ETF trend in india is rising now a days.

But do you really understand what ETF really is?

In this thread we gonna take a deep dive into ETF !!

Do maximum retweet to educate more investors.

But do you really understand what ETF really is?

In this thread we gonna take a deep dive into ETF !!

Do maximum retweet to educate more investors.

With the simple define,

An ETF is a basket of securities, shares of which are sold on an exchange.

They combine features and potential benefits similar to those of stocks, mutual funds, or bonds. Like stocks, ETF shares are traded throughout the day based on supply and demand.

An ETF is a basket of securities, shares of which are sold on an exchange.

They combine features and potential benefits similar to those of stocks, mutual funds, or bonds. Like stocks, ETF shares are traded throughout the day based on supply and demand.

Similar to trading stocks

Trading ETFs is no different from trading stocks, and a little research goes a long way to helping you choose the right ETF.

Trading ETFs is no different from trading stocks, and a little research goes a long way to helping you choose the right ETF.

So who really manage them?

Like mutual fund shares, ETF shares represent partial ownership of a portfolio that's assembled by professional managers.

Like mutual fund shares, ETF shares represent partial ownership of a portfolio that's assembled by professional managers.

Mutual Funds vs ETF

Mutual funds pool money from investor and a fund manager actively managed them. So, You pay manager in hope that they will make more return than market.

Where ETFs are like stocks, which you can buy and sell anytime.

Mutual funds pool money from investor and a fund manager actively managed them. So, You pay manager in hope that they will make more return than market.

Where ETFs are like stocks, which you can buy and sell anytime.

However, in most of the mutual funds, they levied 1% in case of withdrawal before a year, and expense ratio is also much higher in most of the cases.

But,

ETFs are freely traded and there is also no lock in period like in case of some of the mutual fund schemes.(ELSS etc.)

But,

ETFs are freely traded and there is also no lock in period like in case of some of the mutual fund schemes.(ELSS etc.)

ETF vs Stock

ETFs are more diverse than investing in individual stocks. Instead of buying a handful of individual stocks, investing in an ETF would give you instant exposure to a multitude of stocks.

ETFs are more diverse than investing in individual stocks. Instead of buying a handful of individual stocks, investing in an ETF would give you instant exposure to a multitude of stocks.

ETF Market in India

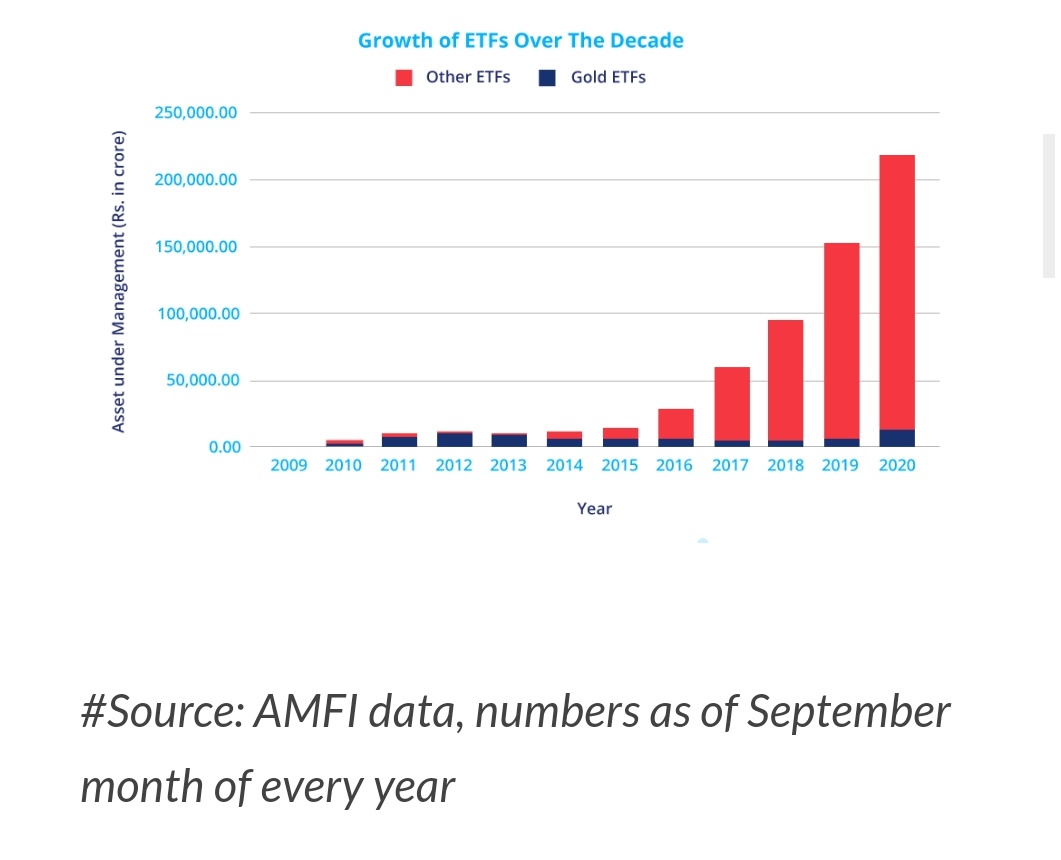

Assets under management for ETFs in India grew from INR 15.13 thousand crores in September 2015 to INR 218.82 thousand crores in September 2020. The five-year growth was about 15x and the CAGR was around 70%.

