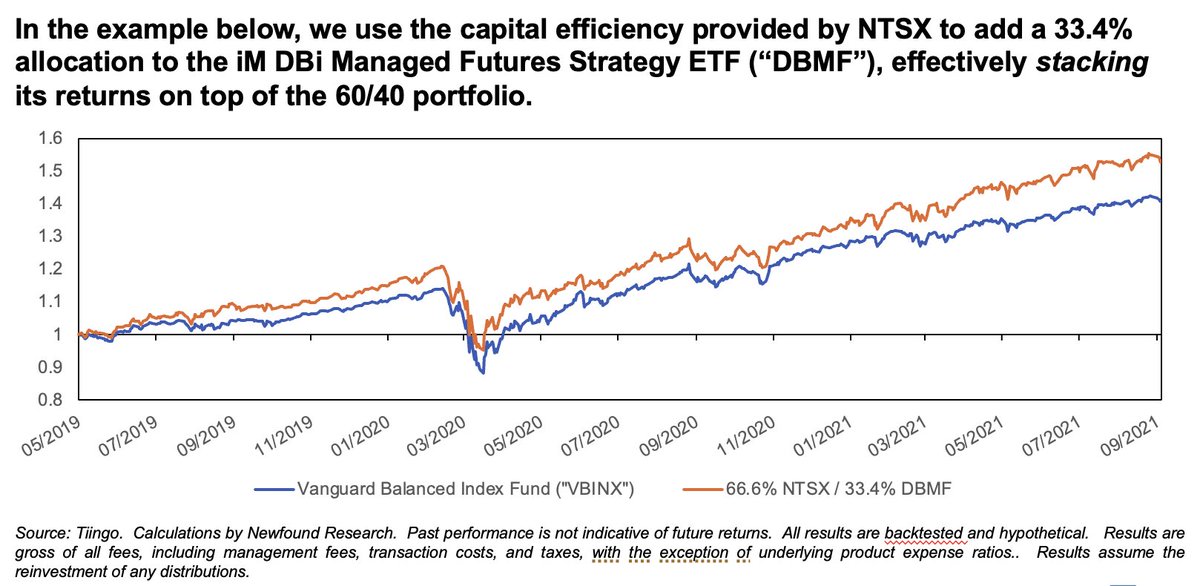

9/ We can allocate 2/3 of our portfolio, get the equivalent exposure to a 60/40 (1.5 x 2/3 = 1), and then allocate the remaining 1/3 of the portfolio to something else.

10/ If we look at the portfolio holistically, we could argue we're using the capital efficiency in $NTSX to "stack" a second source of returns on top of a 60/40 portfolio.

