I use options as tools for risk management. Some of my fav options strategies and when do I deploy

1 - LEAP buying - Risk capital OR stop loss amount during the severe drawdowns or elongated period of flat trading as it leads to decline in Imp Vol

1 - LEAP buying - Risk capital OR stop loss amount during the severe drawdowns or elongated period of flat trading as it leads to decline in Imp Vol

2 - Selling covered calls - selling 10-20% OTM covered calls especially on high Imp Vol stocks, during high RSI and, recent highs and before strong resistance level. I exclude stocks that have the tendency to make very strong moves in short term and part of my long-term 10x hold

3 - Collar strategy - Sell CC and Buy Puts on stocks made strong gains in last few days/weeks and near-term headwinds expected -> Sell CC 10-20% OTM, collect premiums and buy 15-25% puts below the price. It's a hedging strategy and can be optimized to minimize cost

4 - Selling cash-secured Puts -When the stock price is above comfort level and/or you may suspect the drop in near terms by can't take chance to sit out. If stocks drop you get assignments at your preferred price, if not you collect cash that can be used for buying LEAP

All strategies are dynamic i.e. you take actions based on the outcome of the strategy. Options are for sophisticated investors (By sophisticated here i mean, someone who can understand basic option pricing and movement mechanism)

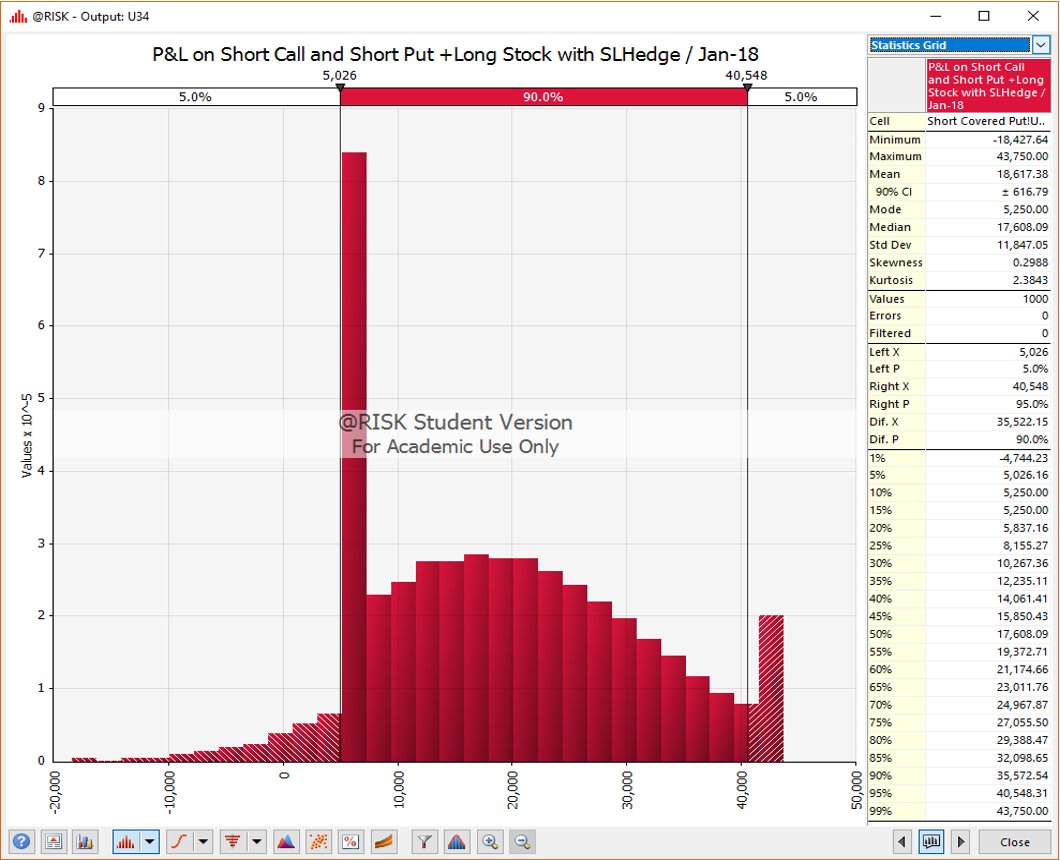

Every strategy has its risks and if you don't know what risks you are exposed to and how your position can move against you, it's Russian roulette then. I prefer writing and building simulations with moves and exit criteria before hand e.g. below for illustration purpose only

I prefer modeling all large options strategies and moves in Monte-carlo simulations either in excel or Python to optimize size and strike price, sharing some examples below for illustrative purposes

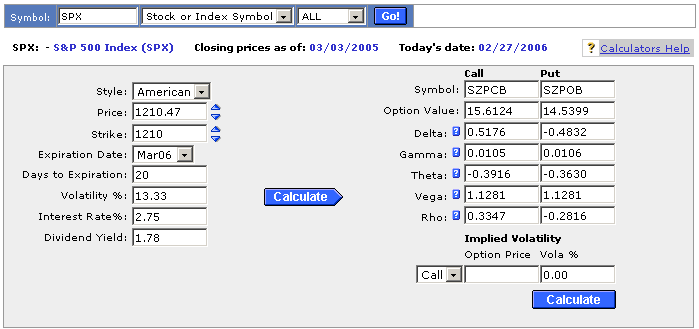

The purpose of this thread is to raise awareness that options should be deployed with proper risk management and understanding of exposure. if you are not savvy to do excel and python use simple public domain tools such as ivolatility calculator by CBOE

Just select, option type, stock symbol, price, strike price, expiry date, imp vol and test it for a large number of combinations, write it down and build a pseudo scenario simulation results

Disclaimer: This thread is not financial advice, shared for information purposes only, and definitely not for those who are looking for tips to buy and sell options based on signals, provided in real-time or in a Patreon or discord group. Learn Options before you deploy it

• • •

Missing some Tweet in this thread? You can try to

force a refresh