ok didn't really come up with a singular thread topic so I'm just gonna stitch together some of the q&a from people and shit in a rambling, disjointed mess of a post below, enjoy (or don't, idgaf)

thread, 1/n

thread, 1/n

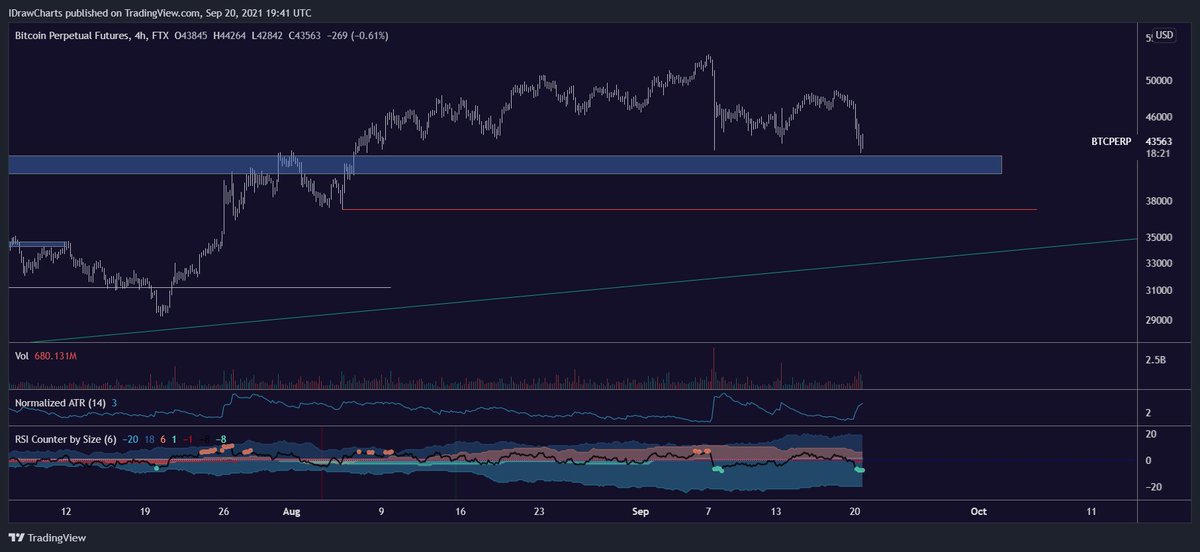

https://twitter.com/IDrawCharts/status/1440411855718023169

yes, pair trading is awesome and more people should try it

if you don't know, it works by pairing a short position on one ticker (eg, BTC perps) with an equally-sized long position on another (like ETH perps)

the end result is a long on ETHBTC

if you don't know, it works by pairing a short position on one ticker (eg, BTC perps) with an equally-sized long position on another (like ETH perps)

the end result is a long on ETHBTC

https://twitter.com/donceladon/status/1440422206882738181?s=19

obviously we already have ethbtc pairings, but you can do stuff like SOL/ETH, or SUSHI/UNI

can even chart the pairs in tradingview by separating the two tickers with a backslash

gets even more fun when you have a good reason for doing so...

can even chart the pairs in tradingview by separating the two tickers with a backslash

gets even more fun when you have a good reason for doing so...

Satsdart did a nice thread on identifying strength, but you can also use it to identify weakness

long the strong one, short the weak one. This'll give you a (usually) lower-volatility position that's not as correlated to the overall market's direction

long the strong one, short the weak one. This'll give you a (usually) lower-volatility position that's not as correlated to the overall market's direction

https://twitter.com/satsdart/status/1439954052046073856?s=19

also some other applications (eg, index vs a component) but I'm sure you can figure them out

Pair trades do require more margin since it's technically 2 positions, but especially in crypto, it's easy to find strong trends between pairs to take advantage of

