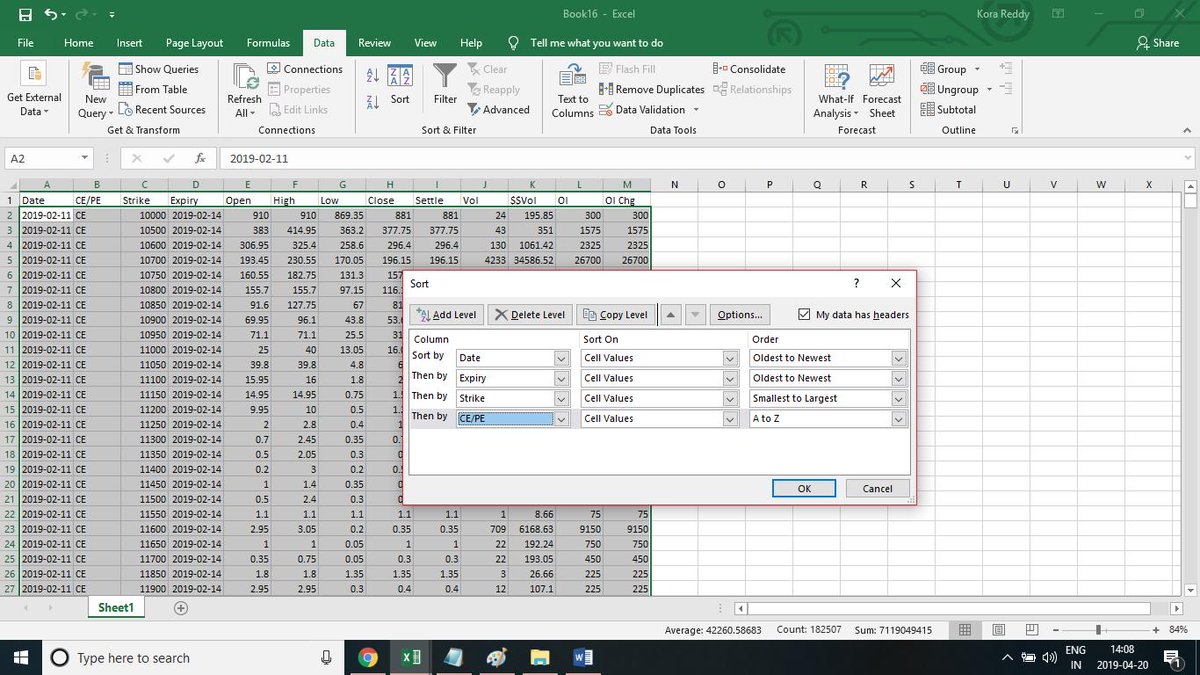

is current days change in percecnt ,

DoW is day of the week

5H/L , am simple looking whether it is 5 day hi or 5 day lo , if not am marking "-" ,