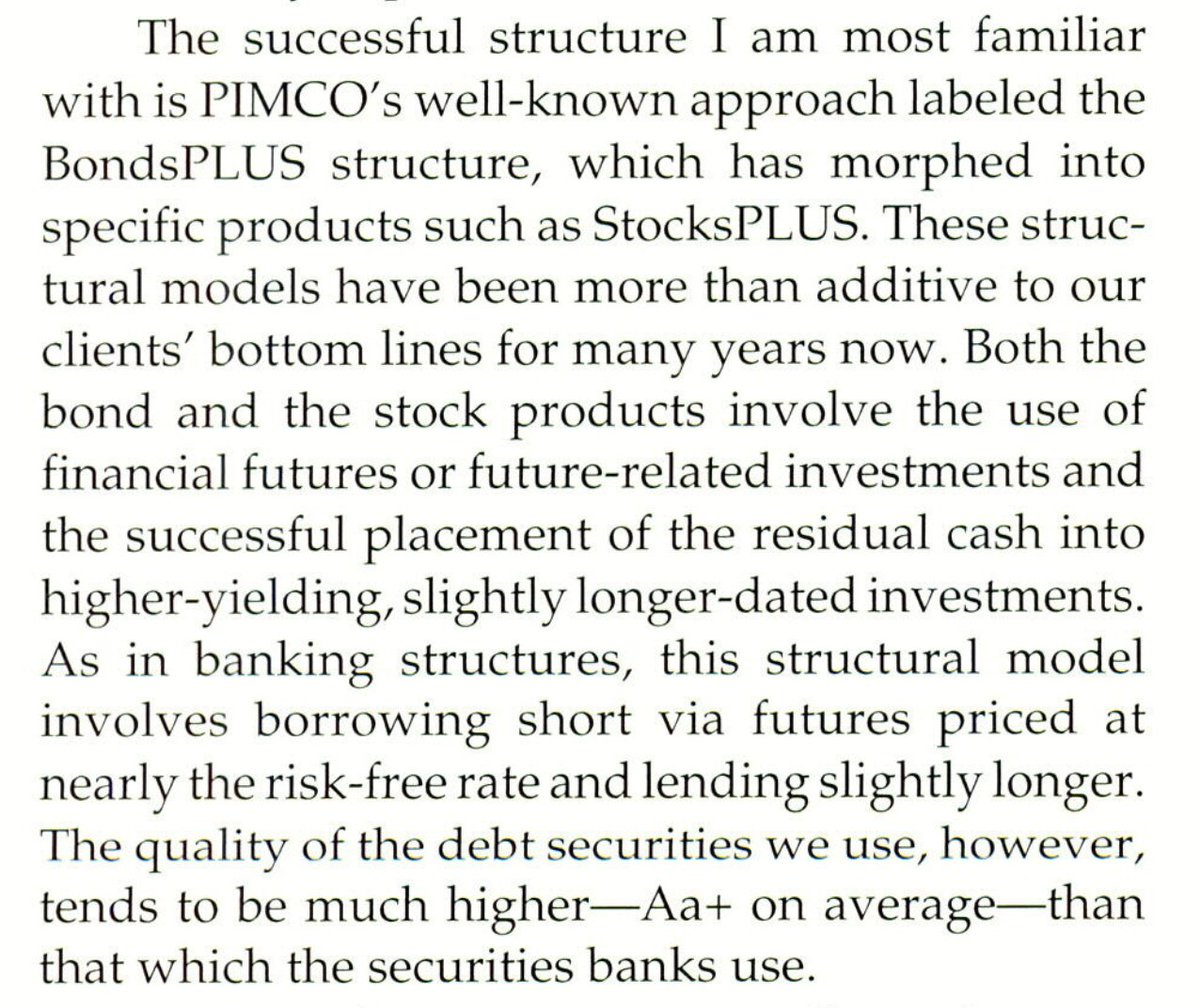

11/ In 2005, Bill Gross published "Consistent Alpha Generation through Structure" (jstor.org/stable/4480698).

He explained that a core part of the alpha they generated at PIMCO was "structural alpha."

How does it work?

He explained that a core part of the alpha they generated at PIMCO was "structural alpha."

How does it work?

12/ We use the attractive financing rate embedded in derivatives to free up capital that we can invest in slightly higher risk (credit and duration) bonds.

13/ While PIMCO used this approach to generate "structural alpha," our paper (investresolve.com/return-stackin…) suggests that it can be used to not only seek higher returns, but do so in a more resilient and palatable structure.

14/ By using capital efficient funds, we can achieve our target traditional asset allocation and free up capital to be invested in either economically diversifying asset classes or uncorrelated strategies.

e.g. 66.6% $NTSX + 33.4% $DBMF (managed futures)

e.g. 66.6% $NTSX + 33.4% $DBMF (managed futures)

16/ "Doesn't leverage invite catastrophe?"

It can if not used prudently. That's why we emphasize the need to focus on adding diversifying exposures.

It can if not used prudently. That's why we emphasize the need to focus on adding diversifying exposures.

17/ Even still, crises can lead to acute deleveraging cycles and cause correlations to crash to 1.

This is where investors might consider incorporating tail hedges into their portfolio.

(Institutions can likely structure highly convex trades to hedge the correlation risk.)

This is where investors might consider incorporating tail hedges into their portfolio.

(Institutions can likely structure highly convex trades to hedge the correlation risk.)

18/ At the end of the day, I still believe that "risk cannot be destroyed, only transformed."

With return stacking, we're trying to avoid increasing equity/credit/liquidity risk and instead taking on leverage risk.

With return stacking, we're trying to avoid increasing equity/credit/liquidity risk and instead taking on leverage risk.

19/ But we believe that leverage, when prudently applied, can lead to much more resilient and robust portfolios.

• • •

Missing some Tweet in this thread? You can try to

force a refresh