Assets under management for ETFs in India grew from INR 15.13 thousand crores in September 2015 to INR 218.82 thousand crores in September 2020. The five-year growth was about 15x and the CAGR was around 70%.

In India the major share of investments in ETF, that is around 88% is held by institutional investors and retail investors hold only 3% whereas in US, ETFs are driven by both retail and institutional investors.

From 2014 onwards, the share of other ETFs (equity & debt) picked up steam and went from 39% (2014) of total ETF AUM to as high as 93% in 2020. (Source: AMFI data)

Investing in ETFs is quite easy in india,

you can invest in ETFs via your Dmat account.

But before investing,

One should always check expense ratio, tracking error and liquidity.

Let's understand them one by one :

you can invest in ETFs via your Dmat account.

But before investing,

One should always check expense ratio, tracking error and liquidity.

Let's understand them one by one :

Expense Ratio : % of fund assets used for administrative, management, advertising, and all other expenses.

Eg. An expense ratio of 1% per annum means that each year 1% of the fund's total assets will be used to cover expenses.

Eg. An expense ratio of 1% per annum means that each year 1% of the fund's total assets will be used to cover expenses.

Tracking Error : Difference between an investment portfolio’s returns and the index it mimics or tries to beat.

Eg. If your ETFs benchmark is Nifty, in last one year Nifty given 12% return and your ETF given 11%, Then 11-12= -1% is Tracking Error.

Eg. If your ETFs benchmark is Nifty, in last one year Nifty given 12% return and your ETF given 11%, Then 11-12= -1% is Tracking Error.

ETF liquidity : Ease with which a particular Exchange Traded Fund (ETF) can be bought and sold on the exchange

2 Components

– The liquidity of the ETFs traded on the exchange

– The liquidity of the individual assets in an ETF

More liquid individual assets = Easy to redeem ETF

2 Components

– The liquidity of the ETFs traded on the exchange

– The liquidity of the individual assets in an ETF

More liquid individual assets = Easy to redeem ETF

There are many different types of ETFs in the market. Some of the famous ETFs are Index ETF, Gold ETF, Bond ETF, International ETF, Liquid ETF, Commodity ETF, Inverse ETF and Leveraged ETF.

Index ETFs : replicate an indices performance.

Gold ETFs : tracks the price of Gold in the market, and it is the same value as 24 pure physical gold.

Bond ETFs : replicates the returns of bond indexes, generally they are highly liquid and diversified.

Gold ETFs : tracks the price of Gold in the market, and it is the same value as 24 pure physical gold.

Bond ETFs : replicates the returns of bond indexes, generally they are highly liquid and diversified.

International ETFs : invest in foreign based securities, they are passively invested around an index as an underlying.

Liquid ETFs : invest in short term money market instruments& government sec which have short term maturity, the objective is to increase returns and reduce risk

Liquid ETFs : invest in short term money market instruments& government sec which have short term maturity, the objective is to increase returns and reduce risk

Commodity ETFs : Administered in future trading by dealing in precious metals.

Inverse ETFs/ Bear/Short ETFs : Returns perform inversely to the benchmark index portfolio.

Leveraged ETF : High risk ETFs that use debt and financial instruments to increase returns

Inverse ETFs/ Bear/Short ETFs : Returns perform inversely to the benchmark index portfolio.

Leveraged ETF : High risk ETFs that use debt and financial instruments to increase returns

Advantages includes :

Diversification

Transparent (always see what stocks are included in ETF)

Easy to Trade

Liquid

Low Cost

Lower Risk(track the index only)

Lower capital gain tax

Diversification

Transparent (always see what stocks are included in ETF)

Easy to Trade

Liquid

Low Cost

Lower Risk(track the index only)

Lower capital gain tax

Some of the risk ETF has :

Capital(initial amt can be high)

Illiquid ETF lead to higher buying & selling cost and difficulty in trading

Lower dividend yield as compared to stock

Concentration risk

Capital(initial amt can be high)

Illiquid ETF lead to higher buying & selling cost and difficulty in trading

Lower dividend yield as compared to stock

Concentration risk

How to identify best ETFs?

Expense Ratio and Tracking error should be lower and AUM should be on more to provide enough liquidity.

Expense Ratio and Tracking error should be lower and AUM should be on more to provide enough liquidity.

One Last thing,

⚡Do You Know?

like ELSS, investments made in CPSE and Bharat-22 ETFs will be subject to lock-in for three years and eligible for tax deductions of up to ₹1.5 lakh under section 80C of the Income-Tax Act.

⚡Do You Know?

like ELSS, investments made in CPSE and Bharat-22 ETFs will be subject to lock-in for three years and eligible for tax deductions of up to ₹1.5 lakh under section 80C of the Income-Tax Act.

This is our first thread in long format!!

Hope you liked it!!

Do like and maximum "retweet" & help us to reach more investors.

@BeatTheStreet10

Hope you liked it!!

Do like and maximum "retweet" & help us to reach more investors.

@BeatTheStreet10

• • •

Missing some Tweet in this thread? You can try to

force a refresh