Gap is simply todays open minus yesday cls

Cdl is candle in pts , that is today close minus todays open

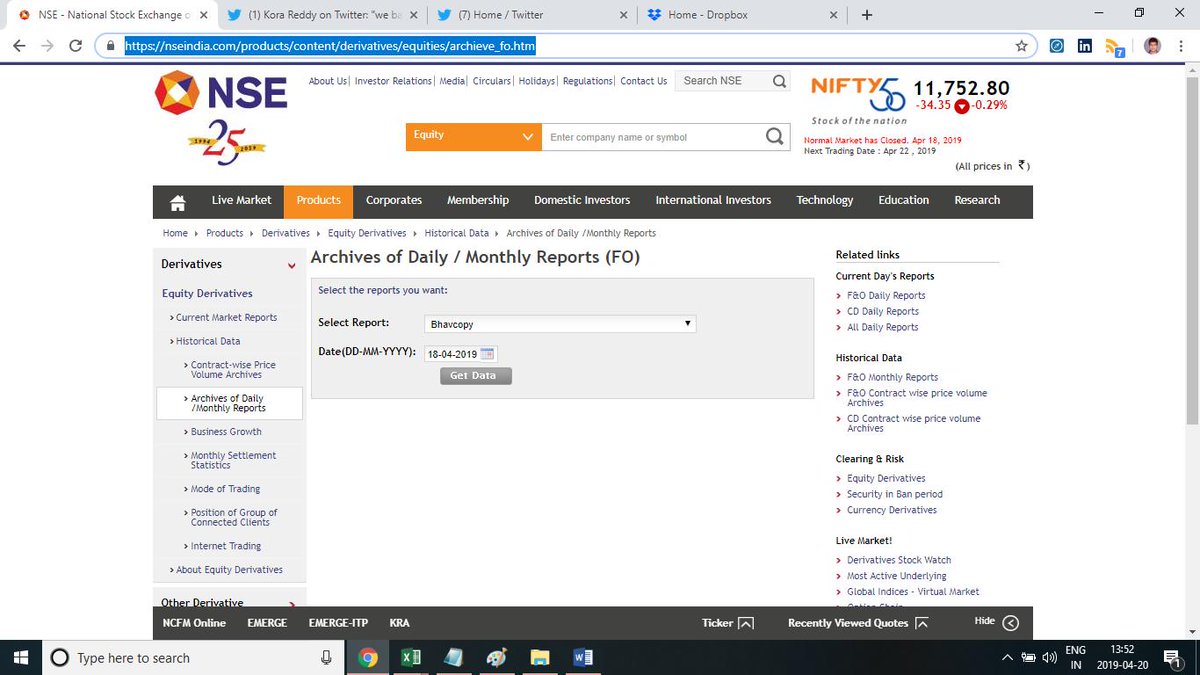

DTE - days to expiry , that is current date minus the nearest weekly expiry ( acheived via vlookup )

t+1%t+1t+2%t+2t+3%t+3t+4%t+4t+5%t+5

11 feb to till date ,

it makes things easier if you jsut want observe soemthign later

dropbox.com/s/ff8lbs0t0m4j…

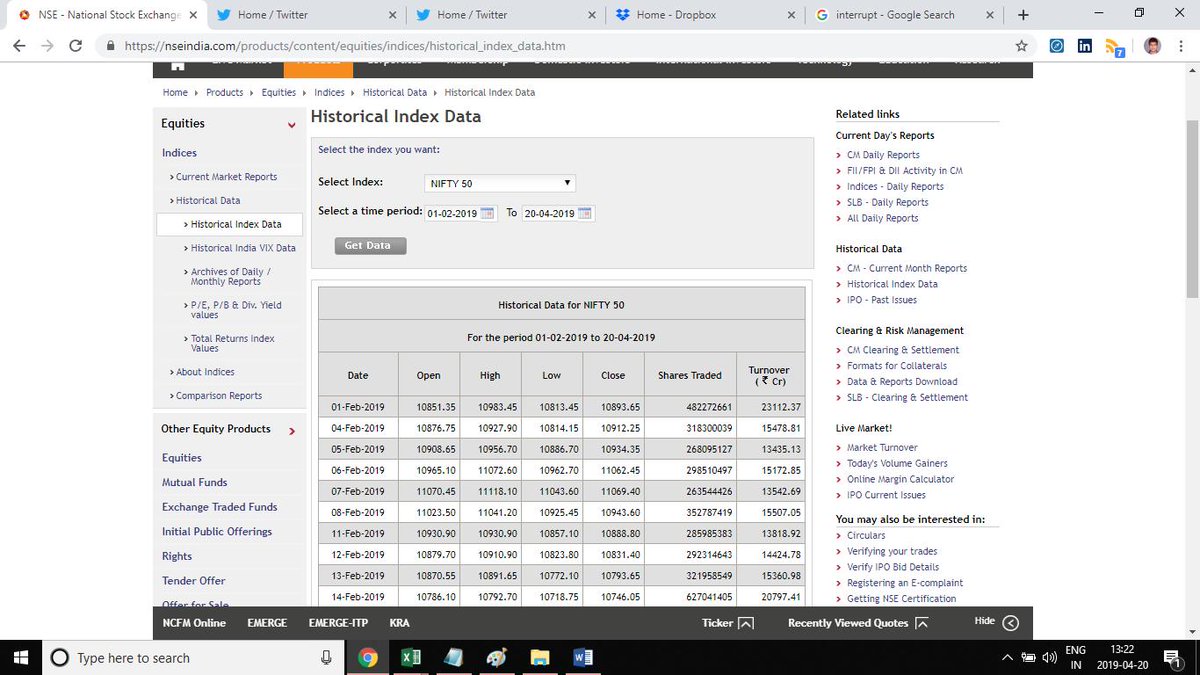

close is nifty idx close on that date

PE is put strike we are observing ,

i simply use =ROUND(B2*0.98,-2) for a 2% away put strike , as an example

we also model our trade signals from close to close btw

expiry : which expiry we are trading

i will just restrict to one - >

algo rules ) short ATM PE on upday

, looks like the nifty idx basic formulas we didn't create a column called expiry date for the current date , so we add that and here is updated sheet of the same -> dropbox.com/s/d9bimq11a5p8…

and in O1 we key in our exit criteria as t+1 to t+5 , meaning our hold period is

so we go to nifty idx basic formula updated version 2 sheet and filter column h for grater than zero values and simply take those nifty closes and t+1 and expiry date details and paste then in the nifty options look up sheet

here is the updated ver 3 sheet ->

dropbox.com/s/6iacyyvydf7t…