1/ After the price action we have seen today, it is good to remember that #Bitcoin is exposed to the risk of liquidity events in the broader market.

That means if the SP500 dips significantly, leveraged traders will definitely sell some BTC to raise cash.

See March 2020. 👇

That means if the SP500 dips significantly, leveraged traders will definitely sell some BTC to raise cash.

See March 2020. 👇

2/ Right now with the increased likelihood that the Fed will start tapering their purchasing program we get a higher chance of a significant corrections in the stock market.

Let’s remember that the Fed’s balance sheet is up $4 trillions in two years...

Let’s remember that the Fed’s balance sheet is up $4 trillions in two years...

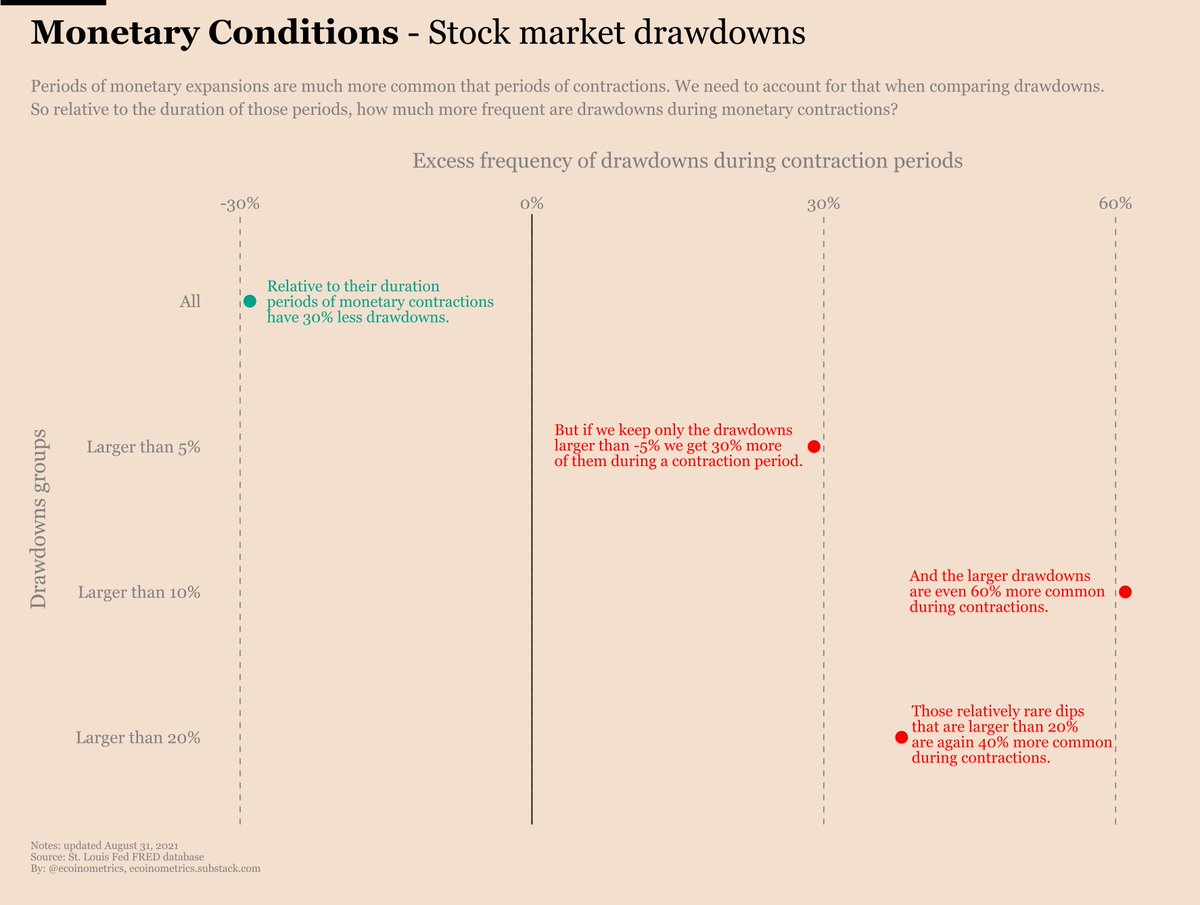

4/ We can compare the SP500 drawdowns when the Fed’s balance sheet is expanding vs contracting.

At first sight there does not seem to be much of a difference. 🤔

At first sight there does not seem to be much of a difference. 🤔

5/ Whether it is contraction or expansion, the SP500 drawdowns have about the same distribution.

But maybe those drawdowns last a bit longer during balance sheet contractions. 🤔

But maybe those drawdowns last a bit longer during balance sheet contractions. 🤔

6/ Ah! But we have missed something.

Yes there are less red dots than green dots BUT it is also true that the Fed has been expanding its balance sheet most of the time in the past 14 years.

So what we need to do is compare the number of drawdowns by unit of time.

Yes there are less red dots than green dots BUT it is also true that the Fed has been expanding its balance sheet most of the time in the past 14 years.

So what we need to do is compare the number of drawdowns by unit of time.

7/ Actually it turns out that during monetary contractions:

🟢Small drawdowns are 30% less likely.

🔴But drawdowns larger than 5% are 30% more likely.

🔴And drawdowns larger than 10% are 60% more likely.

🟢Small drawdowns are 30% less likely.

🔴But drawdowns larger than 5% are 30% more likely.

🔴And drawdowns larger than 10% are 60% more likely.

8/ So as the Fed talks more about tapering we are likely to see big drawdowns in the stock market and that might impact the price of #Bitcoin in the short term.

For more details, I wrote about all that a few weeks ago.

Go check it out 👇

ecoinometrics.substack.com/p/ecoinometric…

For more details, I wrote about all that a few weeks ago.

Go check it out 👇

ecoinometrics.substack.com/p/ecoinometric…

• • •

Missing some Tweet in this thread? You can try to

force a refresh