Pair trades do require more margin since it's technically 2 positions, but especially in crypto, it's easy to find strong trends between pairs to take advantage of

already answered this one (check responses), but I figured some people might be interested

marketmaking is conceptually simple: try to buy a couple ticks lower than you sell by using limit orders placed v close to market, and do a shit ton of volume to make the profit worthwhile

marketmaking is conceptually simple: try to buy a couple ticks lower than you sell by using limit orders placed v close to market, and do a shit ton of volume to make the profit worthwhile

whoops forgot link lmfao

anyways, conceptually simple but managing the risk is hard and so is competing for volume

my method is a little different than most of my competition I think, and still v inefficient

v broad overview in my response to below

anyways, conceptually simple but managing the risk is hard and so is competing for volume

my method is a little different than most of my competition I think, and still v inefficient

v broad overview in my response to below

https://twitter.com/cryptoquanto/status/1440418201083383809?s=19

useless, been saying so for years

it's not actually completely worthless, some people make good choices based off of it, but I'd rather compare individual assets to each other than try and inefficiently lump 'em all together to compare against btc

it's not actually completely worthless, some people make good choices based off of it, but I'd rather compare individual assets to each other than try and inefficiently lump 'em all together to compare against btc

https://twitter.com/DeFi_pirate/status/1440479838385545217?s=19

Good question because it indicates the way most of you think about leverage but you're wrong

if you're using leverage to borrow money you don't have, there's a 99% chance you're fucking up, eventually you'll get burned

if you're using leverage to borrow money you don't have, there's a 99% chance you're fucking up, eventually you'll get burned

https://twitter.com/_Lorax3/status/1440415017615069186?s=19

a good example for how to use leverage:

you have 10k USDC, you want to trade

instead of depositing all 10k on exchanges, you deposit 2k and put the other 8k to work farming stablecoins and generating a return.

leverage allows you to still trade at your full size

you have 10k USDC, you want to trade

instead of depositing all 10k on exchanges, you deposit 2k and put the other 8k to work farming stablecoins and generating a return.

leverage allows you to still trade at your full size

use it to mitigate risk and increase capital efficiency, not to borrow money

all that to say, what the question was originally asking, poorly phrased: when to size up and go heavier into your positions?

answer is "whenever you have less risk per dollar of exposure than normal"

all that to say, what the question was originally asking, poorly phrased: when to size up and go heavier into your positions?

answer is "whenever you have less risk per dollar of exposure than normal"

couple different forms of that

eg, if you're the FIRST guy to hear about the SEC suing XRP (or whatever it was), you have less implied risk to short XRP than you normally would

your odds of success are just so much higher because you KNOW:

A) it'll drop

B) you're first to act

eg, if you're the FIRST guy to hear about the SEC suing XRP (or whatever it was), you have less implied risk to short XRP than you normally would

your odds of success are just so much higher because you KNOW:

A) it'll drop

B) you're first to act

so you can size up there, you're getting less risk per dollar on the position.

another eg: you bought 1 BTC at 30k and expect further uptrend, you've moved your stop up to 35k

You've secured profit, which means your risk is now down to just your UPnL, +5k

another eg: you bought 1 BTC at 30k and expect further uptrend, you've moved your stop up to 35k

You've secured profit, which means your risk is now down to just your UPnL, +5k

so your risk is limited to a positive result, you can size up to increase your risk again, and therefore potential reward

pyramid-ing into trends like this has the potential to win huge, but can also turn a winning trade that fails to continue into a wash

so be selective

pyramid-ing into trends like this has the potential to win huge, but can also turn a winning trade that fails to continue into a wash

so be selective

specifically for fundamental swings (as opposed to exploiting a pattern), I'm trying to figure out what people are going to believe about an asset in the future

https://twitter.com/Hitta71/status/1440413860972806150?s=19

eg, if the solana mcap is currently 5% of the eth mcap, will the market eventually conclude it is more than 5% as valuable?

if so, I expect sol to outperform as the market comes to that conclusion after me

this takes a LOT of asset-specific understanding and research to do well

if so, I expect sol to outperform as the market comes to that conclusion after me

this takes a LOT of asset-specific understanding and research to do well

Fundamental plays are about beating everyone else to the crowd's conclusion, the faster you are at it, the more you can make

for other styles tho, this framework is ideal once you have enough experience to spot patterns in a large enough data sample

for other styles tho, this framework is ideal once you have enough experience to spot patterns in a large enough data sample

https://twitter.com/IDrawCharts/status/1428709735575035905?s=19

also takes a lot of time and effort, but it's much more homogenized across trades

biggest thing here is getting your data set, for a discretionary trader you'll need a trade log and ideally a journal for market observations even when not trading

find patterns in-sample

biggest thing here is getting your data set, for a discretionary trader you'll need a trade log and ideally a journal for market observations even when not trading

find patterns in-sample

• • •

Missing some Tweet in this thread? You can try to

force a refresh