1/14 What is Olympus Pro and what does it mean for @OlympusDAO , $OHM and (3, 3) other than numba go up? At its core, Olympus Pro is all about bringing (3, 3) to the whole of DeFi, not just the Ohmies.

A 🧵 on how Olympus Pro brings (3, 3) to the next level 👇

A 🧵 on how Olympus Pro brings (3, 3) to the next level 👇

2/14 We have covered what $OHM is & how #OHMISBACKED. Briefly, $OHM's bond sales, strong community & game theory mechanics enabled liquidity ownership rather than relying on mercenary capital from LPs. This enables $OHM to be a reserve asset in #DeFi

https://twitter.com/Fund975/status/1433339241677791234

3/14 #OlympusPro is bringing this bond sale program to other protocols, enabling them to OWN their liquidity by providing protocol-owned liquidity-as-a-service. This allows them to focus on building better products.

olympusdao.medium.com/introducing-ol…

olympusdao.medium.com/introducing-ol…

4/14 Olympus Pro X will serve as a bond marketplace, allowing DeFi investors to swap LP tokens for other protocol tokens at a discounted price, much like $OHM bonds. This enables new protocols to get attention from investors, similar to an exchange listing.

5/14 This benefits $OHM, as the Olympus Treasury gets 3.3% (hehe) of bond payouts. If 100 $ABC is sold through #OlympusPro , the treasury gets 3.3 $ABC as revenue. For context, OlympusDAO daily reserve bond sales has $1.5m of volume and an average of $2.7m daily revenue.

6/14 But how much can revenue increase? Assuming 0 growth in Organic revenue, a 10x increase in bond sales will increase daily revenue by 18%. This doesnt take into account the massive +ve delta exposure that early tokens have & what $OHM will look like with 10x bond sale volume

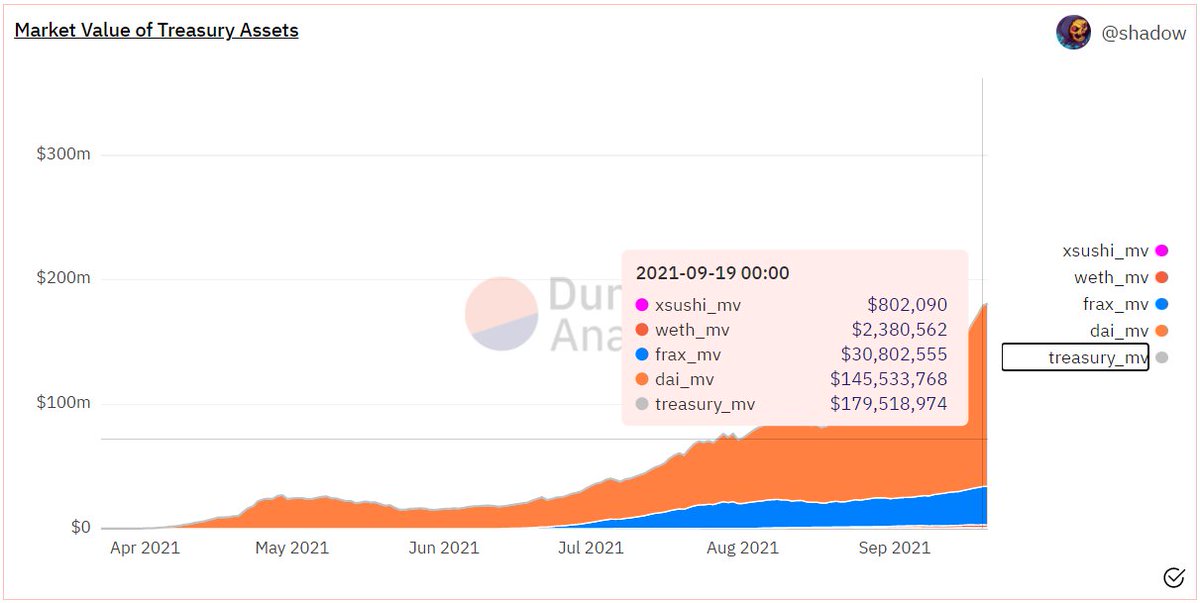

7/14 The $OHM treasury can begin accumulating more diverse assets from partner protocols, helping it become a more effective reserve asset in DeFi. You can follow the $OHM dashboard on @DuneAnalytics by @sh4dowlegend for real time updates. Imagine if it starts holding $SPELL 👀

