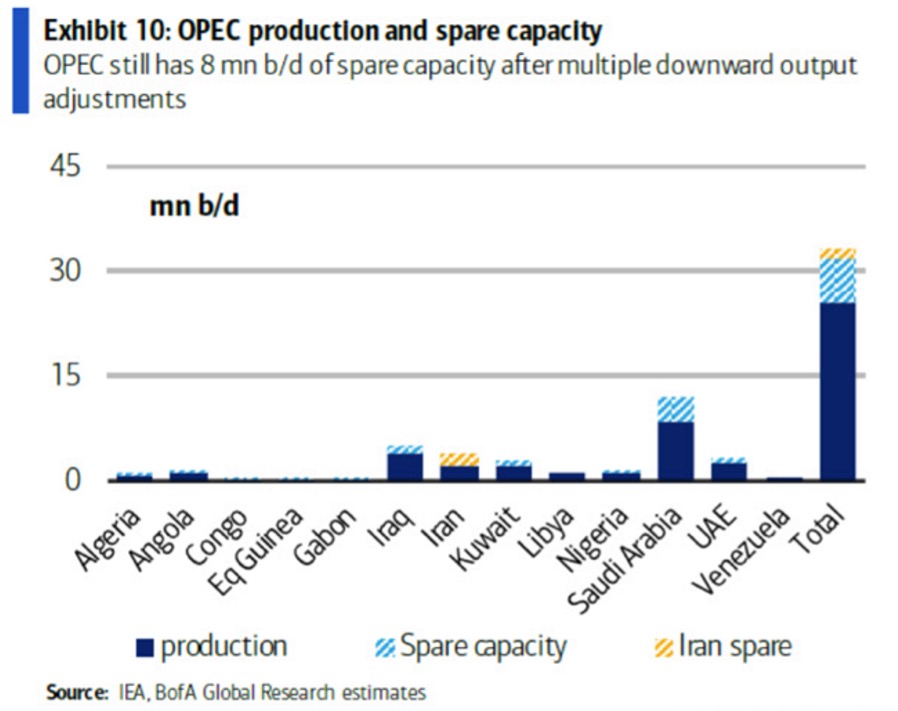

As energy prices rise around the world, many continue to downplay the possibility of a global energy supply crisis, citing OPEC+ spare capacity available to come back online. But does OPEC+ really have as much spare capacity as advertised?

Thread below👇

Thread below👇

Due to a lack of reliable data, many industry experts and analytics firms have adopted OPEC+’s self- reported numbers. The EIA estimates that OPEC+ has 6.9MM bbl/d of spare capacity, yet no one knows if this is accurate, and few seem to care. (1/12)

OPEC+ controls about 50% of the global oil supply, mostly from Russia and Saudi Arabia. These are known as “swing producers” because, unlike most other producers, they adjust their production in response to changing market fundamentals to balance the market. (2/12)

OPEC+ has less spare capacity than advertised. What's left of the cartel’s spare capacity could be fully absorbed as oil demand approaches pre-pandemic levels. And demand has rebounded more rapidly than expected. Here’s why we think that: (3/12)

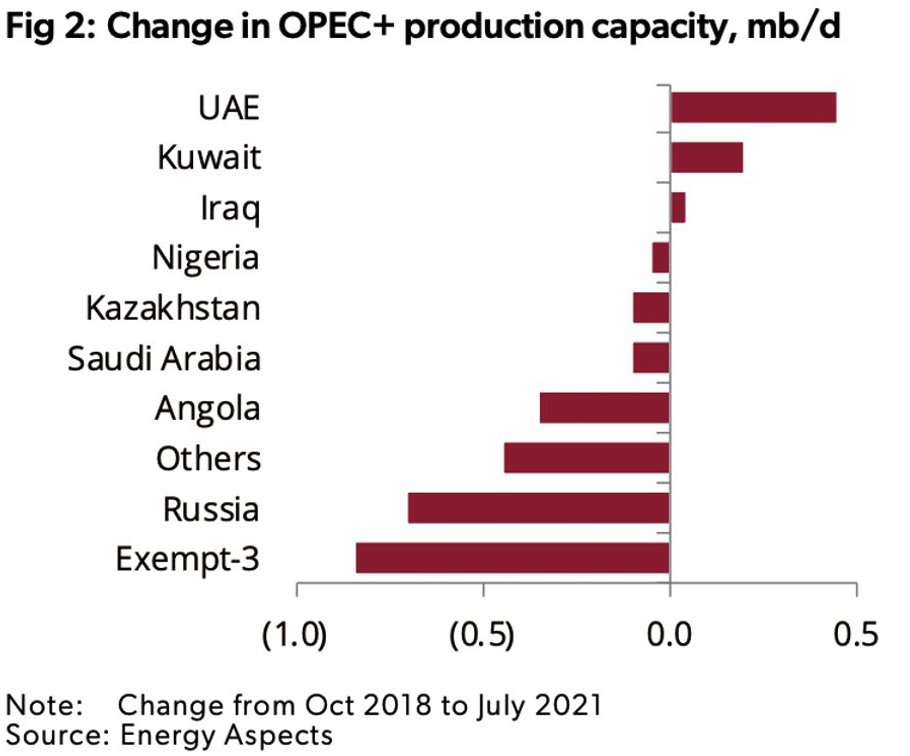

Actual production capacity for most OPEC+ member countries has declined materially in the last 3 years, according to Energy Aspects and others. (4/12)

OPEC+ may be having difficulty filling production quotas as they rise. They announced in mid-July that they would collectively increase output by 0.4MM bbl/d beginning in August, yet they only increased production by 0.1MM bbl/d. (5/12)

Also, oil demand in the world’s largest economies—particularly in Asia—is recovering faster than anticipated. This supports our long-term macro view that global demand will far exceed OPEC+ total production and that the market will be in a structural deficit. (6/12)

Focusing on the actual production capacity of the two largest OPEC+ producers, Saudi Arabia and Russia, highlights the biggest differences between actual and spare capacity. Spare capacity may be materially lower than claimed. (7/12)

OPEC’s estimate of Saudi Arabia’s productive capacity is 12MM bbl/d. Yet whenever Saudi production has neared 10MM bbl/d, the average since 2010, their onshore oil inventories draw. Saudi inventories have been falling since 2016, as seen below. (8/12)

Russia joined with OPEC to form OPEC+ in 2016, with current production averaging 10.7MM bbl/d as of September. Russia likely has limited spare capacity vs current production, owing to a history mismanagement of petroleum resources. (9/12)

Russia’s most recent production numbers are also unimpressive. As global demand recovers, Russia’s production has languished despite having been allotted nearly 0.2MM bbl/d in additional production since April. (10/12)

As world oil demand recovers from Covid-19 and grows to new highs there may be a call on OPEC+ spare capacity, particularly as inventories deplete and as US shale is “on strike," with a new focus away from growth and towards capital return. (11/12)

We may be approaching a time of higher world oil demand than world oil supply capacity. This could result in much higher oil prices and a potential return to the stagflation type economic situation last seen in the 1970s, in which oil and gas stocks did quite well. (12/12)

If you enjoyed this read, check out the full report here, in addition to other in-depth research and content, at no cost.

bisoninterests.com/content/f/the-…

bisoninterests.com/content/f/the-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh