1/15 Here's why I'm MEGA bullish on $Relay @Relay_chain and why you should be too.

Monthly Buyback and burns 🔥

Major partnerships incoming 🤝

Triple audited bridge by @HalbornSecurity 🔐

10m market cap 💰

Price: $3 💸

$MOVR $AVAX $HECO $POLY $BSC $MAI

#Moonriver #bridge

Monthly Buyback and burns 🔥

Major partnerships incoming 🤝

Triple audited bridge by @HalbornSecurity 🔐

10m market cap 💰

Price: $3 💸

$MOVR $AVAX $HECO $POLY $BSC $MAI

#Moonriver #bridge

2/15

Blockchain technology is rapidly evolving, and many more chains will be created in the coming years. It's important to recognize that bridge services will play a key role in transporting assets between popular blockchains and enabling specialized blockchains to connect.

Blockchain technology is rapidly evolving, and many more chains will be created in the coming years. It's important to recognize that bridge services will play a key role in transporting assets between popular blockchains and enabling specialized blockchains to connect.

3/15

So What is Relay? Relay is a bridge that lets us move crypto between blockchains with simplicity, security and speed, making cross-chain accessible to the masses. Because Relay is a service, you might not even know you’re using it, yet Relay is the premiere bridge of DeFi.

So What is Relay? Relay is a bridge that lets us move crypto between blockchains with simplicity, security and speed, making cross-chain accessible to the masses. Because Relay is a service, you might not even know you’re using it, yet Relay is the premiere bridge of DeFi.

4/15

Relay offers a seamless bridge that operates across a growing list of smart chains where it is being integrated directly into native DeFi applications, dApps, and DEXs. This is Bridging as a Service (BaaS).

Relay offers a seamless bridge that operates across a growing list of smart chains where it is being integrated directly into native DeFi applications, dApps, and DEXs. This is Bridging as a Service (BaaS).

5/15

Cross-chain bridging produces a situation where native assets from Ethereum move to Avax/BSC and are subject to different supply and demand pressures, creating arbitrage opportunities. The fastest bridge will attract the most volume because it enables these opportunities.

Cross-chain bridging produces a situation where native assets from Ethereum move to Avax/BSC and are subject to different supply and demand pressures, creating arbitrage opportunities. The fastest bridge will attract the most volume because it enables these opportunities.

6/15

Nodes on the Relay network quickly and securely shuttle transactions between different blockchains. Because the Relay API is built for seamless integration into dApps and DEXs, any trading platform can adopt Relay and immediately provide cross-chain opportunities to users.

Nodes on the Relay network quickly and securely shuttle transactions between different blockchains. Because the Relay API is built for seamless integration into dApps and DEXs, any trading platform can adopt Relay and immediately provide cross-chain opportunities to users.

7/15

Cross-chain transactions use $RELAY token liquidity!

Lock/mint/burn/release

To Bridge

Token is locked on one chain, wrapped token is minted on the other.

To Return

Wrapped token is burned and then released in its origin chain.

Cross-chain transactions use $RELAY token liquidity!

Lock/mint/burn/release

To Bridge

Token is locked on one chain, wrapped token is minted on the other.

To Return

Wrapped token is burned and then released in its origin chain.

8/15 Are the Bridge relayers known?

Presently the Relay Chain includes five well-known Relayers:

@BitcoinComExch

@zokyo_io

@ChartExPro

@AvalaunchApp

@Bridge_Mutual

all of which increase the Bridge’s security and reliability.

Presently the Relay Chain includes five well-known Relayers:

@BitcoinComExch

@zokyo_io

@ChartExPro

@AvalaunchApp

@Bridge_Mutual

all of which increase the Bridge’s security and reliability.

9/15 A Complete DeFi Bridge:

Bulletproof smart-contracts (audited first by @zokyo_io and more recently by @HalbornSecurity).

🔵Tokenomics that enrich our partners, holders, and bridge users using $Relay.

🔵DEX liquidity partners - @QuickswapDEX & more to come.

Bulletproof smart-contracts (audited first by @zokyo_io and more recently by @HalbornSecurity).

🔵Tokenomics that enrich our partners, holders, and bridge users using $Relay.

🔵DEX liquidity partners - @QuickswapDEX & more to come.

10/15

Continued

🔵Native asset conversion @gondola_finance

🔵Insurance @Bridge_Mutual

🔵Ticketing and Support workflow

🔵Participating Community

Continued

🔵Native asset conversion @gondola_finance

🔵Insurance @Bridge_Mutual

🔵Ticketing and Support workflow

🔵Participating Community

11/15

The Revenue Architecture:

$RELAY token holders can provide liquidity for cross-chain swaps and earn the fees in coins like,

$AVAX, $ETH, $BNB, $MATIC, $HT, $DOT, $SOL,

This means that by holding and staking $RELAY the fees are split among $RELAY Liquidity providers.

