Data-Driven Bitcoin Macro Strategy

For Financial Advisors, Professional & High-Net-Worth Investors

6 subscribers

How to get URL link on X (Twitter) App

You can dollar cost average an asset daily, weekly or monthly, over the long run it doesn’t matter.

You can dollar cost average an asset daily, weekly or monthly, over the long run it doesn’t matter.

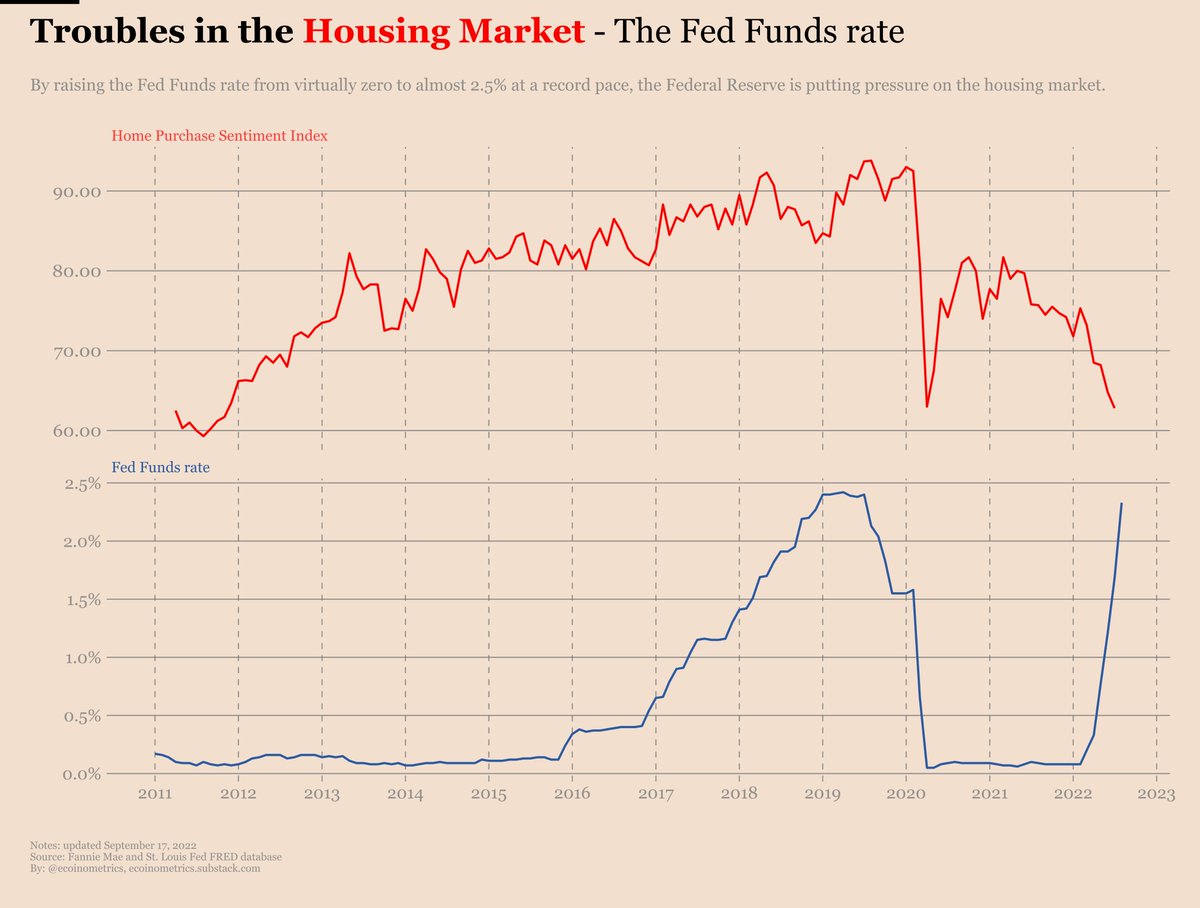

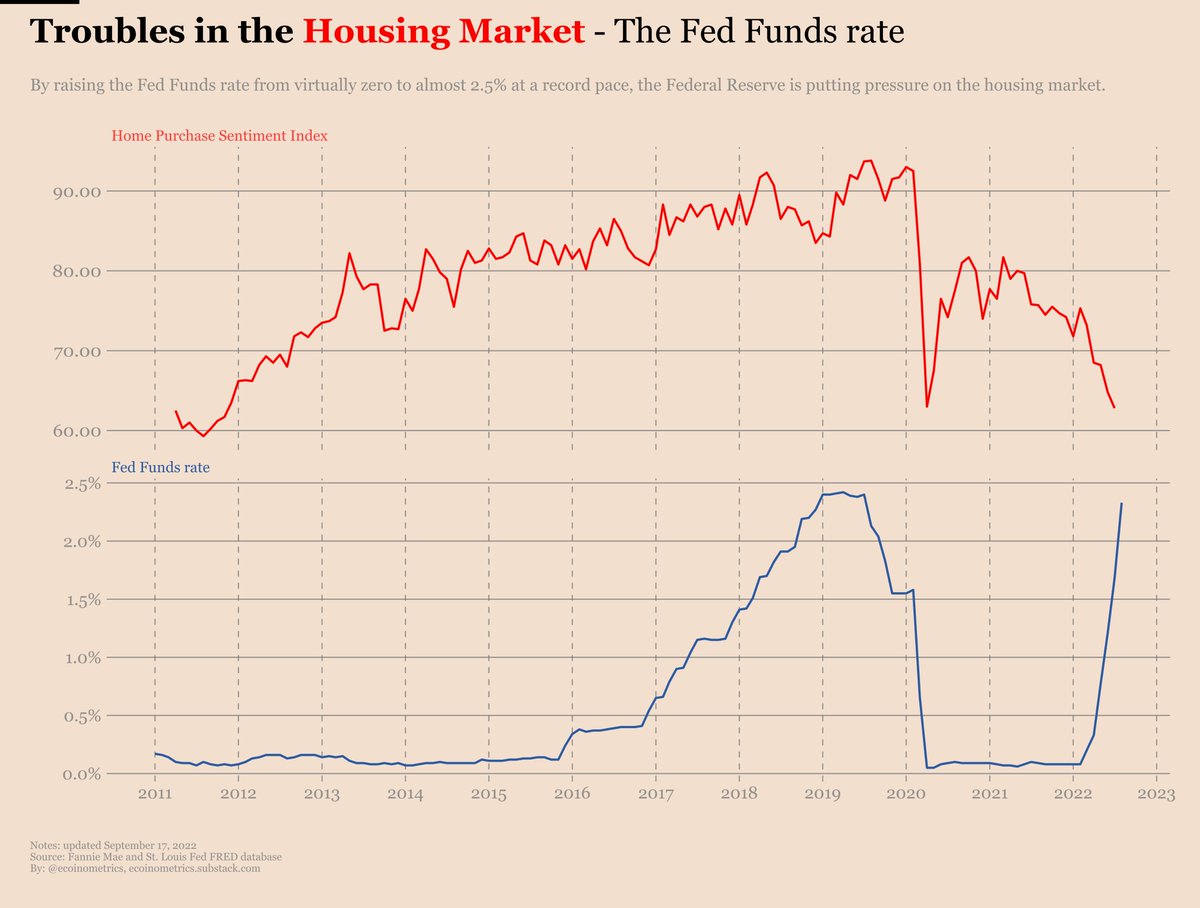

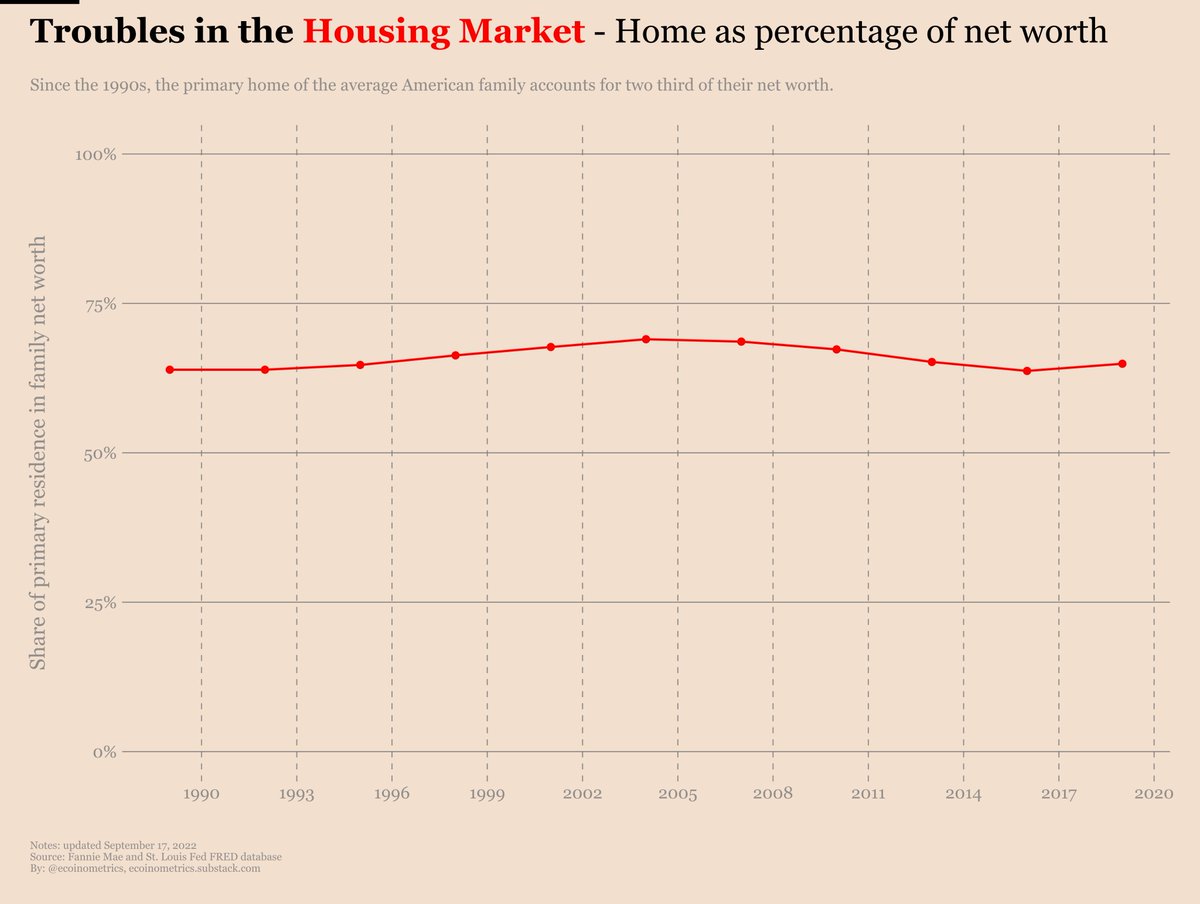

US families typically have the majority of their wealth tied to their home.

US families typically have the majority of their wealth tied to their home.

You all know what dollar cost averaging is. Pick an asset:

You all know what dollar cost averaging is. Pick an asset:

I'll give you some hints:

I'll give you some hints:

Long Term Capital Management or LTCM was founded in 1994 by John Meriwether.

Long Term Capital Management or LTCM was founded in 1994 by John Meriwether.

