sunday gyan for passive folks around nifty strategy indices ->

of the various strategy indices available for investing via a fund or ETF ->

Nifty-50

Nifty-100

Value-20

MoMo-30

Low-Vol-30

Qual-30

Alpha-Low-Vol

50-Eq-Wt

Nifty-50

Nifty-100

Value-20

MoMo-30

Low-Vol-30

Qual-30

Alpha-Low-Vol

50-Eq-Wt

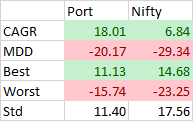

10 years Returns and Max Drawdown , and monthly sharpe ratio , best and worst month performance details ->

taking the quality , value , momentum , bolatility as 4 factors ->

Qual-30 ( SBI Quality ETF , 50 bps expense ratio )

Value-20 ( Nippon India ETF NV20 , 35 bps)

Alpha-Low-Vol ( ICICI Prudential Alpha Low Vol 30 ETF , 40 bps)

MoMo-30 ( UTI Nifty200 MoMo 30 Fund , 40 bps)

Qual-30 ( SBI Quality ETF , 50 bps expense ratio )

Value-20 ( Nippon India ETF NV20 , 35 bps)

Alpha-Low-Vol ( ICICI Prudential Alpha Low Vol 30 ETF , 40 bps)

MoMo-30 ( UTI Nifty200 MoMo 30 Fund , 40 bps)

BTW , bolatility is volatility in bengali , did you know that the world cup kapil dev lifted after the spectacular catch sir viv richards is called , Prudential World Cup 1983

also jimmy amarnath was the man of the match both in semifinals and finals , who has habit of showing off hand kerchief from his pant pockets while batting ( i was a copy cat of this hanki while batting ) , now back to the topic

setting up a mean variance portfolio with those 4 factors , with few ifs and buts conditions , we get the optimal weights at

Qual-30:0.40

Value-20 : 0.10

Alpha-Low-Vol : 0.40

MoMo-30: 0.10

Qual-30:0.40

Value-20 : 0.10

Alpha-Low-Vol : 0.40

MoMo-30: 0.10

such portfolio against Nifty ->

PortNifty

CAGR18.016.84

MDD-20.17-29.34

Best11.1314.68

Worst-15.74-23.25

Std11.4017.56

PortNifty

CAGR18.016.84

MDD-20.17-29.34

Best11.1314.68

Worst-15.74-23.25

Std11.4017.56

fares a bit more twice the performance of nifty 50

highlighted in yellow were two years where the portfolio underperformed against nifty

do your self a favour by cleaning up all your smallcase craps , and getinto to those 4 funds in the said ratio !!

this portfolio in cricket batsmen parlance , can bat against , Muttiah Muralitharan & Shane Warnie bowling in tandem at namma benguluru pitch on 5th day post lunch session

or against malcolm marshal and wasim bhai on a first day fresh off the covers pitch at durban or perth , without a helmet and hanki tucked into pant pockets !!

• • •

Missing some Tweet in this thread? You can try to

force a refresh