8/14 For the protocols, they not only get native liquidity ownership & exposure to new investors, but also join the $OHM community. They also be given rebates if they decide to accumulate $OHM or OHM liquidity, helping to get more control on that small pool of unowned liquidity

9/14 Partners can also sell tokens to the Olympus treasury for $OHM / OHM-pairs through co-bonding, distributing $OHM to partner treasuries. This is important because a treasury asset owned only by its issuer + holders but not by counterparties is not an effective reserve asset.

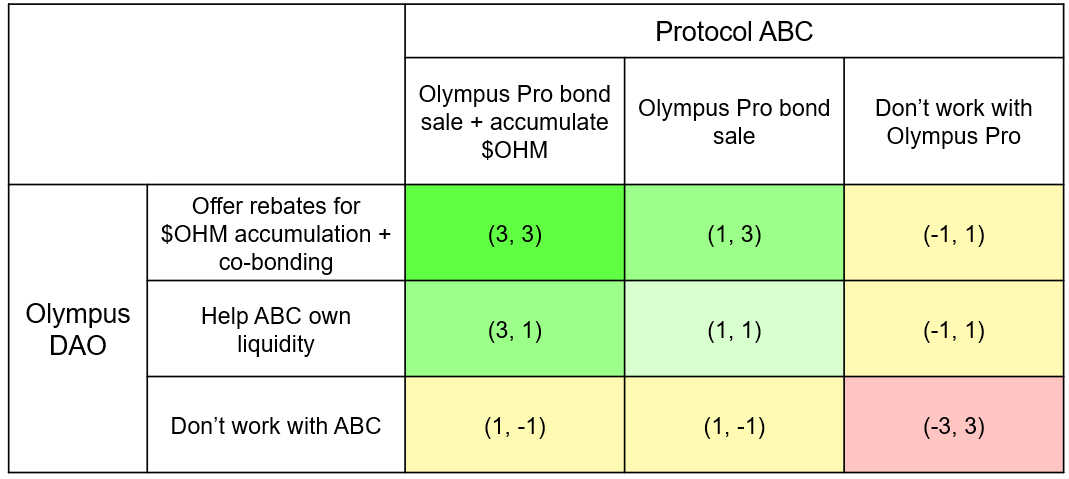

10/14 This sets up another game between @OlympusDAO and prospective protocols - a longer term partnership helps both parties to (3, 3).

11/14 By cooperating and creating a positive-sum environment, partner protocols get to hold on to a strong reserve asset and own their liquidity while $OHM gets distributed as a reserve asset to early partners and accumulates quality tokens.

12/14 We are looking at a set-up for Ohm treasury TVL to grow exponentially, as it begins accumulating the assets of early promising protocols (potentially future 10x assets) while cementing itself as reserve asset in DeFi. What do you think this chart can look like in 1 year?

13/14 In the meantime, you should follow @ohmzeus , @sayinshallah , @ishaheen10 , @unbanksyETH , @AgoraDispatch , @Fiskantes , @WartuII , @MIM_Spell , @OlympusIntern and @TokenReactor for more alpha leaks on $OHM and (3, 3).

14/14 Do you like our content? Follow us 👉 @Fund975 to keep up to date with the latest investment opportunities in DeFi. We know we said our next thread will be on the Secret Network ecosystem, but we got too excited for @OlympusDAO

• • •

Missing some Tweet in this thread? You can try to

force a refresh