There is an Emergence of Canadian Tech Companies beyond these leaders:

$SHOP (eCommerce)

$LSPD (Payments)

$DCBO (Enterprise Learning)

$MAGT.TO (Security)

$NVEI (Cross-border Payments)

A Briefing thread on the Canadian tech ecosystem and funnel:

$SHOP (eCommerce)

$LSPD (Payments)

$DCBO (Enterprise Learning)

$MAGT.TO (Security)

$NVEI (Cross-border Payments)

A Briefing thread on the Canadian tech ecosystem and funnel:

2/ I've done a write-up on most of the top Canadian names:

First was $DCBO Docebo in January. An enterprise learning company accelerating its growth rate, customer adoption and a leader in LMS systems. Stock has been crazy!

investianalystnewsletter.substack.com/p/docebo-inc-l…

First was $DCBO Docebo in January. An enterprise learning company accelerating its growth rate, customer adoption and a leader in LMS systems. Stock has been crazy!

investianalystnewsletter.substack.com/p/docebo-inc-l…

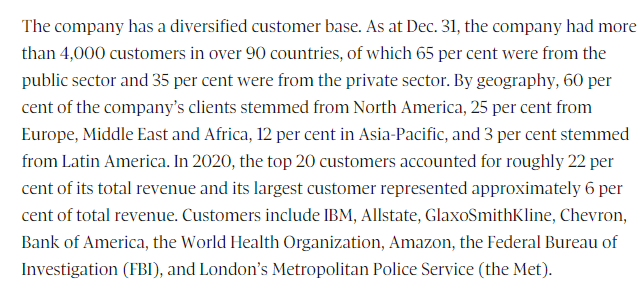

3/ $NVEI.TO: Global electronic payment processor. They have a proprietary platform that offers direct connections to all major payment cards.

They solve payment issues for complex transactions in over 150 different currencies using 450 payment methods.

investianalystnewsletter.substack.com/p/nuvei-corpor…

They solve payment issues for complex transactions in over 150 different currencies using 450 payment methods.

investianalystnewsletter.substack.com/p/nuvei-corpor…

3I) $NVEI.TO

My thread below: Since this thread, stock is up 200%.

Full thread below:

My thread below: Since this thread, stock is up 200%.

Full thread below:

https://twitter.com/InvestiAnalyst/status/1344371721025949697

4/ $WELL.TO: Digital health leader

My piece is below. I own shares. However, this write-up is so old, their digital health practice has evolved and the thesis has grown so much bigger in other areas

investianalystnewsletter.substack.com/p/well-health-…

My piece is below. I own shares. However, this write-up is so old, their digital health practice has evolved and the thesis has grown so much bigger in other areas

investianalystnewsletter.substack.com/p/well-health-…

5/ $DND.TO:

a leading provider of cloud-based software and

technology solutions designed to improve efficiency and increase productivity for legal and business professionals.

+Revenue Growth: 90%

+EBITDA Margins: 40%

investianalystnewsletter.substack.com/p/dye-and-durh…

a leading provider of cloud-based software and

technology solutions designed to improve efficiency and increase productivity for legal and business professionals.

+Revenue Growth: 90%

+EBITDA Margins: 40%

investianalystnewsletter.substack.com/p/dye-and-durh…

6/ GoodFood Market Corp $FOOD.TO: A leading online grocery provider in Canada.

Strong margins and growth, well-positioned within Online Grocery Shopping.

investianalystnewsletter.substack.com/p/goodfood-mar…

Strong margins and growth, well-positioned within Online Grocery Shopping.

investianalystnewsletter.substack.com/p/goodfood-mar…

7/ Dialogue Health Solutions (Leading telemedicine in the enterprise space):

Focused primarily on the B2B/Market for:

a) Quality primary care,

b) EAP (Employee Assistance Programs),

c) Mental health.

I used to own shares and I still like this name.

Focused primarily on the B2B/Market for:

a) Quality primary care,

b) EAP (Employee Assistance Programs),

c) Mental health.

I used to own shares and I still like this name.

https://twitter.com/InvestiAnalyst/status/1377410747836235784?s=20

8/ Magnetic Forensics: $MAGT.TO

This is currently my top idea!

A cybersecurity and cloud investigative tech.

Some of my initial thesis are below, I will share more on this ongoing. I'm still doing DD, but won't be surprised if it entered my portfolio. More in the future:

This is currently my top idea!

A cybersecurity and cloud investigative tech.

