Evergrande and the Debt Iceberg ✨one final 🧵

(Ft the $FRDM index)

(Ft the $FRDM index)

I wrote a brief explainer thursday of last week and wanted to expand upon that - not from the point of contagion, but rather the contagion of ~exposure~

kyla.substack.com/p/evergrande-a…

kyla.substack.com/p/evergrande-a…

Quick TLDR of the last piece

But now the question is how much exposure is there in U.S. markets? And narrowing down even more - how much *unnecessary* exposure is there?

But now the question is how much exposure is there in U.S. markets? And narrowing down even more - how much *unnecessary* exposure is there?

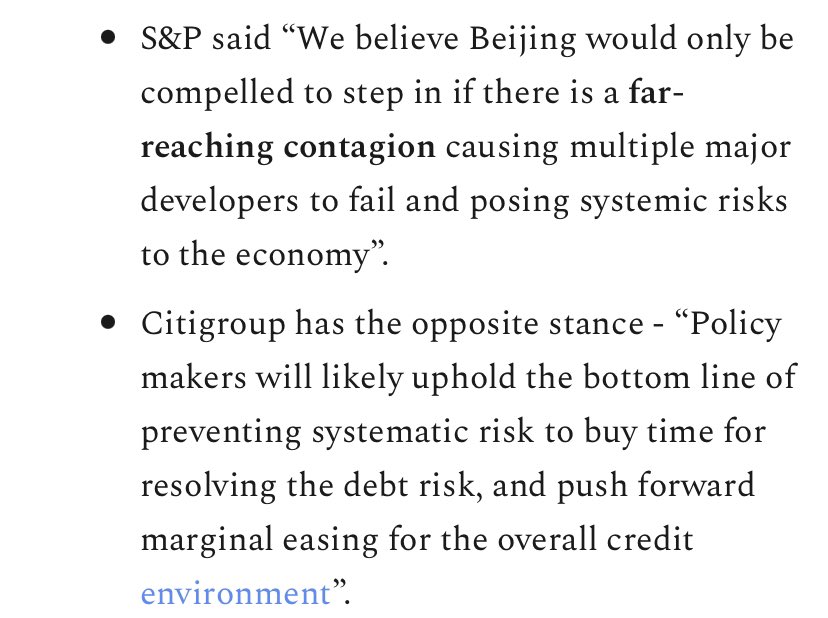

Everyone still on the fence as to what Beijing will do (mostly)

The main point here is that if Beijing does see contagion, they will step in. They are not going to let this implode.

The main point here is that if Beijing does see contagion, they will step in. They are not going to let this implode.

Evergrande is offering wealth management investors (those who hold the wealth management products from their “internet finance affiliate”) the chance to redeem their losses with real estate 😬 aka Evergrande is SHORT on cash

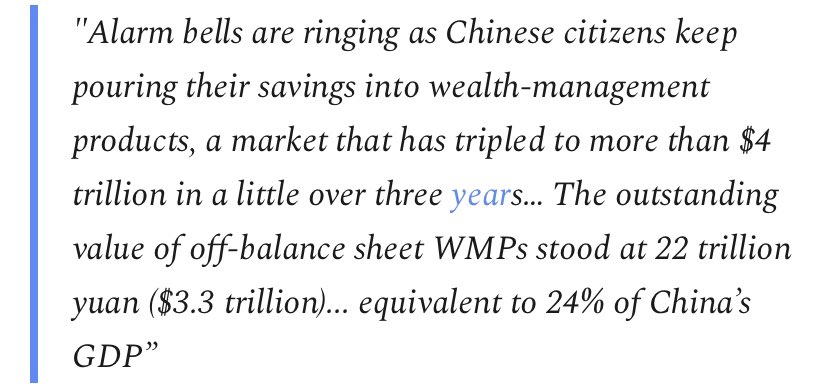

These WMPs offered were/are VERY popular in China

These WMPs offered were/are VERY popular in China

Evergrande will have an impact on the holders of these wealth management products

Real estate is not cash

Evergrande risk is also bleeding into other real estate & property companies (also overleveraged) and commodities (if Evergrande goes down, so does demand for commodities)

Real estate is not cash

Evergrande risk is also bleeding into other real estate & property companies (also overleveraged) and commodities (if Evergrande goes down, so does demand for commodities)

https://twitter.com/lisaabramowicz1/status/1439871246380982275

The wealth management fallout could be interesting from a consumer confidence perspective

consumer sentiment is often a core driver of performance - if people are afraid, they aren’t buying

And that could create a lot of problems

consumer sentiment is often a core driver of performance - if people are afraid, they aren’t buying

And that could create a lot of problems

Real estate is ~30% of China’s GDP, so a collapse in Evergrande could send shockwaves, sure

But the housing market has been shaky there for a while now, and stability will come at a cost - ghost cities are expensive to maintain

But the housing market has been shaky there for a while now, and stability will come at a cost - ghost cities are expensive to maintain

But this isn’t *really* about Evergrande, it’s about a very overleveraged, debt-laden industry which is the opposite of what Beijing wants.

The government is going to shape the economy into what they want it to be. And Evergrande likely will not mess that up.

The government is going to shape the economy into what they want it to be. And Evergrande likely will not mess that up.

Evergrande has been on the radar for a WHILE. This is not new.

In 2018, the People’s Bank of China called out Evergrande and essentially told them to get themselves together

Even now the PBOC is moving on it - they injected into the system.