The Revenue Architecture:

$RELAY token holders can provide liquidity for cross-chain swaps and earn the fees in coins like,

$AVAX, $ETH, $BNB, $MATIC, $HT, $DOT, $SOL,

This means that by holding and staking $RELAY the fees are split among $RELAY Liquidity providers.

12/15

The Relay bridge is designed so as Relay becomes

more popular, $RELAY holders benefit both in increased rewards and increased market interest to hold $RELAY.

This is further helped by the low supply of $RELAY

- Only 10M Total Supply and the monthly buy back and burns.

The Relay bridge is designed so as Relay becomes

more popular, $RELAY holders benefit both in increased rewards and increased market interest to hold $RELAY.

This is further helped by the low supply of $RELAY

- Only 10M Total Supply and the monthly buy back and burns.

13/15

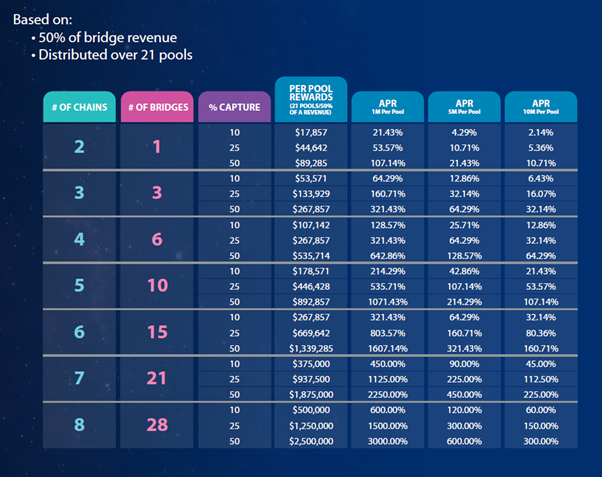

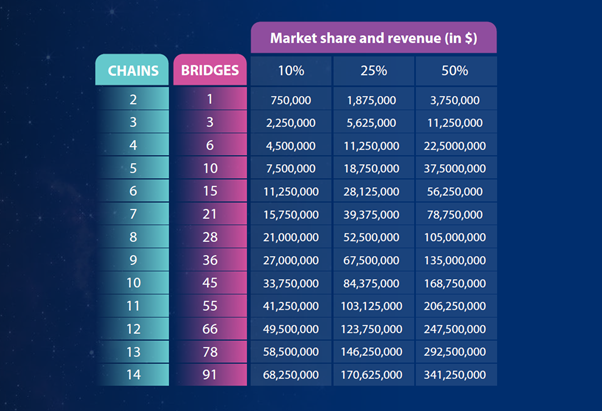

Monthly bridge revenue simulation

Based on a $10 transaction fee for using the bridge, the following table represents the market yield as more blockchains are added to the Relay service.

Look at those APR's for simply providing liquidity for $RELAY!!

Monthly bridge revenue simulation

Based on a $10 transaction fee for using the bridge, the following table represents the market yield as more blockchains are added to the Relay service.

Look at those APR's for simply providing liquidity for $RELAY!!

14/15

So what does the future look like for @relay_chain?

- Continuous onboarding of new chains: $Cosmos, $Fantom, $Solona, and $Near

- Forging more partnerships - $MOVR @MoonriverNW, @QiDaoProtocol $MAI

- More Exchanges, more volume, more buy back and burns = higher price.

So what does the future look like for @relay_chain?

- Continuous onboarding of new chains: $Cosmos, $Fantom, $Solona, and $Near

- Forging more partnerships - $MOVR @MoonriverNW, @QiDaoProtocol $MAI

- More Exchanges, more volume, more buy back and burns = higher price.

15/15 And it's only 10m Market cap 💰

Buy $RELAY on:

- @QuickswapDEX (quickswap.exchange/#/swap?outputC…) (MATIC)

- @Uniswap (app.uniswap.org/#/swap?outputC…) (ETH)

- @PancakeSwap (pancakeswap.finance/swap?outputCur…) (BSC)

- @traderjoe_xyz (traderjoexyz.com/#/trade?output…) (AVAX)

Buy $RELAY on:

- @QuickswapDEX (quickswap.exchange/#/swap?outputC…) (MATIC)

- @Uniswap (app.uniswap.org/#/swap?outputC…) (ETH)

- @PancakeSwap (pancakeswap.finance/swap?outputCur…) (BSC)

- @traderjoe_xyz (traderjoexyz.com/#/trade?output…) (AVAX)

• • •

Missing some Tweet in this thread? You can try to

force a refresh