🚨🚨 China Credit - Writing on the Wall - and How to Trade It. (9/15/21)👇👇

2. In June, I described contagion in the Chinese credit as a tail risk - not necessarily a probability, a significant risk that was being underpriced. But now the fuse has been lit and no one is stamping it out. The collapse of the property sector is now a probability.

3. (If you're newer to the saga, I'd encourage you to read this master thread below thread in sequence as it provides necessary pretext. If you're up to date, then jump right in.)

https://twitter.com/TheLastBearSta1/status/1435231303633448963

4. The mainstream focus is on #Evergrande because it is the biggest domino to fall and seen as a litmus test for state response. Now that we have the playbook (rapid deterioration, no white knights, no state intervention) we need to think forward not backwards. But first....

5. Consider this question seriously: How is it that Evergrande is insolvent? It has never reported a loss. Even in 1H21, it showed profit of RMB14.5bn. It has current assets in excess of its current liabilities in every period.

6. This dumb question is actually illuminating. You will never make a loss if you never acknowledge the expense of malinvestment - i.e. if you never write anything off. If you don't expense your losses, they show up as assets on your B/S. Where? Inventory.

7. EG has RMB1.4 Trillion (US$221bn) as current inventory on its balance sheet as of 6/30/21 and yet has acknowledged it has been unsuccessful at monetizing *ANY* assets including its own HQ - how embarrassing. Anything of value has already been sold or pledged away.

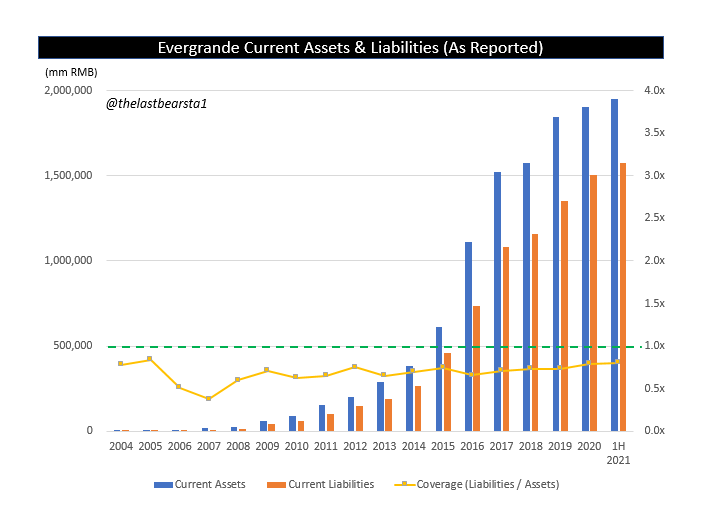

8. Below is EG's current assets vs. current liabilities, as reported. The yellow line shows current liability coverage - if it is below 1.0x (green line) then there shouldn't be liquidity issues. Above the company needs to fund the shortfall and there could be liquidity issues.

9. Now, I've repeated the chart and scaling, but removing inventory from current assets. Earlier in its growth and China's urbanization, the company was growing and the shortfall could be filled with expanding credit. Since 2016, growth has flatlined as liabilities pile up.

10. Inventory includes land bank, work in progress construction and completed inventory. While we can quibble about how much of this is "legitimate", In EG's case, the value of their inventory has proved to be zero. Recent reporting says land sale value is down 96% YoY in Sep

11. This is how a company that has never reported a loss can go insolvent - hiding $220bn of losses as current assets. Ok - got it. But Evergrande is truly unique right? That's what the Global Times tells us:

globaltimes.cn/page/202109/12…

globaltimes.cn/page/202109/12…

12. Here are the same two charts for another major property developer. As reported, its current assets have always exceeded its liabilities - but ex. inventory, its asset growth has stalled since 2016 while its liabilities explode. *pre-2010 coverage data is less relevant*

13. This is company is Sunac (1918.HK). Sunac's equity and debt trading are below. Current yield on its 2025 USD bonds is just under 9%, based on a 94c price. By comparison, Evergrande's 2025 bonds trade at 25c. Since last week's warning, Sunac stock is down 18%.

15. This is Country Garden (2007.HK). Country Garden is the size of Evergrande. Currently its 2025 USD bonds are trading at 108, or a 4.0% YTM based on bid prices as of Tuesday. https://t.co/8z0mwuMME2 is down 16% over the past two trading sessions.

16. But surely this "Assets less Inventory" metric is a swag right? Below is "Liabilities / Assets" and "Inventory as a % of Current Assets" of several large developers (dotted lines are companies in default or stress). Stressed companies are worse - but just barely.

17. Evergrande is not unique, rather it is typical - and that is a much scarier thought. It will only become harder to remaining developers to survive as the RE market, land values go to zero, and funding evaporates.

18. The Market's first mistake was counting on government support for EG and underestimating the state of its finances. The mistake the Market is now making is not re-pricing risk for similarly cash strapped developers who now must also contend with contagion.