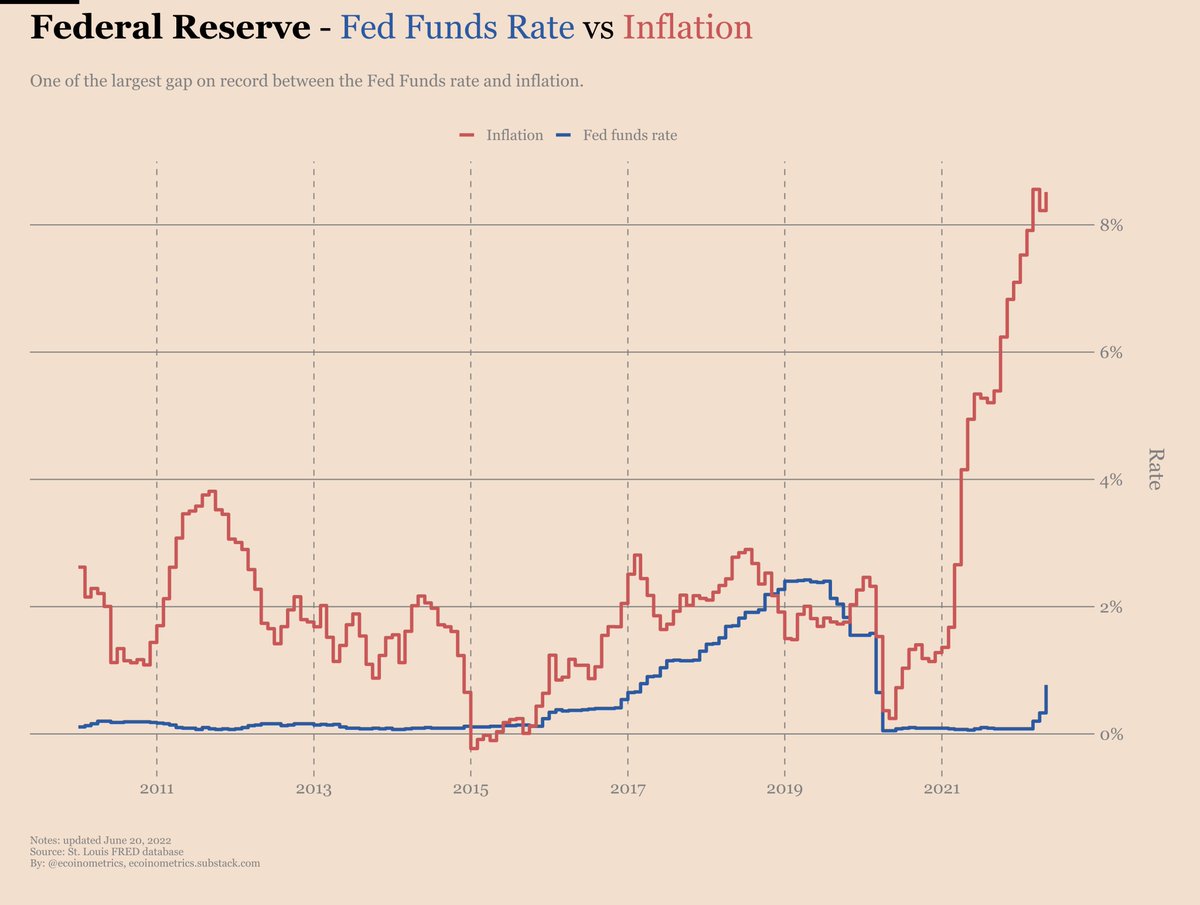

Maybe just looking at the inflation rate is a little abstract.

Maybe just looking at the inflation rate is a little abstract.

{2/11} For context, the US just banned the import of Russian oil.

{2/11} For context, the US just banned the import of Russian oil.

2/ The US dollar index is a weighted average of the exchange rates between the USD and the currencies of some selected trading partners.

2/ The US dollar index is a weighted average of the exchange rates between the USD and the currencies of some selected trading partners.