Some of my initial thesis are below, I will share more on this ongoing. I'm still doing DD, but won't be surprised if it entered my portfolio. More in the future:

9/ Under-the-radar Canadian Tech Leaders that don't get attention:

+ $ENGH (Software tech)

+ $CSU + $TOI.V (Tech aggregators)

+ $CTO.TO Converge Tech, Hybrid IT & Cloud Security services (I own shares in Portfolio 2)

+ $KXS (Supply-Chain Logistics)

+ $STC (Sangota in IT)

+ $EGLX

+ $ENGH (Software tech)

+ $CSU + $TOI.V (Tech aggregators)

+ $CTO.TO Converge Tech, Hybrid IT & Cloud Security services (I own shares in Portfolio 2)

+ $KXS (Supply-Chain Logistics)

+ $STC (Sangota in IT)

+ $EGLX

10/ Donville kent asset management has a good resource that goes into more details for those interested:

file:///C:/Users/fodum/Downloads/Canadian%20Growth%20Company%20-Reports%20-October-2020-1.pdf

file:///C:/Users/fodum/Downloads/Canadian%20Growth%20Company%20-Reports%20-October-2020-1.pdf

11/ Immediate IPO's in the funnel currently is Decision-analytics software maker Copperleaf Technologies which provides AI-powered optimization software to blue-chip companies in the energy, utilities and infrastructure giants. Copperleaf claimed they have never lost a customer.

12/ On the Private Markets, there are a young crop that are emerging:

+ Wealthsimple

+ Koho

+ Neo Financial

+ Ada

+ Bench

+ Few upcoming in Sask - @seantoconnor is brewing Coconut software, Vendasta, 7shift and upcoming in Ag-Tech. Watch out!

linkedin.com/pulse/linkedin…

+ Wealthsimple

+ Koho

+ Neo Financial

+ Ada

+ Bench

+ Few upcoming in Sask - @seantoconnor is brewing Coconut software, Vendasta, 7shift and upcoming in Ag-Tech. Watch out!

linkedin.com/pulse/linkedin…

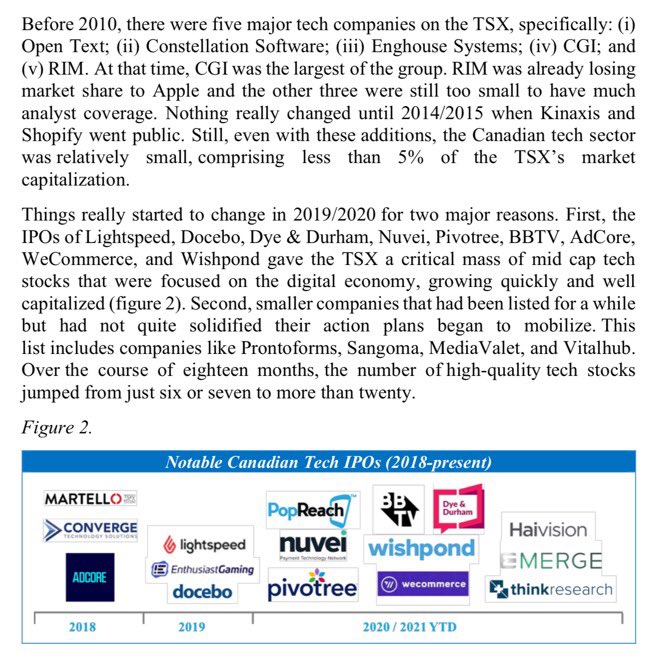

13/ Canadian companies are conservative about going public- only 14 tech Co's within the last year, however, things are changing.

Would we ever get another $SHOP or $LSPD again? I have no clue, but I believe there are some good companies in the funnel to watch.

Would we ever get another $SHOP or $LSPD again? I have no clue, but I believe there are some good companies in the funnel to watch.

14/ My top high-growth Canadian Co's: $MAGT.TO, $NVEI, $DCBO & $THNC

Obviously, $SHOP & $LSPD are fantastic!

On the Private markets, Wealthsimple, Ada, Maple and Neo are interesting to watch in 2022.

Fingers crossed! What did I miss?

Let me know your thoughts on Canadian tech!

Obviously, $SHOP & $LSPD are fantastic!

On the Private markets, Wealthsimple, Ada, Maple and Neo are interesting to watch in 2022.

Fingers crossed! What did I miss?

Let me know your thoughts on Canadian tech!

• • •

Missing some Tweet in this thread? You can try to

force a refresh