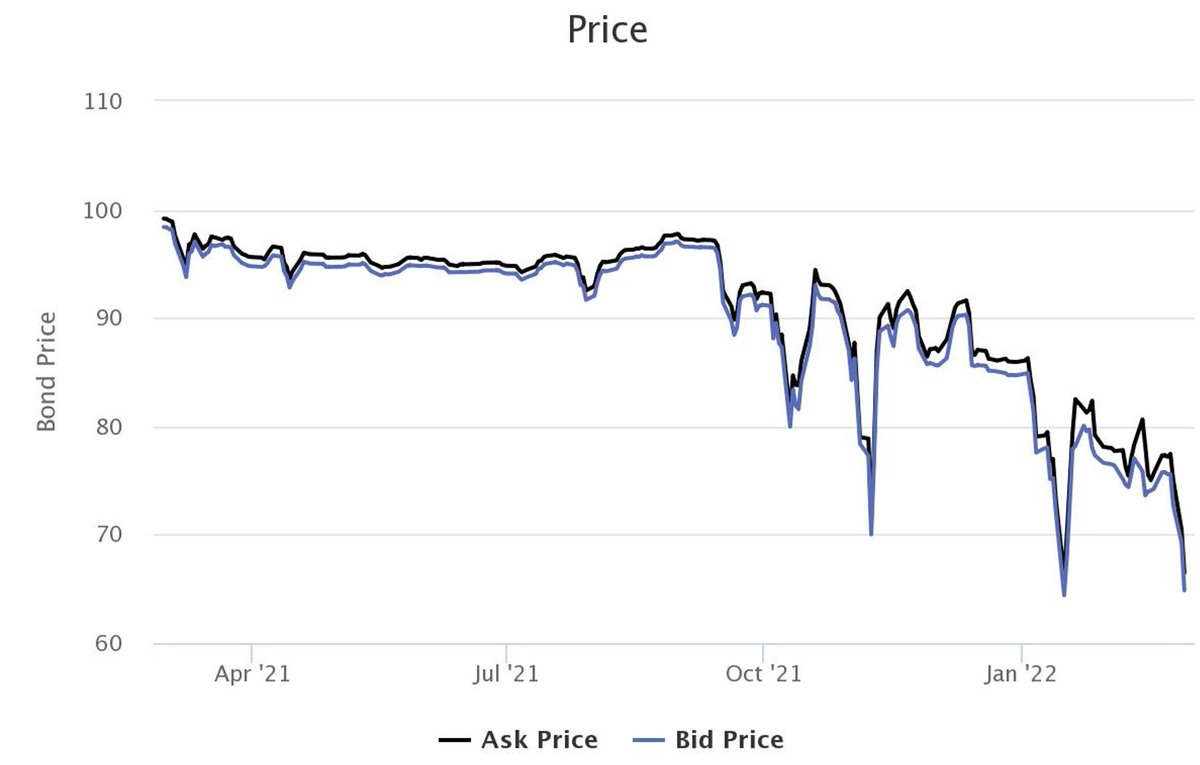

19. The opportunity to trade Evergrande trade is done. But with the EG bond action as a template, and contagion spreading, there is *IMO* a major opportunity to play developers that are deemed safe. Below is YTM on 2025 USD bonds for EG, Vanke, Country Garden and Sunac.

20. I belief that all of the bonds could be trading near "recovery" levels of 25c in the short term, and there is a good chance of no recovery at all, given the off B/S liabilities and de-facto subordination to the mainland's priorities

21. Banks are where systematic risk lies, but for a trader, I'd suggest the most direct route. The massive USD bond funding (priced with the assumption of central backstopping) was a critical funding avenue for the past several years and ultimately, those lenders will hold a bag.

22. *I Don't Trade Credit* But if I did, I would try to find anyone willing to write a CDS on a "stable" prop dev like Country Garden. Outright shorting the bonds may even be cheaper. Shorting the spread between "good co" and "bad co" probably is the most risk averse way.

23. This is IDEA - do your own research and determine the executability. Risks include market liquidity and remaining possibility of central intervention (though I doubt intervention will lead to offshore recovery). These USD bond markets are huge. Country Garden has $20bn out.

24. Thinking defensively on second order effects, if this all blows up, it will be a massive hit to base materials (iron ore in particular) as well as consumer products that have a large market in China. From a macro perspective, this is a huge hit to global growth.

25. The biggest risk to US investors not holding direct debt, is that this is the vol-shock that squeezes the vol sellers and unleashes a reflexive unwind that devastates anyone long anything.

This is just one person's analysis. Take it as you will.

https://twitter.com/TheLastBearSta1/status/1424833306781159433

This is just one person's analysis. Take it as you will.

Still going. 2031's quoted at 65 on Monday. The easy money is on this trade is gone, but yes, there is still more to go.

For the record, that's an investment grade bond (BBB- @FitchRatings), issued just over a year ago, trading down from par to highly distressed in two quarters

For the record, that's an investment grade bond (BBB- @FitchRatings), issued just over a year ago, trading down from par to highly distressed in two quarters

STILL GOING.

Country Garden USD 2027s now quoted at 31 cents on the dollar. Just 6 cents to go to hit my 25 cent target made on 9/15/21 when these traded at 105.

Country Garden USD 2027s now quoted at 31 cents on the dollar. Just 6 cents to go to hit my 25 cent target made on 9/15/21 when these traded at 105.

And now... Country Garden 2031 USD Bonds with a bid price of 25, as predicted in September.

Though the bonds may fall further, I think the risk/reward opportunity on this trade may finally be done.

The Writing on the Wall - and How to Trade it.

[End]

Though the bonds may fall further, I think the risk/reward opportunity on this trade may finally be done.

The Writing on the Wall - and How to Trade it.

[End]

• • •

Missing some Tweet in this thread? You can try to

force a refresh