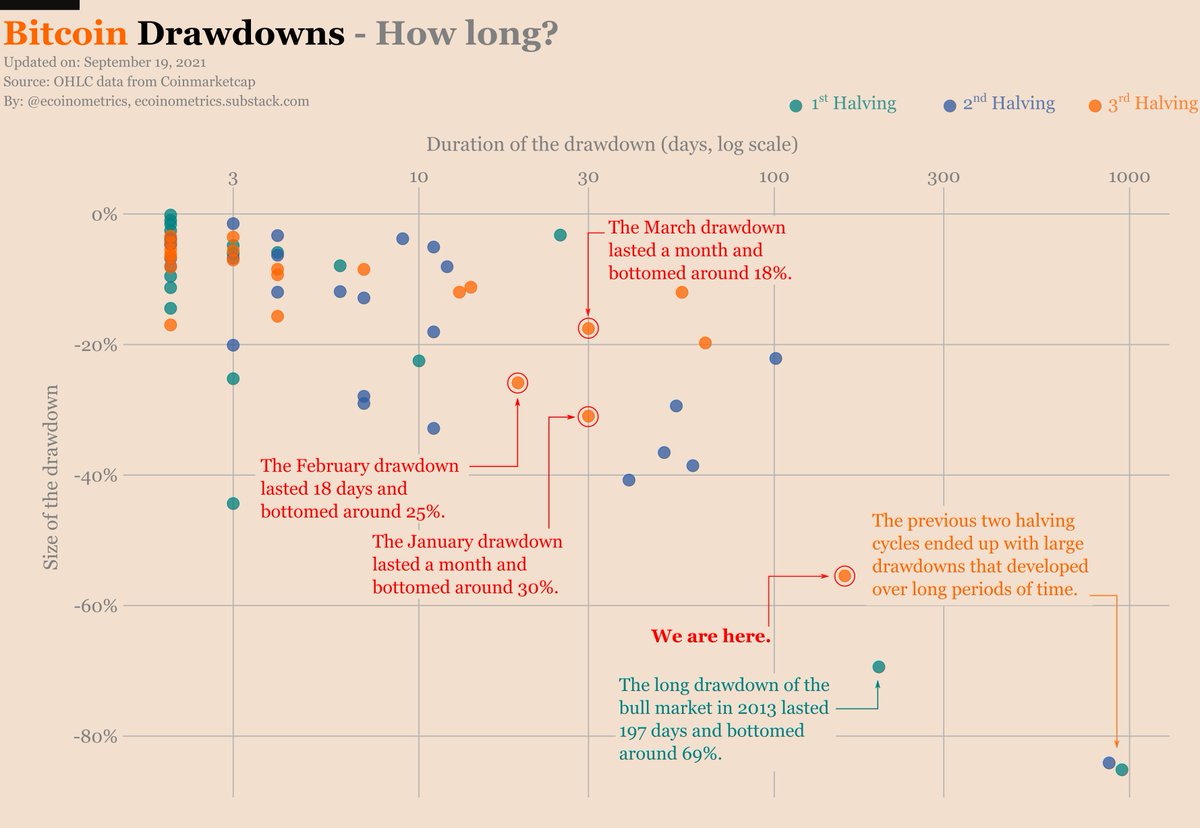

2/4 We are one month away from the longest drawdown in #Bitcoin's history outside of an end-of-cycle bear market. 👇

2/4 We are one month away from the longest drawdown in #Bitcoin's history outside of an end-of-cycle bear market. 👇

2/ Right now with the increased likelihood that the Fed will start tapering their purchasing program we get a higher chance of a significant corrections in the stock market.

2/ Right now with the increased likelihood that the Fed will start tapering their purchasing program we get a higher chance of a significant corrections in the stock market.

