We cannot have a Chinese financial crisis right now. My schedule is already full. Anyway, trying to come up to speed on Evergrande; this post by Michael Pettis is helpful 1/ carnegieendowment.org/chinafinancial…

There seems to be a broad consensus that while bad, this isn't China's Lehman moment. Of course, broad consensuses have been wrong a lot these past 15 years. But here's the thing: even the Lehman moment wasn't really a Lehman moment 2/

What I mean is that the financial disruption of 2008-9 was fairly brief — but the economy stayed depressed for many years thereafter, suggesting that the liquidity crisis was less of the story than longer-term factors 3/

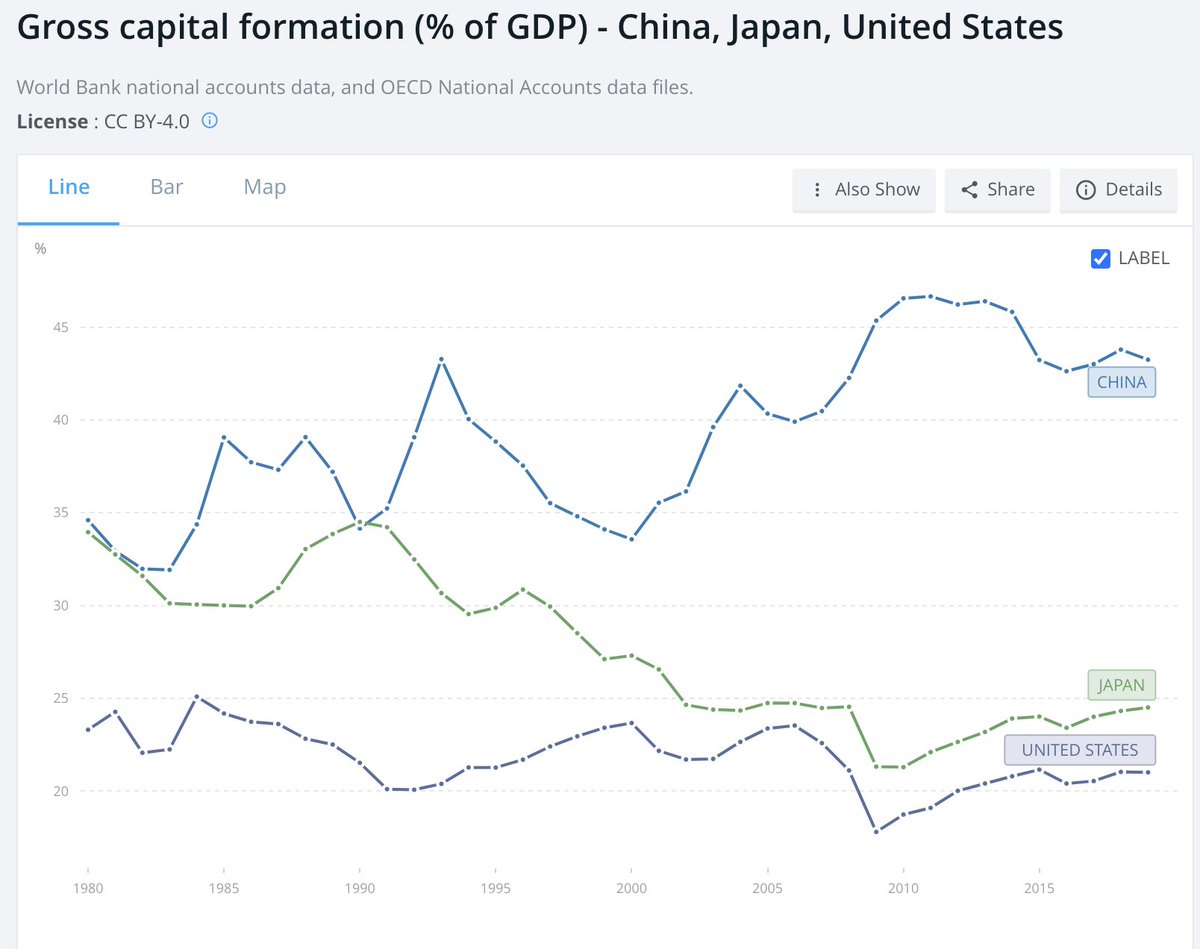

In retrospect, there's a good case that the reason the bursting of the housing bubble seemed to matter so much was that it was masking an underlying problem of secular stagnation. The same might be said of Japan's real estate-stock bubble of the late 1980s 4/

And if you think demography is a key factor in secstag — which I still mostly do, despite some recent discussion of inequality — worth noting that China is starting to display Japan-like demography (pop 15-64) 5/

So even if Evergrande is contained — hey, remember when people said that about subprime? — it may be the leading edge of bigger problems 7/

• • •

Missing some Tweet in this thread? You can try to

force a refresh