exciting panel on inflation panel at Sintra, with @Isabel_Schnabel chairing.

Charles Goodhart: we are in an extraordinary moment, we dont have a general theory of inflation.

we used to have two - monetarist and Phillips Curve - but none has performed well.

we used to have two - monetarist and Phillips Curve - but none has performed well.

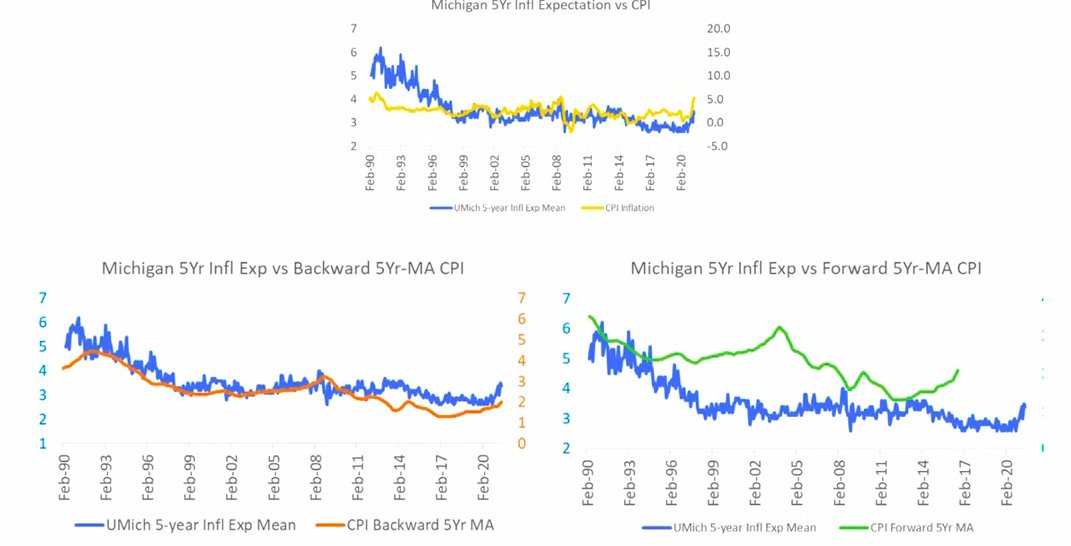

we also have the expectations theory of inflation - but that doesnt work either, since inflationary expectations are backwards looking and adaptive

oh, Goodhart is now literally reading 'the controversial and disruptive' Fed paper

Goodheart: it was the general availability & weakness of labour over past thirty years that kept inflationary pressures down.

it is the supply side shifts in labour that matter, and @Lagarde ignored it, particularly demographic decline

it is the supply side shifts in labour that matter, and @Lagarde ignored it, particularly demographic decline

he also wonders about the wisdom of including owner occupied housing price into consumer price, may generate tightening pressures

is there a name for the New Keynesian condition of miscalculating slides to time ratio?

jaja, Charles Goodheart just called inflationary expectations theory 'extremely weak lark'

also, he's brining in a critical issues, globalisation, for which my new macro students should be grateful

the New Keynesian is, unsurprisingly, not impressed with the Fed paper 'if you dont have anything formal, how can you be criticised'

ok, definitely on team Goodheart, who's getting attacked because 'we solved the backwards expectation problem 30 years ago'

New Keynesians, if you come at King Goodhart you better come prepared, cause he was a central banker 30 years ago, and savaged you after Lehman

in this brave new world, IMF Chief Economist is calling for workers of the world Unite and ask for higher wages :)

Goodhart: the trust in central bankers being able to raise nominal rates will lead to a sharp recession, worsen fiscal positions, deflate asset bubbles.

you cant raise without coordinating with fiscal

you cant raise without coordinating with fiscal

Andrew Bailey @bankofengland - I wouldnt agree Charles on irrelevance of expectations, but we certainly need better modelling to understand 'rational inattention'

love that mainstream macro modelling is again coping with its inattention to the world by blaming the regular human (the agent that ignores inflation when it should notice it)

and Yannis Stournaras brings us back to globalisation, very fittingly

what a gracious chair @Isabel_Schnabel is, excellent panel, one takeaway is that Fed paper ruffled a lot of (New Keynesian) feathers!

• • •

Missing some Tweet in this thread? You can try to

force a refresh