2/ That being said, in 40 days this drawdown will become the longest #Bitcoin has ever experienced outside of a bear market. 👇

2/ That being said, in 40 days this drawdown will become the longest #Bitcoin has ever experienced outside of a bear market. 👇

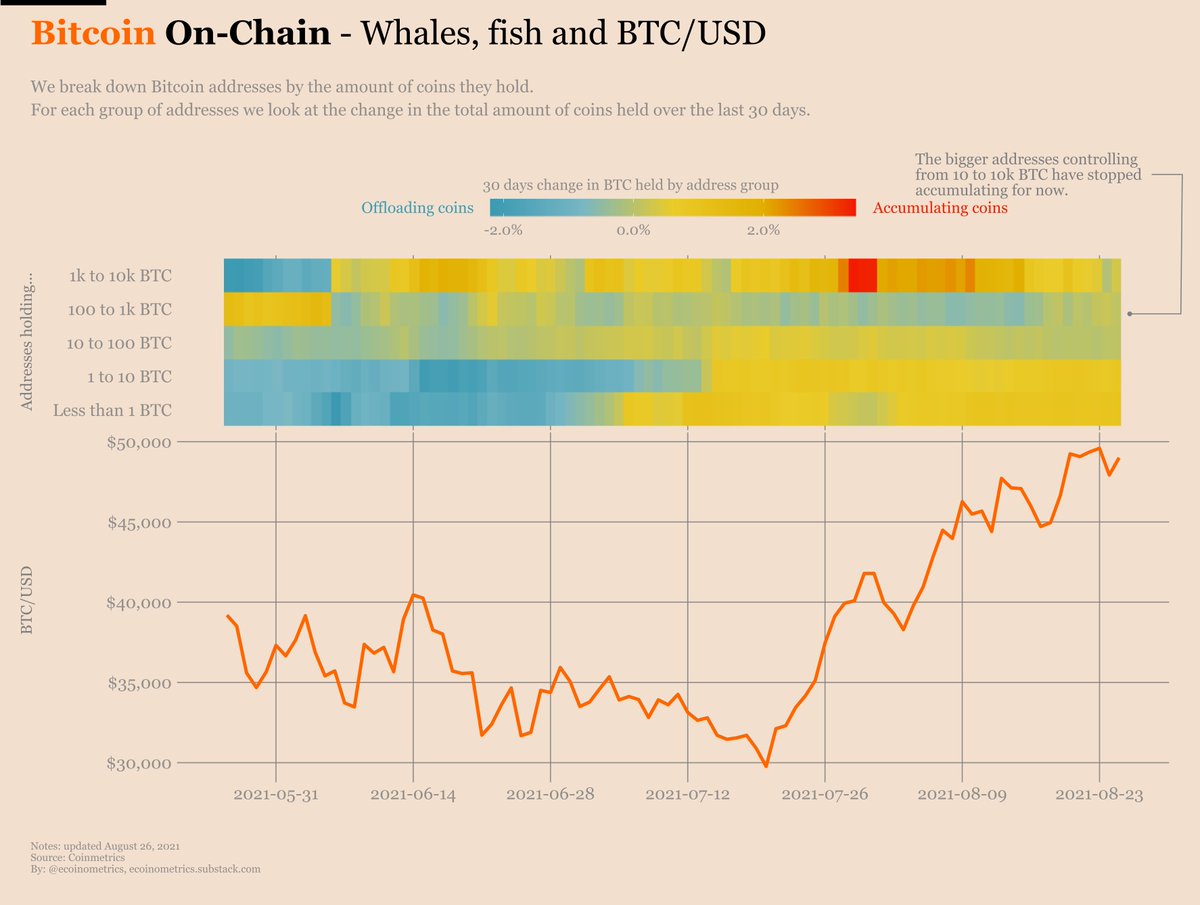

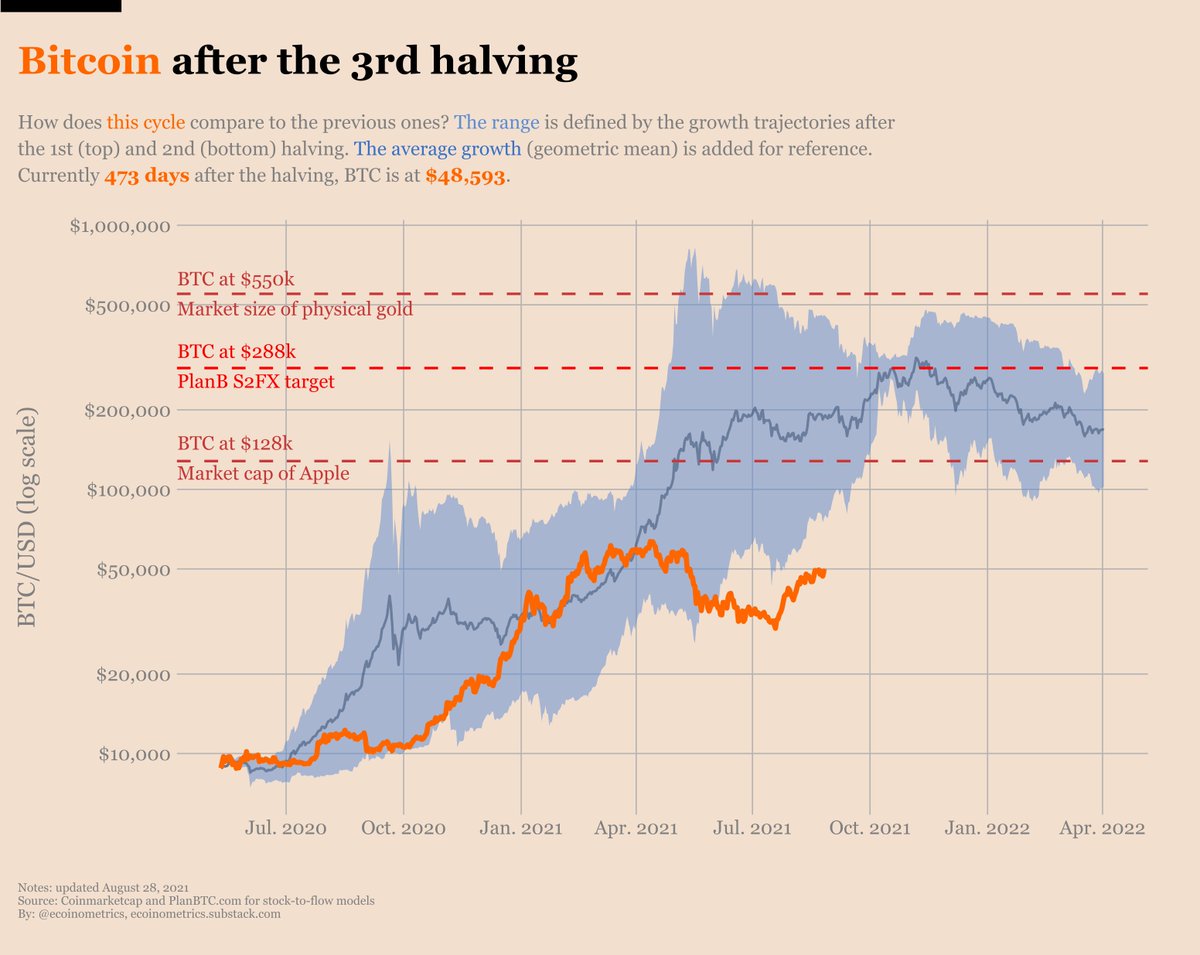

2/ ... the recovery from the bottom of this correction is well underway.

2/ ... the recovery from the bottom of this correction is well underway.

2/ The addresses controlling 10 to 10k #BTC have been accumulating more slowly. In particular the whales have turned neutral on a 30 days basis.

2/ The addresses controlling 10 to 10k #BTC have been accumulating more slowly. In particular the whales have turned neutral on a 30 days basis.