In 2018, the People’s Bank of China called out Evergrande and essentially told them to get themselves together

Even now the PBOC is moving on it - they injected into the system.

https://twitter.com/Sino_Market/status/1440486941045125129?s=20

The main concern is the exposure in other countries and banks (Evergrande is tied up across 128 banks and 121 non-banking institutions), which can get a bit messy.

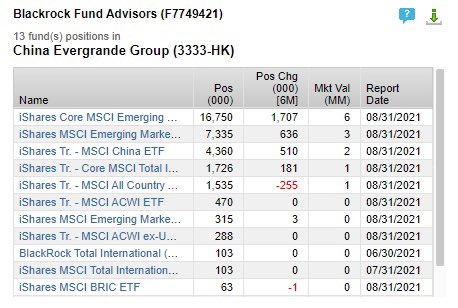

Vanguard, BlackRock, and many other fund managers, have exposure here.

Vanguard, BlackRock, and many other fund managers, have exposure here.

This exposure “makes sense” (more or less) as Evergrande is a big company - it has a huge market cap, so of course it’s going to be included in a lot of funds. Exposure to the Chinese real estate market and more? Perfect.

This gets into contagion risk

This gets into contagion risk

Contagion risk here is the general *exposure* through fund managers

The inclusion of companies like Evergrande in broad EM index funds means investors are often inadvertently overexposed to this volatility and systemic risk

The inclusion of companies like Evergrande in broad EM index funds means investors are often inadvertently overexposed to this volatility and systemic risk

Read this thread for more info on that conundrum

https://twitter.com/kylascan/status/1423409390925729794

When you look at the holders of Evergrande’s bonds, it becomes a more than meets the eye sort of story

Ashmore has the most exposure to Evergrande specifically, but sizing here isn’t the biggest point - it’s general growth of exposure in the space - and it sure is growing!

Ashmore has the most exposure to Evergrande specifically, but sizing here isn’t the biggest point - it’s general growth of exposure in the space - and it sure is growing!

Blackrock just raised $1bn to set up a mutual fund in China through its Chinese subsidiary, increasing their exposure to China even more

https://twitter.com/CNBCi/status/1438034854835261443

“The Evergrande crisis may bring bankruptcy and investor loss, but in the long run it could lead to more efficient allocation of capital” is a fascinating look at how they think of risk in these markets

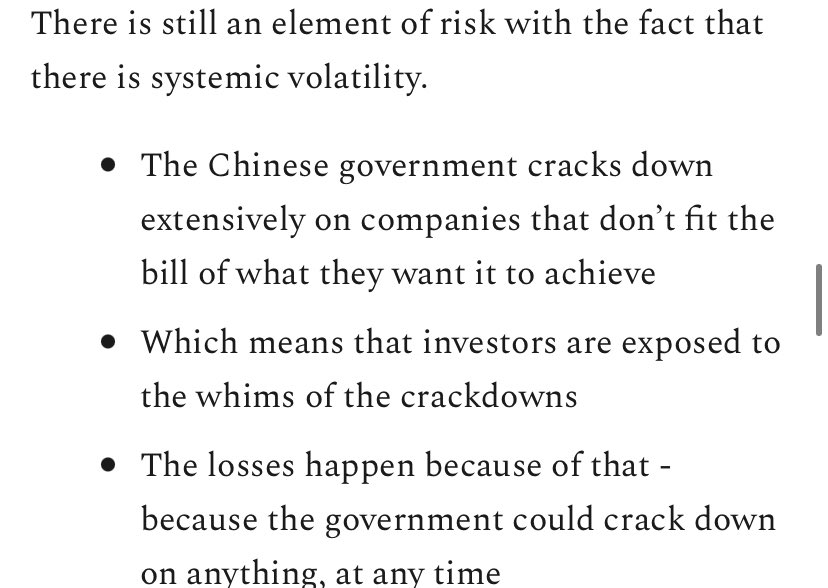

Even though the broad situation is potentially risky for the property sector, it’s still important to highlight that this isn’t going to be the next big global meltdown - however, it could start tipping dominoes in that direction.

It’s hard to price out contagion risk, especially with somewhat murky accounting like Evergrande has

Think back to the delisting bill - it gives Chinese companies 3 years to comply with U.S. listing mandates - goal to standardize uncertainty and clean up some of the unknown.

Think back to the delisting bill - it gives Chinese companies 3 years to comply with U.S. listing mandates - goal to standardize uncertainty and clean up some of the unknown.

But in the meantime, investors are exposed to this sort of bankruptcy and loss. These usually end up being large tail risks due to government policies that incentivize debt driven growth with murky book keeping

Stock market didn’t fall earlier this week because of Evergrande - it fell because the Fed will potentially begin to taper and Treasury Department is also severely flirting with the debt ceiling

If/when/hownthe Fed tapers that will potentially lead to more shakeouts of companies that have relied on easy money for growth versus actually having a sustainable backbone of fundamentals here

Overall, the shakeout could spell out other things for a global financial system that has relied on cheap financing and levered growth hacks

Evergrande isnt the only not-so-grand story out there

Evergrande isnt the only not-so-grand story out there

Overexposure to uncertain risk

A potential solution is an index like $FRDM

Addressing both (1) contagion risk of murky accounting and (2) the risk of prioritization of debt driven growth by investing in countries that prioritize personal & economic freedom.

A potential solution is an index like $FRDM

Addressing both (1) contagion risk of murky accounting and (2) the risk of prioritization of debt driven growth by investing in countries that prioritize personal & economic freedom.

• • •

Missing some Tweet in this thread? You can try to

force a refresh